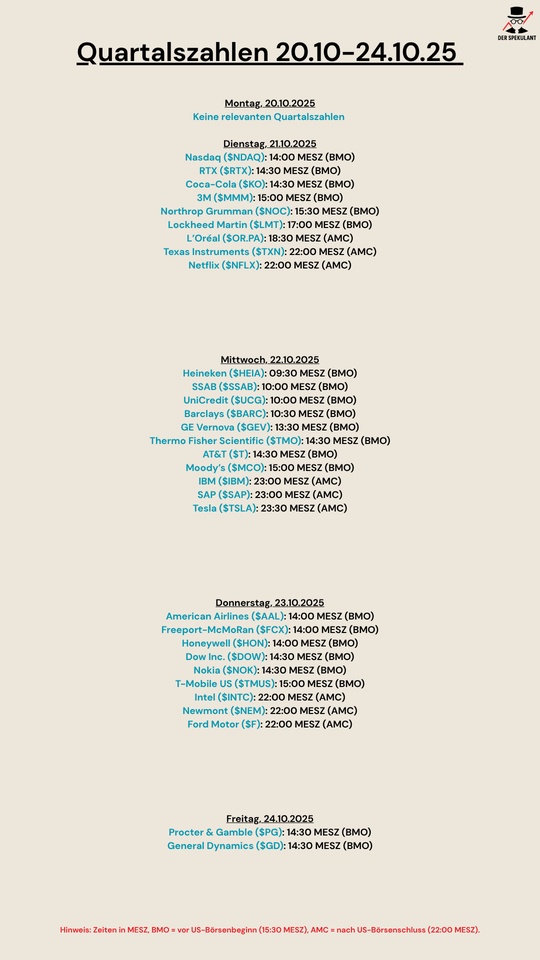

$NDAQ (-0,14%)

$RTX (+0,1%)

$KO (-0,37%)

$MMM (-1,74%)

$NOC (-0,1%)

$LMTB34

$OR (-0,56%)

$TXN (-1,56%)

$NFLX (-1,61%)

$HEIA (-2,16%)

$SAAB B (+5,28%)

$UCG (-2%)

$BARC (+0,23%)

$GEV (-1,56%)

$TMO (+0,74%)

$T (+2,17%)

$MCO (+2,02%)

$IBM (+8,06%)

$SAP (-3,22%)

$TSLA (-3,07%)

$AAL (+8,03%)

$FCX (+0,06%)

$HON (-2,23%)

$DOW (+1,43%)

$NOKIA (+1,13%)

$TMUS (-1,05%)

$INTC (-7,3%)

$NEM (-4,95%)

$F (+6,36%)

$PG (-0,4%)

$GD (+2,31%)

Discussão sobre AAL

Postos

28Quartalsberichte 21.10-24.10.25

American Airlines Q2'25 Earnings Highlights

🔹 Revenue: $14.4B (Est. $14.29B) 🟢; Record High

🔹 Adjusted EPS: $0.95 (Est. $0.78) 🟢

FY25 Guidance (Updated):

🔹 EPS: ($0.20) to $0.80 (Est. ($0.01)) 🔴

🔸 Midpoint: $0.30

🔸 Top end achievable if domestic demand improves

Q3 Guidance:

🔹 EPS: ($0.60) to ($0.10) (Est. $0.76) 🔴

Key Business Highlights:

🔹 Record revenue driven by premium demand and restored indirect channels

🔹 All international entities delivered YoY unit revenue growth

🔹 AAdvantage loyalty program active accounts +7% YoY

🔹 Co-branded card spend +6% YoY

Operations & Strategy:

🔹 Achieved record refining throughput in U.S. Gulf Coast

🔹 Free Cash Flow (1H25): $2.5B

🔹 Net Debt: $29B

🔹 Ongoing investment in tech, fleet, lounges, and Flagship Suite®

🔹 Net Income: $628M adj. / $599M GAAP

🔹 Operating Margin: ~8%

🔹 Total Liquidity: $12B

CEO Commentary:

🔸 “We delivered record revenue in an evolving demand environment.”

🔸 “Our investments in network, loyalty, and customer experience are paying off.”

🔸 “We remain confident in our long-term strategy despite short-term volatility.”

Earnings Highlights:

Heute:

- $PG (-0,4%) Procter & Gamble Q3'25 Earnings Highlights

- EPS: $1.54 (Est. $1.55) ❌

- Revenue: $19.78B (Est. $20.36B) ❌; DOWN -2% YoY

- Organic Sales: +1% YoY

- $CMCSA (-0,16%) Comcast Q1 2025 Earnings Highlights

- Adjusted EPS: $1.09 (Est. $0.99) ✅; UP +4.5% YoY

- Revenue: $29.89B (Est. $29.8B) ✅; DOWN -0.6% YoY

- Domestic Broadband Net Loss: -199K (Est. -144K) ❌

- $HAS (-0,24%) Hasbro Q1 2025 Earnings Highlights

- EPS: $0.70 (Est. $0.69) ✅

- Revenue: $887.1M (Est. $771.15M) ✅; UP +17% YoY

- Operating Profit: $171M (19.2% margin)

- Adjusted Operating Profit: $222M (25.1% margin); UP +5.5pp YoY

- Operating Cash Flow: $138M (vs. $178M YoY)

- Returned $98M to shareholders via dividends, reduced debt by $50M

- $MRK (+0,33%) Q1 2025 Earnings Highlights

- Adjusted EPS: $2.22 (Est. $2.13) ✅; UP +7% YoY

- Revenue: $15.53B (Est. $15.33B) ✅; DOWN -2% YoY, UP +1% ex-FX

- Gross Margin: 78.0% (vs. 77.6% YoY) ✅

- $PEP (+0,08%) PepsiCo Q1'25 Earnings Highlights

- Core EPS: $1.48 (Est. $1.49) ❌; DOWN -4% YoY

- Revenue: $17.92B (Est. $17.78B) ✅

- Organic Revenue Growth: +1.2% YoY

- $AAL (+8,03%) American Airlines Q1'25 Earnings Highlights

- Revenue: $12.60B (Est. $12.68B) ❌

- Adj. EPS: ($0.59) (Est. ($0.62)) ✅

- Passenger Rev: $11.39B (Est. $11.36B) ✅

- Load Factor: 80.6% (Est. 81.9%) ❌

- ASM: 69.90B (Est. 69.91B) 🟡

- Withdrew FY guidance due to macro uncertainty

- Previously guided FY25 EPS: $1.70–$2.70

Gestern Abend:

- $NOW (-0,5%) ServiceNow Q1'25 Earnings Highlights

- Adj EPS: $4.04 (Est: $3.83) ✅

- Total Revenue: $3.09B (Est: $3.08B) ✅; UP +18.5% YoY

- Subscription Revenue: $3.01B (Est: $3.00B) ✅; UP +19% YoY

- Adjusted Gross Profit: $2.54B (Est: $2.53B) ✅

- Adjusted Gross Margin: 82% (Est: 81.8%) ✅; DOWN from 83% YoY

- Adjusted Subscription Gross Margin: 84.5% (Est: 83.9%) ✅; DOWN from 86% YoY

- Adj. Free Cash Flow: $1.48B (Est: $1.32B) ✅; UP +21% YoY

$CMG (-1,83%) Chipotle Q1'25 Earnings Highlights

- Revenue: $2.88B (Est: $2.94B) ❌ ; UP +6.4% YoY

- Adj EPS: $0.29 (Est: $0.28) ✅; UP +7.4% YoY

- Comparable Sales: DOWN -0.4% (Est: +1.74%) ❌

- Operating Margin: 16.7% (Est: 16.4%) ✅; UP +40 bps YoY

- Restaurant-Level Margin: 26.2% (Est: 25.9%) ✅; DOWN -130 bps YoY

- Average Restaurant Sales: $3.19M (Est: $3.17M) ✅

- Digital Sales Mix: 35.4% of total food & beverage revenue

$IBM (+8,06%) Q1'25 Earnings Highlights

- Revenue: $14.54B (Est: $14.41B) ✅; UP +0.5% YoY

- Operating EPS: $1.60 (Est: $1.42) ✅; DOWN -5% YoY

- Adj Gross Margin: 56.6% (Est: 55.6%) ✅; UP +190 bps YoY

- $LRCX (+2,75%) Q3'25 Earnings Highlights

Key Metrics

- EPS (Non-GAAP): $1.04 (Est: $1.00) ✅; UP +14% QoQ

- Revenue: $4.72B (Est: $4.63B) ✅; UP +8% QoQ

- $TXN (-1,56%) Instruments Q1'25 Earnings Highlights

- EPS: $1.28 (Est: $1.06) ✅; UP +7% YoY

- Revenue: $4.07B (Est: $3.91B) ✅; UP +11% YoY

- Operating Profit: $1.32B (Est: $1.18B) ✅; UP +3% YoY

American Airlines Q1'25 Earnings Highlights

🔹 Revenue: $12.60B (Est. $12.68B) 🔴

🔹 Adj. EPS: ($0.59) (Est. ($0.62)) 🟢

🔹 Passenger Rev: $11.39B (Est. $11.36B) 🟢

🔹 Load Factor: 80.6% (Est. 81.9%) 🔴

🔹 ASM: 69.90B (Est. 69.91B) 🟡

🔸 Withdrew FY guidance due to macro uncertainty

🔸 Previously guided FY25 EPS: $1.70–$2.70

Q2'25 Guidance:

🔹 Adj. EPS: $0.50–$1.00 (Est. $0.96) 🟡

🔹 Revenue: Down 2% to Up 1% YoY

🔹 Adj. Operating Margin: ~+6% to +8.5%

🔹 Capacity: +2% to +4% YoY

🔹 CASM-ex (unit costs ex. fuel): +3% to +5% YoY

Segment:

🔸 Domestic Revenue: $8.13B, -1.6% YoY

🔸 International Revenue: $3.26B, +2.1% YoY

▫ Pacific: +30.2% YoY

▫ Atlantic: -2.7% YoY

▫ Latin America: +0.2% YoY

Operations & Strategy:

🔹 Traffic (RPM): -1.9% YoY

🔹 Total Revenue per ASM: 17.95¢ (+0.7% YoY)

🔹 Operating Margin: -2.2% (Adj: -1.6%)

🔸 Free Cash Flow: $1.7B

🔸 Debt Reduced by $1.2B in Q1; Target: <$35B by FY2027

🔸 Liquidity: $10.8B (cash + credit)

🔸 AAdvantage® enrollments +6% YoY; credit card spend +8% YoY

🔸 Complimentary Wi-Fi for loyalty members launching Jan 2026

🔸 Aircraft count: 1,552 (+2.3% YoY); Total FTEs: 133,100

CEO Commentary:

🔸 “We’re well-positioned for uncertainty thanks to a refreshed fleet and disciplined cost control. Despite headwinds, our strategic investments give us confidence in long-term performance.” — CEO Robert Isom

American Airlines Surpasses Q4 Expectations with Strong Earnings Growth, Nearly Tripling Adjusted Net Income

FINANCIAL HIGHLIGHTS

- Adjusted EPS: $0.86 (vs $0.29 year-over-year)

* Exceeded analyst estimates of $0.65

* Nearly 200% improvement from previous year

- Revenue Performance

* Operating revenue: $13.66B (+4.6% YoY)

* Passenger revenue: $12.40B (+3.3% YoY)

* Both metrics exceeded analyst expectations

- Profitability

* Adjusted net income: $609M (vs $192M YoY)

* Significantly outperformed estimates of $471.3M

OPERATIONAL METRICS

- Capacity and Utilization

* Available seat miles: 71.50B (+2.5% YoY)

* Revenue passenger miles: 60.68B (+4.0% YoY)

* Load factor: 84.9% (improved from 83.6% YoY)

- Cost Management

* CASM ex-fuel: $13.99 (+5.7% YoY)

* Total CASM: $17.52 (-1.5% YoY)

* Passenger yield: 20.44 cents (-0.7% YoY)

* PRASM: $17.34 (+0.8% YoY)

FLEET

- Total aircraft: 1,562 units

- Fleet growth: +2.7% YoY

$AAL (+8,03%) | American Airlines Q3'24 Earnings Highlights:

🔹 Adj EPS: $0.30 (Est. $0.13) 🟢

🔹 Revenue: $13.6B (Est. $13.5B) 🟢; UP +1.2% YoY

🔹 Passenger Revenue: $12.52B (Est. $12.37B) 🟢; UP +0.8% YoY

🔹 ASMs: 75.67B; UP +3.2% YoY

🔹 Load Factor: 86.6% (Est. 84.2%); UP +2.6pp YoY

FY24 Guidance:

🔸 Raised Adj EPS: $1.35 - $1.60 (Prior: $0.70 - $1.30; Est. $1.22) 🟢

🔸 Adj Operating Margin: 4.5% - 5.5% (Prior: 3.5% - 5.5%)

🔸 Capacity (ASMs): +5% to +6% YoY

🔸 TRASM: Revised to "-4% to -3%" (Prior: "-5% to -3%")

🔸 CASM ex-fuel: +2% to +3% YoY (Prior: +1% to +3% YoY)

Q4 Guidance:

🔸 Adjusted EPS: $0.25 - $0.50 (Est. $0.30) 🟢

🔸 Capacity (ASMs): +1% to +3% YoY

🔸 TRASM: -3% to -1%

🔸 CASM ex-fuel: +4% to +6% YoY

Operational Metrics:

🔹 Revenue Passenger Miles (RPMs): 65.50B; UP +6.4% YoY

🔹 Passenger Yield: 19.12¢; DOWN -5.3% YoY

🔹 CASM (Cost per ASM): $17.92; DOWN -4.2% YoY

🔹 CASM ex-fuel: $13.39; UP +2.8% YoY

🔹 Total Aircraft: 1,546; UP +3.1% YoY

Additional Updates:

🔸 Capex (FY24 and FY25): Lower than prior forecast due to aircraft delivery delays

🔸 Cash and Liquidity: $11.8B in total available liquidity

🔸 Debt Reduction: On track to reduce total debt by $15B by 2025

Here are all of the changes coming to the S&P 500

- Stocks being added in: Palantir $PLTR (+2,29%), $DELL (+2,26%) and $ERIE (-0,71%)

- Stocks being removed: American Airlines $AAL (+8,03%), $ETSY (+0,17%), Bio-Rad $BIO (+0,24%)

I had now pulled the ripcord. The price of $AAL (+8,03%) is always at the same level. I really didn't think the industry would be so complicated with kerosene prices, etc. I thought the industry would recover after the pandemic. But the most important thing is that you learn from your mistakes😒

Títulos em alta

Principais criadores desta semana