$NDAQ (+1,49%)

$RTX (+0,72%)

$KO (-1,23%)

$MMM (+2,81%)

$NOC (+1,54%)

$LMTB34

$OR (+0,6%)

$TXN (+0,46%)

$NFLX (-0,47%)

$HEIA (-1,21%)

$SAAB B (-1,74%)

$UCG (+0,96%)

$BARC (+1,78%)

$GEV (+3,33%)

$TMO (+0,14%)

$T (-3,77%)

$MCO (+1,63%)

$IBM (+3,79%)

$SAP (+2,92%)

$TSLA (+1,82%)

$AAL (+5,1%)

$FCX (+1,08%)

$HON (+6,73%)

$DOW (+12,42%)

$NOKIA (+10,84%)

$TMUS (-3,47%)

$INTC (+11,6%)

$NEM (+0,57%)

$F (+4,11%)

$PG (+0,24%)

$GD (+1,24%)

Discussão sobre MCO

Postos

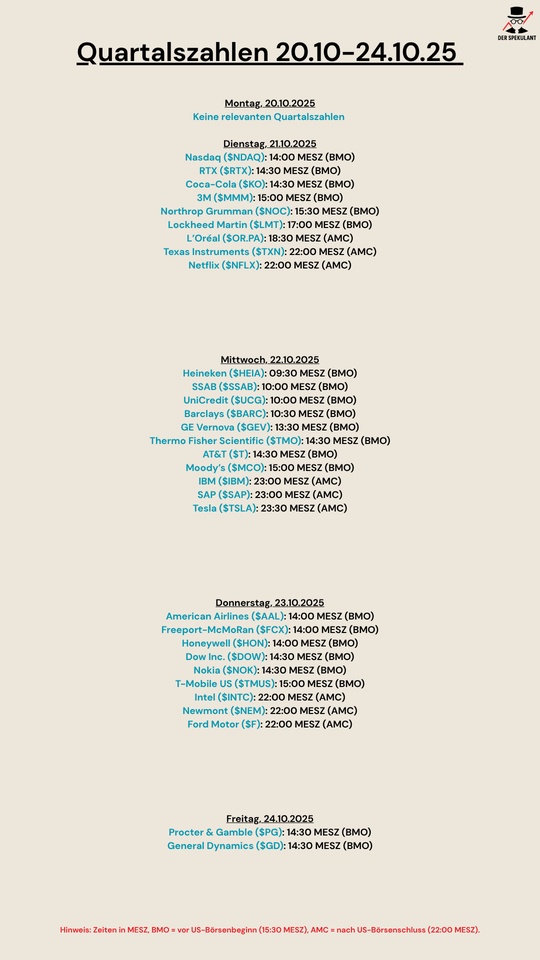

22Quartalsberichte 21.10-24.10.25

Megatrend robotics, freshly updated, added value guaranteed!

After my first post on humanoid robots received a lot of positive feedback, I went into more detail. I have subsequently added my favorites in each sector.

Extended analysis of the value chain including shovel manufacturers and potential hidden champions

New categorySecondary key sectors (sales, marketing, financing)

In additionTop 25 companies worldwide, as well as Top 10 Europe and Top 10 Asia

I have also added a video link for beginners. This will give you an idea of how far the development of humanoid robotics has already progressed.

Thank you for your attention and your support 🙏

🌐 1. value chain of humanoid robots (with hidden champions)

1. research & chip design

$ARM (+1,05%) ARM (UK) - CPU-IP, energy-efficient processors

$SNPS (+0,03%) Synopsys (US) - EDA software, chip design

$CDNS (+2,04%) Cadence (US) - EDA & Simulation

$PTC PTC (US) - Engineering Software, CAD/PLM

$DSY (-10,66%) Dassault Systèmes (FR) - 3D Design & Digital Twin

$SIE (-0,37%) Siemens (DE) - Industrial Software & Lifecycle Mgmt

$ADBE (-0,2%) Adobe (US) - Design, AR/UX

ANSYS (US) - multiphysical simulation - acquisition by Synopsis

Altair (US) - CAE, simulation, digital twin - acquisition by Siemens

$HXGBY (+0,49%)

Hexagon (SE) - Metrology & Simulation

$AWE (+2,2%) Alphawave IP Group (UK) - High-speed chip IP for AI/robotics

1.Synopsis, 2.Siemens and 3.Adobe are my top 3 in this sector

2. manufacturing technology & equipment

$ASML (+2,17%) ASML (NL) - Lithography (EUV)

$AMAT (+2,2%) Applied Materials (US) - Semiconductor equipment

$8035 (+1,46%) Tokyo Electron (JP) - wafer fabrication

$KEYS (+1,16%) Keysight Technologies (US) - Metrology

$6857 (-1,13%) Advantest (JP) - Chip test systems

$TER (+4,54%) Teradyne (US) - test systems + cobots

$6954 (+0,66%) Fanuc (JP) - Industrial robots, CNC

$CAT (+1,47%) Caterpillar (US) - autonomous machines

$KU2G KUKA (DE) - industrial robots

Comau (IT) - automation - not listed on the stock exchange

$ROK Rockwell Automation (US) - industrial automation

$JBL (+3,61%) Jabil (US) - contract manufacturing (EMS/ODM)

$KIT (+15,5%) Kitron (NO) - European EMS/ODM manufacturer

$AIXA (+0,25%) Aixtron (DE) - deposition equipment for compound semiconductors

$LRCX (+1,93%)

Lam Research (US) - Etch/deposition systems

$MKSI (+4,56%)

MKS Instruments (US) - Plasma/vacuum technology

$ASM (+2,79%)

ASM International (NL) - Deposition systems

1.ASML, 2.Keysight Technologies, 3.Fanuc are my top 3 in this sector

3. chip manufacturing (foundries)

$TSM (+0,6%) TSMC (TW) - leading foundry

$SMSN Samsung Electronics (KR) - foundry + memory

$GFS (+1,47%) GlobalFoundries (US) - specialty chips

$INTC (+11,6%)

Intel Foundry Services (US) - new western foundry player

$981

SMIC (CN) - largest Chinese foundry

$UMC

UMC (TW) - Power/RF/Embedded chips

1.TSMC, 2.Intel, 3.Samsung Electronics are my top 3 in this sector

4. computing & control unit ("brain")

$NVDA (+1,16%) Nvidia (US) - GPUs, AI chips

$INTC (+11,6%) Intel (US) - CPUs, FPGAs

$AMD (+3,4%) AMD (US) - CPUs, GPUs

$MRVL (-0,07%) Marvell (US) - Network Chips

$MU (+4,36%) Micron (US) - Memory

$DELL (+3,14%) Dell Technologies (US) - Edge & Infrastructure

Graphcore (UK) - AI chips (IPU) - not a listed company

Cerebras (US) - Wafer-scale engine - not a listed company

SiPearl (FR) - European HPC chip - not a listed company

1.Nvidia, 2.Marvell, 3.Micron are my top 3 in this sector

5. sensors ("senses")

$6758 (+0,26%) Sony (JP) - image sensors

$6861 (-0,12%) Keyence (JP) - Industrial sensors

$STM (-12,4%) STMicroelectronics (FR/IT) - Sensors, MCUs

$TDY Teledyne (US) - optical/infrared sensors

$CGNX (+3,64%) Cognex (US) - Machine Vision

$HON (+6,73%) Honeywell (US) - sensor technology, security

ANYbotics (CH) - autonomous sensor fusion - not a listed company

$AMBA (+4,91%) Ambarella (US) - video & computer vision SoCs for real-time image recognition

$OUST

Velodyne Lidar (US) - Lidar sensors - acquisition by Ouster

$AMS (-4,16%)

OSRAM (AT/DE) - optical sensors

1.Teledyne, 2.Keyence, 3.Ouster are my top 3 in this sector

6. actuators & power electronics ("muscles")

$IFX (-2,31%) Infineon (DE) - Power Electronics

$ON (-0,34%) onsemi (US) - Power & Sensors

$TXN (+0,46%) Texas Instruments (US) - Mixed-Signal Chips

$ADI (+0,25%) Analog Devices (US) - Signal Processing

$PH Parker-Hannifin (US) - Hydraulics/Pneumatics

$MP (-1,66%) MP Materials (US) - Magnets

$APH (+5,1%) Amphenol (US) - Connectors

$6481 (-3,17%) THK (JP) - Linear guides & actuators

$6324 (-6,52%)

Harmonic Drive (JP) - Precision gears & servo drives for robotics

$6594 (-9,62%)

Nidec (JP) - Electric motors

$6506 (-0,61%)

Yaskawa (JP) - Drives & Robotics

$SU (+1,63%)

Schneider Electric (FR) - Energy & control solutions

$ZIL2 (+3,34%)

ElringKlinger (DE) - Battery & fuel cell technology, lightweight construction

1.Parker-Hannifin, 2.MP Materials, 3.Infinion are my top 3 in this sector

7. communication & networking ("nerves")

$QCOM (+0,21%) Qualcomm (US) - mobile communications, edge AI

$ANET (+5,04%) Arista Networks (US) - Networks

$CSCO (-0,46%) Cisco (US) - Networks, Security

$EQIX (+0,28%) Equinix (US) - Data centers

NTT Docomo (JP) - 5G/6G carrier - not a listed company

$VZ Verizon (US) - Telecommunications

$SFTBY SoftBank (JP) - Carrier + Robotics

$ERIC B (+0,88%)

Ericsson (SE) - 5G/IoT infrastructure

$NOKIA (+10,84%)

Nokia (FI) - 5G/6G for industry

$HPE (+0,6%)

Juniper Networks (US) - Network technology - acquisition by HP

1.Arista Networks, 2.SoftBank, 3.Cisco are my top 3 in this sector

8. energy supply

$3750 (-1,16%) CATL (CN) - Batteries

$6752 (-0,95%) Panasonic (JP) - Batteries

$373220 LG Energy (KR) - Batteries

$ALB (+6,83%) Albemarle (US) - Lithium

$LYC (+5,04%) Lynas (AU) - Rare earths

$UMICY (+1,46%) Umicore (BE) - recycling

WiTricity (US) - inductive charging - not a listed company

$ABBN (+3,15%) Charging (CH) - charging infrastructure

$SLDP

Solid Power (US) - Solid state batteries

Northvolt (SE) - European batteries - not a listed company

$PLUG

Plug Power (US) - fuel cells

$KULR (+1,72%)

KULR Technology (US) - Thermal management & battery safety for mobile systems

1.Albemarle, 2.CATL, 3.Panasonic are my top 3 in this sector

9. cloud & infrastructure

$AMZN (+1,02%) Amazon AWS (US) - Cloud, AI

$MSFT (-0,03%) Microsoft Azure (US) - Cloud, AI

$GOOG (+1,14%) Alphabet Google Cloud (US) - Cloud, ML

$VRT

Vertiv Holdings (US) - Data center infrastructure (UPS, cooling, edge)

$ORCL (+2,66%)

Oracle Cloud (US) - ERP + Cloud

$IBM (+3,79%)

IBM Cloud (US) - Hybrid cloud + AI

$OVH (-6,02%)

OVHcloud (FR) - European cloud

1.Alphabet, 2.Microsoft, 3.Oracle are my top 3 in this sector

10. software & data platforms

$PLTR (+2,84%) Palantir (US) - Data integration

$DDOG (+2%) Datadog (US) - Monitoring

$SNOW (+4,86%) Snowflake (US) - Data Cloud

$ORCL (+2,66%) Oracle (US) - Databases, ERP

$SAP (+2,92%) SAP (DE) - ERP systems

$SPGI (+0,34%) S&P Global (US) - financial/market data

ROS2 Foundation - robotics middleware - not listed on the stock exchange

$NVDA (+1,16%) NVIDIA Isaac (US) - robotics development - part of Nvidia

$INOD (+3,5%) Innodata (US) - data annotation & AI training data

$PATH (+2,39%)

UiPath (RO/US) - Robotic process automation

$AI (+1,65%)

C3.ai (US) - AI platform

$ESTC (+1,16%)

(NL/US) - Search & data analysis

1.S&P Global, 2.Palantir, 3.Datadog are my top 3 in this sector

11. end applications / robots

$ABBN (+3,15%) ABB (CH/SE) - Industrial Robots

$6954 (+0,66%) Fanuc (JP) - Industrial robots

$TSLA (+1,82%) Tesla Optimus (US) - humanoid robot

$9618 (+2,02%) JD.com (CN) - logistics robot

$AAPL (+0,3%) Apple (US) - Platform & UX

$700 (+1,98%) Tencent (CN) - Platform & AI

$9988 (+3,54%) Alibaba (CN) - logistics & platform

PAL Robotics (ES) - humanoid robots - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

$TER (+4,54%) Universal Robots (DK) - cobots - belongs to the Teradyne Corporation

Engineered Arts (UK) - humanoid robots - not a listed company

$ISRG (+4,41%) Intuitive Surgical (US) - surgical robotics

$GMED (+0%)

Globus Medical (US) - surgical robotics (ExcelsiusGPS platform)

$7012 (+7,93%) Kawasaki Heavy Industries (JP) - industrial robots, automation

$CPNG (-0,06%) Coupang (KR) - Logistics end user

$IRBT (+4,66%)

iRobot (US) - consumer robotics (e.g. Roomba), non-humanoid, but navigation/sensor fusion

Boston Dynamics (US) - humanoid & mobile robots-no listed company

Hanson Robotics (HK) - humanoid robots (Sophia) - not a listed company

Agility Robotics (US) - humanoid robot "Digit" - not a listed company

1.Apple, 2.Tencent, 3.Alibaba are my top 3 in this sector

🛠 2. cross enablers (shovel manufacturers) - with hidden champions

Raw materials & battery materials

Albemarle - Lynas - Umicore

$SQM

SQM (CL) - Lithium

$ILU (+8,11%)

Iluka Resources (AU) - Rare earths

$ARR (-5,43%)

American Rare Earths (US/AU) - New supply chains

my number 1 in the sector is Albemarle

manufacturing technology

ASML - Applied Materials - Tokyo Electron

$LRCX (+1,93%)

Lam Research (US) - Plasma/etching processes

$ASM (+2,79%)

ASM International (NL) - ALD equipment

$MKSI (+4,56%)

MKS Instruments (US) - Plasma/vacuum technology

my number 1 in the sector is ASML

Quality assurance

Keysight - Advantest - Teradyne

$EMR (+2,29%)

National Instruments (US) - Measurement technology - from Emerson Electric adopted

$300567

ATE Test Systems (CN) - test systems

$FORM (+3,65%)

FormFactor (US) - Wafer probing

my number 1 in the sector is Keysight

Motion & Drive

Parker-Hannifin

Festo (DE) - Pneumatics, Soft Robotics - not a listed company

Bosch Rexroth (DE) - Drives, Controls - not a listed company

$6481 (-3,17%)

THK (JP) - Linear guides

my number 1 in the sector is Parker-Hannifin

Sensors/Imaging

$TDY Teledyne

$BSL (-2,76%) Basler (DE) - Industrial cameras

FLIR (US) - Thermal imaging sensors - acquisition by Teledyne

ISRA Vision (DE) - Machine Vision - not a listed company

my number 1 in the sector is Teledyne

Magnets & Materials

MP Materials

$6501 (+0,67%)

Hitachi Metals (JP) - Magnetic materials

VacuumSchmelze (DE) - Magnetic materials - not a listed company

$4063 (-0,66%)

Shin-Etsu Chemical (JP) - Specialty materials

my number 1 in the sector is MP Materials

Chip Design & Simulation

Synopsys - Cadence - ARM

$SIE (-0,37%)

Siemens EDA (DE/US)-Mentor Graphics-strategic business unit of Siemens AG

Imagination Tech (UK) - GPU-IP - not a listed company

$CEVA (+3,96%)

CEVA (IL) - Signal Processor IP

my number 1 in the sector is Synopsys

Engineering & Lifecycle

PTC - Dassault - Siemens

Altair (US) - Simulation - no longer a listed company

$HXGBY (+0,49%)

Hexagon (SE) - Metrology

$SNPS (+0,03%)

ANSYS (US) - Simulation - takeover by Synopsys

my number 1 in the sector is Siemens

Networks & Data Centers

Arista - Cisco - Equinix

$HPE (+0,6%)

Juniper (US) - Networks - Acquisition of HPE

$DTE (-1,7%)

T-Systems (DE) - Industry cloud

$OVH (-6,02%)

OVHcloud (FR) - European cloud

my number 1 in the sector is Arista

Cloud infrastructure

AWS - Azure - Google Cloud

$ORCL (+2,66%)

Oracle Cloud (US) - ERP & databases

$IBM (+3,79%)

IBM Cloud (US) - Hybrid Cloud

$9988 (+3,54%)

Alibaba Cloud (CN) - Asian Cloud

$VRT

Vertiv Holdings (US) - Cloud/Infra

my number 1 in the sector is Alphabet (Google)

finance/information infra

S&P Global

$MCO (+1,63%)

Moody's (US) - Ratings

$MSCI (+1,18%)

MSCI (US) - Indices

$MORN

Morningstar (US) - Investment Research

my number 1 in the sector is S&P Global

Creative/Experience Infra

Adobe

$ADSK (+1,54%)

Autodesk (US) - CAD & Design

$U

Unity (US) - 3D/AR simulation

Epic Games (US) - Unreal Engine - not a listed company

my number 1 in the sector is Adobe

Platform & Ecosystem

Apple - Tencent - Alibaba

$META (+0,13%)

Meta (US) - AR/VR, Social Robotics

ByteDance (CN) - AI & platforms - not a listed company

$9888 (+2,77%)

Baidu (CN) - AI & Cloud

my number 1 in the sector is Tencent

Infrastructure/Edge

Dell

$HPE (+0,6%)

HPE (US) - Edge Computing

$SMCI

Supermicro (US) - AI servers

$6702 (+1,97%)

Fujitsu (JP) - Edge & HPC

my number 1 in the sector is Dell

storage solutions

Micron

$HY9H

SK Hynix (KR) - Memory

$285A (+2,66%)

Kioxia (JP) - NAND

$WDC

Western Digital (US) - Storage solutions

my number 1 in the sector is Micron

🏛 3. secondary key sectors with hidden champions

Financing & Capital

$GS (+0,87%) Goldman Sachs (US) - investment bank; ECM/DCM, M&A, growth financing

$MS Morgan Stanley (US) - investment bank; tech banking, capital markets

$BLK (+0,15%) BlackRock (US) - asset manager; capital allocation, ETFs/index funds

$9984 (-1,65%) SoftBank Vision Fund (JP) - mega VC; growth equity in robotics/AI

Sequoia Capital (US) - venture capital; early/growth in AI/robotics - this is a classic venture capital fund

DARPA (US) - government R&D funding (robotics/defense) - independent research and development agency

EU Horizon (EU) - research funding/grants for DeepTech - Innovative Europe pillar

China State Funds (CN) - state industry/technology fund

Lux Capital (US) - VC for DeepTech - Uptake (US) - AI-based predictive maintenance

DCVC (US) - Robotics & AI focus - investing exclusively via VC fund investments

Speedinvest (AT) - EU VC for robotics - access to investment only via fund investments

my number 1 in the sector is Softbank

Maintenance & Service

$SIE (-0,37%) Siemens (DE) - Industrial Service, Lifecycle & Retrofit

$ABBN (+3,15%) ABB (CH/SE) - Robotics Service, Spare Parts, Field Support

$GEHC (+0,75%) GE Healthcare (US) - Medtech service incl. robotic systems

Uptake (US) - AI-based predictive maintenance - not a listed company

Augury (US/IL) - condition monitoring, condition diagnostics - not a listed company

$KU2 KUKA Service (DE) - Robotics maintenance

$6954 (+0,66%) Fanuc Service (JP) - global service network

Boston Dynamics AI Institute (US) - Robotics longevity - funded by Hyundai Motor Group

my number 1 in the sector is Siemens

Marketing & Advertising

$WPP (-2,14%) WPP (UK) - global advertising group; branding/communications

$OMC Omnicom (US) - marketing/PR network

$PUB (+0,8%) Publicis (FR) - communications/advertising group

$META (+0,13%) Meta (US) - Digital Ads (Facebook/Instagram)

$GOOG (+1,14%) Google Ads (US) - search & display advertising

TikTok / ByteDance (CN) - social ads & distribution - not a listed company

$AAPL (+0,3%) Apple (US) - Branding/UX; Acceptance & Platform Marketing

$WPP (-2,14%)

AKQA (UK/US) - Tech branding - Since 2012 majority owned by the WPP Groupbut continues to operate as an autonomous operating unit

R/GA (US) - Innovation marketing - not a listed company

Serviceplan (DE) - largest independent EU agency - not a listed company

my number 1 in the sector is Meta

Law, Regulation & Ethics

ISO (CH) - international standards, robotics standards

TÜV (DE) - certification & safety tests

UL (US) - safety/conformity testing

EU AI Act (EU) - legal framework for AI & robotics

UNESCO AI Ethics (UN) - global ethics guidelines

Fraunhofer IPA (DE) - Robotics safety standards

ANSI (US) - standards

IEC (CH) - Electrical engineering standards

Training & Talent

MIT (US) - Robotics/AI Research & Education

ETH Zurich (CH) - autonomous systems & robotics

Stanford (US) - AI/Robotics labs & spin-offs

Tsinghua University (CN) - Robotics/AI in Asia

CMU (US) - Robotics Institute

EPFL (CH) - Robotics research

TU Munich (DE) - humanoid robot "Roboy"

🌍 Top 25 companies for humanoid robotics

These companies are central to the development & production of humanoid robotsbecause without them, crucial parts of the chain would be missing:

Chips & computing power (brain of the robots)

$NVDA (+1,16%) Nvidia (US) - AI GPUs & Isaac platform, foundation for robotic AI

$2330 TSMC (TW) - world's most important foundry, produces the AI chips

$ASML (+2,17%) ASML (NL) - EUV lithography, indispensable for chip production

$005930 Samsung Electronics (KR) - memory, logic, foundry

$HY9H SK Hynix (KR) - DRAM & NAND memory for AI

$MU (+4,36%) Micron (US) - Memory solutions for AI workloads

my number 1 in the sector is ASML

Sensors & perception (senses of robots)

$SONY Sony (JP) - image sensors, market leader

$6861 (-0,12%) Keyence (JP) - Industrial sensors & vision systems

$CGNX (+3,64%) Cognex (US) - Machine Vision, precise image processing

my number 1 in the sector is Keyence

Actuators & motion (muscles of robots)

$IFX (-2,31%) Infineon (DE) - power electronics, motor control

$6594 (-9,62%) Nidec (JP) - World market leader for electric motors

$PH Parker-Hannifin (US) - hydraulics/pneumatics, motion technology

$6481 (-3,17%) THK (JP) - Linear guides & actuators

my number 1 in the sector is Parker-Hannifin

Communication, cloud & infrastructure (nerves & data flow)

$QCOM (+0,21%) Qualcomm (US) - Mobile & Edge Chips

$AMZN (+1,02%) Amazon AWS (US) - Cloud & AI infrastructure

$MSFT (-0,03%) Microsoft Azure (US) - Cloud, AI services

$CSCO (-0,46%) Cisco (US) - Networks & Security

$VRT Vertiv Holdings (US) - Data Center Infrastructure

my number 1 in the sector is Microsoft

End Applications & Platforms (robots themselves)

$TSLA (+1,82%) Tesla (US) - humanoid robot Optimus

$ABBN (+3,15%) ABB (CH/SE) - Robotics & Automation

$6954 (+0,66%) Fanuc (JP) - industrial robots & CNC systems

$7012 (+7,93%) Kawasaki Heavy Industries (JP) - industrial robots

PAL Robotics (ES) - humanoid robots (TALOS, ARI, TIAGo) - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

Universal Robots (DK) - cobots

my number 1 in the sector is Tesla

🇪🇺 Top 10 European key companies for humanoid robotics

$ASML (+2,17%)

ASML (NL)

World market leader in EUV lithography - no modern chips for AI & robotics without ASML.

$IFX (-2,31%) Infineon (DE)

Leading in power electronics & motor control - crucial for actuators of humanoid robots.

$STM (-12,4%)

STMicroelectronics (FR/IT)

Sensors, microcontrollers & power chips - the basis for control & perception.

$SAP (+2,92%)

SAP (DE)

ERP & data platforms, important for integrating humanoid robots into industrial processes.

$SIE (-0,37%)

Siemens (DE)

Industrial software, automation, digital twin - key for engineering & lifecycle management.

$KU2 KUKA (EN)

Robotics pioneer, industrial robots & automation - know-how for humanoid motion mechanics.

PAL Robotics (ES) - not a listed company

Specialist for humanoid robots (TALOS, ARI, TIAGo), internationally used in research & service.

Neura Robotics (DE) - Not a listed company

Young high-tech company, develops cognitive humanoid robots with advanced AI (4NE-1).

Universal Robots (DK) - Not a listed company

Market leader for cobots - platform for safe human-robot collaboration.

Engineered Arts (UK) - not a listed company

Develops humanoid robots such as Amecaknown for realistic facial expressions & gestures - important for HRI (Human-Robot Interaction)

🌏 Top 10 Asian key companies for humanoid robotics

$2330

TSMC (Taiwan)

World's largest semiconductor foundry, produces high-end chips (e.g. Nvidia, AMD, Apple) - no AI hardware without TSMC.

$005930

Samsung Electronics (South Korea)

Foundry, memory, logic chips, image sensors - extremely broadly positioned in robotics components.

$HY9H

SK Hynix (KR) - Memory

$SONY

Sony (Japan)

Market leader in CMOS image sensors, essential for robotic vision & perception.

$6861 (-0,12%)

Keyence (Japan)

Sensor technology & machine vision for industrial automation, widely used in robotics.

$6954 (+0,66%)

Fanuc (Japan)

Industrial robots & CNC systems, one of the most important manufacturers of robotics hardware worldwide.

$6506 (-0,61%)

Yaskawa Electric (Japan)

Drives, motion control & robot arms - relevant for humanoid motion control.

$6594 (-9,62%)

Nidec (Japan)

World market leader for electric motors (from mini motors to high-performance drives).

$7012 (+7,93%)

Kawasaki Heavy Industries (JP) - Industrial robots

$9618 (+2,02%)

JD.com (China)

Driver for robotics in e-commerce & logistics, invests in humanoid robotics applications

Build robots, earn shovels

The hype is all about humanoid robots, but the constant winners are in the background.

I have divided the analysis into two perspectives. 1. the complete value chain of humanoid robots, which shows all the players from the chip to the finished robot, and 2. the blade manufacturers in the background, who always earn money as enablers, regardless of which manufacturer wins the race.

ASML, Applied Materials and Tokyo Electron dominate in manufacturing technology. Quality assurance comes from Keysight, Advantest and Teradyne. Chip design is supported by Synopsys, Cadence and ARM. Data streams are secured by Arista Networks, Cisco and Equinix. The computing basis is created in the cloud by Amazon, Microsoft and Alphabet. Albemarle, Lynas and Umicore play a central role in raw materials and battery materials. These companies monetize their customers' investment waves, have high barriers to entry, service revenues and pricing power, but remain cyclical with risks from export rules, capex cuts and currency movements.

🌐 Value chain of humanoid robots Sector overview

1. research & chip design (IP / EDA)

$ARM (+1,05%)

ARM Holdings (ARM, UK/USA) - CPU architectures

$SNPS (+0,03%)

Synopsys (SNPS, USA) - Chip design software

$CDNS (+2,04%)

Cadence Design Systems (CDNS, USA) - EDA & Simulation

2. manufacturing technology & equipment

$ASML (+2,17%)

ASML (ASML, NL) - EUV lithography, key monopoly

$AMAT (+2,2%)

Applied Materials (AMAT, USA) - Process equipment

$8035 (+1,46%)

Tokyo Electron (8035.T, JP) - Wafer equipment

$KEYS (+1,16%)

Keysight Technologies (KEYS, USA) - Test & RF measurement technology

$6857 (-1,13%)

Advantest (6857.T, JP) - Semiconductor test systems

$TER (+4,54%)

Teradyne (TER, USA) - Test systems + robotics (Universal Robots)

3. chip production (Foundries)

$TSM (+0,6%)

TSMC (TSM, TW) - Largest contract manufacturer

$005930

Samsung Electronics (005930.KQ, KR) - Memory + Foundry

$GFS (+1,47%)

GlobalFoundries (GFS, USA) - Specialized production

4. computing & control unit ("brain")

$NVDA (+1,16%)

Nvidia (NVDA, USA) - GPUs, AI accelerators

$INTC (+11,6%)

Intel (INTC, USA) - CPUs, FPGAs

$AMD (+3,4%)

AMD (AMD, USA) - CPUs/GPUs

$MRVL (-0,07%)

Marvell Technology (MRVL, USA) - Network/data center chips

5. sensors ("senses")

$6758 (+0,26%)

Sony (6758.T, JP) - CMOS image sensors

$6861 (-0,12%)

Keyence (6861.T, JP) - Vision systems, sensors

$STM (-12,4%)

STMicroelectronics (STM, CH/FR) - MEMS sensors

6. actuators & power electronics ("muscles")

$IFX (-2,31%)

Infineon (IFX, DE) - Power semiconductors, SiC

$ON (-0,34%)

N Semiconductor (ON, USA) - SiC/Power Chips

$STM (-12,4%)

STMicroelectronics (STM, CH/FR) - Motor control & power

$TXN (+0,46%)

Texas Instruments (TXN, USA) - Motor control, power ICs

$ADI (+0,25%)

Analog Devices (ADI, USA) - Energy & BMS chips

7. communication & networking ("nerves")

$QCOM (+0,21%)

Qualcomm (QCOM, USA) - 5G/SoCs

$AVGO (+2,3%)

Broadcom (AVGO, USA) - Network & radio chips

$SWKS (+1,6%)

Skyworks Solutions (SWKS, USA) - RF components

8. energy supply

$300750

CATL (300750.SZ, CN) - Batteries

$6752 (-0,95%)

Panasonic (6752.T, JP) - Batteries for automotive/robotics

$373220

LG Energy Solution (373220.KQ, KR) - Batteries

9. cloud & infrastructure

$AMZN (+1,02%)

Amazon (AMZN, USA) - AWS

$MSFT (-0,03%)

Microsoft (MSFT, USA) - Azure

$GOOG (+1,14%)

Alphabet (GOOGL, USA) - Google Cloud

$EQIX (+0,28%)

Equinix (EQIX, USA) - Data center operator

$ANET (+5,04%)

Arista Networks (ANET, USA) - Network infrastructure

$CSCO (-0,46%)

Cisco Systems (CSCO, USA) - Edge & Data Center Networks

10. software & data platforms

$PLTR (+2,84%)

Palantir (PLTR, USA) - Data integration, decision software

$DDOG (+2%)

Datadog (DDOG, USA) - Cloud monitoring / observability

$SNOW (+4,86%)

Snowflake (SNOW, USA) - Cloud-native data platform

$ORCL (+2,66%)

Oracle (ORCL, USA) - Databases, ERP

$SAP (+2,92%)

SAP (SAP, DE) - ERP/cloud systems

$PATH (+2,39%)

UiPath (PATH, USA) - Automation software (RPA)

$AI (+1,65%)

C3.ai (AI, USA) - Enterprise AI platform

11. end applications / robots

$ABB

ABB (ABB, CH) - Industrial robots

$6954 (+0,66%)

Fanuc (6954.T, JP) - Industrial robots, CNC

$TSLA (+1,82%)

Tesla (TSLA, USA) - Optimus" humanoid robot

$9618 (+2,02%)

JD.com (JD, CN) - E-commerce & automated logistics

🛠️ Shovel manufacturer for humanoid robots

🔹 Hardtech (physical "shovels")

These companies provide the material basis: manufacturing machines, raw materials, semiconductor base.

Semiconductor Equipment & Manufacturing

$ASML (+2,17%)

ASML (ASML, NL) - EUV lithography (monopoly).

$AMAT (+2,2%)

Applied Materials (AMAT, USA) - Wafer equipment.

$8035 (+1,46%)

Tokyo Electron (8035.T, JP) - Process equipment.

Test systems (hardware-side)

$6857 (-1,13%)

Advantest (6857.T, JP) - Semiconductor test.

$TER (+4,54%)

Teradyne (TER, USA) - Test systems + industrial robots.

Materials & raw materials

$ALB (+6,83%)

Albemarle (ALB, USA) - Lithium (batteries).

$LYC (+5,04%)

Lynas Rare Earths (LYC.AX, AUS) - Rare earths for magnets.

$UMICY (+1,46%)

Umicore (UMI.BR, BE) - Cathode materials, recycling.

🔹 Soft/infra (digital "shovels")

These companies supply the infrastructure & toolswithout which development, training and operation would be impossible.

Design Software & IP

$SNPS (+0,03%)

Synopsys (SNPS, USA) - EDA software.

$CDNS (+2,04%)

Cadence Design Systems (CDNS, USA) - Chip design & simulation.

$ARM (+1,05%)

ARM Holdings (ARM, UK/USA) - CPU architectures (license model).

Test & Measurement (software/signal level)

$KEYS (+1,16%)

Keysight Technologies (KEYS, USA) - Electronics & RF test systems.

Network & data center backbone

$ANET (+5,04%)

Arista Networks (ANET, USA) - High-speed networks.

$CSCO (-0,46%)

Cisco Systems (CSCO, USA) - Data center/edge networks.

$EQIX (+0,28%)

Equinix (EQIX, USA) - Data centers (colocation).

Cloud infrastructure

$AMZN (+1,02%)

Amazon (AMZN, USA) - AWS (cloud, AI training).

$MSFT (-0,03%)

Microsoft (MSFT, USA) - Azure.

$GOOG (+1,14%)

Alphabet (GOOGL, USA) - Google Cloud.

Takeaway: Investing in the infrastructure stack allows you to participate in the robotics trend regardless of the subsequent product winner and reduces the individual product risk, but you have to live with cycles. In your opinion, which stage of the chain offers the best risk/return combination and fits into a disciplined portfolio?

Source: Own analysis based on publicly available company information and IR materials of the companies mentioned.

Image material: Techa Tungateja/iStockphoto

Moody's shares shorter overview

Moody's $MCO (+1,63%)

MCO is primarily known for credit ratings, but also offers financial analysis and risk management tools.

The share has grown at a CAGR of 15.8 % since 2001 and has fallen by 18 % since February 2024.

Reasons for the attractiveness of MCO:

- 5-year key figures:

- Sales CAGR: 8,85 %

- Free cash flow CAGR: 12,97 %

- Dividend CAGR: 11,20 %

- Gross profit margin: 72,15 %

- Return on invested capital (ROIC): 16,10 %

- Liquidity: 229,31 %

- Payout ratio: 29,45 %

- Share buy-backs: 0,81 %

Time to buy: My top 30 companies that I am particularly looking at in the current crash

It is now slowly becoming clear who has what it takes to make good profits in the coming years.

Here are my top 30 companies by category, which I am particularly looking at in the current crash.

Some are still overvalued, others are already very attractive at the current price level.

Tier 1 (high corporate quality and strong growth)

Airbnb $ABNB (-0,68%)

Alphabet $GOOGL (+1,25%)

Amazon $AMZN (+1,02%)

ASML $ASML (+2,17%)

Axon $AXON (+1,94%)

Cadence $CDNS (+2,04%)

Constellation Software $CSU (+0,99%)

Crowdstrike $CRWD (+4,14%)

Fair Isaac $FICO (+2,58%)

Hermes $RMS (-0,05%)

Intuit $INTU (-0,48%)

Intuitive Surgical $ISRG (+4,41%)

Mastercard $MA (-0,01%)

Meta $META (+0,13%)

Netflix $NFLX (-0,47%)

Microsoft $MSFT (-0,03%)

Palantir $PLTR (+2,84%)

Tesla $TSLA (+1,82%)

Tier-2 (high business quality and moderate growth)

Booking $BKNG (-2,75%)

Costco $COST (-0,49%)

Ferrari $RACE (+2,13%)

Moody's $MCO (+1,63%)

MSCI $MSCI (+1,18%)

Transdigm $TDG (+2,67%)

Tier-3 (medium / solid corporate quality and strong growth)

Hims & Hers $HIMS (+2,06%)

Robinhood $HOOD (+5,45%)

Roblox $RBLX

Shopify $SHOP (+2,85%)

Spotify $SPOT (+0,38%)

The Trade Desk $TTD (+0,26%)

I bought on Friday and am buying again today - even in the course of the next few days and weeks, when we could probably see even lower prices.

Where are you buying?

Watchlist for turbulent times

In uncertain times, it is important to keep a watchlist so that you can pick up stable shares at bargain prices. I hope we go down a few more levels, another -20% would be nice, even if the short to medium-term price losses hurt.

I currently have almost 30 stocks on my watchlist, some of which are attractive in terms of price, while others are still far too high for me. I have not listed stocks that are already in my portfolio and that I would like to buy (in order of dividend amount):

Hercules Capital $HTGC (+0%) or Main Street Capital $MAIN (-0,96%)

Chevron $CVX (+0,47%)

Vinci SA $DG (+3,58%)

United Parcel Service $UPS (+0,03%)

3i Infrastructure $3IN (-0,98%)

Iron Mountain $IRM (+0,9%)

Micro Star International $MSS

Nextera Energy $NEE (+0,5%)

Partners Group $PGHN (-0,09%)

Itochu Shoji $8001 (+0,05%)

Canadian National Railway $CNR (-0,22%)

Svenska Cellulosa $SCA B (+1,83%)

VAT $VAT

Investor AB $IVSB

Assa Abloy $ASSA B (+0,74%)

Linde $LIN (-1,41%)

John Deere $DE (+1,66%)

Landstar Systems $LSTR (-2,61%)

Dover Corporation $DOV (+8,03%)

Alimentation Couche-Tard $ATD (-1,63%)

ASML $ASML (+2,17%)

Infineon Technologies $IFX (-2,31%)

Sherwin-Williams $SHW (-0,67%)

Tencent $700 (+1,98%)

Microsoft $MSFT (-0,03%)

S&P Global Inc. $SPGI (+0,34%) or Moody's Corp. $MCO (+1,63%)

Visa $V (+0,05%) or Mastercard $MA (-0,01%)

Ferrari $RACE (+2,13%)

Which stocks do you have on your watchlist?

Warren Buffett praises US equities and Japan investments

Warren Buffett remains a heavyweight on the stock market. In his latest letter to Berkshire Hathaway shareholders, he emphasizes the importance of his US holdings and shows interest in Japan. 💼

Buffett emphasizes that Berkshire holds shares in large, profitable companies such as Apple $AAPL (+0,3%)American Express $AXP (+0,98%), Coca-Cola $KO (-1,23%) and Moody's $MCO (+1,63%) . These companies generate high returns on the capital invested. At the end of the year, these investments were worth a total of USD 272 billion.

One exciting point is his strategy of buying shares when others are selling. Buffett emphasizes that it is rare for exceptional companies to be completely for sale. But fractions of these "treasures" can be bought on Wall Street from Monday to Friday.

With regard to Japan, Berkshire has increased its investments in this market. This shows that Buffett is also taking advantage of international opportunities to diversify his portfolio. Berkshire's current cash position is an impressive USD 334 billion. This means that Buffett remains one of the most influential investors in the world.

10 listed companies with the highest pricing power

ASML $ASML (+2,17%) (semiconductor equipment)

Visa $V (+0,05%) (payment transactions)

Mastercard $MA (-0,01%) (payment transactions)

Moody's $MCO (+1,63%) (credit ratings)

S&P Global $SPGI (+0,34%) (credit ratings and indices)

Hermès $RMS (-0,05%) (luxury goods)

Fair Isaac Corporation $FICO (+2,58%) (credit scoring)

Coca-Cola $KO (-1,23%) (beverages)

Apple $AAPL (+0,3%) (consumer electronics and technology)

Nvidia $NVDA (+1,16%) (AI and GPUs)

Also also worth mentioningbut not in the top 10:

Transdigm $TDG (+2,67%) (aerospace)

MSCI $MSCI (+1,18%) (financial services)

Cadence $CDNS (+2,04%) (EDA software)

Synopsys $SNPS (+0,03%) (EDA software)

Ferrari $RACE (+0,02%) (luxury cars)

What do you think? Have I forgotten an interesting company / share?

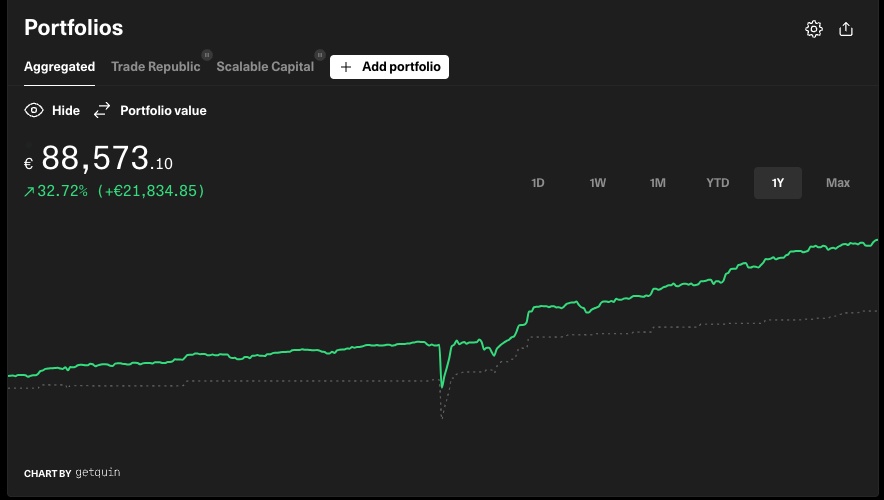

Portfolio at the end of 2024

In 2024, a lot has happened for me financially. I started investing around the middle of 2021. As I come from a family in which investing in the stock market was rather frowned upon (my parents invested in car manufacturers in 2000, which then slipped in 2001 just like everything else and they realized the losses), I only dared to start with small amounts bit by bit on an ETF basis in 2021. Financial flow classic 70% MSCI World ETF and 30% MSCI EM. The good thing about this was above all building up the automatism of investing money steadily and not waiting until the end of the month.

However, in 2024 I started to look more closely at the topic of finance, sometimes watching Berkshire conferences with Warren Buffett and Charlie Munger and realized that I was interested in individual stocks and would like to own Apple (shares) myself, for example. In February 24' I then looked at my EM position and saw that the position had been more or less at 0 since '21. So I sold just under €1000 and put it into Apple. And no, I didn't calculate the intrinsic value of the share first and didn't know at the time that Apple would be launching devices with AI at the end of 2024. I myself work in the field of software engineering/data science and if someone has the choice, you actually always take the Macbook over Windows computers. But that's another topic for debate :)

The Apple shares then performed really well even after the purchase and I was fascinated by the fact that I generated more unrealized profits with a single share or 6 Apple shares within 2 months than with the EM in 4 years. (I'll come back to EM later)

From March onwards, I suspended my savings plan in the ETFs and simply put the money in my Scalable clearing account instead. I didn't know what exactly I wanted to buy now, so pretty much from mid-24' I started to dive more into investing and how to analyze stocks. I had already studied discounted cash flow analysis in my bachelor's degree, back then in the subject of finance with a 3.0 :D. So I built an Excel spreadsheet and started using DCF models to calculate the intrinsic value of shares.

But what exactly should my strategy be when buying shares?

I mean, I already liked getting a dividend from Apple, so did I want to pursue some kind of dividend growth strategy? Should I go for "fast growers" as Peter Lynch would say? But should I then also add so-called "stalwarts" (dividend stocks) and "asset plays" (stocks with very expensive inventories, for example, or investments and cash whose book value is well below their actual value) to my portfolio, as he advises?

"Only buy something that you'd be perfectly happy to hold if the market shut down for ten years" - W. Buffett

Long-term focus

My investment horizon is over 10 years, so it is important to me to have some kind of predictability of income from the companies I want to buy. It was also important for me to be patient when buying from the outset and to allow some time to pass in order to check whether an investment thesis holds up over quarters.

Quality

I focus exclusively on companies with a leading position in their respective industry, either number 1 or number 2 in the respective sector with a large market share. The important thing here is that growth should be primarily organic. This means that the company should either simply build good, irreplaceable products that customers love and therefore remain loyal to, or simply be so influential that they can simply raise their prices without really losing customers ("pricing power" like Apple)

Concentration

Especially for someone coming from the financial flow school where the more diversified the investment, the better, it was hard to get used to this element. The investor Dev Kantesaria, who has successfully managed Valley Forge Capital for years and whose philosophy is also based on mine, once described this very aptly in an interview: "Why should I invest in my 25th best investment idea?". Accordingly, my goal is only to invest in a maximum of 15 individual stocks - I can't even manage to regularly check more in my free time and check whether the investment thesis still holds up.

Discipline

With the Emerging Markets ETF, I have held a position in my portfolio for several years purely out of conviction that this investment in emerging markets will work out in the long term. I also want to hold my stocks with the same conviction that they will perform well over the long term. In addition, I usually invest in companies when their intrinsic value suggests a margin of safety of at least 15-20%. For example, there was a slump in Alphabet shares in the summer with the unrest that Alphabet might be split up. The share was worth around €150 at the time. All of Alphabet's individual businesses have a combined intrinsic value of €250-300. Also related to this strategy element is that I don't really touch individual sectors that are associated with large research and development costs, for example, unless I really know my way around them. So I avoid biotech companies because I hardly know anything about them, but I invest in tech companies because I work in IT myself.

So I look for companies that are quasi monopolies in their respective industries, with strong market shares and a large moat due to irreplaceable or hard-to-penetrate products and a solid margin with a focus on steady free cash flow growth.

So why do I actually have the Emerging Markets ETF?

I asked myself this question and then promptly took another look at just ETF to see which stocks are actually in it. The top 10 holdings accounted for almost 25%. Why is that important? Some people always complain that the Magnificent 7 have such a high share in the S&P500, also slightly more than 25%, but this is usually due to the fact that companies are often weighted by market capitalization. If you then take a closer look at the top 10, 5 of them are Chinese companies. In general, China accounts for just under 25% of the ETF share. Chinese equities are not bad per se, there are some very good companies. However, the constant intervention of the government is a problem, laws can be changed overnight and a company becomes obsolete, or Mr. Ma, the CEO of Alibaba, simply disappears for a few months after having expressed mild criticism of government officials in a speech. These characteristics go against my strategy as formulated above, which is why the EM ETF was thrown out completely in July.

I then slowly tried to build up my individual positions towards the end of July, primarily $CRM (-0,66%) , $ASML (+2,17%) , $MSFT (-0,03%) , $BKNG (-2,75%) , $GOOG (+1,14%) , $V (+0,05%) and $AMZN (+1,02%) . On August 5 there was a small correction, I think it was due to the "Japanese carry trade". That week I made another big purchase, very happy not to have invested all my freed-up EM capital at once. As a result, I was able to invest heavily in Amazon and Alphabet and make them my largest single positions.

Overall, I am very happy with the decision. I am aware that the last stock market year was a very good one overall and that you shouldn't be deceived by appearances. Things will probably not always go so well. My third-largest single position, in which I was in the red at just under €1500 in the meantime $ASML (+2,17%) is good proof of this. Nevertheless, this company is a virtual monopoly in the chip manufacturing sector and will most likely remain so for the next 10 years. Therefore, I can only shrug my shoulders and look at the reports from the Magnificent 7, which are constantly expanding their data centers and in some cases were unable to meet demand in the last quarters of 2024! But there are already some good articles on this here on getquin. A new addition at the end of '24 is $UBER (+2,61%) I will also be steadily expanding my position there, and the watchlist also includes $MELI (+2,56%) , $MCO (+1,63%) , $SPGI (+0,34%) , $CAKE (-1,27%) and $AMD (+3,4%) for 2025.

To summarize:

Portfolio performance: 31% vs. S&P500 25%

Invested capital: approx. 22,000 euros

Portfolio value growth: approx. 42,000 euros

Goals for 2025:

- 30k invested (a large crypto cash-out will take place with approx. 20-30k, not included in the portfolio)

- Beat the S&P500

- Increase portfolio value to 150k

- Sell $TTWO (-0,52%) (GTA 6 bet, but by the time this appears it feels like you've already done 10x in other companies)

- expansion $SPGI (+0,34%) and addition of $MCO (+1,63%) (credit rating duopolies)

Moody's $MCO (+1,63%) has upgraded the outlook for Nissan $7201 (+0,95%) to negative, although the credit rating remains unchanged. This is due to uncertainties about the company's financial recovery and the challenges in its main business areas. Moody's points to weak sales and structural problems that could jeopardize Nissan's medium-term stability.

Further details can be found in the article on TradingView.

The news is based on what I personally consider to be reputable sources. No investment advice. Follow me for more updates!

S&P Global Q3 2024 $SPGI (+0,34%)

Financial performance:

S&P Global delivered a robust financial performance in Q3 2024 with revenue up 16% to USD 3,575 million. This growth was mainly driven by strong performances in the Ratings and Indices segments. Adjusted operating profit increased by 20% to USD 1,744 million, indicating improved operational efficiency.

Balance sheet analysis:

The balance sheet shows a stable financial position, with total assets of USD 60,368 million as of September 30, 2024. The company recorded an increase in cash and cash equivalents to USD 1,697 million, compared to USD 1,291 million at the end of 2023, indicating improved liquidity. However, there was a slight increase in current liabilities, which could indicate rising financial obligations.

Income statement:

The income statement shows a significant increase in net income, resulting in a 33% increase in GAAP diluted EPS to $3.11. In addition, adjusted diluted EPS increased 21% to $3.89 due to higher adjusted net income.

Cash flow analysis:

S&P Global's cash flow from operating activities was strong, totaling $1,445 million in the third quarter. Free cash flow improved to USD 1,330 million, indicating efficient cash management. Nevertheless, spending on financing activities increased, indicating higher outflows related to financing.

Key figures and profitability:

The company's operating profit margin improved by 530 basis points to 40.1%, while the adjusted operating profit margin increased by 180 basis points to 48.8%. These improvements underline the increased profitability and operational efficiency.

Segment analysis:

- Ratings: Sales increased by 36%, driven by strong demand for credit ratings.

- Indices: Sales grew by 18%, supported by higher asset-linked fees and exchange-traded derivatives.

- Commodity Insights: Sales increased by 9%, supported by a strong performance in the energy sector.

- Market Intelligence: Sales increased by 6%, although the adjusted margin outlook was revised downwards.

Competitive Analysis:

S&P Global continues to leverage its strong market position in credit ratings and indices. The company's strategic focus on sustainability, energy transition and generative AI positions it favorably against competitors in the evolving market environment.

Forecasts and management commentary:

The company has updated its forecast for 2024 and expects sales growth of between 11.5% and 12.5%, which represents a significant increase on the previous range of 8.0% to 10.0%. In addition, the operating profit margin is expected to expand to between 600 and 650 basis points.

Risks and opportunities:

The main risks include the potential impact of rising short-term debt and falling unrealized income, which could affect future revenue recognition. On the other hand, strategic investments in sustainability and AI offer significant opportunities for growth.

Summary and strategic implications:

S&P Global's strong financial performance and strategic initiatives indicate a stable financial position and significant growth potential. The company's focus on sustainability and AI as well as its robust revenue growth position it favorably for sustained success. Nevertheless, careful management of financial commitments and revenue recognition will be critical to maintain this growth trajectory. If you get the price right, then definitely a buy candidate alongside $MCO (+1,63%) .

Positive statements:

- Revenue growth: S&P Global reported a 16% increase in revenue in the third quarter of 2024, reaching $3,575 million, indicating strong performance across all segments.

- Earnings per share: Adjusted diluted earnings per share increased 21% to $3.89, supported by an 18% increase in adjusted net income and a 2% reduction in diluted shares outstanding.

- Forecast adjustment: S&P Global updated its 2024 guidance to expect revenue growth between 11.5% and 12.5%, an increase from the previous range of 8.0% to 10.0%.

- Expected margin expansion: The company expects operating profit margin expansion of 600 to 650 basis points, indicating improved operating efficiency.

- Strategic focus: The strategic focus on the energy transition, sustainability and the use of generative AI is expected to expand S&P Global's data capabilities and position the company for future growth.

Negative statements:

- Revision of margin guidance: Despite the overall positive performance, the adjusted margin outlook for the Market Intelligence division has been revised downwards to 32.5% - 33.0% from 33.0% - 34.0% previously.

- Short-term debt: The company's short-term debt increased, with payments on short-term debt totaling $188 million, which could indicate increasing financial obligations.

- Financing expenses: Cash flows used in financing activities increased to $3,280 million from $2,602 million in the prior year, indicating higher outflows related to financing.

- Unearned Revenue: Unearned revenue decreased from $3,461 million at the end of 2023 to $3,288 million at September 30, 2024, potentially impacting future revenue recognition.

- Management change: The change in leadership, with Martina Cheung to be appointed as the new President and CEO, brings uncertainty as the company manages this change in top management.

Títulos em alta

Principais criadores desta semana