Nevertheless, I have decided to minimize the risk in my portfolio for the first time.

What did I do?

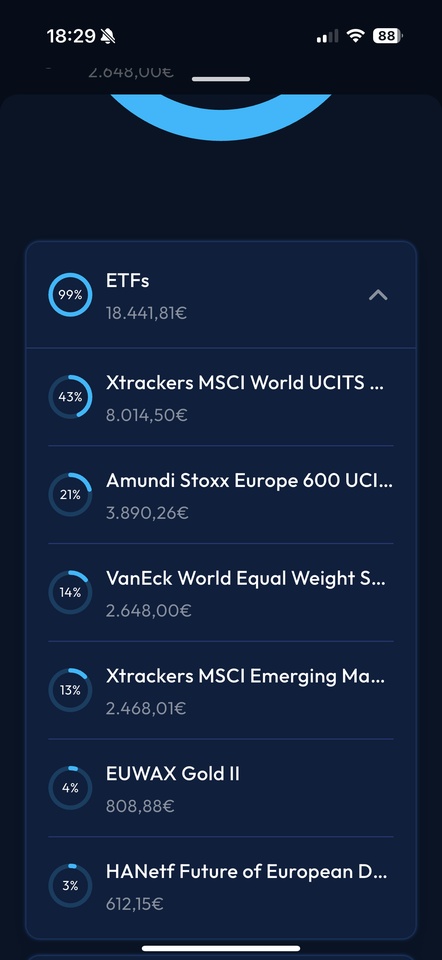

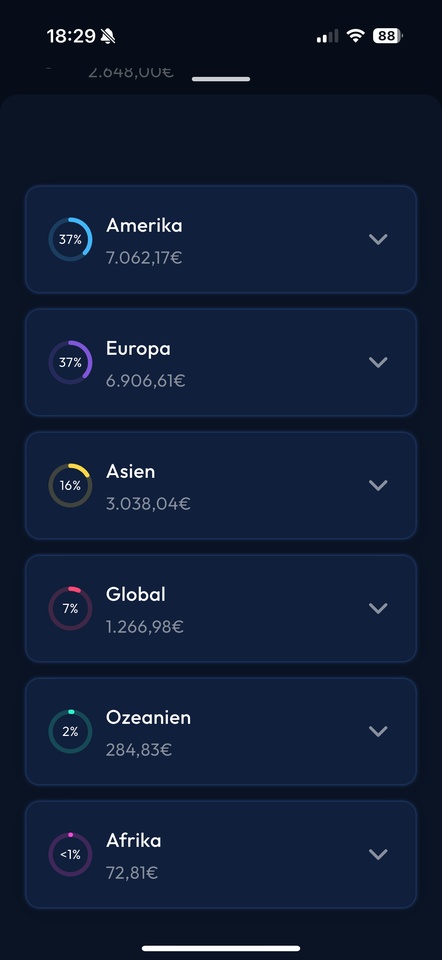

Stocks that I am not (or no longer!) 100% convinced of were removed from the portfolio and shifted into ETFs.

Thank goodness with a manageable loss.

ETF share increased and higher monthly savings, because I'm now an apprentice and earn more.

Savings as follows:

$COPX (+2,95%) is saved with 600€

$IWDA (+0,57%) with 400€

$XEMD (+1,64%) with 250€

250€ overnight money

In 3 months, my Volksbank membership in the amount of € 4800 will be terminated. This will then be used to buy shares again.

Until then, my securities account will remain: $IREN (-6,41%) , $RKLB (-6,56%) , $QBTS (-7,11%)

So: more safety, lower risk= better sleep, less headache