October 23, 2025

So it's over for today ✌️😁

Postos

10October 23, 2025

So it's over for today ✌️😁

Hello my dears,

As already announced, I would like to present another company to you in a brief analysis.

The company is still on my watch list, but should soon find its way into my portfolio. After I suggested the share to @simpson Holding as a NEW investment a few weeks ago. Of course I don't want to withhold this company from you.

As usual with @simpson Holding, it is a quality company with growth. Which has already proven over several years that the moat holds.

But I don't want to keep you in suspense any longer. The company in question is Teledyne. $TDY (-1,37%)

Dear readers, who might already be familiar with the company, or who is invested, and what is your opinion?

During my research today, I realized that I have fallen a little bit in love with the company (you shouldn't fall in love with a company).

The reason could be that it is a very diversified company. Which is almost exclusively active in future-oriented sectors.

By the way, for all the critics and smart pigs who are always on the lookout for mistakes of any kind. I would like to say "It took me a lot of time today to write this short analysis. I'm doing this on a voluntary basis without earning any money. Because I just think this community is MEGA".

(without AI)

Introduction: I would like to start with the multiples.

Multiples: (USD in millions, source MarketScreener )

Market value 27,533

2025 2026 2027

KGV 32.6 28.8 25.7

Earnings per share 18 20.38 22.87

Turnover 6,067 6,389 6,719

EBITDA 1,490 1,620 1,731

Net result 852.5 965.6 1,081.0

Net debt 1,374.0 842.8 -333.1

CAPEX 111.5 117.9 125.4

Free cash flow 1,083 1,200 1,309

EBITDA MARGIN % 24.56% 25.35% 25.76%

EBIT MARGIN % 17.72% 19.13% 20.41%

ROE 9.82% 10.02% 10.05%

Number of shares 46,888 46,888 46,888

My dears, I think the estimates are very conservative. And as the chart shows, the estimates were exceeded in the last earnings.

I like the fact that important multiples can be increased, and thus the P/E ratio decreases.

But now to the really exciting part of the short analysis.

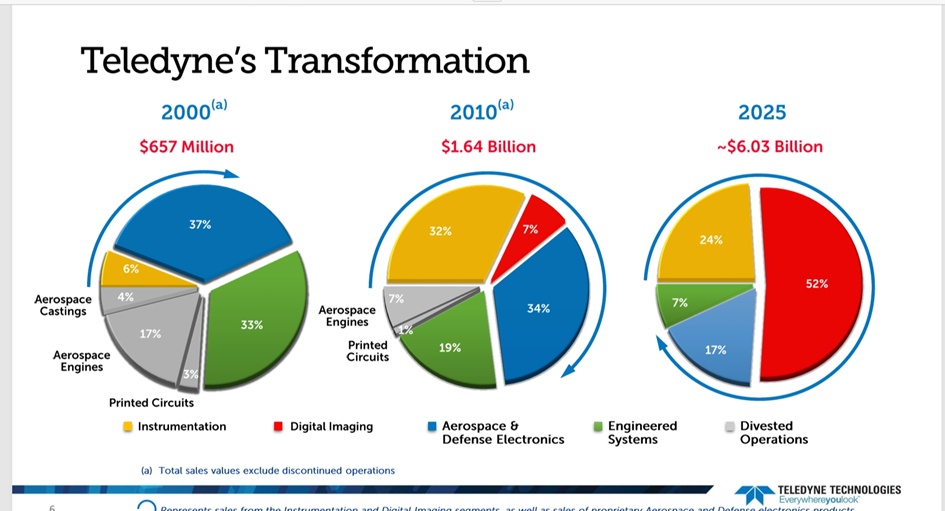

Company presentation:

Ladies and gentlemen, in order not to make the presentation too long for you, which might be too boring for some of you. I have simply included some informative graphics.

You may not know it, but Teledyne enables

many of the products and services you use every day.

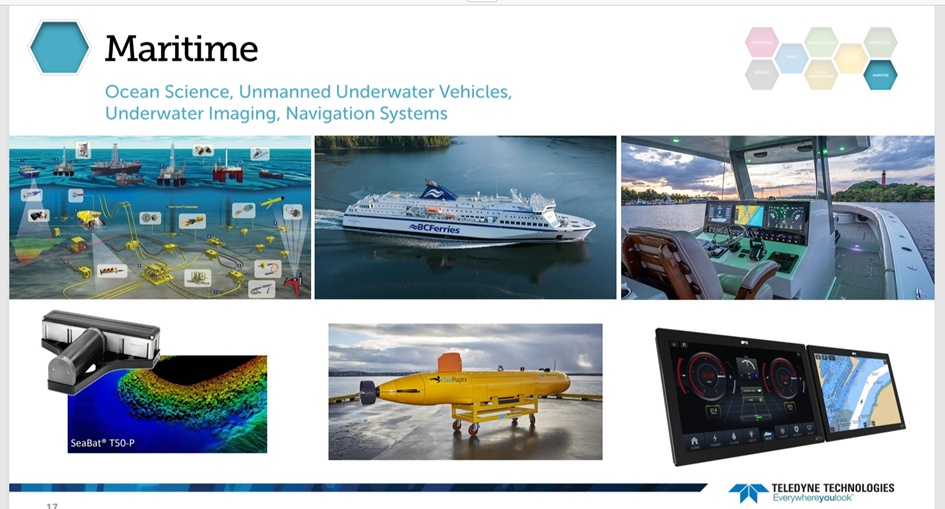

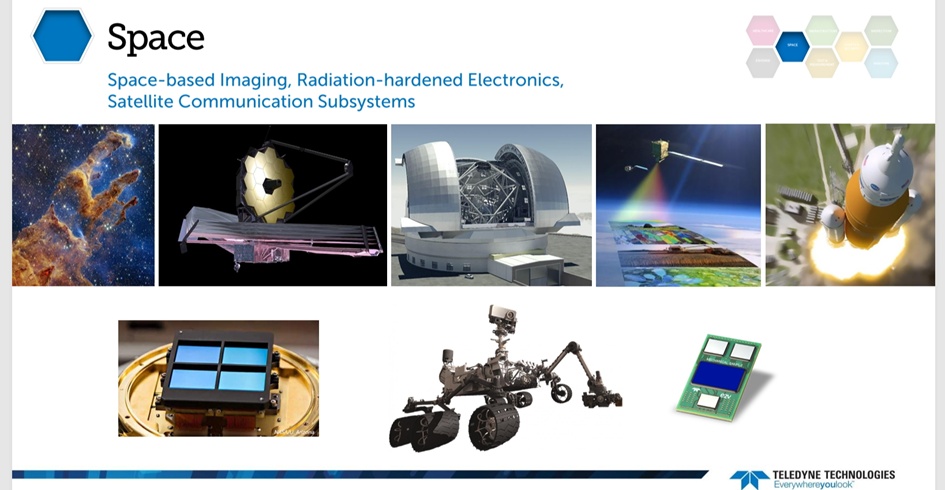

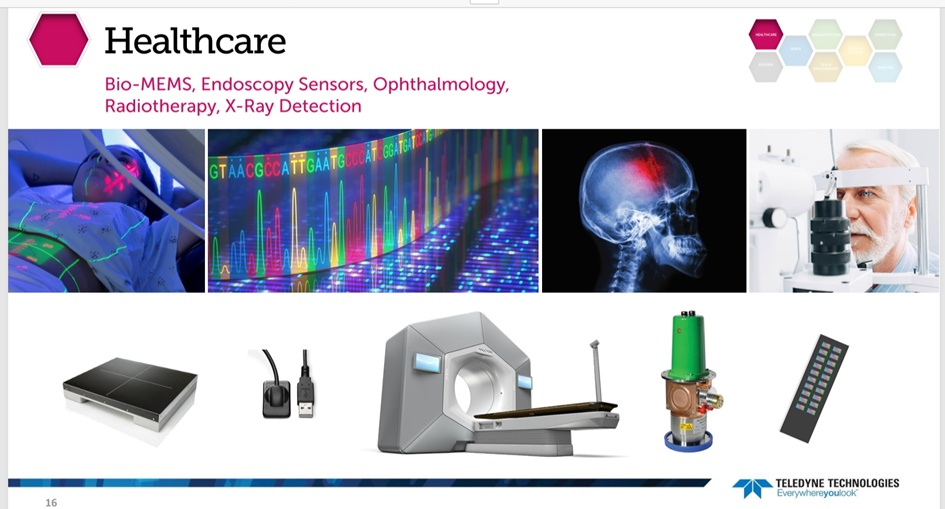

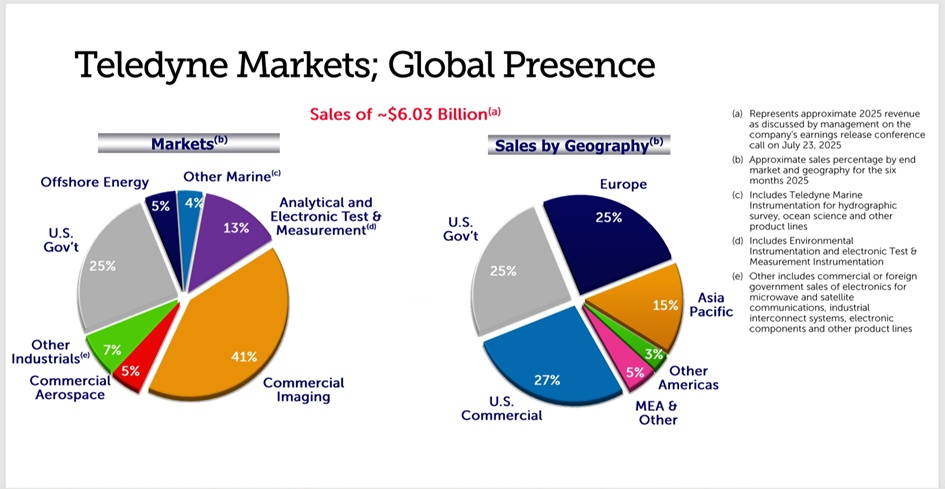

Teledyne provides enabling technologies to capture, transmit and analyze information for industrial growth markets. These markets include aerospace and defense, factory automation, environmental monitoring of air and water quality, electronics design and development, oceanographic research, energy, medical imaging and pharmaceutical research.

About Teledyne:

Teledyne Technologies Incorporated provides enabling technologies for industrial growth markets that require advanced technology and high reliability. These markets include aerospace and defense, factory automation, environmental monitoring of air and water quality, electronics design and development, oceanographic research, deepwater oil and gas exploration and production, medical imaging and pharmaceutical research.

Our products include digital image sensors, cameras and systems in the visible, infrared and X-ray spectrum, monitoring and control instruments for marine and environmental applications, harsh environment connectivity, electronic test and measurement equipment, aircraft information management systems and subsystems for defense electronics and satellite communications. We also supply technical systems for defense, space, environmental and energy applications. We differentiate ourselves from many of our direct competitors with a customer and corporate sponsored applied research center that enhances our product development capabilities.

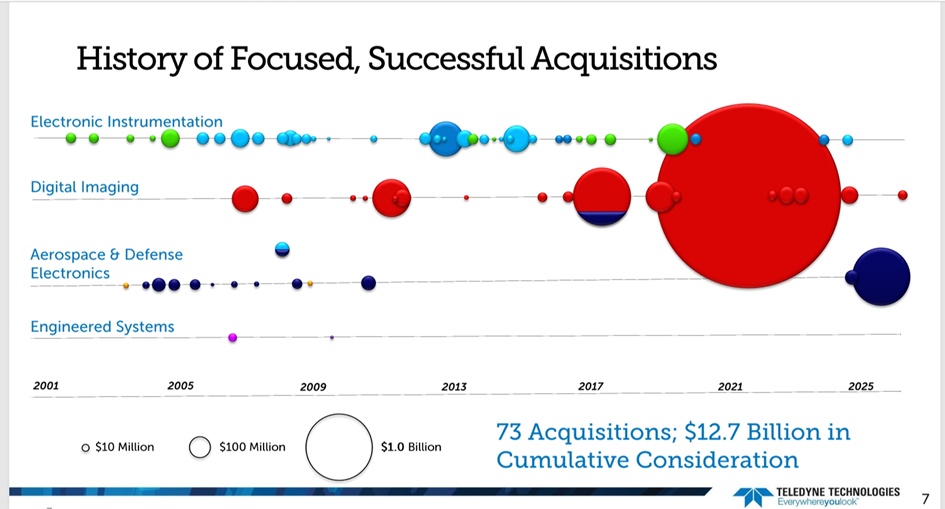

Our strategy continues to focus on growth in our core markets of instrumentation, digital imaging, aerospace and defense electronics and engineered systems. Our core markets are characterized by high barriers to entry and include specialized products and services that are unlikely to become commoditized. We intend to strengthen and expand our core businesses through targeted acquisitions and product development.

We aggressively pursue operational excellence to continuously improve our margins and earnings. At Teledyne, operational excellence includes the rapid integration of the businesses we acquire. By leveraging complementary technologies across our businesses and internal research and development, we strive to develop new products to grow our business and expand our addressable markets.

Teledyne's operations are located primarily in the United States, the United Kingdom, Canada and Western and Northern Europe.

However, as I have noticed over the last few weeks that you are particularly interested in certain areas. I would like to take a closer look at two sectors.

Aerospace & Defense Electronics

And

Aerospace & Defense Electronics

Teledyne Aerospace & Defense Electronics offers a comprehensive portfolio of advanced solutions that meet the most demanding requirements in the harshest environments. Our diverse product lines offer both customized and standard solutions to meet the current and future needs of critical applications in avionics, power, electronic warfare, missiles, radar and surveillance, aerospace, test and measurement, and satellite communications.

Teledyne Aerospace & Defense Electronics serves the defense, space and commercial markets worldwide, offering a comprehensive portfolio of advanced solutions that meet the most demanding requirements in the harshest environments. With custom and standard products, we offer a diverse portfolio to meet the current and future needs of critical avionics, power, electronic warfare, missile, radar, satcom, space, test and measurement applications.

Teledyne Aerospace & Defense Electronics is one of the four Geschäftssegmente von Teledyne Technologies Incorporated (NYSE:TDY). With over $5.6 billion in sales and approximately 15,000 employees worldwide, Teledyne's expertise and ability to provide the aerospace and defense industry with technologically advanced products and services has been proven.

Our aerospace electronics business provides advanced avionics systems for commercial air transport and military aircraft for data acquisition, communications, networking, data loading and wireless data transmission; portable data loaders; ground-based applications for data management and analysis; and aviation batteries.

Teledyne controls

Provides on-board avionics systems and ground-based applications that enable commercial and military aircraft operators to access, manage and utilize their data more efficiently.

Teledyne battery products

Provides high-performance valve-regulated lead-acid (VRLA) batteries and battery systems for general aviation and defense applications.

Perhaps a drone producer that few people have on their radar. And all this at an acceptable P/E ratio.

German Armed Forces award drone contract to Teledyne FLIR Defense

Teledyne FLIR Defense, part of Teledyne Technologies Incorporated, has been awarded a contract by the German army to supply its Black Hornet® 4 Personal Reconnaissance System to the German armed forces. This has now been announced by the company.

Teledyne FLIR is the supplier of Black Hornet 4 systems, parts and training under a two-year contract with the Federal Office of Bundeswehr Equipment, Information Technology and In-Service Support (BAAINBw). The contract award was brokered by Teledyne FLIR's regional partner, European Logistic Partners (ELP) GmbH of Wuppertal, Germany, as the BAAINBw contractor.

The Black Hornet 4 represents the next generation of lightweight nano drones capable of providing small combat units with enhanced covert situational awareness. The 12 megapixel day vision camera and high-resolution thermal imaging camera provide the operator with razor-sharp video and still images. Weighing just 70 grams, the Black Hornet 4 can fly for over 30 minutes and more than two kilometers and is said to operate in 25 knots of wind and rain.

A highly stealthy, advanced drone such as the Black Hornet 4 provides a distinct advantage for law enforcement agencies to carry out their most challenging missions, the statement added.

FLIR Defense has delivered more than 33,000 Black Hornet drones to military and security forces in over 45 countries. Black Hornet drones are used by the Ukrainian Armed Forces and have proven themselves in countless operations under difficult conditions.

The award-winning Black Hornet is designed and built by Teledyne FLIR Defense in Norway.

+ 4

Wednesday, 22.10.2025 15:37

Source: reuters.com

@Tenbagger2024 Is this the desired dip?

Government shutdown won't last forever? 🧐

Oct 22 - ** Shares of target acquisition sensor maker Teledyne fall nearly 4.6% in premarket trading to about $547.7 ** The company warns (link) that the U.S. government shutdown may impact new contracts in the near term ** "Given the current U.S. government shutdown, we are somewhat cautious in our expectations for new orders and shipments in the near term," said Executive Chairman Robert Mehrabian ** TDY raises its full-year adj. earnings per share for the full year to $21.45 to $21.60, from $21.20 to $21.50 previously ** The company is generating 3rd quarter adj. Q3 EPS of $5.57, above estimates of $5.48 per share ** Eleven of 13 brokerages rate the stock a "buy" or higher and two rate it a "hold"; median price target is $614, according to data compiled by LSEG **Including session moves, shares are up18.4 percent year to date

Hello my dears,

After introducing you to $TDY (-1,37%) Teledyne and noticed from your comments and likes. You are interested in the blade suppliers, so today I climbed deep into the engine room.

And found for you $LTRX found Lanotronix.

@EpsEra (do you know the company?)

Since Teledyne is a long-term runner that has impressed with its robustness in recent years.

I would like to emphasize that Lanotronix is a rather cyclical stock.

However, the tide could now be turning because Lanotronix products are becoming increasingly important. This is reflected in sales.

As the chart shows, investors also seem to be recognizing this. And that's why, dear readers, I don't want to withhold the company from you.

Estimates in millions:

2026 2027

Turnover 126.26 141.28

Profit - 6.24 - 3.46

EBIT 7.26 11.68

KGV -31.3 -57.8

Free cashf 16.95 12.8

(The company is not yet profitable)

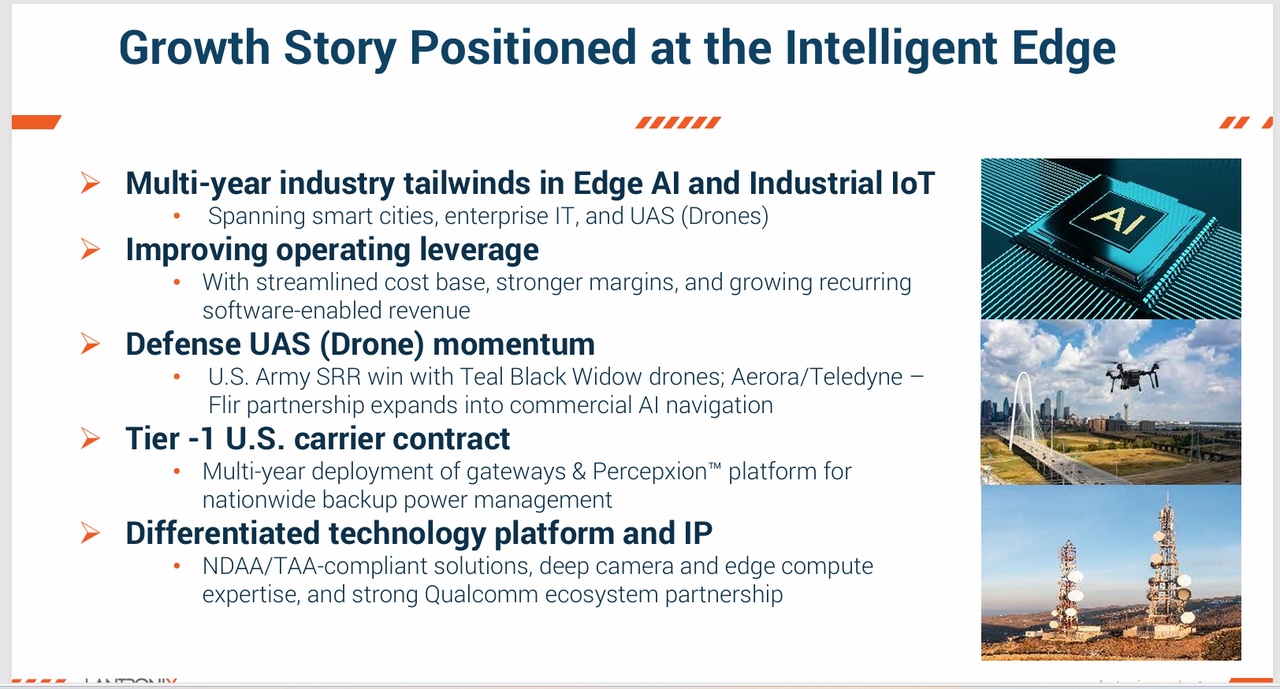

Lantronix Inc (NASDAQ: LTRX) is a leading global provider of compute and connectivity solutions for IoT solutions that enable AI edge intelligence

Lantronix Inc (Nasdaq: LTRX) is a global leader in edge AI and industrial IoT solutions, providing intelligent computing, secure connectivity and remote management for mission-critical applications. Serving high-growth markets including smart cities, enterprise IT, and unmanned systems for commerce and defense, Lantronix enables customers to optimize operations and accelerate digital transformation. The comprehensive portfolio of hardware, software and services supports applications ranging from secure video surveillance and intelligent utility infrastructure to fail-safe out-of-band network management. By delivering intelligence at the network edge, Lantronix helps organizations achieve efficiency, security and a competitive advantage in today's AI-driven world.

Lantronix wins the IoT Evolution Asset Tracking Award 2025

Tier 1 mobile operator in the U.S. selects Lantronix to digitally monitor 50,000+ cellular generators with FOX Series telematics edge gateways

IRVINE, California, October 7, 2025 - Lantronix Inc. (NASDAQ: LTRX), a leading global provider of computing and connectivity IoT solutions for edge AI applications, today announced that its Gateways der FOX-Serie received the IoT Evolution Asset Tracking Award 2025 from IoT Evolution Magazine, the leading publication for the Internet of Things. A key player in the digital transformation of remote assets, Lantronix industrial IoT edge telematics gateways are the choice of a Tier 1 U.S. cellular operator for monitoring its 50,000+ cellular generators.

Lantronix gewinnt den IoT Evolution Asset Tracking Award 2025

Lantronix launches no-code AI platform EdgeFabric.ai for edge computing/n

strategic collaboration positions Lantronix for long-term, high-margin growth in the defense and commercial drone markets, expected to reach $57.8 billion by 2030*

Lantronix launches no-code AI platform EdgeFabric.ai for edge computing/n

Lantronix lanciert No-Code-KI-Plattform EdgeFabric.ai für Edge Computing/n Von Investing.com

Lantronix share: Breakthrough in the drone market!

A new major order could be the turning point for Lantronix: The IoT specialist has beaten off the competition and been selected as a technology partner by Gremsy, a leading manufacturer of camera stabilizers for drones. The news has already caused the share price to jump by over 86% in the past six months.

The cooperation is based on Lantronix' Open-Q 5165RB System-on-Module, which is based on the Qualcomm Dragonwing processor. This solution powers Gremsy's new drone platform and Lynx ISR payload, which is seamlessly integrated with Teledyne FLIR's Hadron 640R dual thermal imaging camera. Notably, the technology is already in production and generating initial sales.

Why Lantronix was awarded the contract

"We chose Lantronix because the company is the trusted world market leader in the global drone industry," says Nguyen Van Chu from Gremsy, explaining the decision. Another decisive factor was the long-standing partnership with $QCOM (+0,21%) Qualcomm and the ability to deliver NDAA and TAA compliant solutions - a key advantage for government and defense applications.

The integrated solution scores with its energy efficiency and enables longer flight times with lower power consumption. Edge-based AI processing for object detection, real-time analytics and advanced connectivity with Wi-Fi 6 complete the package. The robust design works even in extreme temperatures from -25°C to +85°C.

Market potential makes investors prick up their ears

The figures speak for themselves: the drone market for defense and commercial applications is expected to grow to 57.8 billion dollars by 2030. Lantronix is cleverly positioning itself in this growth market with its high-margin solution, serving mission-critical applications in the government, energy, agriculture and infrastructure sectors.

CEO Saleel Awsare emphasizes the strategic importance: "With an increasing number of high-profile global drone customers, Lantronix is a key enabler for secure, high-performance drone platforms." The partnership with Gremsy demonstrates the scalability of the technology and opens the door for further collaborations with drone manufacturers worldwide.

Analysts are optimistic and see price targets of between 5 and 8 dollars per share. With a market capitalization of 180 million dollars, the drone division could become an important growth driver - especially if further design wins follow.

Lantronix Aktie: Durchbruch im Drohnenmarkt! () | aktiencheck.de

Lantronix solution supports US Army-certified Teal Drones, a Red Cat Holdings company, and unlocks growth opportunities for secure edge AI. $RCAT (+3,73%) Red Cat Holdings, and unlocks growth opportunities for secure edge AI

Lantronix Enables TAA and NDAA Compliant Edge AI Solution, Supports Sensitive U.S. Government Missions and Expands Long-Term Positioning in Defense Market

Lantronix-Lösung unterstützt die von der US-Armee

+ 1

Hello my dears,

Yesterday I wrote another company presentation / brief analysis.

Of course, it would also be nice to have a chart analysis.

That's why I'm launching a call today for people from the community who think they can do it.

a chart analysis of $TDY (-1,37%) Teledyne.

I'm really looking forward to your posts.

A special thanks to all those who motivate me to continue reporting here with likes 👍 and great comments.

My dears, since I didn't get everything into one post at getquin.

Here is part 2

Multiples: (USD in millions, source MarketScreener )

Market value 27,533

2025 2026 2027

KGV 32.6 28.8 25.7

Earnings per share 18 20.38 22.87

Turnover 6,067 6,389 6,719

EBITDA 1,490 1,620 1,731

Net result 852.5 965.6 1,081.0

Net debt 1,374.0 842.8 -333.1

CAPEX 111.5 117.9 125.4

Free cash flow 1,083 1,200 1,309

EBITDA MARGIN % 24.56% 25.35% 25.76%

EBIT MARGIN % 17.72% 19.13% 20.41%

ROE 9.82% 10.02% 10.05%

Number of shares 46,888 46,888 46,888

My dears, I think the estimates are very conservative. And as the chart shows, the estimates were exceeded in the last earnings.

I like the fact that important multiples can be increased, and thus the P/E ratio decreases.

+ 5

Hello my dears,

As already announced, I would like to present another company to you in a brief analysis.

The company is still on my watch list, but should soon find its way into my portfolio. After I suggested the share to @simpson Holding as a NEW investment a few weeks ago. Of course I don't want to withhold this company from you.

As usual with @simpson Holding, it is a quality company with growth. Which has already proven over several years that the moat holds.

But I don't want to keep you in suspense any longer. The company in question is Teledyne. $TDY (-1,37%)

Dear readers, who might already be familiar with the company, or who is invested, and what is your opinion?

During my research today, I realized that I have fallen a little bit in love with the company (you shouldn't fall in love with a company).

The reason could be that it is a very diversified company. Which is almost exclusively active in future-oriented sectors.

By the way, for all the critics and smart pigs who are always on the lookout for mistakes of any kind. I would like to say "It took me a lot of time today to write this short analysis. I'm doing this on a voluntary basis without earning any money. Because I just think this community is MEGA".

(without AI)

Introduction: I would like to start with the multiples.

Multiples: (USD in millions, source MarketScreener )

Market value 27,533

2025 2026 2027

KGV 32.6 28.8 25.7

Earnings per share 18 20.38 22.87

Turnover 6,067 6,389 6,719

EBITDA 1,490 1,620 1,731

Net result 852.5 965.6 1,081.0

Net debt 1,374.0 842.8 -333.1

CAPEX 111.5 117.9 125.4

Free cash flow 1,083 1,200 1,309

EBITDA MARGIN % 24.56% 25.35% 25.76%

EBIT MARGIN % 17.72% 19.13% 20.41%

ROE 9.82% 10.02% 10.05%

Number of shares 46,888 46,888 46,888

My dears, I think the estimates are very conservative. And as the chart shows, the estimates were exceeded in the last earnings.

I like the fact that important multiples can be increased, and thus the P/E ratio decreases.

But now to the really exciting part of the short analysis.

Company presentation:

Ladies and gentlemen, in order not to make the presentation too long for you, which might be too boring for some of you. I have simply included some informative graphics.

You may not know it, but Teledyne enables

many of the products and services you use every day.

Teledyne provides enabling technologies to capture, transmit and analyze information for industrial growth markets. These markets include aerospace and defense, factory automation, environmental monitoring of air and water quality, electronics design and development, oceanographic research, energy, medical imaging and pharmaceutical research.

About Teledyne:

Teledyne Technologies Incorporated provides enabling technologies for industrial growth markets that require advanced technology and high reliability. These markets include aerospace and defense, factory automation, environmental monitoring of air and water quality, electronics design and development, oceanographic research, deepwater oil and gas exploration and production, medical imaging and pharmaceutical research.

Our products include digital image sensors, cameras and systems in the visible, infrared and X-ray spectrum, monitoring and control instruments for marine and environmental applications, harsh environment connectivity, electronic test and measurement equipment, aircraft information management systems and subsystems for defense electronics and satellite communications. We also supply technical systems for defense, space, environmental and energy applications. We differentiate ourselves from many of our direct competitors with a customer and corporate sponsored applied research center that enhances our product development capabilities.

Our strategy continues to focus on growth in our core markets of instrumentation, digital imaging, aerospace and defense electronics and engineered systems. Our core markets are characterized by high barriers to entry and include specialized products and services that are unlikely to become commoditized. We intend to strengthen and expand our core businesses through targeted acquisitions and product development.

We aggressively pursue operational excellence to continuously improve our margins and earnings. At Teledyne, operational excellence includes the rapid integration of the businesses we acquire. By leveraging complementary technologies across our businesses and internal research and development, we strive to develop new products to grow our business and expand our addressable markets.

Teledyne's operations are located primarily in the United States, the United Kingdom, Canada and Western and Northern Europe.

However, as I have noticed over the last few weeks that you are particularly interested in certain areas. I would like to take a closer look at two sectors.

Aerospace & Defense Electronics

And

Aerospace & Defense Electronics

Teledyne Aerospace & Defense Electronics offers a comprehensive portfolio of advanced solutions that meet the most demanding requirements in the harshest environments. Our diverse product lines offer both customized and standard solutions to meet the current and future needs of critical applications in avionics, power, electronic warfare, missiles, radar and surveillance, aerospace, test and measurement, and satellite communications.

Teledyne Aerospace & Defense Electronics serves the defense, space and commercial markets worldwide, offering a comprehensive portfolio of advanced solutions that meet the most demanding requirements in the harshest environments. With custom and standard products, we offer a diverse portfolio to meet the current and future needs of critical avionics, power, electronic warfare, missile, radar, satcom, space, test and measurement applications.

Teledyne Aerospace & Defense Electronics is one of the four Geschäftssegmente von Teledyne Technologies Incorporated (NYSE:TDY). With over $5.6 billion in sales and approximately 15,000 employees worldwide, Teledyne's expertise and ability to provide the aerospace and defense industry with technologically advanced products and services has been proven.

Our aerospace electronics business provides advanced avionics systems for commercial air transport and military aircraft for data acquisition, communications, networking, data loading and wireless data transmission; portable data loaders; ground-based applications for data management and analysis; and aviation batteries.

Teledyne controls

Provides on-board avionics systems and ground-based applications that enable commercial and military aircraft operators to access, manage and utilize their data more efficiently.

Teledyne battery products

Provides high-performance valve-regulated lead-acid (VRLA) batteries and battery systems for general aviation and defense applications.

Perhaps a drone producer that few people have on their radar. And all this at an acceptable P/E ratio.

German Armed Forces award drone contract to Teledyne FLIR Defense

Teledyne FLIR Defense, part of Teledyne Technologies Incorporated, has been awarded a contract by the German army to supply its Black Hornet® 4 Personal Reconnaissance System to the German armed forces. This has now been announced by the company.

Teledyne FLIR is the supplier of Black Hornet 4 systems, parts and training under a two-year contract with the Federal Office of Bundeswehr Equipment, Information Technology and In-Service Support (BAAINBw). The contract award was brokered by Teledyne FLIR's regional partner, European Logistic Partners (ELP) GmbH of Wuppertal, Germany, as the BAAINBw contractor.

The Black Hornet 4 represents the next generation of lightweight nano drones capable of providing small combat units with enhanced covert situational awareness. The 12 megapixel day vision camera and high-resolution thermal imaging camera provide the operator with razor-sharp video and still images. Weighing just 70 grams, the Black Hornet 4 can fly for over 30 minutes and more than two kilometers and is said to operate in 25 knots of wind and rain.

A highly stealthy, advanced drone such as the Black Hornet 4 provides a distinct advantage for law enforcement agencies to carry out their most challenging missions, the statement added.

FLIR Defense has delivered more than 33,000 Black Hornet drones to military and security forces in over 45 countries. Black Hornet drones are used by the Ukrainian Armed Forces and have proven themselves in countless operations under difficult conditions.

The award-winning Black Hornet is designed and built by Teledyne FLIR Defense in Norway.

+ 4

September 15, 2025

"Star investor" Homer J Simpson invested in Teledyne Technologies with his "holding" after a positive comment from getquin Top Analyst @Tenbagger2024 in Teledyne Technologies.

Above all, Homer J likes the exciting business with potential for the future.

The sales of approx. 10% ️ and EPS of 5.20$ are also impressive.

In addition, the 2 billion share buyback program and several company takeovers also played a decisive role for an entry.

After my first post on humanoid robots received a lot of positive feedback, I went into more detail. I have subsequently added my favorites in each sector.

Extended analysis of the value chain including shovel manufacturers and potential hidden champions

New categorySecondary key sectors (sales, marketing, financing)

In additionTop 25 companies worldwide, as well as Top 10 Europe and Top 10 Asia

I have also added a video link for beginners. This will give you an idea of how far the development of humanoid robotics has already progressed.

Thank you for your attention and your support 🙏

🌐 1. value chain of humanoid robots (with hidden champions)

1. research & chip design

$ARM (+1,05%) ARM (UK) - CPU-IP, energy-efficient processors

$SNPS (+0,03%) Synopsys (US) - EDA software, chip design

$CDNS (+2,04%) Cadence (US) - EDA & Simulation

$PTC PTC (US) - Engineering Software, CAD/PLM

$DSY (-10,66%) Dassault Systèmes (FR) - 3D Design & Digital Twin

$SIE (-0,37%) Siemens (DE) - Industrial Software & Lifecycle Mgmt

$ADBE (-0,2%) Adobe (US) - Design, AR/UX

ANSYS (US) - multiphysical simulation - acquisition by Synopsis

Altair (US) - CAE, simulation, digital twin - acquisition by Siemens

$HXGBY (+0,49%)

Hexagon (SE) - Metrology & Simulation

$AWE (+2,2%) Alphawave IP Group (UK) - High-speed chip IP for AI/robotics

1.Synopsis, 2.Siemens and 3.Adobe are my top 3 in this sector

2. manufacturing technology & equipment

$ASML (+2,17%) ASML (NL) - Lithography (EUV)

$AMAT (+2,2%) Applied Materials (US) - Semiconductor equipment

$8035 (+1,46%) Tokyo Electron (JP) - wafer fabrication

$KEYS (+1,16%) Keysight Technologies (US) - Metrology

$6857 (-1,13%) Advantest (JP) - Chip test systems

$TER (+4,54%) Teradyne (US) - test systems + cobots

$6954 (+0,66%) Fanuc (JP) - Industrial robots, CNC

$CAT (+1,47%) Caterpillar (US) - autonomous machines

$KU2G KUKA (DE) - industrial robots

Comau (IT) - automation - not listed on the stock exchange

$ROK Rockwell Automation (US) - industrial automation

$JBL (+3,61%) Jabil (US) - contract manufacturing (EMS/ODM)

$KIT (+15,5%) Kitron (NO) - European EMS/ODM manufacturer

$AIXA (+0,25%) Aixtron (DE) - deposition equipment for compound semiconductors

$LRCX (+1,93%)

Lam Research (US) - Etch/deposition systems

$MKSI (+4,56%)

MKS Instruments (US) - Plasma/vacuum technology

$ASM (+2,79%)

ASM International (NL) - Deposition systems

1.ASML, 2.Keysight Technologies, 3.Fanuc are my top 3 in this sector

3. chip manufacturing (foundries)

$TSM (+0,6%) TSMC (TW) - leading foundry

$SMSN Samsung Electronics (KR) - foundry + memory

$GFS (+1,47%) GlobalFoundries (US) - specialty chips

$INTC (+11,6%)

Intel Foundry Services (US) - new western foundry player

$981

SMIC (CN) - largest Chinese foundry

$UMC

UMC (TW) - Power/RF/Embedded chips

1.TSMC, 2.Intel, 3.Samsung Electronics are my top 3 in this sector

4. computing & control unit ("brain")

$NVDA (+1,16%) Nvidia (US) - GPUs, AI chips

$INTC (+11,6%) Intel (US) - CPUs, FPGAs

$AMD (+3,4%) AMD (US) - CPUs, GPUs

$MRVL (-0,07%) Marvell (US) - Network Chips

$MU (+4,36%) Micron (US) - Memory

$DELL (+3,14%) Dell Technologies (US) - Edge & Infrastructure

Graphcore (UK) - AI chips (IPU) - not a listed company

Cerebras (US) - Wafer-scale engine - not a listed company

SiPearl (FR) - European HPC chip - not a listed company

1.Nvidia, 2.Marvell, 3.Micron are my top 3 in this sector

5. sensors ("senses")

$6758 (+0,26%) Sony (JP) - image sensors

$6861 (-0,12%) Keyence (JP) - Industrial sensors

$STM (-12,4%) STMicroelectronics (FR/IT) - Sensors, MCUs

$TDY (-1,37%) Teledyne (US) - optical/infrared sensors

$CGNX (+3,64%) Cognex (US) - Machine Vision

$HON (+6,73%) Honeywell (US) - sensor technology, security

ANYbotics (CH) - autonomous sensor fusion - not a listed company

$AMBA (+4,91%) Ambarella (US) - video & computer vision SoCs for real-time image recognition

$OUST

Velodyne Lidar (US) - Lidar sensors - acquisition by Ouster

$AMS (-4,16%)

OSRAM (AT/DE) - optical sensors

1.Teledyne, 2.Keyence, 3.Ouster are my top 3 in this sector

6. actuators & power electronics ("muscles")

$IFX (-2,31%) Infineon (DE) - Power Electronics

$ON (-0,34%) onsemi (US) - Power & Sensors

$TXN (+0,46%) Texas Instruments (US) - Mixed-Signal Chips

$ADI (+0,25%) Analog Devices (US) - Signal Processing

$PH Parker-Hannifin (US) - Hydraulics/Pneumatics

$MP (-1,66%) MP Materials (US) - Magnets

$APH (+5,1%) Amphenol (US) - Connectors

$6481 (-3,17%) THK (JP) - Linear guides & actuators

$6324 (-6,52%)

Harmonic Drive (JP) - Precision gears & servo drives for robotics

$6594 (-9,62%)

Nidec (JP) - Electric motors

$6506 (-0,61%)

Yaskawa (JP) - Drives & Robotics

$SU (+1,63%)

Schneider Electric (FR) - Energy & control solutions

$ZIL2 (+3,34%)

ElringKlinger (DE) - Battery & fuel cell technology, lightweight construction

1.Parker-Hannifin, 2.MP Materials, 3.Infinion are my top 3 in this sector

7. communication & networking ("nerves")

$QCOM (+0,21%) Qualcomm (US) - mobile communications, edge AI

$ANET (+5,04%) Arista Networks (US) - Networks

$CSCO (-0,46%) Cisco (US) - Networks, Security

$EQIX (+0,28%) Equinix (US) - Data centers

NTT Docomo (JP) - 5G/6G carrier - not a listed company

$VZ Verizon (US) - Telecommunications

$SFTBY SoftBank (JP) - Carrier + Robotics

$ERIC B (+0,88%)

Ericsson (SE) - 5G/IoT infrastructure

$NOKIA (+10,84%)

Nokia (FI) - 5G/6G for industry

$HPE (+0,6%)

Juniper Networks (US) - Network technology - acquisition by HP

1.Arista Networks, 2.SoftBank, 3.Cisco are my top 3 in this sector

8. energy supply

$3750 (-1,16%) CATL (CN) - Batteries

$6752 (-0,95%) Panasonic (JP) - Batteries

$373220 LG Energy (KR) - Batteries

$ALB (+6,83%) Albemarle (US) - Lithium

$LYC (+5,04%) Lynas (AU) - Rare earths

$UMICY (+1,46%) Umicore (BE) - recycling

WiTricity (US) - inductive charging - not a listed company

$ABBN (+3,15%) Charging (CH) - charging infrastructure

$SLDP

Solid Power (US) - Solid state batteries

Northvolt (SE) - European batteries - not a listed company

$PLUG

Plug Power (US) - fuel cells

$KULR (+1,72%)

KULR Technology (US) - Thermal management & battery safety for mobile systems

1.Albemarle, 2.CATL, 3.Panasonic are my top 3 in this sector

9. cloud & infrastructure

$AMZN (+1,02%) Amazon AWS (US) - Cloud, AI

$MSFT (-0,03%) Microsoft Azure (US) - Cloud, AI

$GOOG (+1,14%) Alphabet Google Cloud (US) - Cloud, ML

$VRT

Vertiv Holdings (US) - Data center infrastructure (UPS, cooling, edge)

$ORCL (+2,66%)

Oracle Cloud (US) - ERP + Cloud

$IBM (+3,79%)

IBM Cloud (US) - Hybrid cloud + AI

$OVH (-6,02%)

OVHcloud (FR) - European cloud

1.Alphabet, 2.Microsoft, 3.Oracle are my top 3 in this sector

10. software & data platforms

$PLTR (+2,84%) Palantir (US) - Data integration

$DDOG (+2%) Datadog (US) - Monitoring

$SNOW (+4,86%) Snowflake (US) - Data Cloud

$ORCL (+2,66%) Oracle (US) - Databases, ERP

$SAP (+2,92%) SAP (DE) - ERP systems

$SPGI S&P Global (US) - financial/market data

ROS2 Foundation - robotics middleware - not listed on the stock exchange

$NVDA (+1,16%) NVIDIA Isaac (US) - robotics development - part of Nvidia

$INOD (+3,5%) Innodata (US) - data annotation & AI training data

$PATH (+2,39%)

UiPath (RO/US) - Robotic process automation

$AI (+1,65%)

C3.ai (US) - AI platform

$ESTC (+1,16%)

(NL/US) - Search & data analysis

1.S&P Global, 2.Palantir, 3.Datadog are my top 3 in this sector

11. end applications / robots

$ABBN (+3,15%) ABB (CH/SE) - Industrial Robots

$6954 (+0,66%) Fanuc (JP) - Industrial robots

$TSLA (+1,82%) Tesla Optimus (US) - humanoid robot

$9618 (+2,02%) JD.com (CN) - logistics robot

$AAPL (+0,3%) Apple (US) - Platform & UX

$700 (+1,98%) Tencent (CN) - Platform & AI

$9988 (+3,54%) Alibaba (CN) - logistics & platform

PAL Robotics (ES) - humanoid robots - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

$TER (+4,54%) Universal Robots (DK) - cobots - belongs to the Teradyne Corporation

Engineered Arts (UK) - humanoid robots - not a listed company

$ISRG (+4,41%) Intuitive Surgical (US) - surgical robotics

$GMED (+0%)

Globus Medical (US) - surgical robotics (ExcelsiusGPS platform)

$7012 (+7,93%) Kawasaki Heavy Industries (JP) - industrial robots, automation

$CPNG (-0,06%) Coupang (KR) - Logistics end user

$IRBT (+4,66%)

iRobot (US) - consumer robotics (e.g. Roomba), non-humanoid, but navigation/sensor fusion

Boston Dynamics (US) - humanoid & mobile robots-no listed company

Hanson Robotics (HK) - humanoid robots (Sophia) - not a listed company

Agility Robotics (US) - humanoid robot "Digit" - not a listed company

1.Apple, 2.Tencent, 3.Alibaba are my top 3 in this sector

🛠 2. cross enablers (shovel manufacturers) - with hidden champions

Raw materials & battery materials

Albemarle - Lynas - Umicore

$SQM

SQM (CL) - Lithium

$ILU (+8,11%)

Iluka Resources (AU) - Rare earths

$ARR (-5,43%)

American Rare Earths (US/AU) - New supply chains

my number 1 in the sector is Albemarle

manufacturing technology

ASML - Applied Materials - Tokyo Electron

$LRCX (+1,93%)

Lam Research (US) - Plasma/etching processes

$ASM (+2,79%)

ASM International (NL) - ALD equipment

$MKSI (+4,56%)

MKS Instruments (US) - Plasma/vacuum technology

my number 1 in the sector is ASML

Quality assurance

Keysight - Advantest - Teradyne

$EMR (+2,29%)

National Instruments (US) - Measurement technology - from Emerson Electric adopted

$300567

ATE Test Systems (CN) - test systems

$FORM (+3,65%)

FormFactor (US) - Wafer probing

my number 1 in the sector is Keysight

Motion & Drive

Parker-Hannifin

Festo (DE) - Pneumatics, Soft Robotics - not a listed company

Bosch Rexroth (DE) - Drives, Controls - not a listed company

$6481 (-3,17%)

THK (JP) - Linear guides

my number 1 in the sector is Parker-Hannifin

Sensors/Imaging

$TDY (-1,37%) Teledyne

$BSL (-2,76%) Basler (DE) - Industrial cameras

FLIR (US) - Thermal imaging sensors - acquisition by Teledyne

ISRA Vision (DE) - Machine Vision - not a listed company

my number 1 in the sector is Teledyne

Magnets & Materials

MP Materials

$6501 (+0,67%)

Hitachi Metals (JP) - Magnetic materials

VacuumSchmelze (DE) - Magnetic materials - not a listed company

$4063 (-0,66%)

Shin-Etsu Chemical (JP) - Specialty materials

my number 1 in the sector is MP Materials

Chip Design & Simulation

Synopsys - Cadence - ARM

$SIE (-0,37%)

Siemens EDA (DE/US)-Mentor Graphics-strategic business unit of Siemens AG

Imagination Tech (UK) - GPU-IP - not a listed company

$CEVA (+3,96%)

CEVA (IL) - Signal Processor IP

my number 1 in the sector is Synopsys

Engineering & Lifecycle

PTC - Dassault - Siemens

Altair (US) - Simulation - no longer a listed company

$HXGBY (+0,49%)

Hexagon (SE) - Metrology

$SNPS (+0,03%)

ANSYS (US) - Simulation - takeover by Synopsys

my number 1 in the sector is Siemens

Networks & Data Centers

Arista - Cisco - Equinix

$HPE (+0,6%)

Juniper (US) - Networks - Acquisition of HPE

$DTE (-1,7%)

T-Systems (DE) - Industry cloud

$OVH (-6,02%)

OVHcloud (FR) - European cloud

my number 1 in the sector is Arista

Cloud infrastructure

AWS - Azure - Google Cloud

$ORCL (+2,66%)

Oracle Cloud (US) - ERP & databases

$IBM (+3,79%)

IBM Cloud (US) - Hybrid Cloud

$9988 (+3,54%)

Alibaba Cloud (CN) - Asian Cloud

$VRT

Vertiv Holdings (US) - Cloud/Infra

my number 1 in the sector is Alphabet (Google)

finance/information infra

S&P Global

$MCO (+1,63%)

Moody's (US) - Ratings

$MSCI (+1,18%)

MSCI (US) - Indices

$MORN

Morningstar (US) - Investment Research

my number 1 in the sector is S&P Global

Creative/Experience Infra

Adobe

$ADSK (+1,54%)

Autodesk (US) - CAD & Design

$U

Unity (US) - 3D/AR simulation

Epic Games (US) - Unreal Engine - not a listed company

my number 1 in the sector is Adobe

Platform & Ecosystem

Apple - Tencent - Alibaba

$META (+0,13%)

Meta (US) - AR/VR, Social Robotics

ByteDance (CN) - AI & platforms - not a listed company

$9888 (+2,77%)

Baidu (CN) - AI & Cloud

my number 1 in the sector is Tencent

Infrastructure/Edge

Dell

$HPE (+0,6%)

HPE (US) - Edge Computing

$SMCI

Supermicro (US) - AI servers

$6702 (+1,97%)

Fujitsu (JP) - Edge & HPC

my number 1 in the sector is Dell

storage solutions

Micron

$HY9H

SK Hynix (KR) - Memory

$285A (+2,66%)

Kioxia (JP) - NAND

$WDC

Western Digital (US) - Storage solutions

my number 1 in the sector is Micron

🏛 3. secondary key sectors with hidden champions

Financing & Capital

$GS (+0,87%) Goldman Sachs (US) - investment bank; ECM/DCM, M&A, growth financing

$MS Morgan Stanley (US) - investment bank; tech banking, capital markets

$BLK (+0,15%) BlackRock (US) - asset manager; capital allocation, ETFs/index funds

$9984 (-1,65%) SoftBank Vision Fund (JP) - mega VC; growth equity in robotics/AI

Sequoia Capital (US) - venture capital; early/growth in AI/robotics - this is a classic venture capital fund

DARPA (US) - government R&D funding (robotics/defense) - independent research and development agency

EU Horizon (EU) - research funding/grants for DeepTech - Innovative Europe pillar

China State Funds (CN) - state industry/technology fund

Lux Capital (US) - VC for DeepTech - Uptake (US) - AI-based predictive maintenance

DCVC (US) - Robotics & AI focus - investing exclusively via VC fund investments

Speedinvest (AT) - EU VC for robotics - access to investment only via fund investments

my number 1 in the sector is Softbank

Maintenance & Service

$SIE (-0,37%) Siemens (DE) - Industrial Service, Lifecycle & Retrofit

$ABBN (+3,15%) ABB (CH/SE) - Robotics Service, Spare Parts, Field Support

$GEHC (+0,75%) GE Healthcare (US) - Medtech service incl. robotic systems

Uptake (US) - AI-based predictive maintenance - not a listed company

Augury (US/IL) - condition monitoring, condition diagnostics - not a listed company

$KU2 KUKA Service (DE) - Robotics maintenance

$6954 (+0,66%) Fanuc Service (JP) - global service network

Boston Dynamics AI Institute (US) - Robotics longevity - funded by Hyundai Motor Group

my number 1 in the sector is Siemens

Marketing & Advertising

$WPP (-2,14%) WPP (UK) - global advertising group; branding/communications

$OMC Omnicom (US) - marketing/PR network

$PUB (+0,8%) Publicis (FR) - communications/advertising group

$META (+0,13%) Meta (US) - Digital Ads (Facebook/Instagram)

$GOOG (+1,14%) Google Ads (US) - search & display advertising

TikTok / ByteDance (CN) - social ads & distribution - not a listed company

$AAPL (+0,3%) Apple (US) - Branding/UX; Acceptance & Platform Marketing

$WPP (-2,14%)

AKQA (UK/US) - Tech branding - Since 2012 majority owned by the WPP Groupbut continues to operate as an autonomous operating unit

R/GA (US) - Innovation marketing - not a listed company

Serviceplan (DE) - largest independent EU agency - not a listed company

my number 1 in the sector is Meta

Law, Regulation & Ethics

ISO (CH) - international standards, robotics standards

TÜV (DE) - certification & safety tests

UL (US) - safety/conformity testing

EU AI Act (EU) - legal framework for AI & robotics

UNESCO AI Ethics (UN) - global ethics guidelines

Fraunhofer IPA (DE) - Robotics safety standards

ANSI (US) - standards

IEC (CH) - Electrical engineering standards

Training & Talent

MIT (US) - Robotics/AI Research & Education

ETH Zurich (CH) - autonomous systems & robotics

Stanford (US) - AI/Robotics labs & spin-offs

Tsinghua University (CN) - Robotics/AI in Asia

CMU (US) - Robotics Institute

EPFL (CH) - Robotics research

TU Munich (DE) - humanoid robot "Roboy"

🌍 Top 25 companies for humanoid robotics

These companies are central to the development & production of humanoid robotsbecause without them, crucial parts of the chain would be missing:

Chips & computing power (brain of the robots)

$NVDA (+1,16%) Nvidia (US) - AI GPUs & Isaac platform, foundation for robotic AI

$2330 TSMC (TW) - world's most important foundry, produces the AI chips

$ASML (+2,17%) ASML (NL) - EUV lithography, indispensable for chip production

$005930 Samsung Electronics (KR) - memory, logic, foundry

$HY9H SK Hynix (KR) - DRAM & NAND memory for AI

$MU (+4,36%) Micron (US) - Memory solutions for AI workloads

my number 1 in the sector is ASML

Sensors & perception (senses of robots)

$SONY Sony (JP) - image sensors, market leader

$6861 (-0,12%) Keyence (JP) - Industrial sensors & vision systems

$CGNX (+3,64%) Cognex (US) - Machine Vision, precise image processing

my number 1 in the sector is Keyence

Actuators & motion (muscles of robots)

$IFX (-2,31%) Infineon (DE) - power electronics, motor control

$6594 (-9,62%) Nidec (JP) - World market leader for electric motors

$PH Parker-Hannifin (US) - hydraulics/pneumatics, motion technology

$6481 (-3,17%) THK (JP) - Linear guides & actuators

my number 1 in the sector is Parker-Hannifin

Communication, cloud & infrastructure (nerves & data flow)

$QCOM (+0,21%) Qualcomm (US) - Mobile & Edge Chips

$AMZN (+1,02%) Amazon AWS (US) - Cloud & AI infrastructure

$MSFT (-0,03%) Microsoft Azure (US) - Cloud, AI services

$CSCO (-0,46%) Cisco (US) - Networks & Security

$VRT Vertiv Holdings (US) - Data Center Infrastructure

my number 1 in the sector is Microsoft

End Applications & Platforms (robots themselves)

$TSLA (+1,82%) Tesla (US) - humanoid robot Optimus

$ABBN (+3,15%) ABB (CH/SE) - Robotics & Automation

$6954 (+0,66%) Fanuc (JP) - industrial robots & CNC systems

$7012 (+7,93%) Kawasaki Heavy Industries (JP) - industrial robots

PAL Robotics (ES) - humanoid robots (TALOS, ARI, TIAGo) - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

Universal Robots (DK) - cobots

my number 1 in the sector is Tesla

🇪🇺 Top 10 European key companies for humanoid robotics

$ASML (+2,17%)

ASML (NL)

World market leader in EUV lithography - no modern chips for AI & robotics without ASML.

$IFX (-2,31%) Infineon (DE)

Leading in power electronics & motor control - crucial for actuators of humanoid robots.

$STM (-12,4%)

STMicroelectronics (FR/IT)

Sensors, microcontrollers & power chips - the basis for control & perception.

$SAP (+2,92%)

SAP (DE)

ERP & data platforms, important for integrating humanoid robots into industrial processes.

$SIE (-0,37%)

Siemens (DE)

Industrial software, automation, digital twin - key for engineering & lifecycle management.

$KU2 KUKA (EN)

Robotics pioneer, industrial robots & automation - know-how for humanoid motion mechanics.

PAL Robotics (ES) - not a listed company

Specialist for humanoid robots (TALOS, ARI, TIAGo), internationally used in research & service.

Neura Robotics (DE) - Not a listed company

Young high-tech company, develops cognitive humanoid robots with advanced AI (4NE-1).

Universal Robots (DK) - Not a listed company

Market leader for cobots - platform for safe human-robot collaboration.

Engineered Arts (UK) - not a listed company

Develops humanoid robots such as Amecaknown for realistic facial expressions & gestures - important for HRI (Human-Robot Interaction)

🌏 Top 10 Asian key companies for humanoid robotics

$2330

TSMC (Taiwan)

World's largest semiconductor foundry, produces high-end chips (e.g. Nvidia, AMD, Apple) - no AI hardware without TSMC.

$005930

Samsung Electronics (South Korea)

Foundry, memory, logic chips, image sensors - extremely broadly positioned in robotics components.

$HY9H

SK Hynix (KR) - Memory

$SONY

Sony (Japan)

Market leader in CMOS image sensors, essential for robotic vision & perception.

$6861 (-0,12%)

Keyence (Japan)

Sensor technology & machine vision for industrial automation, widely used in robotics.

$6954 (+0,66%)

Fanuc (Japan)

Industrial robots & CNC systems, one of the most important manufacturers of robotics hardware worldwide.

$6506 (-0,61%)

Yaskawa Electric (Japan)

Drives, motion control & robot arms - relevant for humanoid motion control.

$6594 (-9,62%)

Nidec (Japan)

World market leader for electric motors (from mini motors to high-performance drives).

$7012 (+7,93%)

Kawasaki Heavy Industries (JP) - Industrial robots

$9618 (+2,02%)

JD.com (China)

Driver for robotics in e-commerce & logistics, invests in humanoid robotics applications

The hype is all about humanoid robots, but the constant winners are in the background.

I have divided the analysis into two perspectives. 1. the complete value chain of humanoid robots, which shows all the players from the chip to the finished robot, and 2. the blade manufacturers in the background, who always earn money as enablers, regardless of which manufacturer wins the race.

ASML, Applied Materials and Tokyo Electron dominate in manufacturing technology. Quality assurance comes from Keysight, Advantest and Teradyne. Chip design is supported by Synopsys, Cadence and ARM. Data streams are secured by Arista Networks, Cisco and Equinix. The computing basis is created in the cloud by Amazon, Microsoft and Alphabet. Albemarle, Lynas and Umicore play a central role in raw materials and battery materials. These companies monetize their customers' investment waves, have high barriers to entry, service revenues and pricing power, but remain cyclical with risks from export rules, capex cuts and currency movements.

🌐 Value chain of humanoid robots Sector overview

1. research & chip design (IP / EDA)

$ARM (+1,05%)

ARM Holdings (ARM, UK/USA) - CPU architectures

$SNPS (+0,03%)

Synopsys (SNPS, USA) - Chip design software

$CDNS (+2,04%)

Cadence Design Systems (CDNS, USA) - EDA & Simulation

2. manufacturing technology & equipment

$ASML (+2,17%)

ASML (ASML, NL) - EUV lithography, key monopoly

$AMAT (+2,2%)

Applied Materials (AMAT, USA) - Process equipment

$8035 (+1,46%)

Tokyo Electron (8035.T, JP) - Wafer equipment

$KEYS (+1,16%)

Keysight Technologies (KEYS, USA) - Test & RF measurement technology

$6857 (-1,13%)

Advantest (6857.T, JP) - Semiconductor test systems

$TER (+4,54%)

Teradyne (TER, USA) - Test systems + robotics (Universal Robots)

3. chip production (Foundries)

$TSM (+0,6%)

TSMC (TSM, TW) - Largest contract manufacturer

$005930

Samsung Electronics (005930.KQ, KR) - Memory + Foundry

$GFS (+1,47%)

GlobalFoundries (GFS, USA) - Specialized production

4. computing & control unit ("brain")

$NVDA (+1,16%)

Nvidia (NVDA, USA) - GPUs, AI accelerators

$INTC (+11,6%)

Intel (INTC, USA) - CPUs, FPGAs

$AMD (+3,4%)

AMD (AMD, USA) - CPUs/GPUs

$MRVL (-0,07%)

Marvell Technology (MRVL, USA) - Network/data center chips

5. sensors ("senses")

$6758 (+0,26%)

Sony (6758.T, JP) - CMOS image sensors

$6861 (-0,12%)

Keyence (6861.T, JP) - Vision systems, sensors

$STM (-12,4%)

STMicroelectronics (STM, CH/FR) - MEMS sensors

6. actuators & power electronics ("muscles")

$IFX (-2,31%)

Infineon (IFX, DE) - Power semiconductors, SiC

$ON (-0,34%)

N Semiconductor (ON, USA) - SiC/Power Chips

$STM (-12,4%)

STMicroelectronics (STM, CH/FR) - Motor control & power

$TXN (+0,46%)

Texas Instruments (TXN, USA) - Motor control, power ICs

$ADI (+0,25%)

Analog Devices (ADI, USA) - Energy & BMS chips

7. communication & networking ("nerves")

$QCOM (+0,21%)

Qualcomm (QCOM, USA) - 5G/SoCs

$AVGO (+2,3%)

Broadcom (AVGO, USA) - Network & radio chips

$SWKS (+1,6%)

Skyworks Solutions (SWKS, USA) - RF components

8. energy supply

$300750

CATL (300750.SZ, CN) - Batteries

$6752 (-0,95%)

Panasonic (6752.T, JP) - Batteries for automotive/robotics

$373220

LG Energy Solution (373220.KQ, KR) - Batteries

9. cloud & infrastructure

$AMZN (+1,02%)

Amazon (AMZN, USA) - AWS

$MSFT (-0,03%)

Microsoft (MSFT, USA) - Azure

$GOOG (+1,14%)

Alphabet (GOOGL, USA) - Google Cloud

$EQIX (+0,28%)

Equinix (EQIX, USA) - Data center operator

$ANET (+5,04%)

Arista Networks (ANET, USA) - Network infrastructure

$CSCO (-0,46%)

Cisco Systems (CSCO, USA) - Edge & Data Center Networks

10. software & data platforms

$PLTR (+2,84%)

Palantir (PLTR, USA) - Data integration, decision software

$DDOG (+2%)

Datadog (DDOG, USA) - Cloud monitoring / observability

$SNOW (+4,86%)

Snowflake (SNOW, USA) - Cloud-native data platform

$ORCL (+2,66%)

Oracle (ORCL, USA) - Databases, ERP

$SAP (+2,92%)

SAP (SAP, DE) - ERP/cloud systems

$PATH (+2,39%)

UiPath (PATH, USA) - Automation software (RPA)

$AI (+1,65%)

C3.ai (AI, USA) - Enterprise AI platform

11. end applications / robots

$ABB

ABB (ABB, CH) - Industrial robots

$6954 (+0,66%)

Fanuc (6954.T, JP) - Industrial robots, CNC

$TSLA (+1,82%)

Tesla (TSLA, USA) - Optimus" humanoid robot

$9618 (+2,02%)

JD.com (JD, CN) - E-commerce & automated logistics

🛠️ Shovel manufacturer for humanoid robots

🔹 Hardtech (physical "shovels")

These companies provide the material basis: manufacturing machines, raw materials, semiconductor base.

Semiconductor Equipment & Manufacturing

$ASML (+2,17%)

ASML (ASML, NL) - EUV lithography (monopoly).

$AMAT (+2,2%)

Applied Materials (AMAT, USA) - Wafer equipment.

$8035 (+1,46%)

Tokyo Electron (8035.T, JP) - Process equipment.

Test systems (hardware-side)

$6857 (-1,13%)

Advantest (6857.T, JP) - Semiconductor test.

$TER (+4,54%)

Teradyne (TER, USA) - Test systems + industrial robots.

Materials & raw materials

$ALB (+6,83%)

Albemarle (ALB, USA) - Lithium (batteries).

$LYC (+5,04%)

Lynas Rare Earths (LYC.AX, AUS) - Rare earths for magnets.

$UMICY (+1,46%)

Umicore (UMI.BR, BE) - Cathode materials, recycling.

🔹 Soft/infra (digital "shovels")

These companies supply the infrastructure & toolswithout which development, training and operation would be impossible.

Design Software & IP

$SNPS (+0,03%)

Synopsys (SNPS, USA) - EDA software.

$CDNS (+2,04%)

Cadence Design Systems (CDNS, USA) - Chip design & simulation.

$ARM (+1,05%)

ARM Holdings (ARM, UK/USA) - CPU architectures (license model).

Test & Measurement (software/signal level)

$KEYS (+1,16%)

Keysight Technologies (KEYS, USA) - Electronics & RF test systems.

Network & data center backbone

$ANET (+5,04%)

Arista Networks (ANET, USA) - High-speed networks.

$CSCO (-0,46%)

Cisco Systems (CSCO, USA) - Data center/edge networks.

$EQIX (+0,28%)

Equinix (EQIX, USA) - Data centers (colocation).

Cloud infrastructure

$AMZN (+1,02%)

Amazon (AMZN, USA) - AWS (cloud, AI training).

$MSFT (-0,03%)

Microsoft (MSFT, USA) - Azure.

$GOOG (+1,14%)

Alphabet (GOOGL, USA) - Google Cloud.

Takeaway: Investing in the infrastructure stack allows you to participate in the robotics trend regardless of the subsequent product winner and reduces the individual product risk, but you have to live with cycles. In your opinion, which stage of the chain offers the best risk/return combination and fits into a disciplined portfolio?

Source: Own analysis based on publicly available company information and IR materials of the companies mentioned.

Image material: Techa Tungateja/iStockphoto

Swarms of nanodrones can greatly increase the efficiency of agriculture. Researchers are certain that they can spray and fertilize independently when they detect a need and much more.

Sat., May 31, 2025, 3:47 p.m.

Unprecedented growth

The global market for agricultural nanodrones is growing rapidly. Forecasts predict an average annual growth rate of 35% over the next decade. Governments and private investors are increasingly investing in this groundbreaking technology and driving progress in research, development and deployment.

Agricultural countries such as India, Brazil and the countries of sub-Saharan Africa are actively using nanodrones. The market for small and nano drones is expected to reach USD 10.4 billion by 2030, growing at a compound annual growth rate of 8.6% from 2023. The focus here is on agriculture and disaster management.

Political recommendations also advocate subsidies and incentives to encourage small farmers to use drone technology.

Nanodrones make agriculture much more efficient

Research shows that the use of nanodrones has helped to optimize efficiency in agriculture. The Robotic Eagle-Micro Drone, for example, shows the potential of bio-inspired nanodrones in tackling agricultural problems such as pollinator decline and crop monitoring.

Nanocopters, or small helicopter-like drones, can also be used to stimulate pollination and increase productivity.

Examples: Monitor, detect, treat

The seamless integration of nanodrones into sensor networks has proven its worth in large-scale agricultural monitoring. It improves crop yields and reduces the use of chemical pesticides at the same time.

As these drones detect plant diseases before visible symptoms appear, they prevent large-scale crop losses and thus ensure food security even in regions affected by unpredictable climate changes.

Newer nanodrones offer innovative solutions that increase efficiency while reducing operating costs and environmental impact. For example, nanodrones such as AgroFly are designed for high-precision pesticide application, minimizing drift and ensuring optimal crop protection without excessive exposure to the product.

Another system called AgroWings is designed for large-scale monitoring and is equipped with AI-powered sensors that analyze soil conditions, detect nutrient deficiencies and provide real-time feedback to farmers.

Robotic Eagle uses advanced imaging technologies to detect early signs of disease, pest infestation and water stress to intervene in time and prevent large-scale crop failure.

Nano drones in agriculture are a growing trend. There are various companies that specialize in drones for agriculture and whose shares are traded on the stock exchange, such as Drone Destination or ZenaTech. There are also companies that manufacture drones in general, such as DJI or Parrot, whose shares can also be found on the stock exchange.

Drone Destination:

This company is a major player in the agricultural drone market and recently completed a successful IPO.

Drone Destination Limited is an India-based drone as a service (DaaS) and training company. The company is engaged in trading, operating, manufacturing, repairing, leasing and training for various types of drones including Multirotor, Fixed Wing, Hybrid UAV, e-VTOL, UAS, SUAV, RPV, RPAS, UWV, UGV and others. The company is a licensee of the General Directorate of Civil Aviation.

ZenaTech: $ZENA (+1,45%)

This company specializes in AI-powered drone solutions that can also be used in agriculture.

DJI and Parrot: $PARRO (+3,06%)

These companies are leading manufacturers of drones that can also be used in agriculture.

Joby Aviation: $JOBY

A company that focuses on the development of air cab drones that can also be used in agriculture.

Northrop Grumman: $NOC (+1,54%)

A well-known defense manufacturer that also develops and offers drones for agriculture.

Teledyne Technologies: $TDY (-1,37%)

A company active in various fields, including agriculture and aviation, offering drone solutions.

Exail Technologies: $EXA (+0,54%)

A company that focuses on developing drone solutions for agriculture and other industries.

Autel Robotics: $688208

Another major manufacturer of civilian drones that also offers drones for agriculture.

$RCAT (+3,73%) Red Cat Holdings and its subsidiaries develop drones that can be used in various fields, including agriculture. For example, drones can be used to inspect fields, take aerial photographs and monitor crops.

Please note that investing in shares involves risks and that you should inform yourself thoroughly before investing.

Moin together,

what do you think about Teledyne $TDY (-1,37%) ?

https://aktie.traderfox.com/visualizations/US8793601050/DI/teledyne-technologies-inc

In my opinion, a very solid company with growth potential and low risk.

However, I have never noticed the company in a portfolio here.

Principais criadores desta semana