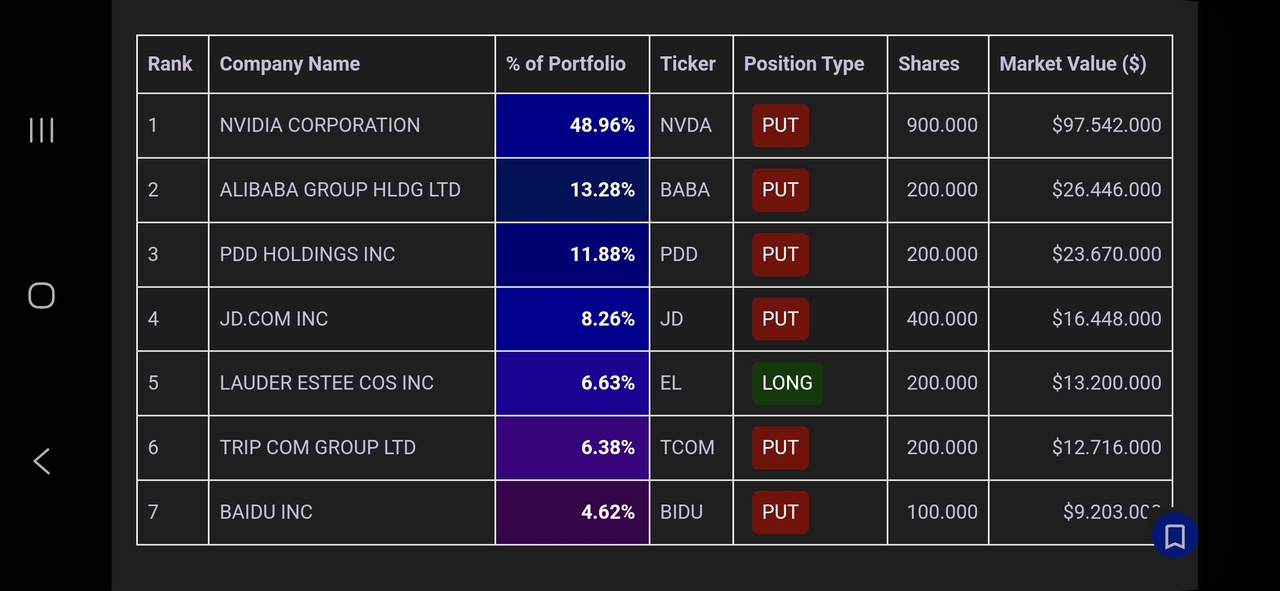

That doesn't look very optimistic. 🤔

$NVDA (+2,18%)

$BABA (+1,49%)

$PDD (+0,22%)

$JD (+0%)

$EL (+1,99%)

$TCOM (+2,45%)

$BIDU (+1,74%)

Source: www.michael-burry.com

Postos

7That doesn't look very optimistic. 🤔

$NVDA (+2,18%)

$BABA (+1,49%)

$PDD (+0,22%)

$JD (+0%)

$EL (+1,99%)

$TCOM (+2,45%)

$BIDU (+1,74%)

Source: www.michael-burry.com

As a listener to Trip.com Group's conference call ($TCOM (+2,45%)) fourth quarter 2024 conference call, I was able to gain insights into the company's strategies and financial results. Here is a summary of the call:

James Liang, Co-Founder and Executive Chairman, began by explaining the company's overarching strategy. He emphasized the remarkable resilience of the travel market and the increasing value consumers place on experiences experiences. He highlighted that by 2024, Trip.com Group is expected to have a GMV of over 1.2 trillion RMB (169 billion USD) achieved. A key point of his remarks was the importance of AI innovation for Trip.com. The company's AI-powered tools aim to make travel planning more accessible and tailored to individual needs.

He named Trip.Best, Trip.Trends, Trip.Deals, Trip.Events, Itinerary and TripGenie are examples of these innovative tools. TripGenie in particular enjoyed growing popularity, which was reflected in a 200% increase in traffica an increase in browsing time of almost 100 % and and an 200% increase in the number of conversations. reflected.

In addition, Liang pointed to the robust growth of the international business which accounted for 14% of Group sales in the fourth quarter and 10% in the full year 2024 accounted for. He also emphasized the company's commitment to the promotion of incoming tourismthe support of rural development through sustainable rural tourism projects and the implementation of sustainable practicesto make a positive contribution to environmental protection.

Jane Sun, CEO and Director, presented the operational highlights and provided insights into current trends. She reported an impressive sales growth of 23 % in the fourth quarter and 20 % for the full year 2024. The outbound business continued to record strong growth, boosted by the easing of visa regulations and the increasing availability of international flights. In the fourth quarter, industry-wide cross-border flight capacity reached over 80% of pre-pandemic levels, while outbound hotel and flight ticket bookings from Trip.com increased by more than 120% compared to 2019 outperforming the industry by 30 to 40 %.

Sun also highlighted the strong increase in domestic tourism in China with 5.6 billion trips in 2024underlining the growing importance of travel in Chinese people's daily lives. The incoming tourism is also becoming an important factor for economic and cultural dynamism. In the fourth quarter and in 2024 as a whole, inbound inbound bookings on Trip.com's platforms increased by over 100% compared to the previous yearwhereby the bookings from visa-free countries increased by over 150%. In response, Trip.com Group introduced free city tours for international travelers in transit in Shanghai and Beijing.

Sun mentioned that Trip.com has strengthened its presence in key APAC markets and and expanded into new regions. In the fourth quarter airline ticket and hotel bookings on the international OTA platform increased by over 70 % year-on-yearwith APAC bookings increased by around 80 %. The company strategically invests in technology and talent acquisition and operates 16 global call centers to ensure world-class customer service.

Another focus was on the silver generationthe 50+ generation, which is a growing and affluent market segment. Trip.com has launched the Old Friends Club initiative to specifically address this target group. In addition, Trip.com is committed to sustainable development and supports its employees with various measures, which has earned the company numerous awards as an attractive employer.

Cindy Wang, CFO, presented the detailed financial results and gave an outlook on future developments. The net revenue for the fourth quarter of 2024 amounted to RMB 12.7 billion, an increase of 23% year-on-year. For the full year 2024, net revenue amounted to RMB 53.3 billion, an increase of 20% year-on-year. Revenue from accommodation reservations increased in the fourth quarter by 33% compared to the previous year and for the year as a whole by 25 % compared to the previous year. Sales of transportation tickets increased in the fourth quarter by 16 % compared to the previous year and for the year as a whole by 10 % compared to the previous year. Turnover with package tours increased in the fourth quarter by 24 % compared to the previous yearmainly driven by the international business, which grew by around 100 %.

The company is planning strategic capital return initiatives for 2025including a share buyback program of up to USD 400 million and a cash dividend totaling approximately USD 200 millionunderlining the confidence in the company's financial strength and future growth prospects.

In the subsequent Q&A session, all executives were available to answer analysts' questions and provide detailed insights.

Brian Gong from Citi inquired about the potential impact of AI agents and large language models on OTAs like Trip.com. Liang replied that AI agents will not replace OTAs, but rather complement them. Trip.com offers added value in terms of real-time travel information and end-to-end servicesthat cannot be replicated by AI alone.

Alex Yao from JPMorgan asked about the current current demand for leisure and business travelthe growth rate for 2025 and the key revenue drivers. Sun identified the young generationthe silver generation and the further opening of borders as key drivers. She also mentioned the expected recovery of direct flight connections as a positive factor.

Joyce Ju from Bank of America asked about the business trends during the Chinese New Year and the outlook for 2025. Wang reported a healthy appetite for travel and an expansion of the travel radius. She mentioned that the hotel prices gradually approaching the previous year's level.

Simon Cheung from Goldman Sachs inquired about the outlook for the outlook for the Trip.com platform and the reactions from competitors. Sun emphasized the internal strengths of the company, such as the one-stop shopping platformthe excellent user experience, the customer service and the investments in AI.

In summary, the conference call was extremely insightful and highlighted that Trip.com Group is extremely well positioned to capitalize on growth opportunities in the travel market. The company is focusing heavily on AI innovation, tapping into new market segments and expanding its international business to ensure long-term success.

I hope I was able to introduce you to one of the most important Chinese competitors of Booking $BKNG (+0,79%) and Expedia $EXPE (+1,33%) closer to you.

Trip.com Group Limited Q3 FY2024 #EarningsReport Summary | $TCOM (+2,45%)

In Q3 FY2024, http://Trip.com Group Limited saw robust growth in domestic and international travel, bolstered by increased consumer confidence and heightened travel sentiment. Net revenue surged by 16% YoY, supported by strong demand and favorable seasonality.

📊 Income Statement Highlights (vs Q3 FY2023):

▫️ Net Income: $970M vs $656M (+47.92%)

▫️ Total Revenue: $2.26B vs $1.96B (+16.00%)

▫️ Adjusted EPS: $1.25 vs $1.03 (+21.36%)

▫️ Gross Margin: 82.36% vs 81.99%

▫️ Operating Income: $712M vs $556M (+28.06%)

▫️ Adjusted EBITDA: $808M vs $659M (+22.60%)

Revenue breakdown:

▫️ Accommodation Reservations: $969M (+22.00%)

▫️ Transportation Ticketing: $805M (+5.00%)

▫️ Packaged Tours: $222M (+17.00%)

▫️ Corporate Travel: $93M (+11.00%)

▫️ Others: $176M (+40.18%)

💼 Balance Sheet Highlights (as of September 30, 2024):

▫️ Total Assets: $34.81B vs $31.22B (+11.52%)

▫️ Total Liabilities: $14.85B vs $13.69B (+8.48%)

▫️ Equity: $19.86B vs $17.53B (+13.31%)

▫️ Cash & Equivalents: $12.40B (+10.86%)

🔮 Future Outlook:

http://Trip.com Group anticipates continued growth driven by AI-enabled innovations and strong international travel recovery. Management highlights opportunities in global travel expansion, although macroeconomic conditions and competition pose risks.

getquin Daily Summary 28.06.2022

Hello getquin,

today's MarketNews is about the G7 summit, a raid at the biggest Japanese car manufacturer in Luxembourg and Germany and a not pleasant forecast from Lufthansa.

Do you already know our Learnsection? On Friday, a new article on a blockchain ETF was published here.

Europe🌍:

1st raid on Hyundai and Kia in Germany and Luxembourg

The offices of carmaker Hyundai and its subsidiary Kia have been raided on suspicion of improperly modifying diesel vehicles. According to the Frankfurt public prosecutor's office on Tuesday, eight buildings in Germany and Luxembourg were searched by around 140 criminal investigators. Suspicions of fraud and air pollution against managers of Hyundai and Kia and supplier BorgWarner served as the background for the action.

Prosecutors found that the South Korean automaker allegedly sold more than 210,000 diesel vehicles by 2020, even though the cars allegedly had illegal defeat devices installed. These lead to a number of common scenarios where emission control devices are drastically reduced or turned off.

Thats the sound of the police 👮: https://bit.ly/3npzroY

🟩 $HYUD (🔼 +4,24 %)

Americas 🌏:

2nd EY to pay $100 million to settle U.S. allegations of fraud in accountant audits

Big Four accounting firm Ernst & Young will pay $100 million to settle allegations by the U.S. Securities and Exchange Commission (SEC) that its auditors cheated on Certified Public Accounting (CPA) exams and misled the agency's investigators.

The London-based auditor admitted to the allegations, the regulator said, and agreed to pay what the SEC says is the largest fine against an auditor.

The CPA is the key qualification for auditors in the United States.

More info here: https://reut.rs/3uvJIEn

Welt🗺️:

3rd CEO Lufthansa doesn't expect flight chaos to end before winter

The CEO of Europe's largest airline group said in a letter to customers that the situation, characterized by staff shortages, parts shortages and restricted airspace, "is unlikely to improve in the near future." In Europe alone, the industry will hire several thousand new employees. But in the coming winter, this capacity expansion will only stabilize the situation. Speaking on behalf of the organization, Spohr expressed regret that the "ramp-up of the complicated air traffic system from virtually zero to almost 90% again today" after the Corona disaster had not resulted in the expected reliability, punctuality and robustness. Management acknowledged that there are several places where the Lufthansa Group is also understaffed.

Are you planning to fly? https://bit.ly/3u5aPWA

🟩 $LHA (-0,96%) (🔼🔽 +1,54%)

Special:

4th G7 - What will be discussed?

Tonight ends the third and final day of the G7 Summit at Elmar Castle. As described in yesterday's MarketNews article, the 7 most important industrialized nations are discussing current global problems. The main topics of this year's G7 Summit were predictable. The current Ukraine war played a very important role in the meeting, as it brings gas and food shortages. But it also makes other countries think about their security policies, such as an upgrade of the military. Another topic at the summit, as in previous years, was the COVID-19 pandemic and how to act more quickly against pandemics in the future. Also in focus was the climate change and the plans of the individual countries against the climate policy.

General info on the G7 summit here: https://www.g7germany.de/g7-de

Quarterly figures:

Nike $NKE (-0,55%)

EPS: 🟩 $0.81 expected vs $1.00 reported; difference: 22.99

Revenue: 🟩 $12.09 billion expected vs $12.23 billion published; variance: 1.16%

For more, see Nike: https://swoo.sh/3HVAfeW

𝗦𝘁𝗼𝗰𝗸𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗱𝗮𝘆:

🟩 TOP $TCOM (+2,45%) 26,95 € (🔼 +15,91%)

🟥 FLOP $WISE (+0,13%) , 3,72 € (🔽 -14,19%)

🟥Most searched $AMZN (+1,58%) , 105,83 € (🔽 -1,48%)

🟩 Most traded $1211 (-0,58%) , 39,79 € (🔼 +5,02 %)

🟩 S&P500, 3,904.84 (🔼 +0.12 %)

🟩 DAX, 13,303.45 (🔼 +0.89 %)

🟩 bitcoin ₿, €19,803.69 (🔼 +1.11 %)

Time: 16:30 CEST

𝗙𝘂𝗻 𝗙𝗮𝗰𝘁:

Did you know that paper money was first used in the 7th century in China among merchants. In fact, in the 11th century, due to a shortage of copper, not enough coins could be produced, which made paper money common. In Europe, bills did not appear until 500 years later. In 1661, Sweden was the first country to use paper money.

getquin Daily Summary 28.06.2022

Hello getquin,

today's MarketNews is about the G7 summit, a raid on the largest Japanese car manufacturer in Luxembourg and Germany and a not pleasant forecast from Lufthansa.

Europe 🌍:

1. Raid at Hyundai and Kia in Germany and Luxembourg

The offices of carmaker Hyundai and its subsidiary Kia have been raided on suspicion of improperly modifying diesel vehicles. According to the public prosecutor's office in Frankfurt on Tuesday, eight buildings in Germany and Luxembourg were searched by about 140 criminal investigators. Suspicions of fraud and air pollution against managers of Hyundai and Kia as well as the supplier BorgWarner served as the background for the action.

The public prosecutor's office found that the South Korean carmaker is alleged to have sold more than 210,000 diesel vehicles by 2020, although illegal defeat devices were allegedly installed in the cars. These lead to a number of common scenarios in which the emission control devices are drastically reduced or turned off.

Thats the sound of the police 👮: https://bit.ly/3npzroY

🟩 $HYUD (🔼 +4.24 %)

America 🌏:

2. EY to pay $100m to settle US allegations of fraud in accountant audits

Big Four accounting firm Ernst & Young will pay $100 million to settle allegations by the US Securities and Exchange Commission (SEC) that its auditors cheated on Certified Public Accounting (CPA) exams and misled the agency's investigators.

The London-based auditor admitted to the allegations, the regulator said, and agreed to pay what the SEC said was the largest fine against an auditor.

The CPA is the key qualification for auditors in the United States.

More information here: https://reut.rs/3uvJIEn

World🗺️:

3. CEO Lufthansa does not expect end to flight chaos before winter

The CEO of Europe's largest airline group said in a letter to customers that the situation, characterised by staff shortages, parts shortages and restricted airspace, "is unlikely to improve in the near future". In Europe alone, the industry will hire several thousand new employees. But in the coming winter, this capacity expansion will only stabilise the situation. Spohr expressed regret on behalf of the organisation that the "ramp-up of the complicated air traffic system from practically zero to almost 90% again today" after the Corona disaster had not led to the expected reliability, punctuality and robustness. The management admitted that there are several places where the Lufthansa Group is also understaffed.

Are you planning to fly? https://bit.ly/3u5aPWA

🟩 $LHA (-0,96%) (🔼🔽 +1.54%)

Spezial:

4. G7 - What will be discussed?

Tonight marks the end of the third and final day of the G7 Summit at Elmar Castle. As described in yesterday's MarketNews article, the 7 most important industrialised countries are discussing current global problems. The main topics of this year's G7 Summit were predictable. The current Ukraine war played a very important role in the meeting as it brings gas and food shortages. But it also makes other countries think about their security policies, like rearming the military. Another topic at the summit, as in previous years, was the COVID-19 pandemic and how to take faster action against pandemics in the future. The focus was also on climate change and the plans of the individual countries to counter climate policy.

General information on the G7 Summit here: https://www.g7germany.de/g7-de

Earnings Call:

Nike $NKE (-0,55%)

EPS: 🟩 $0.81 expected vs $1.00 published; Difference: 22.99%.

Revenue: 🟩 $12.09bn expected vs $12.23bn published; difference: 1.16%.

Read more at Nike: https://swoo.sh/3HVAfeW

Stocks of the day:

🟩 TOP $TCOM (+2,45%) 26.95 € (🔼 +15.91%)

🟥 FLOP $WISE (+0,13%) , 3.72 € (🔽 -14.19%)

🟥Most searched $AMZN (+1,58%) , 105.83 € (🔽 -1.48%)

🟩 Most traded $1211 (-0,58%) , 39.79 € (🔼 +5.02 %)

🟩 S&P500, 3,904.84 (🔼 +0.12 %)

🟩 DAX, 13,303.45 (🔼 +0.89 %)

🟩 Bitcoin ₿, 19,803.69 € (🔼 +1.11 %)

𝗙𝘂𝗻 𝗙𝗮𝗰𝘁:

Did you know that paper money was first used among merchants in China in the 7th century? In the 11th century, due to a shortage of copper, not enough coins could be produced, which made paper money widespread. In Europe, notes did not appear until 500 years later. In 1661, Sweden was the first country to use paper money.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗘𝗹𝗼𝗻 𝗠𝘂𝘀𝗸 𝗯𝗲𝘄𝗲𝗴𝘁 𝗱𝗲𝗻 𝗠𝗮𝗿𝗸𝘁 / 𝗔𝗹𝗶𝗯𝗮𝗯𝗮 𝗯𝗹𝗶𝗰𝗸𝘁 𝗶𝗻𝘀 𝗠𝗲𝘁𝗮𝘃𝗲𝗿𝘀𝗲 / 𝗗𝗼𝗴𝗲𝗰𝗼𝗶𝗻 𝘁𝗼 𝘁𝗵𝗲 𝗺𝗼𝗼𝗻 💎

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Aarons Inc. ($PRG (-0,74%)), Global Payments Inc. ($GPN (-0,25%)), and First Capital Inc. ($FCAP) are trading ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Toro Company ($TTC (-0,22%)), Trip.com Group limited ($CLV (+2,45%)) and Metro St. ($B4B (+0%)) present their quarterly figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Tesla ($TSLA (-3,22%)) - Elon Musk sold more of his Tesla stock this week. The mandatory disclosure to the Securities and Exchange Commission showed that he sold another 934,000 Tesla shares for about $900 million. The background for the sales was a Twitter post by Musk in which he put to a vote whether to sell 10% of his Tesla shares. Since the result of the vote went in favor of the sale, he sold a total of $12.7 billion worth of shares. Tesla shares have since fallen by around 17%.

Alibaba ($BABA (+1,49%)) - China's Alibaba is entering the metaverse market. Alibaba Group Holding reported a new company under the name: Yuanjing Shengsheng to test the potential of gaming in the metaverse.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Dogecoin ($DOGE (+1,79%)) - Elon Musk is once again moving the crypto markets via Twitter. He wrote in a tweet that he wants to accept payments in the Tesla fan store with Dogecoin, just to see how it works. The Memecoin rose by 20% as a result.

Follow us for french content on @MarketNewsUpdateFR

Principais criadores desta semana