Why are air conditioning systems standard in new cars but not in new properties in Germany?

Discussão sobre WSO

Postos

8Watchlist for the 2KW 2025

A quick overview of the stocks I am trying to get into the portfolio for the coming week. The limit orders can be adjusted to the market. However, I will start with this on Monday morning

Fastenal - limit EUR 69.50 $FAST (+0,71%)

Coca Cola limit 58.50 EUR $KO (-0,09%)

Watsco limit 451,50 EUR $WSO (+0,74%)

Waste Management Limit 195.00 EUR $WM (-0,26%)

UnitedHealth Limit 490 EUR $UNH (+1,04%)

Philip Morris limit EUR 117 $PM (+0,02%)

Lockheed Martin Limit 460.00 EUR $LMT (-1,22%)

Iron Mountain Limit 100 EUR $IRM (+1,66%)

Have a nice rest of Sunday .

⚠️⚠️⚠️Breaking News⚠️⚠️⚠️

ATTENTION to all who have a deposit with Trade Republic, today more than 100 savings plans will be executed with me, the real offensive starts at 15.30 and can take up to 4 hours, as there may well be "massive" "failures" and "delays" during this time, I ask you to keep calm, take a deep breath and not to bombard Trade Republic customer support with inquiries. Thank you very much 😁

As far as the Ultimate Homer "ETF" is concerned, many new stocks were added in September 😁

In since September 2

🇺🇸Chipotle $CMG (-1,87%)

🇺🇸Costco $COST (-0,64%)

🇺🇸Domino's Pizza's $DPZ (-1,29%)

🇺🇸Texas Roadhouse $TXRH (-0,89%)

🇺🇸TransDigm $TDG (+0,09%)

Newly launched today

🇺🇸Booz Allen Hamilton Holding

$BAH (-9,52%)

🇺🇸Blackstone $BX (+0,65%)

🇺🇸KKR & Co

$KKR (+1,98%)

🇺🇸Vulcan Materials

$VMC (+1,19%)

🇺🇸CSX $CSX (+0,49%)

🇺🇸Carrier Global $CARR (+1,08%)

🇺🇸Hilton Worldwide $HLT (+0,5%)

🇺🇸Merck & Co $MRK (+0,8%)

🇺🇸Moodys $MCO (+1,56%)

🇺🇸Rollins $ROL (-0,07%)

🇺🇸Toll Brothers $TOL (+1,64%)

🇺🇸Watsco $WSO (+0,74%)

🇺🇸Cardinal Health $CAH (+3,81%)

🇺🇸Colgate Palmolive $CL (-0,38%)

🇺🇸Emerson Electric $EMR (+0,28%)

🇺🇸Nordson $NDSN (+0,44%)

🇬🇧BAE Systems

$BA. (-1,16%)

🇬🇧RELX

$REL (+1,54%)

🇬🇧Bunzl

$BNZL (-0,71%)

I am not a friend of profit taking but rather buy & hold.

But with $WSO (+0,74%) it was about time in my opinion. I took almost 40%, even though sales stagnated last year and the P/E ratio is over 31. In the long term, I'll see if there's a more favorable entry point again, if not, I'll focus on other stocks.

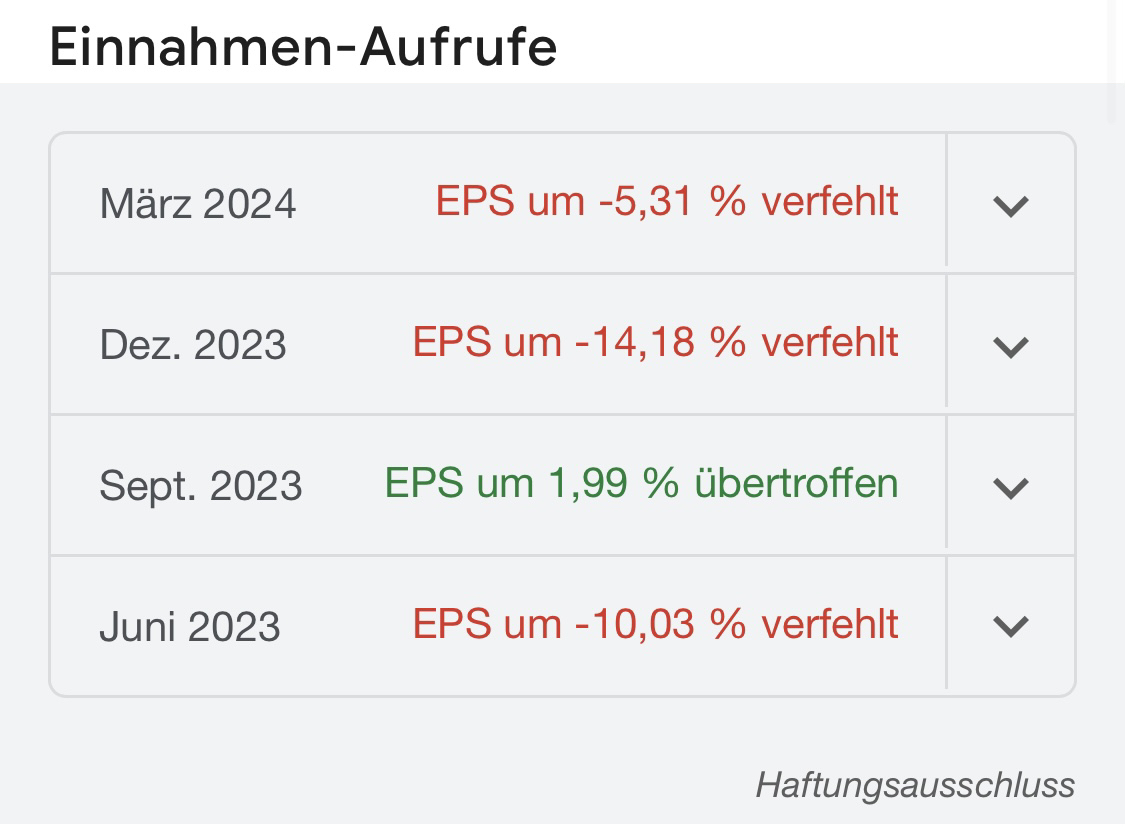

Do you have stocks in your portfolio that regularly miss analysts' expectations but are still doing well?

For me it is $WSO (+0,74%) 😅

I'll just put forward a thesis, you agree or prove me wrong:

"Sometimes it can be wise to enter into an investment without knowing a company's products in detail. Why? Because it forces you to focus on the potential of the company itself, rather than being influenced by personal preferences or prior knowledge."

Do you have shares that you have little to do with? For me at least $WSO (+0,74%)

$WING (-1,78%)

$UNP (-1,48%)

Títulos em alta

Principais criadores desta semana