Good evening to the community,

I need a few opinions from you on downsizing.

at the moment there are 40 individual stocks + 1ETF in my portfolio.

I would like to minimize the existing positions to around 30 and then also increase my cash holdings.

The final list includes

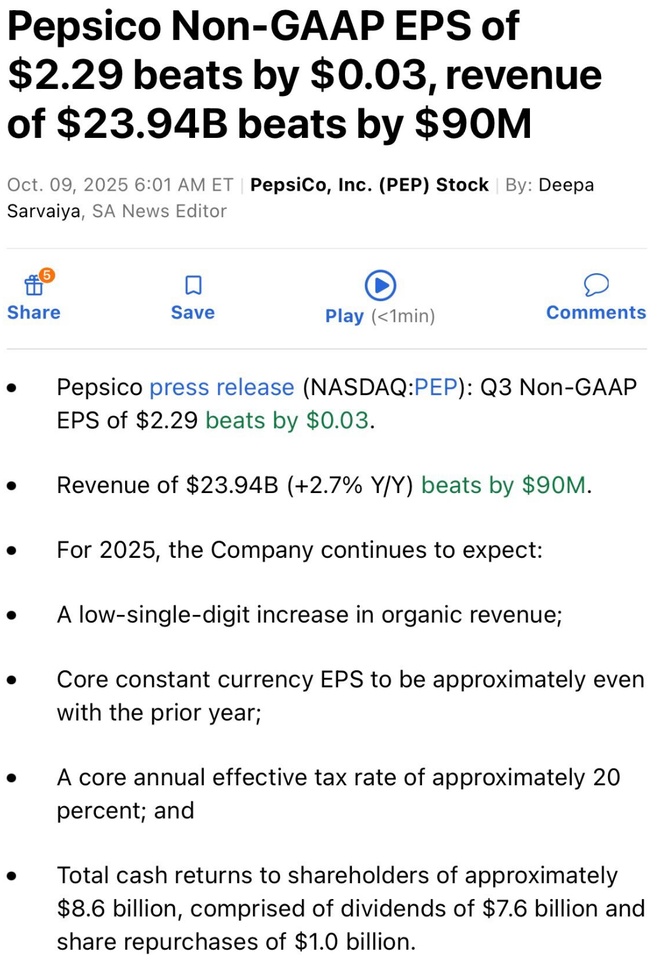

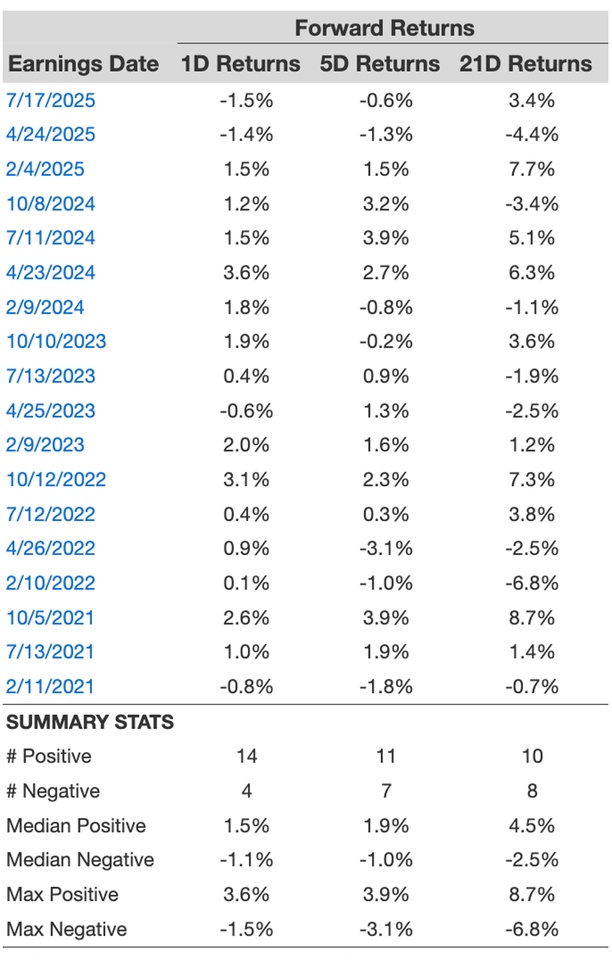

$O (+0,02%) , $MRK (-0,73%) , $PG (+0,24%) , $LIN (-1,41%) , $PEP (-1,25%)

during the selection process I realized that I only picked out the "defensive stocks".

This would mean that my portfolio would then only consist of "tech stocks".

That's why I'm wondering how best to handle it to avoid a "cluster risk".

How do you personally deal with this?

What would be the alternative?

What else would you have on your final list?

I'm looking forward to the exchange!

Greetings go out to the community ✌️