Vitec AB $VIT B (+0,27%) presented its earnings this morning.

"In both the short and medium term, Vitec is very limitedly affected by external factors"

-CEO Olle Backman

(mln sec)

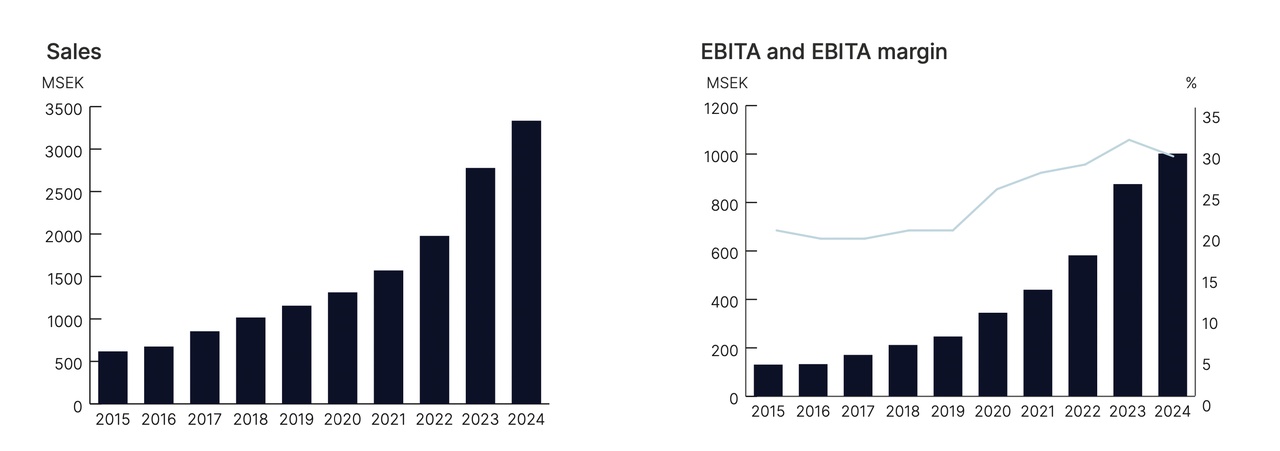

Sales: 880 +23%

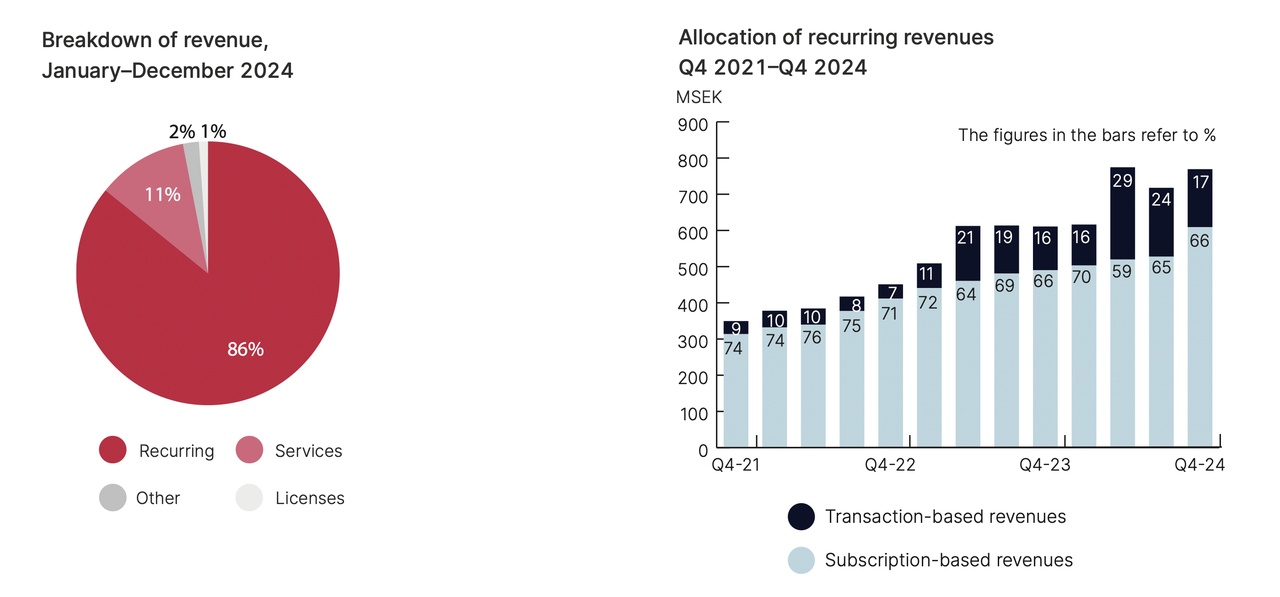

Share of recurring revenue: 89% +300bps

EBITA: 220 +-0%

EBITA margin: 25% -600bps

Operating profit: 153 +-0%

Operating margin: 17% -400bps

Net profit: 83 -3%

EPS: 2.09 -9%

Acquisitions: Intergrip B.V.

"The net of capitalized development costs, amortization and impairment on intangible fixed assets, and acquisition-related amortization had a negative effect on operating profit"

On the whole, Q1 was satisfactory. Although a decline in EPS is never nice to see, these are of a short-term nature. Recurring revenue continues to grow strongly at >20% which indicates a stable business environment. Vitec generates only about 7% of its revenues in the US, which should have a positive impact, especially in the short term.