US markets opened strongly today, then faded throughout the day, while President Trump made headlines by proposing new tariffs on semiconductors and pharmaceutical imports, emphasizing onshore production. Despite broader market hesitation, Palantir ($PLTR (-2,59%) ) impressed with strong earnings, while other players fell flat on expectations, voicing concerns about tariff impact. I also doubled down on one of my key positions, Salesforce ($CRM (+3,41%) ), reinforcing my conviction in the company’s bright future. Looking forward, my eyes are on Oscar Health ($OSCR ) and Novo Nordisk ($NVO (+2,57%) /$NOVO B (+0,65%) ), both of which report earnings tomorrow.

Macro View – Trump vs. The Economy

After sending a rather peculiar letter to drug companies last week demanding lower prices, President Trump continued his harassment tour of pharmaceutical companies today by threatening an initially “low” tariff rate, which would then eventually increase to 250% over the next 12 to 18 months.

Sorry Mr. President having to break it to you, but you can’t dictate companies to throw out their pricing strategies, just because you disapprove of them, only to tell them a week later they’ll have to pay three times more to import their drugs. The math doesn’t add up: Lower prices don’t mix well with higher production costs. That’s business 101, a course a Wharton graduate should have attended, at least physically, if not mentally.

Earnings – The ONE Massively Overvalued Exception

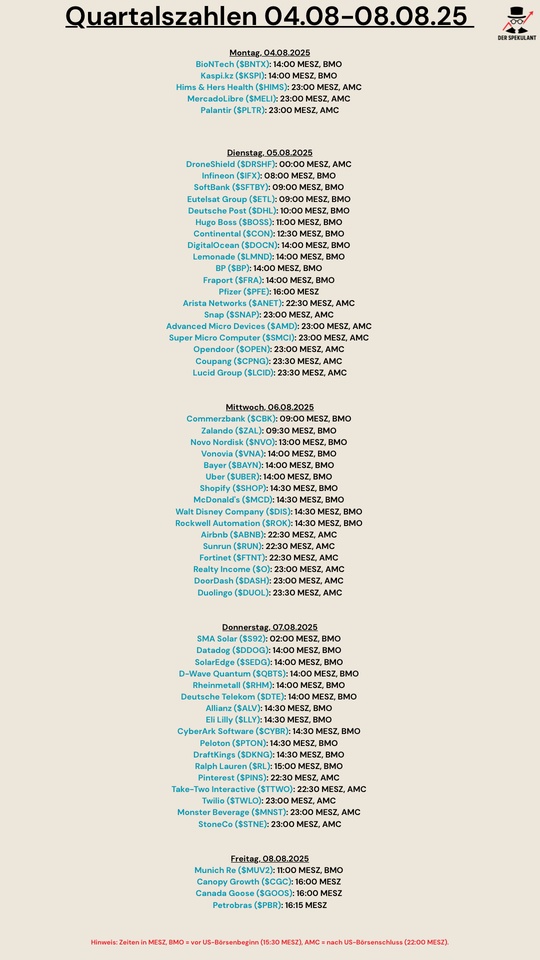

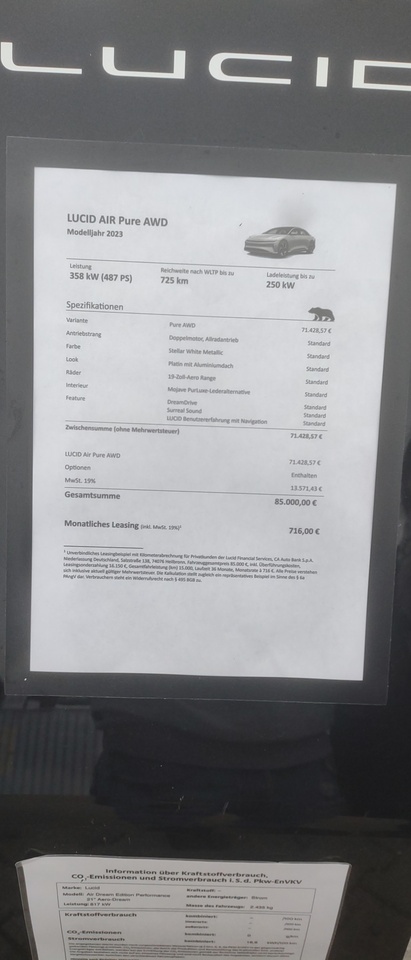

While many earnings left investors disappointed amid this booming earnings season, from Caterpillar ($CAT (-0,99%) ) over Lucid ($LCID (-3,09%) ) to SuperMicro ($SMCI (-0,13%) ), citing different reasons for their misses, ranging from an increasingly noticeable impact of tariffs to just weak execution, one name continues its upward trajectory: Palantir, a great company with an exorbitant price tag.

Don’t get me wrong, I find Palantir to be an incredibly interesting business, with strong growth prospects and a solid leadership, but I just can’t imagine a reality in which a P/E ratio of close to 800 is justified for any company. Even if they cured cancer, that valuation would be a stretch. But I suppose the stock has become more of a religion or cult anyway, rather than an investment based on fundamentals.

My Move – Added to $CRM (Salesforce)

While markets were busy decoding Trump’s latest comments and speculating about his future FED chair pick, I expanded my position in Salesforce, by buying 5 shares at $250, bringing my total share count to 25, which equates to roughly 4% of my portfolio, representing the second largest position behind ASML ($ASML (+0,64%) ).

Salesforce is trading at a forward P/E ratio of 21, while boasting solid 8% revenue growth YoY and strong double-digit EPS expansion. Admittedly, the company isn’t the growth machine it once was, but its focus has shifted visibly from expansion at every cost to an emphasis on profitability. Margins are steadily improving, with gross profit approaching 80%. That’s part of the game, as companies become more mature, they grow different metrics.

One thing to look at, however, is Salesforce’s implementation of AI. The main reason for the stock’s weakness and historically low valuation is concerns about the company’s AI-powered task-managing platform Agentforce, which hasn’t yet shown the results investors would have hoped for. Nevertheless, I see an attractive risk/reward ratio at the current levels. And let’s not forget that Marc Benioff and his team have consistently delivered and proven strong execution. If the stock dips further, I may add more.

Looking Ahead

Tomorrow two companies in my portfolio will report earnings: Novo Nordisk and Oscar Health. I am bullish on both, for different reasons.

I recently published a detailed analysis on Novo Nordisk, arguing that while short-term headwinds might persist, long-term trends remain in place and the company is in a prime spot to capitalize on them. If I had to bet, I would bet on a beat tomorrow, given the conservative estimates and comments from the recently appointed CEO.

With Oscar it’s simpler: I firmly believe in its disruption potential within the health insurance industry, and I look forward to hearing from the company’s stellar leadership during the earnings call.

No matter what happens tomorrow, I remain confident in both companies and will be following them closely.