$AAPL (+1,46%) Apple, Inc. (ISIN: US0378331005)

$ADBE (-0,01%) Adobe Inc (ISIN: US00724F1012)

$AES (+2,79%) AES Corp (ISIN: US00130H1059)

$AMZN (+1,73%) Amazon.com Inc (ISIN: US0231)

$APP (+5,15%) AppLovin Corp (ISIN: US03831W1080)

$AXON (+2,76%) Axon Enterprise, Inc. (ISIN: US05464C1018)

$BE (+8,44%) Bloom Energy Corp. (ISIN: US09

$CRM (-0,19%) Salesforce.com, Inc. (ISIN: US79466L3024)

$GOOGL (+2,14%) Alphabet Inc (Class A) (ISIN: US02079K3059)

$GTLS (-0,12%) Chart Industries, Inc. (ISIN: US16115Q3083)

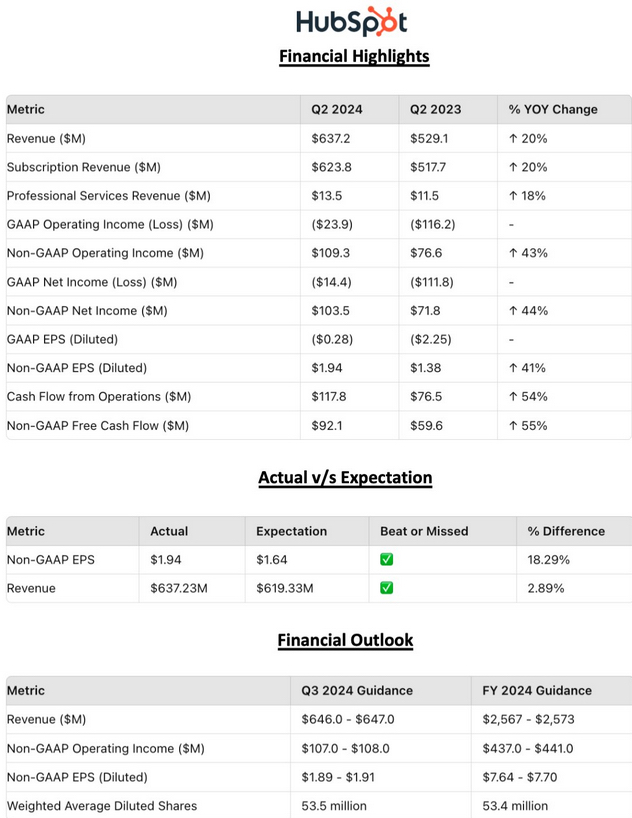

$HUBS (-0,16%) HubSpot Inc (ISIN: US4435731009)

$JCI (+1,69%) Johnson Controls International plc (ISIN: IE00BY7QL619)

$NEE (+0,8%) NextEra Energy, Inc (ISIN: US65339F1012)

$NVDA (+2,23%) NVIDIA Corp (ISIN: US67066G1040)

$SLB (+0,24%) Schlumberger N.V. (ISIN: AN8068571086)

$SPGI (+1,63%) S&P Global Inc (ISIN: US78409V1044)

$TSLA (-3,58%) Tesla Inc (ISIN: US88160R1

$TT (+2,04%) Trane Technologies PLC (ISIN: IE00BK9ZQ967)

$$VRTX (+0,89%) Vertex Pharmaceuticals Inc (ISIN: US92532F1003)

$VERTEX (-0,03%) Vertex, Inc (ISIN: US92538J1060)

$VST (+4,8%) Vistra Corp (ISIN: US92840M1027)

$WIX (+1,78%) Wix.com Ltd (ISIN: IL0011301780)

Morgan Stanley expects these companies to benefit greatly from the global trend towards AI integration, whether through leading chips such as NVIDIA, cloud and software solutions such as Amazon, Alphabet or Salesforce, or specialized applications in energy, industry and biotechnology. With tech giants expected to invest almost 400 billion US dollars by 2026, demand in many of these segments could explode. But while the list reads impressively, there is still the intriguing question of who will ultimately benefit not only from the hype, but also from the sustainable use of this technology.

Source: Boerse-Online (Morgan Stanley report on AI-related stocks)

Image material: Techa Tungateja/iStockphoto