$GLXY (+5,41%) first entry.

Discussão sobre GLXY

Postos

16Portfolio and future plans

Hello everyone,

In this post I would like to talk a bit about my portfolio and my journey so far.

I started investing through Oskar when I was 16, when I started my apprenticeship as a chef. At the beginning of this year, I finished my apprenticeship and decided to take the whole thing into my own hands - away from Oskar and towards my own research and portfolio.

I'm currently 20 years old and save €1,000 a month for my portfolio.

I bought a motorcycle in the summer, which set me back a bit financially. As a result, my portfolio value is currently below €20,000 again.

My strategy is currently a classic buy-and-hold strategy consisting of gold, Bitcoin, an all-world ETF and a few individual shares in which I have long-term confidence.

About my portfolio:

40 % $SPYI (+0,59%)

30 %$BTC (+0,65%)

30 % $EWG2 (+0,24%)

(@Epi thanks for your tips on gold allocation)

I also hold "smaller" positions in:

$GLXY (+5,41%) - 2.126 €

$NBIS (+7,59%) - 500 €

$MTM (+1,35%) - 471 €

$IREN (+7,49%) - 188 € (after partial sale)

My plan is a partial sale of $GLXY (+5,41%) in the first quarter of 2026, depending on how the share reacts to Helios. At $NBIS (+7,59%) and $MTM (+1,35%) I will set a trailing stop loss after a good run. $IREN (+7,49%) I will let it continue to run, as my original position has already been realized.

In the long term, I plan to acquire a property or similar investment for rental purposes. I recently considered taking over a self-service car wash, but this failed due to the current owner's lack of interest.

A home of my own is not currently on my list, as there are no plans to have children in the near future.

My retirement is still a long way off, so I'm not thinking too much about a final portfolio structure at the moment. At the moment, my focus is on investing continuously, learning and growing my capital over the long term.

I invest because I started early on to make my money work for me. Mistakes are part of the process, but the long-term goal remains clear: building wealth with a focus on independence and personal responsibility.

I welcome feedback and am happy to accept tips or suggestions for improvement - especially from those who have been investing for a while or are pursuing similar strategies.

~Philipp

Galaxy Digital Q3’25 Earnings Highlights

🔹 Revenue & Gains: $29.2B (Est. $16B) 🟢 +223% QoQ

🔹 Adj EPS: $1.12 (Est. $0.3) 🟢

🔹 Adj EBITDA: $629M (vs. $211M Q2) +198% QoQ

🔹 Total Equity: $3.17B; Cash & Stablecoins: $1.91B (+62% QoQ)

🔹 Assets on Platform: $17B (+140% QoQ trading volume record)

Q3 Segment Performance

Digital Assets:

🔹 Adj Gross Profit $318M (vs. $71M Q2) +345% QoQ

🔹 Adj EBITDA $250M (vs. $13M Q2) +1,817% QoQ

🔹 Record Global Markets profit $295M, led by spot & derivatives surge

🔹 Trading volume +140% QoQ; executed $9B BTC sale (80K BTC) for a client

🔹 Average loan book $1.8B, +60% QoQ

🔹 Investment Banking: advised on $1.65B Forward Industries placement & Coin Metrics–Talos sale

Asset Management & Infrastructure Solutions:

🔹 Adj Gross Profit $23M (+44% QoQ)

🔹 AUM $8.8B (+17%), Alternatives $4.9B (+102%), Assets Under Stake $6.6B (+110%)

🔹 $2B+ of Q3 inflows; new multi-year treasury mandates adding $4.5B AUM with $40M+ annual recurring revenue

Data Centers (Helios):

🔹 Adj Gross Profit $2.7M; Adj EBITDA $3.7M (pre-revenue phase)

🔹 Signed Phase II lease with CoreWeave, which also exercised final 133 MW option → full 800 MW commitment

🔹 Secured $1.4B project financing to fully fund Phase I ($1.7B build)

🔹 Helios campus expanded to 1,500 acres / 2.7 GW potential power capacity

Treasury & Corporate:

🔹 Adj Gross Profit $408M (+79% QoQ)

🔹 Adj EBITDA $376M (+90% QoQ)

🔹 Gains across crypto, venture, and fund investments

🔹 Diversified exposure across BTC, ETH, SOL, and Web3 equities

Balance Sheet

🔹 Total Assets: $11.5B (+27% QoQ)

🔹 Total Equity: $3.17B (+21% QoQ)

🔹 Cash & Stablecoins: $1.91B (+62% QoQ)

🔹 Net Digital Assets + Investments: $2.14B (+14% QoQ)

🔹 Equity Split: 40% Digital Assets | 25% Data Centers | 35% Treasury & Corporate

Corporate Updates

🔹 GalaxyOne launched Oct 2025, unified fintech platform for U.S. investors to trade crypto,

Earnings Call today at 14:30

$GLXY (+5,41%) What is your opinion on this?

I have no idea, and the crystal ball is at the cleaners. But I do believe in a positive surprise for my portfolio.

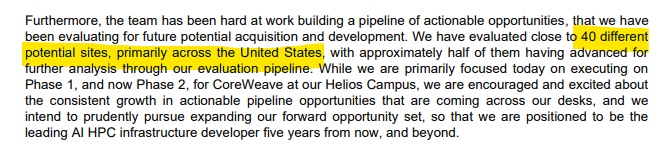

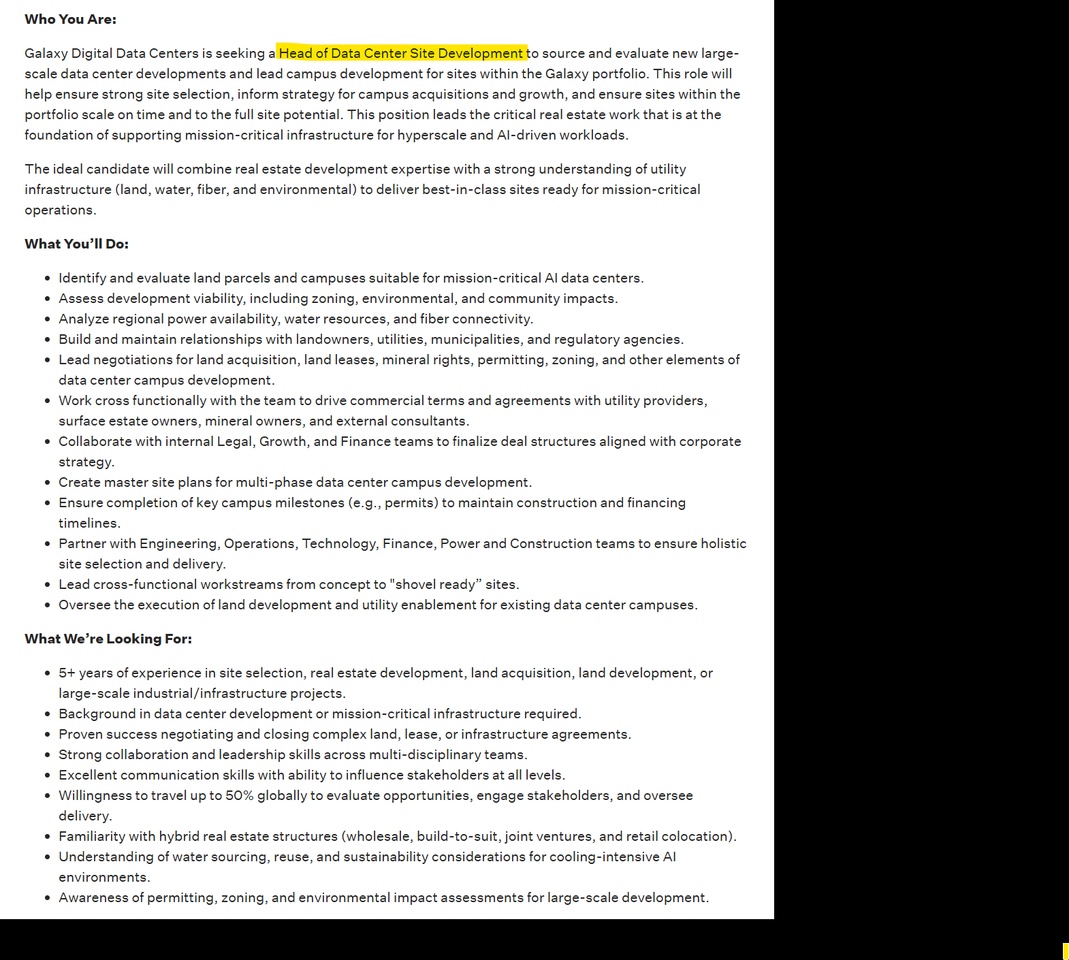

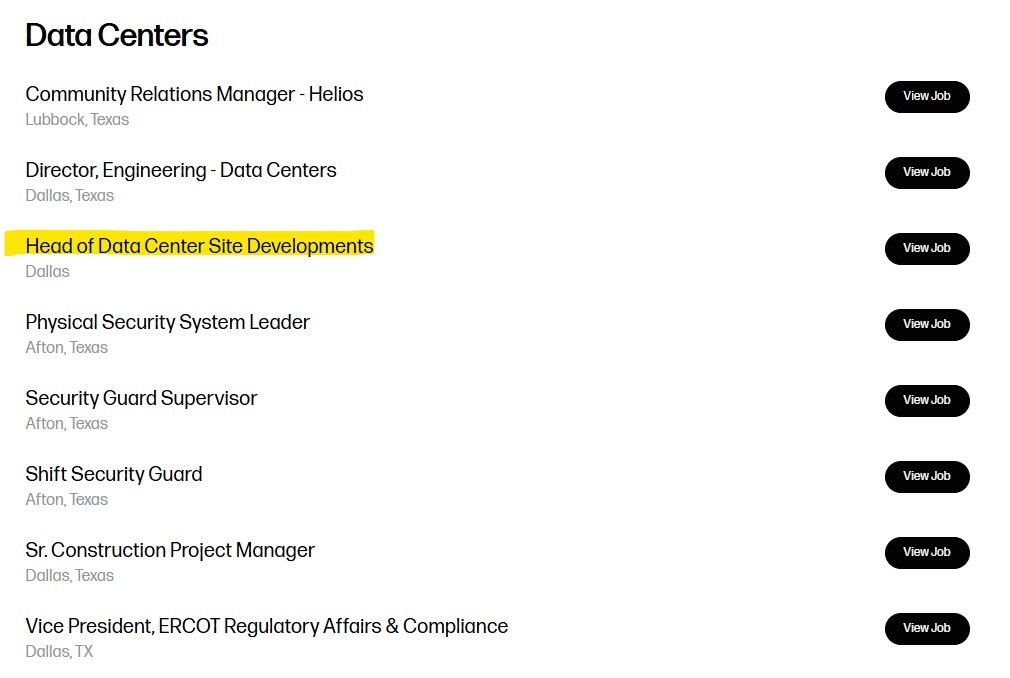

Galaxy Digital expands data center division - focus on new key roles & potential site acquisitions

Galaxy Digital ($GLXY (+5,41%) ) is actively building up a data center business - this fits in with the latest capital measure and could be used (in part) for site acquisitions.

Key points

Galaxy has stated in its transcripts that it has around 40 potential data center locations or in the pipeline.

- Recent capital infusion (~$460m) was announced - officially to accelerate the Helios campus (Texas) and for general purposes; however, the money could also be used for other sites/investments.

- In parallel the internal data center organization is growingSeveral positions have been advertised (e.g. Head of Site Developments, Head of Finance, Director Data Center Operations).

- On LinkedIn there is now a "Head of Data Center Growth & Development" is now listed on LinkedIn (Justin Jordan) - so management roles are already being filled.

Interpretation: It is plausible that some of the funds will be used for acquisitions from the 40-location pipeline - but (still) speculativeas long as Galaxy does not publish an explicit purchase declaration for further sites.

https://job-boards.greenhouse.io/galaxydigitalservices?error=true

www.linkedin.com/in/jjordan1984?utm_source=

+ 2

Could Galaxy Digital's new retail platform redefine the integration of banking and crypto?

- Earlier this month, Galaxy Digital Inc. announced an investment agreement to issue 9,027,778 Class A common shares at a price of $36 per share, raising total gross proceeds of $325,000,008, subject to the approval of the Toronto Stock Exchange.

- Shortly before the investment, Galaxy Digital launched GalaxyOne, a unified platform for U.S. retail investors that combines FDIC-insured checking accounts, premium yield offerings, brokerage accounts and crypto trading to connect traditional and digital financial services under one regulated platform led by Zac Prince.

Galaxy Digital Investment Narrative Summary

As a shareholder of Galaxy Digital, you must be convinced of the convergence of traditional and digital finance. The company is positioned to capitalize on increasing institutional adoption and product innovation. The recently announced $325,000,008 capital raise increases Galaxy's financial flexibility but has limited impact on the key near-term catalyst, the successful launch and adoption of GalaxyOne, or on the biggest near-term risk, which remains execution and margin pressure as funding needs outpace demand for new infrastructure.

Among the recent news, the launch of GalaxyOne stands out as particularly important. This new US-focused platform offers integrated checking, yield, crypto trading and brokerage accounts in a regulated environment, supporting Galaxy's ambition to attract retail and mass affluent investors and potentially increase trading and wealth management revenues if the market embraces it.

In contrast, investors should be aware that the capital-intensive data center build-out is still dependent on securing favorable debt financing and that if macroeconomic conditions tighten, the company may not be able to continue its growth trajectory....

Galaxy Digital's outlook is for revenue of USD 78.4 billion and profit of USD 281.6 million by 2028. This is based on analysts' forecasts of annual revenue growth of 189.9% and a profit increase of $383.2 million compared to the current profit of -$101.6 million.

🚀 My path to building wealth at the age of 19

I am 19 years old and can invest around €1,300 a month.

I have made a conscious decision to invest a little more riskily at this stage of my life in order to build up assets in the long term.

That's why I'm currently taking a 30% / 30% / 40% risk:

Planned split:

- 800 € in individual shares ( $GLXY (+5,41%)

@Multibagger thanks for the contribution and possibly $ONDS (+6,84%) ) - 250 € in $BTC (+0,65%)

250 € in the $CSPX (+0,84%)

My portfolio currently consists of, among other things

- $CSPX (+0,84%) ( 50%)

- $NU (+0,51%) ( 17%)

- $ONDS (+6,84%) (6%)

- $BTC (+0,65%) (5.5% -> I need to build up more in the future)

- $KAS (+0,3%) (6% , -50%)

- $SSW (+0,21%) ( 5%)

- $IREN (+7,49%) (5%)

- $SOL (+1,13%) (4%)

I am currently wavering between two strategies:

Build each position to ~€1,000, then just hold and continue to save monthly in one company with a savings plan.

OR

Strengthen the core (30 % S&P 500, 30 % BTC, 40 % individual stocks) and reduce the number of individual stocks to 5-6 in order to invest in a more focused manner.

In the long term, I would like to grow passively, but still retain the opportunity to outperform through selected growth stocks.

Thank you for reading 🚀

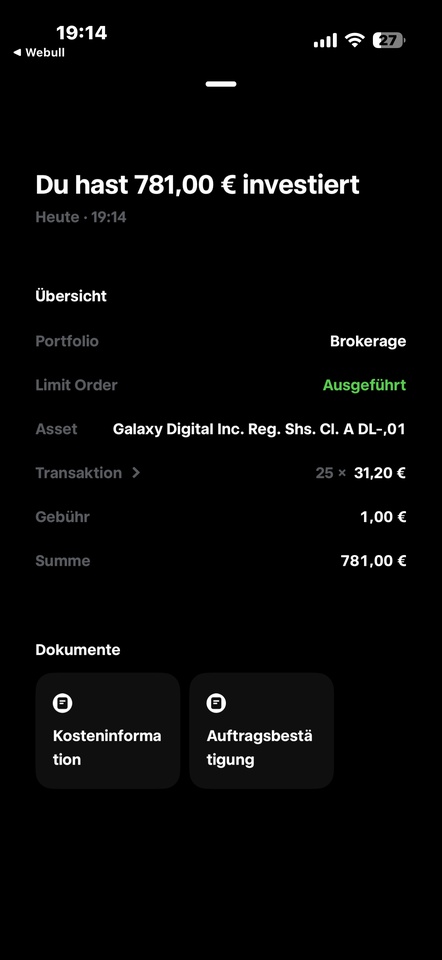

As already announced on the WE

Did I get into $GLXY (+5,41%) .

Let's see what happens. The buy-in wasn't too bad today 😉.

What's on the agenda tomorrow?

I have been thinking about making a few shifts in my treasury holdings. After reading a few articles, I think $GLXY (+5,41%) very promising. I might therefore shift my positions into $3350 (+6,46%) , $BTBT (+6,39%) or even $BMNR (+2,61%) a little.

What do you think?

September

My best month so far since I started actively investing in January 🙌🏼

Decisive factors were:

$GLXY (+5,41%) +55%

$IREN (+7,49%) +71%

$MTM (+1,35%) +74%

$NBIS (+7,59%) +80%

Títulos em alta

Principais criadores desta semana