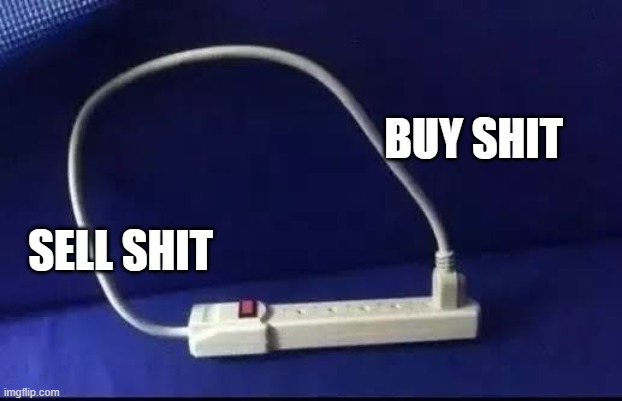

I had already flirted a few times with posts about Trading 212 and the possibility of creating pies to open a portfolio and yesterday after the post of @Novius finally went through with it (kiss goes out). The opening was also very easy with just a few clicks, only the flash transfer was rejected yesterday by my Sparkasse app and was credited to the broker this morning.

The year is only 12 days old and I've already broken all my New Year's resolutions not to take on any additional individual securities for the time being and to put more money into the good $GERD (-0,26%) in addition to the savings plans. Instead, the money went into Salesforce $CRM (-1%) and BB Biotech $BION (+1,97%). I have no idea why I lack the discipline to invest. Maybe it will get better in

February... Maybe it will get better with the Pie 🥸

I'm only using Trading 212 as a gimmick for the time being and have picked speculative individual stocks from six sectors/thematic areas that have actually run too hot for me (the classic community stocks 😃) and would only find their way into the portfolio in the event of a setback.

would only find their way into the portfolio in the event of a setback or whose business model I don't understand (quantum computing, biotech) and therefore have no place in the portfolio without research.

Most of the stocks will be familiar to you. I will therefore refrain from describing them. With the exception of biotech. Since Gemini really had to serve as an advisor for individual stocks. However, I also had $VTYX an egg in my portfolio where the takeover modalities are already set at 14 $/share.

1. Quantum: IonQ, D-Wave, Rigetti.

2. Space: Rocket Lab, Intuitive Machines, Redwire, AST SpaceMobile.

3. defense (autonomous): Kraken Robotics, Ondas, Kratos.

4. Future Mobility: Joby Aviation, Archer Aviation, EHang.

5.. Disruptive Tech: Palantir, SoFi.

6. biotech & genomic revolution (2026 candidates)

- Viking Therapeutics ($VKTX (+3,78%) ): Hottest candidate in the obesity market (weight loss drugs); considered the No. 1 takeover target for Big Pharma.

- Beam Therapeutics$BEAM): Pioneer in "base editing"; more precise gene correction than the first CRISPR generation; focus on sickle cell anemia.

- Intellia Therapeutics ($NTLA (-0,37%)

): Leader in "in vivo" editing (healing takes place directly in the patient's body).

- Ventyx Biosciences $VTYX

): Specialist in immune and inflammatory diseases; currently the target of a billion-euro takeover by Eli Lilly.

- BioAge Labs ($BIOA (-0,29%)

): Focus on longevity and metabolism; uses AI to research anti-ageing therapies.

- CytomX ($CTMX (-0,39%)

): Develops "masked" antibodies that only become active in tumor tissue in order to massively reduce side effects.

- CRISPR Therapeutics ($CRSP (-1,54%)

): The market leader in gene scissors; first commercial approvals for genetic defects already obtained.