Let’s go $ADBE (-0,2%) !!!

Discussão sobre ADBE

Postos

147Savings plans adjusted

Before:

350€ S&P500

150€ Nasdaq 100

100€ $ASML (+2,17%)

Now:

350€ Nasdaq 100

150€ MSCI Emerging Markets

100€ $ADBE (-0,2%)

I have adjusted my monthly savings plans. I no longer want to completely ignore the emerging markets in future. That's why I've now reduced to just one US ETF and opted for the Nasdaq over the S&P 500. Important: I am not selling any positions, only the monthly investments are changing. The S&P is still by far my largest position. The €150 freed up will then go into the new emerging markets ETF. I'm not looking to make a huge shift from the USA to the emerging markets, I just want to slowly build up a small position in the emerging markets and no longer leave them out completely.

I have also terminated my $ASML (+2,17%) savings plan. I am still convinced of ASML (after all, it is my largest single share position). However, the share has performed very well recently, so I am holding my position for the time being and see better opportunities for regular investments in $ADBE (-0,2%) for regular investments. I recently opened a first position here and as long as the share price is around €300, I would like to expand the position further.

Stop Underestimating Adobe — The Market’s Fear Is Overblown

Everywhere I look, people are writing obituaries for $ADBE (-0,2%) — as if a few headlines about “AI disruption” erase decades of dominance, infrastructure, and innovation.

But let’s be real:

- doesn’t just sell “interfaces.” It powers the backbone of creative work — Photoshop, Illustrator, Premiere, After Effects, Acrobat, Firefly, Creative Cloud.

- When AI “replaces interfaces,” it still needs systems, platforms, integrations, file formats, cloud services, compatibility — all of which $ADBE (-0,2%) builds and maintains.

- The creative ecosystem is sticky: designers, agencies, studios, publishers — they depend on Adobe tools. Switching costs are high.

- Yes, AI will shift workflows. But that shift often amplifies the value of robust platforms, not obliterates them.

So no, Adobe is not dying. The market is exaggerating its “destruction.” More likely scenario? Adobe evolves, integrates AI, and remains a pillar of digital creativity.

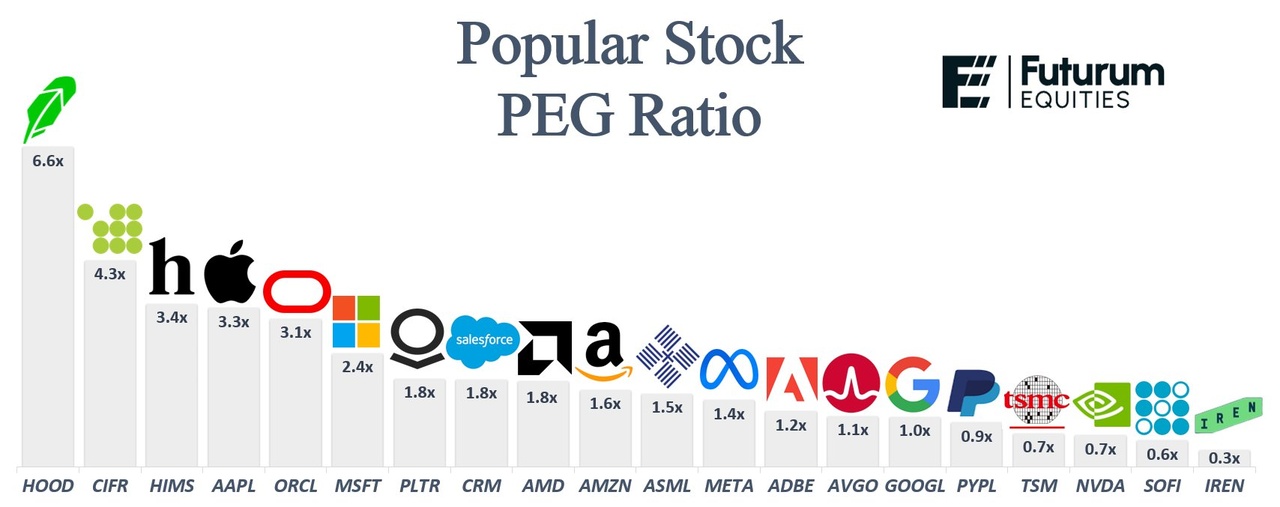

Popular Stock PEG Ratio

First of all, I have not checked these values exactly and do not know from which date they originate, but could mean even more upside for $IREN (+11,88%) especially if more hype comes in here.

PEG < 1 usually means mispriced growth

PEG > 2 is where you start hitting the danger zone

PEG ratios right now:

- $HOOD (+5,45%) ~6.6x

- $CIFR (+12,99%) ~4.3x

- $HIMS (+2,06%) ~3.4x

- $AAPL (+0,3%) ~3.3x

- $ORCL (+2,66%) ~3.1x

- $MSFT (-0,03%) ~2.4x

- $PLTR (+2,84%) ~1.8x

- $CRM (-0,66%) ~1.8x

- $AMD (+3,4%) ~1.8x

- $AMZN (+1,02%) ~1.6x

-$ASML (+2,17%) ~1.5x

- $META (+0,13%) ~1.4x

- $ADBE (-0,2%) ~1.2x

- $AVGO (+2,3%) ~1.1x

- $GOOGL (+1,25%) ~1.0x

- $PYPL (+2,15%) ~0.9x

- $TSM (+0,6%) ~0.7x

- $NVDA (+1,16%) ~0.7x

- $SOFI (+3,68%) ~0.6x

- $IREN (+11,88%) ~0.3x

https://x.com/stocksavvyshay/status/1974838017815957797?s=46&t=5M46IuHFFx0VtfxNNuG8NA

Adobe for a short swing trade 😊

$ADBE (-0,2%) will be in my trading portfolio for a few days. $MMK (+0,37%) and $VER (+1,52%) were kicked out this evening, but a first tranche of Adobe will be added to the portfolio. Quite tightly hedged with speculation on a return to VWAP and above.

The market is completely exaggerating here in my opinion.

Stock market simulation game update

Hello everyone,

The project started today and I have put together the portfolio.

Unfortunately there were a few problems, namely Coinbase $COIN (+0,61%) and Robinhood $HOOD (+5,45%) were blocked because you are not allowed to trade crypto and you couldn't trade gold/silver either (not even the Etfs).

In addition, there are now 6 stocks although I wanted to have 5 to keep diversification as low as possible.

Doordash $DASH (+1,1%) but I want to sell it again after the run Doordash has just had, even if it's a bit difficult to estimate how much upside there is in Doordash.

I will then probably divide the capital into the stocks that are not doing so well or into a new stock like Adobe $ADBE (-0,2%) which in my view is relatively moderately valued and still has potential, or Crowdstrike $CRWD (+4,14%) where I also still see potential, but unfortunately the valuation is also quite high and if the quarterly figures are poor, it can also go down considerably.

Thanks again for the help @Tenbagger2024

@All-in-or-nothing

@Multibagger

Maybe someone else has a few ideas on how best to approach this.

I can only trade the following stocks https://www.planspiel-boerse.de/assets/uploads/2025/09/PB25_Wertpapierliste.pdf so my choice is somewhat limited. (Mainly stocks from the Nasdaq, Dax and Eurostoxx50)

Update: My latest purchases💸

Over the past few days, I have made several share purchases. I have taken the opportunity to diversify my portfolio and selectively add stocks that I consider to be promising in the long term. My focus was on a balanced mix of stable companies and opportunities with growth potential. This allowed me to consistently pursue my investment strategy and further strengthen the basis for the future development of my portfolio.

Energiekontor $EKT (+0,59%) (subsequent purchase)

Novo Nordsik $NOVO B (-0,39%) (subsequent purchase)

LVMH $MC (+0,69%) (subsequent purchase)

Pernod Ricard $RI (-2,32%) (subsequent purchase)

Frosta AG $NLM (-2,58%) (first position)

Adobe $ADBE (-0,2%) (Subsequent purchase)

Nestle $NESN (-1%) (Subsequent purchase)

Occidental Petrolium $OXY (+2,5%) (first position)

Sixt Vz $SIX2 (+2,79%) (Subsequent purchase)

Realty Income $O (+0,02%) (Subsequent purchase)

Ping An Insurance (Subsequent purchase)

Volkswagen $VOW3 (+0,02%) (Subsequent purchase)

The Trade Desk $TTD (+0,26%) (subsequent purchase)

Daikin $6367 (-1,38%) (subsequent purchase)

Danaher $DHR (+2,07%) (subsequent purchase)

Have a great rest of the week!

Let's see what the next few days bring🧐

Sep 15 / New Position: Adobe

AI Narrative Is Wrong – Adobe’s Still Crushing It

I just opened a new position in Adobe. The market has been telling itself this story that AI will “kill” Adobe, that tools like Canva or Figma will eat its lunch. That’s just not true. The numbers are impeccable: free cash flow margins around 40%, revenue still growing double-digits, and they keep crushing earnings. Last quarter was another beat, and they even raised guidance. There’s zero evidence of AI eating into their market share.

In fact, Adobe is leaning into AI. Firefly, Acrobat AI, and other tools are already bringing in billions in ARR. Enterprise adoption is huge – roughly 90% of their top 50 customers are using AI features, and nearly half have doubled their spend since early 2023. This is not a company being disrupted. It’s a company using disruption to its advantage.

Meanwhile, the stock trades at a forward P/E below 20. Think about that: one of the highest-quality software companies in the world, with unmatched scale and brand power, priced like a dying business. It reminds me a lot of Google before its re-rating – great fundamentals, ignored because investors were chasing shinier AI names.

Yes, you need to watch Adobe closely. In software, market position is everything, and if they ever start losing ground, the story changes fast. However, they are not, and markets refuse to accept it. In 9 out of 10 scenarios, Adobe is on top of it. Great business don’t just disappear. Google didn’t, Meta didn’t and Adobe won’t either. They keep buying back shares aggressively, beating quarter after quarter, and have one of the stickiest customer bases in the industry.

Personally, I think this stock is poised for a rebound. And honestly? Investors just don’t want to open their eyes. This is one of the opportunities, where this Buffett quote fits perfectly: “Be greedy when others are fearful.”

To be completely honest, the answer is probably yes, but with a caveat. I think eventually Adobe and most of the photoshop applications, or creative software companies will became irrelevant. However, I guess that point is going to come in 10+,15+,20+ years.

Company structures are rigid and often take decades until change is fully accepted. Just look how long it took major companies to digitalize all communication and finally retire the Fax machine. Adobe as pointed out, is the gold standard in its industry, and there are no real signs of slowing business, rather the opposite. And even if we saw suppressed growth rates, the markets have already priced in the worst case scenario: an Adobe losing its edge and becoming irrelevant.

Summary: Yes, eventually all of Adobe’s functions could be performed by AI, which would change the business dramatically. However the markets exaggerate this risk, since it is likely to be decades away, and Adobe isn’t in a rush to innovate and find solutions, due to its market position.

The Buyback Story Wall Street Ignores

$ADBE (-0,2%) retiring 8% of its market cap in just 12 months is massive.

EPS gets a permanent boost, Oracle-style, yet the market narrative is still stuck on “Adobe fatigue.”

At some point, buybacks + double-digit ARR growth will be too obvious to ignore.

Adobe: History repeats itself...

Why prices do not always reflect reality

What is happening at Adobe right now reveals a fundamental psychological problem of the Börse. If you look at the share price development, you inevitably get the feeling that something is wrong with the company.

After all, if everything was fine, the share price would rise, wouldn't it?

But this is a fallacy. It happens all the time on the stock market that prices and fundamental reality drift apart. In many cases, this discrepancy is resolved within a few months, in other cases it takes much longer.

But in the end, the same thing always happens: the price follows the fundamentals.

Reality can be ignored for a long time, but not forever - and the longer the phase of ignorance lasts, the more impulsive the subsequent upward trend. The number of examples that prove this is almost endless

Adobe delivers records

Adobe set new records at all levels last year. Sales increased by 13 % to USD 47.87 per share, profit by 15 % to USD 18.42 and free cash flow by 16 % to USD 17.51 per share.

Since then, the positive development has continued consistently. In the first quarter, expectations were consistently exceeded and the earnings expectations for 2025 of USD 20.20 - 20.50 per share were confirmed.

The share price slumped in response.

In the second quarter, earnings of USD 5.06 per share were well above expectations of USD 4.98. With sales of USD 5.87 billion, analysts' estimates of USD 5.80 billion were also exceeded. For the year as a whole, this corresponds to an 11% increase in sales and a 13% jump in profits.

As a result, the earnings forecast was raised from USD 20.20 - 20.50 to USD 20.50 - 20.70 per share.

The Adobe share price fell further as a result

Has the starting signal been given?

On September 11, the company presented its figures for the third quarter and the share did indeed react positively. Vorbörslich Adobe is trading up 4.41 % at USD 366.

At USD 5.31 per share, Q3 earnings again exceeded expectations of USD 5.16. With sales of USD 5.99 billion, analysts' estimates of USD 5.90 billion were also exceeded.

For the year as a whole, this corresponds to an 11% increase in sales and a 14% jump in profits.

In addition to organic growth, the ongoing share buybacks also contributed to this - compared to the previous year, the number of outstanding shares fell from 448 to 424 million.

The order backlog (RPO, Remaining Performance Obligations), on the other hand, increased from USD 18.14 billion to USD 20.44 billion.

The signs therefore continue to point to growth.

AI loser or AI winner?

Products that include AI functions now account for almost a quarter of sales. Annualized sales in this area now exceed USD 5 billion.

Adobe has therefore raised its revenue forecast for the current financial year from USD 23.5 - 23.6 billion to USD 23.65 - 23.70 billion and its earnings expectations from USD 20.50 - 20.70 to USD 20.80 - 20.85 per share.

Over the year as a whole, this would correspond to a jump in earnings of around 13%.

This gives Adobe a forward P/E of 17.6, which is currently a valuation that is normally assigned to companies with low single-digit growth rates.

If the bears' disruption fantasies do not materialize, there is corresponding upside potential. Over the last five years, the P/E has averaged 38

Adobe share: Chart from 12.09.2025, price: USD 366.00 - symbol: ADBE | Source: TWS

Adobe could have formed a double bottom that offers upside potential to USD 382. Above this, there would be a Kaufsignal with possible price targets at USD 422 and USD 440.

If this hurdle can also be overcome, this would enable medium-term price gains up to USD 500 - 512.

If, on the other hand, the share price falls below USD 332, the bottoming-out process will have failed for the time being and the bulls will have their chance.

It has always been and still is a clear fundamental BUY.

Only the last five years have been "garbage": however, this has been the case for the company several times in the long term. Calculated over the last 20 years: 16% share price profit per year.

When it comes to creative software, Adobe seems to be making the leap into AI quite well. And that means they will remain what they have always been: the undisputed market leader. And market leader means: making money

Títulos em alta

Principais criadores desta semana