$KHC (-1,4%) Amplio Kraft Heinz a 25.7$

Discussão sobre KHC

Postos

47New dividend portfolio

I would like to start a completely new portfolio that will primarily revolve around dividends.

As a core I was thinking of $TDIV (-0,08%)

Would you say this is a good core?

If not I would add $VHYL (+0,31%) add.

Additionally I would like to have a CC ETF as a kind of support, probably $JEGP (-0,53%) and or $SXYD (+0,17%)

I would like to represent the NASDAQ with $EQQQ (+0,86%) but I will represent it with $ASML (+2,17%) and $2330 will be added.

Allianz $ALV (+0,06%) and Munich Re $MUV2 (+0,09%) I definitely want to include, but they are too expensive for me financially, so I was thinking of the $EXH5 (+0,25%)

Oil shares are represented by $VAR (+1,98%) and one more.

Do you have any recommendations?

I am thinking about $CVX (+0,47%)

$EQNR (+4,51%) and $PETR4 (+2,13%)

I would also like renewable energies, but I'm not familiar with them.

Do you have any suggestions?

Becoming a defensive company $ULVR (+1,05%)

$D05 (+1,44%)

$O (+0,02%) and of course $NOVO B (-0,39%) Being.

$BATS (+1,71%) I already have in a portfolio, would it be too much of a lump to add $MO (+0,28%) to add to it?

I still have $KHC (-1,4%) on the watchlist but the split is not going so well, would it be wise to start with a savings plan?

Apart from that $RIO (+1,5%)

$NKE (+0,61%)

$1211 (+1,84%)

$SOFI (+3,68%) and $HAUTO (+0,91%) will be represented with smaller positions.

What is your opinion?

Would you improve anything?

What else would you add, especially in EE and defensive stocks?

Feedback is very important to me here, so far I have just been wandering aimlessly around the stock market without a fixed plan and strategy.

This is my first attempt to build something serious.

Greetings to all Getquins out there!

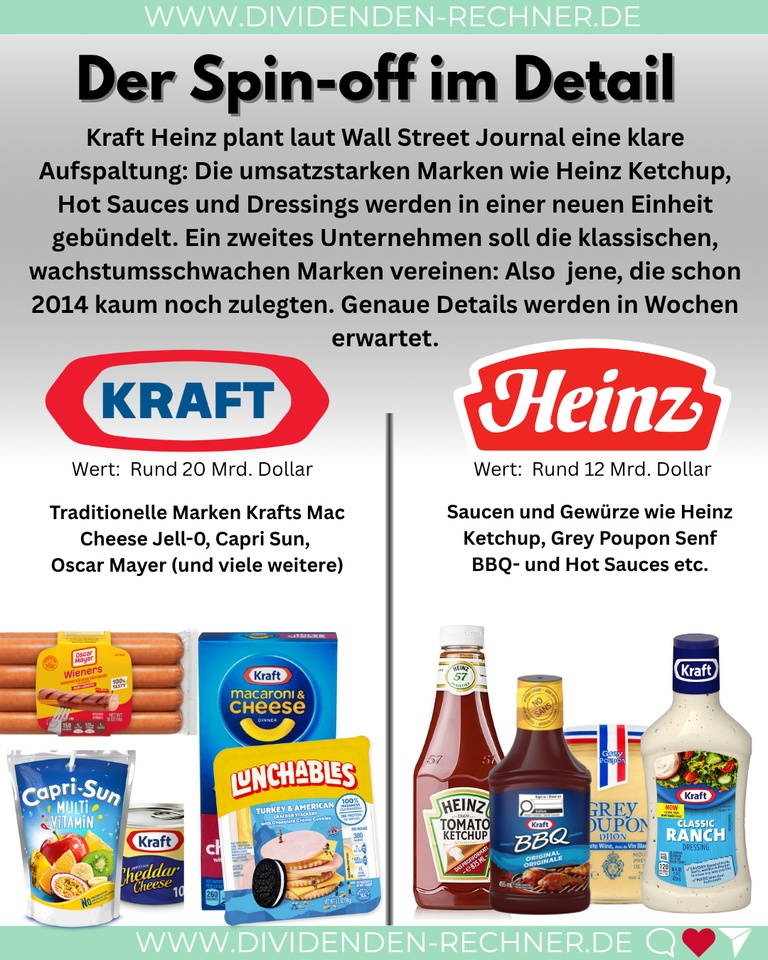

What's going on at Kraft Heinz? A review.

$KHC (-1,4%) was never an investment for me. As tempting as the high dividend is, I always had a bad feeling. And it wasn't just because of Kraft's lunch labels, which give me a stomach ache just looking at them. Here's why in pictures and text.

+ 7

KHC - Company split?

$KHC (-1,4%) - I have just come across an article from the Handelsblatt.

To be honest, I don't quite know what to make of it. It seems to me that every time things aren't going well operationally, someone from the management comes up with the same suggestion: let's split the company up and focus on 'the core brand'. At $ULVR (+1,05%) has similar considerations with the spin-off of the ice cream division. A few years later, the new management regularly comes along and orders the company to diversify or 'broaden its base' and then things go in the other direction again and new business areas and brands are acquired (see Kelloggs and Ferrero, for example).

A capable management should actually be able to improve its own portfolio and the sales of its products. Selling off parts of the company seems a bit unimaginative to me, even if you might be able to make a little money in the short term.

Here is the link to the article:

Ketchup producer: Kraft Heinz wants to split up https://share.google/LI0N7qKkIImgox9EI

Are you invested in $KHC?

Italian rough diamond

$NWL (+2,63%) Plasmon becomes Italian again, with Newlat's entry into the British stock exchange and the purchase of the Plasmon plant in Latina by $KHC (-1,4%) ,the Reggio Emilia-based company continues its policy of growth and acquisitions to increase its market share, although it is not a company that bestows dividends I fell in love with it right away. Still under a billion in capitalization but at this rate I expect a lot of satisfaction from this company, at the moment it seems intent on reinvesting all resources to grow, as soon as it stabilizes it will surely start to distribute like all food companies

Sell Kraft Heinz?

I'm currently down 27% (after dividends) or 29% (purely by price) on Kraft Heinz, but I have an investment horizon that ideally could span several decades. In view of the high dividend, the relatively low P/E ratio and a potential turnaround, it wouldn't be a shame to part with the stock at a loss if it's not actually a piece of junk and will pay me dividends every year that would theoretically put any call money account in the shade, even if the stock market is poor.

I am aware of the irrational component of my considerations (realizing losses is painful, ergo stupid), but at the same time I have a rational component, namely: if I were not already invested, would I currently be considering buying Kraft Heinz, as it may soon be going up again!

Do you think the downturn is already over or will Kraft Heinz sink ever deeper towards the bottom? If the downturn is over, how realistic is growth, at least at industry level, in the next 5-10 years?

Instead, think about whether you have better things to do with the money, or whether KHC is already the ultimate best investment you can imagine for this part of your portfolio.

Kraft Heinz Company

$KHC (-1,4%) : Navigating a Shifting Landscape – What's Next?

The Kraft Heinz Company (KHC) is a name synonymous with household staples, a giant in the packaged food industry. From Heinz ketchup to Oscar Mayer, their brands are deeply embedded in our kitchens. However, like many legacy food companies, KHC has been on a journey of adaptation, facing evolving consumer preferences, supply chain complexities, and intense competition. This post will delve into the current state of Kraft Heinz, what analysts are saying about its trajectory, and what the future might hold.

A Look Back and the Current State

For a period following its 2015 merger, Kraft Heinz faced significant headwinds, including write-downs of its brand assets and a struggle to innovate quickly enough to meet changing tastes. Consumers were increasingly shifting towards healthier, fresh, and more adventurous food options, often from smaller, agile brands. This led to a period of declining sales and a loss of market share.

In recent years, KHC has undertaken a significant transformation under new leadership. The company has focused on divesting non-core assets, streamlining its portfolio, and investing in its most profitable and promising brands. There's been a clear push towards efficiency, cost control, and a renewed emphasis on marketing and innovation for key products. The pandemic, surprisingly, offered a temporary boost to many packaged food companies as "at-home" consumption surged. However, as economies reopen, the challenge for KHC is to maintain that momentum and prove its long-term relevance.

What Are Analysts Saying?

The sentiment among financial analysts regarding Kraft Heinz is generally one of cautious optimism, a departure from the more skeptical views of a few years ago. Many acknowledge the significant progress made in debt reduction and portfolio optimization.

One key area analysts are watching closely is organic sales growth. While cost-cutting measures have improved profitability, sustainable long-term growth hinges on KHC's ability to drive genuine demand for its products. Analysts are keen to see if the company's investments in marketing and product innovation (such as expanding into healthier or more convenient formats for existing brands) are translating into consistent top-line expansion.

Another point of focus is pricing power. In an inflationary environment, KHC's ability to pass on rising costs to consumers without significant volume declines is crucial. Its strong brand recognition provides some leverage, but competitive pressures remain.

Furthermore, analysts are evaluating KHC's capital allocation strategy. Beyond debt reduction, questions linger about future M&A activity (though less likely to be large-scale) and shareholder returns, including dividends and share buybacks. The general consensus is that KHC is now in a more stable financial position, allowing for more strategic flexibility.

The Future of Kraft Heinz

The future for Kraft Heinz will likely be characterized by continued evolution. We can expect to see:

* Further Portfolio Rationalization: KHC may continue to shed underperforming brands and double down on those with strong growth potential or market leadership.

* Innovation within Core Brands: Expect to see more variations, healthier alternatives, and convenience-focused options for iconic brands like Heinz, Philadelphia, and Lunchables. This is about meeting consumer needs without completely abandoning their heritage.

* Increased Focus on E-commerce and Digital Marketing: The shift to online grocery shopping is irreversible. KHC will need to continue investing heavily in its digital presence and direct-to-consumer capabilities.

* Sustainability Initiatives: Consumers are increasingly conscious of the environmental and social impact of the brands they choose. KHC, like its peers, will face growing pressure to demonstrate progress in areas like sustainable sourcing, packaging, and waste reduction.

* Strategic Partnerships: Collaborations with smaller, innovative food companies or even technology firms could offer avenues for growth and diversification.

What Do YOU Think?

Kraft Heinz is a company in constant motion, striving to remain relevant in a dynamic industry. Given its history, its recent efforts, and the broader trends in the food sector, what are your thoughts on The Kraft Heinz Company?

* Do you believe their transformation efforts are sustainable in the long run?

* Which of their strategies do you think will be most impactful?

* As a consumer, how have your perceptions of Kraft Heinz changed, if at all?

* What challenges or opportunities do you see for them moving forward?

Share your insights and opinions in the comments below!

My only concern is whether consumers are not increasingly shifting towards no-name products which will make it hard for the traditional household brands to maintain their pricing policy.

What was Warren Buffet thinking with his oil investments and is he wrong in the long term? (Sector analysis energy and utilities)

When $BRK.B (-0,38%) started during the Corona crisis $OXY (+2,5%) and $CVX (+0,47%) many people didn't understand this. Tech was more popular than ever at the time and oil was considered dead. A short time later, it became clear that oil was here to stay. As discussed in the last market review, the energy sector was one of the best investments during the pandemic.

However, this was probably a special boom for fossil fuels that was to remain a one-off. Since the price explosion, the energy sector has been in a very weak trend and is the worst performing sector directly after healthcare (which could therefore also be very interesting at the moment).

In particular, the dynamic has shifted from oil & gas to electricity - which, however, is not counted as part of the energy sector in the classic GICS but as part of the utilities sector. The reason for this is, of course, the expected triumph of artificial intelligence and the associated hunger for energy in data centers. The best-known company in the sector is probably $NEE (+0,5%)

In any case, Buffet's investments in fossil fuels have not been particularly worthwhile to date, as he may have made a favorable initial entry, but then often bought at unfavorable prices. At the current point in time, the investment case has not yet worked out. It is therefore an interesting question whether Buffet is speculating on something that has not yet been understood by the market or whether it is one of the rare situations in which the good Warren has miscalculated something (think of the disaster around $KHC (-1,4%) ). At any rate, it is difficult to understand what Buffet was thinking and whether his theory is still intact.

Incidentally, I myself am not invested in either utilities or energy, which I think is a great pity. However, I have not been able to identify any company that is currently really convincing in terms of its figures and can be described as a quality company.

What about you? Do you have any oil, gas or electricity stocks in your portfolio?

(And the < 5% exposure in the World ETF does not count)

More opportunities than risks?

$KHC (-1,4%) How do you currently view the Kraft Heinz share? One of the lowest P/E ratios in the sector, over 6% dividend. Should the opportunities outweigh the risks at the current price and valuation? Especially since the wait is paid with a 6% dividend. The payout ratio is in a healthy range. There are share buybacks.

So far Berkshire has never sold here, but has now withdrawn from the board, so it remains to be seen whether shares will be sold here soon.

Despite the uncertain US economy and consumer behavior, I will certainly top up here again.

Títulos em alta

Principais criadores desta semana