The 94-year-old star investor is investing in new shares, according to data published by the US Securities and Exchange Commission (SEC) on Friday night. The document also reveals the identity of a position that was built up in secret.

Berkshire takes a stake in United Health

For two quarters, Berkshire had secretly built up a position in a share without having to disclose it. The process is not unusual. It typically happens when Berkshire builds up large positions and does not want copycats to drive up the price.

It is the US insurer United Health $UNH (+0,86%)

After Buffett's entry became known, the share price shot up by over eight percent in the aftermarket. Since the beginning of the year, however, it is still down around 45 percent.

The majority of analysts are confident that United Health will soon overcome its difficulties. According to the financial service LSEG, 19 out of 28 experts currently recommend buying the share. Their average target price of 313.50 dollars is a good 15 percent higher than Thursday's closing price.

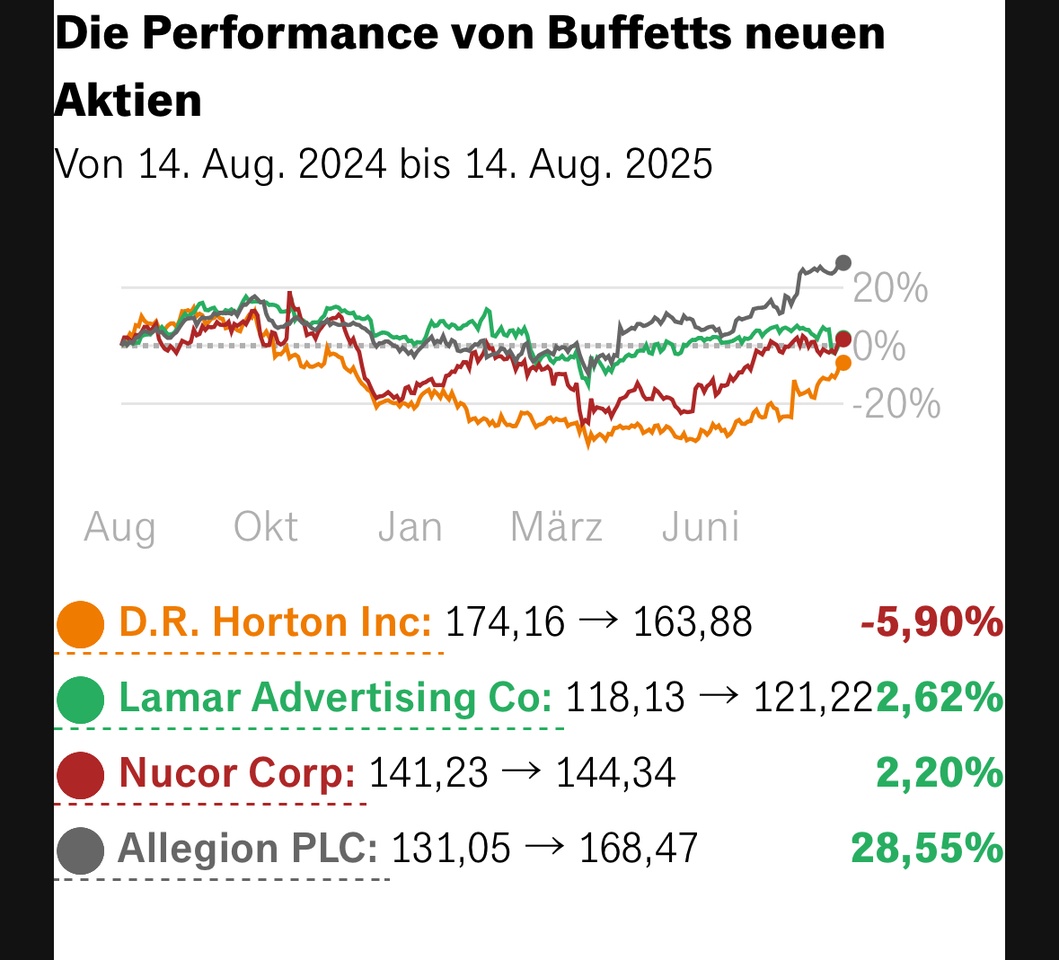

Four more buys

At steel producer $NUE (+0,44%) Nucor, Berkshire held 6.6 million shares worth 857 million dollars as at June 30. At the house building company $DHI (+0,05%) DR Horton amounted to 191 million dollars, at the outdoor advertising company $US5128152007 Lamar Advertising to 142 million dollars and $ALLE (-2,03%) Allegion, a manufacturer of locking systems, to 112 million dollars.

All four shares are rather insignificant in Berkshire's portfolio. Together they are only worth 1.3 billion dollars - just 0.5 percent of the total portfolio.

The most important position that was increased, on the other hand, is the oil company $CVX (-0,61%) Chevron. Berkshire increased its position here for the first time since the fourth quarter of 2023. It grew by just under three percent.

Berkshire also increased its position in $POOL (-2,17%) Pool, which claims to be the world's leading distributor of swimming pool accessories (up 136 percent), as well as beverage manufacturer $STZ (-0,15%) Constellation Brands (up eleven percent), the aerospace company $HEI (-0,13%) Heico (up eleven percent) and the pizza chain $DPZ (-1,75%) Dominos Pizza (up 0.5 percent).

Berkshire's equity portfolio continues to shrink

Sold 20 million $AAPL (+1,48%) Apple shares and securities of $BAC (+1,4%) Bank of America and $DHI (+0,05%) D.R. Horton, and the company also completely divested itself of $TMUS (-1,59%) T-Mobile US.

In the second quarter, Berkshire also sold shares in the cable television company $CHTR (+0,25%) Charter Communications (down 46.5 percent), the healthcare group $DVA (+0,84%) Davita (down 3.8 percent) and the media company $FWONA (-2,21%) Liberty Media (2.5 percent).

Buffett also sold shares in Davita in the current quarter. Although Davita is still the tenth largest position in the Berkshire portfolio, it has shrunk by eight percent since March 31. Since the beginning of the year, it has even fallen by almost eleven percent.

Source: Text (excerpt) & graphics: Handelsblatt, 15.08.2025