The so-called lipstick effect describes the phenomenon that consumers do not completely forego luxury during recessions, but buy smaller luxury items when large purchases are no longer available.

(The chart below compares the performance of ULTA Beauty and the S&P 500 since March 13, 2020, when the nationwide COVID-19 lockdowns began).

(https://de.tradingview.com/chart/Wl3dkBka)

The term was coined by Juliet Schor back in 1998.

"They are looking for affordable luxury, the thrill of buying in an expensive department store, indulging in a fantasy of beauty and sexiness, buying 'hope in a bottle. Cosmetics are an escape from an otherwise drab everyday existence".

He gained notoriety when Estée Lauder boss Leonard Lauder realized after the 2001 attacks that his company was selling an unusually high number of lipsticks.

Without further ado, Lauder considered lipstick to be a counter-indicator to the economic situation.

Today, the effect is widely extended to consumer goods beyond cosmetics:

Small goods instead of expensive prestige items gain in popularity during crises.

1.

What is the lipstick effect?

In essence, the lipstick effect means

When budgets shrink, consumers cut back on expensive purchases - but indulge in a little sin.

"Consumers will still tend to buy small luxury items even during an economic downturn".

Or:

If you can't afford a car, you might buy the new luxury lipstick instead of nothing at all.

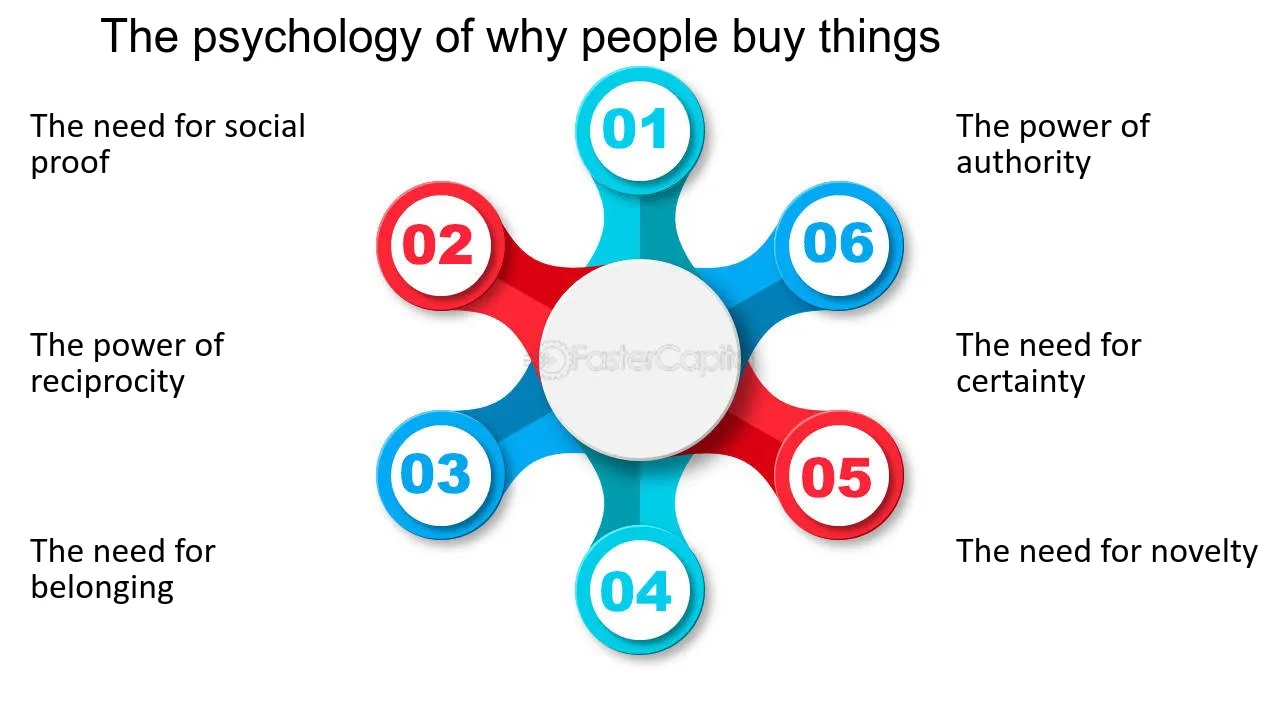

(https://fastercapital.com/startup-topic/People-Will-Actually-Buy.html)

After 9/11, the demand for lipstick shot up by around 11%.

Later, during the 2008 financial crisis $EL (+1,99%) again reported rising cosmetics revenues, while other sectors suffered.

The lipstick effect is not constant; extreme situations such as deep snow or store closures due to the pandemic can weaken it.

However, in normal downturns, studies show that it works quite reliably as a consumption indicator.

2.

Psychological drivers

(https://www.falstaff.com/de/news/im-rausch-der-hormone)

Why do people reach for chocolate rather than expensive theater tickets in uncertain times?

Psychology is behind the lipstick effect.

Even when money is tight, people want to treat themselves to something good - a sweet consolation or a new make-up.

Consuming lipstick or ice cream can lift your mood and give you the feeling that you are doing something positive.

In a recession, women show an increased interest in beauty and attractiveness products, especially when they feel a high motivation to increase their attractiveness or to attract a partner.

This supports the lipstick effect hypothesis:

Even in times of crisis, people do not forgo small luxury items - especially those that boost self-esteem or attractiveness.

The study explains this in terms of evolutionary psychology:

- In uncertain times, perceived financial security decreases.

- People (especially women in this study) therefore invest more in their appearance to send signals of attractiveness that potentially symbolize access to stable social and economic resources.

3.

Economic impact: Crisis-winning industries

In many downturns, certain sectors have benefited disproportionately. Traditionally, cosmetics providers have flourished - lipstick, mascara etc. are seen as an "affordable luxury".

For example $OR (-0,56%) reported increases in sales and profits for the crisis year 2008 despite the global contraction.

This effect explains why cosmetics shares are often considered stable. Tobacco and alcohol companies are also often robust:

Habitual goods such as cigarettes or beer are considered "addictive" goods - even in bad times, demand remains relatively stable. (Historically, cigarettes were even used as a means of bartering for war).

Fast food chains such as McDonald's do well because people want cheap food when everything is more expensive.

Gambling providers can also boom when dreams become more important than sober calculation.

Streaming services/online entertainment are typical: while physical contact is declining, the need for internet entertainment is increasing (Netflix, for example, grew strongly during coronavirus). Investopedia specifically names "fast-casual restaurants and multiplex cinemas" as winners of the crisis.

- Cosmetics

Sales continue to rise in 2008 despite the crisis. The global cosmetics market amounted to around USD 504 billion in 2022 (growth +15% compared to 2021) - a sign of the continued importance of beauty care.

- Tobacco/alcohol

($BATS (-0,17%), $PM (+0,09%), $MO (+0,05%), $DGE (-0,71%))

Habitual drinkers and smokers rarely cut back further, tend to consume the same thing or switch to cheaper brands. Tobacco, for example, was an expensive means of exchange during the war.

- Fast food & entertainment

($MCD (-0,54%), $NFLX (-1,61%), $AMC (-0,85%)

)

Affordable indulgences and distractions are in demand. Reports from the corona crisis document, for example, that Amazon recorded a +70% jump in e-commerce sales in the beauty and care sector during the lockdown compared to pre-crisis levels - an indication that consumers were busy ordering small luxury items online.

4.

Historical examples of crises

Concrete history makes the effect tangible: Already after 9/11 in 2001 $EL (+1,99%) reported unusually high lipstick sales - Leonard Lauder even spoke of a "counter-indicator" to the recession.

The picture continued in 2008/09:$OR (-0,56%) and other cosmetics companies fared better than the market as a whole (they were able to expand their sales), while luxury goods shrank.

Corona pandemic (2020) again brought examples: Although the economy slumped in the first half of the year, online trade in beauty products boomed,

Amazon recorded a +70% increase in beauty/care products in e-commerce in spring 2020 compared to the pre-crisis period and Sephora ($MC (-1,81%)) reported a +30 % increase in online sales compared to 2019.

The effect was even evident in 2022/23: according to market researchers, around a third of make-up customers in the UK bought products as a "reward", with spending on lipstick there increasing by around 12.3% in 2023 (despite the tight cost of living).

In China, the lipstick effect was conspicuously absent in 2022, as a study by the China Institute made clear. (https://cidw.de)

"Despite government efforts to promote moviegoing with subsidies and discounts, consumers remain cautious, especially in tier 1 cities. The "lipstick effect", according to which small expenditures increase in times of crisis, did not materialize in China. In December, the China Film Administration launched a subsidy program."

5.

Stock markets in times of crisis

How did investors react to the lipstick effect? Some consumer stocks are considered defensive securities. Thus $OR (-0,56%) 2008 continued to show a profit - a prime example of stability. Estée Lauder experienced a small price jump in 2001 as investors bet on the strong demand for beauty products.

Tobacco stocks ($BATS (-0,17%) , $MO (+0,05%), $PM (+0,09%)) and food companies ($NESN (-0,97%) ) were also regarded as pullback stocks:

Their cash flows suffer comparatively little as underlying demand continues.

McDonald's ($MCD (-0,54%)) was largely able to compensate for its 2008 share price slump by 2010, and the share price also recovered quickly after the coronavirus slump in 2020.

Netflix ($NFLX (-1,61%)): Its price briefly doubled with the lockdown dividend, after which the situation normalized.

6.

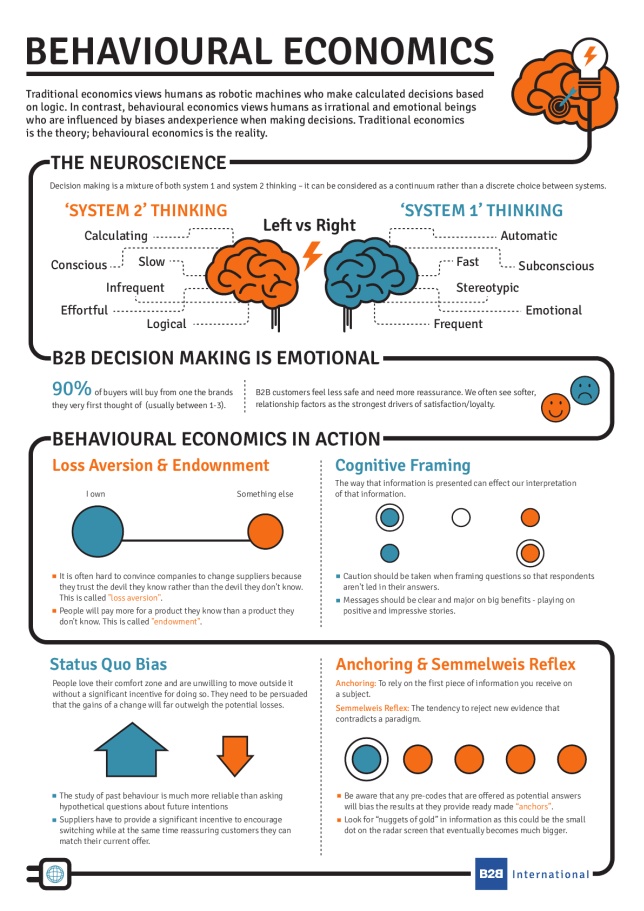

Behavioral economic classification

The lipstick effect fits well into the picture of loss aversion and prospect theory: investors and consumers avoid large losses (e.g. cash tied up in a car) and value small gains relatively highly.

(https://hub.hslu.ch/business-psychology/prospect-theory)

In this sense, an inexpensive luxury item minimizes the feeling of "having done without".

Social influences also have an effect: If you see friends treating themselves to something despite the crisis, you are more likely to justify it for yourself.

Behavioral economics thus explains why people satisfy their unpaid desire for a little happiness during a crisis - often reflexively, emotionally and depending on the context.

(https://www.b2binternational.com/publications/what-is-behavioural-economics)

In both world wars, cigarettes were more a part of survival than chocolate - as a tranquillizer in the trenches and a tangible bartering commodity.

Hitler had smoking banned in many places during the Second World War, but tobacco was still available at the front. Chocolate became scarce in 1939: US soldiers were served sweets in their rations, officially to boost morale. Other goods such as coffee, ice cream and video games have similar stories - in the USA, for example, the chocolate business boomed briefly after the world wars as a nostalgic feel-good store.

What was good as a small consolation in war is considered a luxury in peace.

Sources:

https://www.sueddeutsche.de/panorama/lippenstift-mode-geschichte-1.5360041

https://fastercapital.com/startup-topic/People-Will-Actually-Buy.html

https://fastercapital.com/content/The-Lipstick-Effect-and-its-impact-on-consumer-behavior.html

https://pmc.ncbi.nlm.nih.gov/articles/PMC9636953/#:~:text=consumers%20to%20spend%20more%20on,1