Share analysis

1 Brief overview

2 Introduction

3 Business segments

4 Business figures

5 Latest quarterly figures

6 Holding structure

7 Valuation

8 Conclusion

9 Announcement

10 Sources

Brief overview

Market capitalization: 2.29 billion zloty

KGV/KGVE: 25/19

Annualized yield: 45.67 % p.a.

Analyst rating: Buy

Introduction

cyber_Folks $CBF (+0,83%) is a Polish technology company specializing in the hosting of websites and the registration and trading of domains. cyber_Folks was founded in 1999 by Jakub Dwernicki. Through major investments in Vercom $VRC (-1,05%) and Shoper, cyber_Folks is also developing a large ecosystem for many different sectors. The investment in Shoper $SHO (-3,19%) is not yet included in most business figures because it was only announced at the end of November 2024.

Business areas

https://investors.cyberfolks.pl/

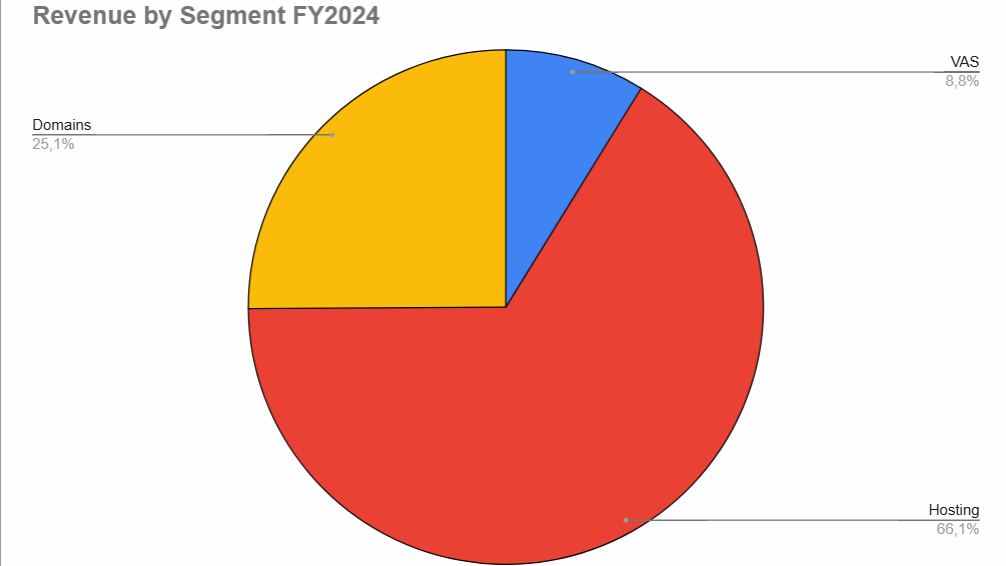

cyber_Folks generates the majority of its revenue from its hosting business. In the 2024 financial year, the company had around 220,000 customers (2023: 220,000 customers). According to the company, the focus is on e-commerce customers.

The most important market is Poland, but the company has also achieved a strong market position in Croatia and Romania. Strategically, the company would like to expand further into more Eastern European countries (Czech Republic, Hungary, Austria, etc.) in order to enable sustainable growth in the future.

The average revenue per customer (ARPU) in the last 12 months is currently 477 zlotys. A year ago it was 350 zlotys. The trend is therefore pointing upwards.

In the domain business, the ARPU is only 89 zlotys. A positive trend can also be seen here. Compared to the previous year, however, the number of domains shrank by 7% to 365,000.

VAS also includes other, relatively irrelevant additional services such as tools for SEO measures, but these are of secondary importance for this analysis.

Business figures (without Shoper)

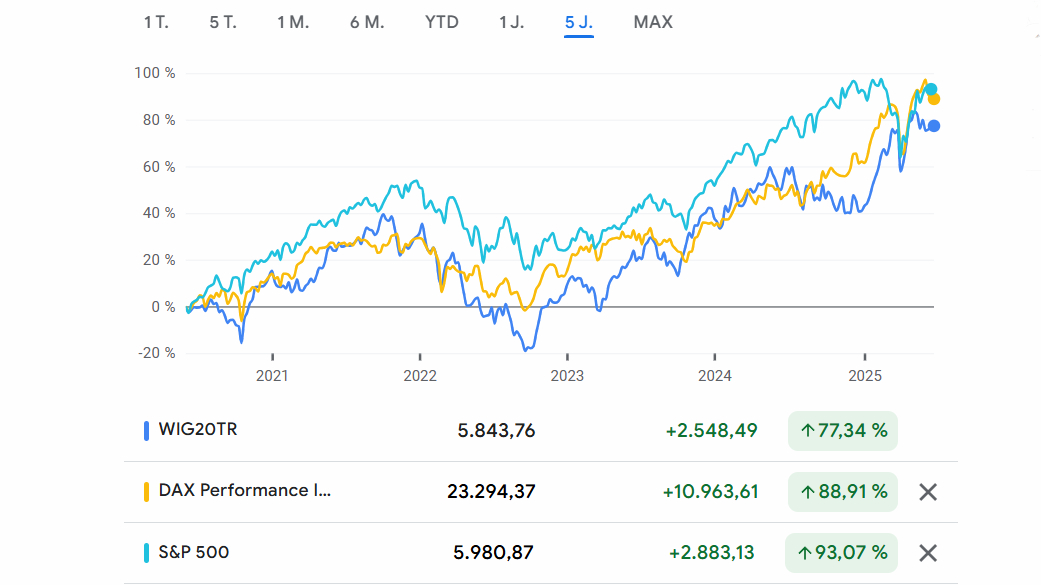

https://www.google.com/finance/quote/CBF:WSE?hl=de

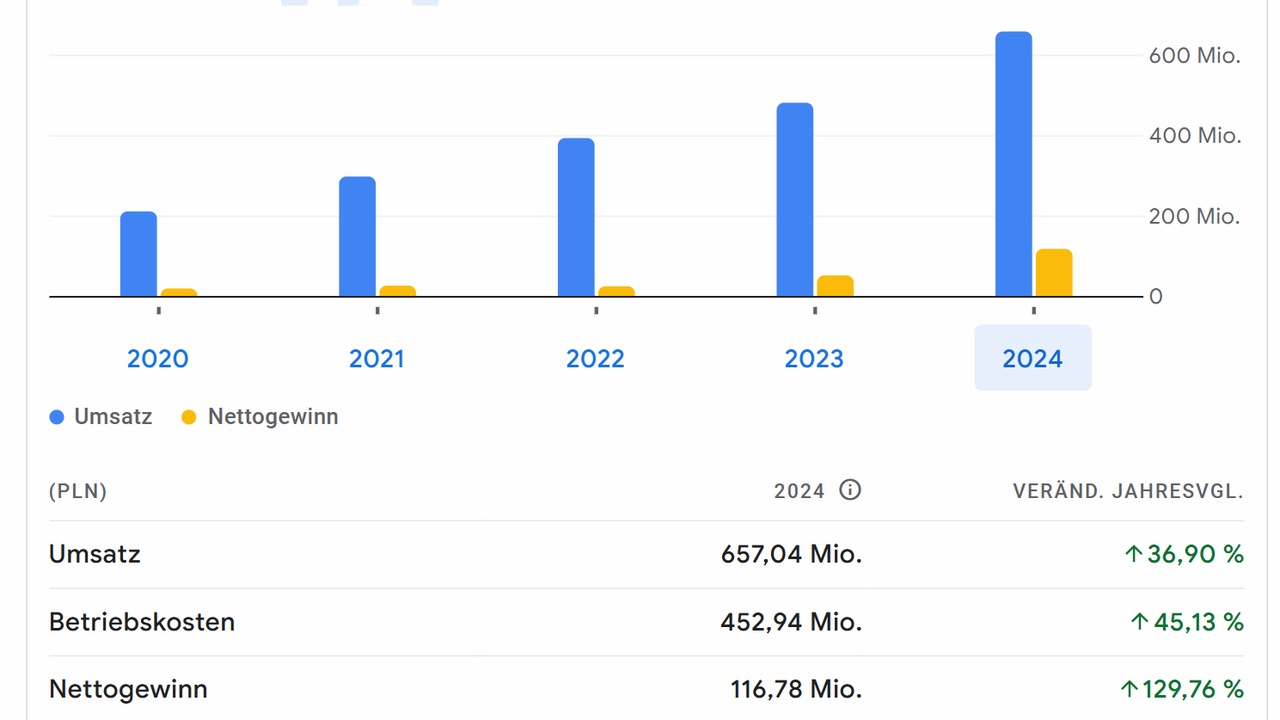

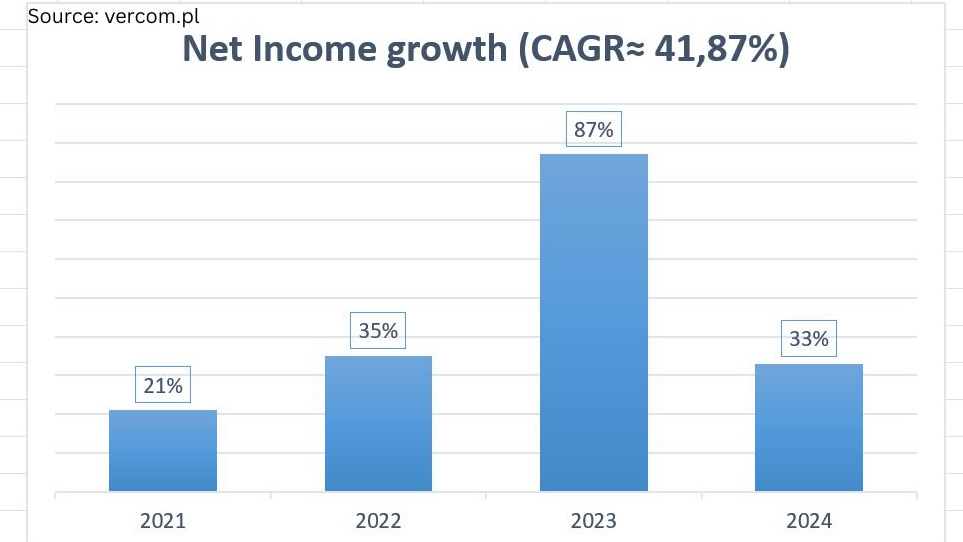

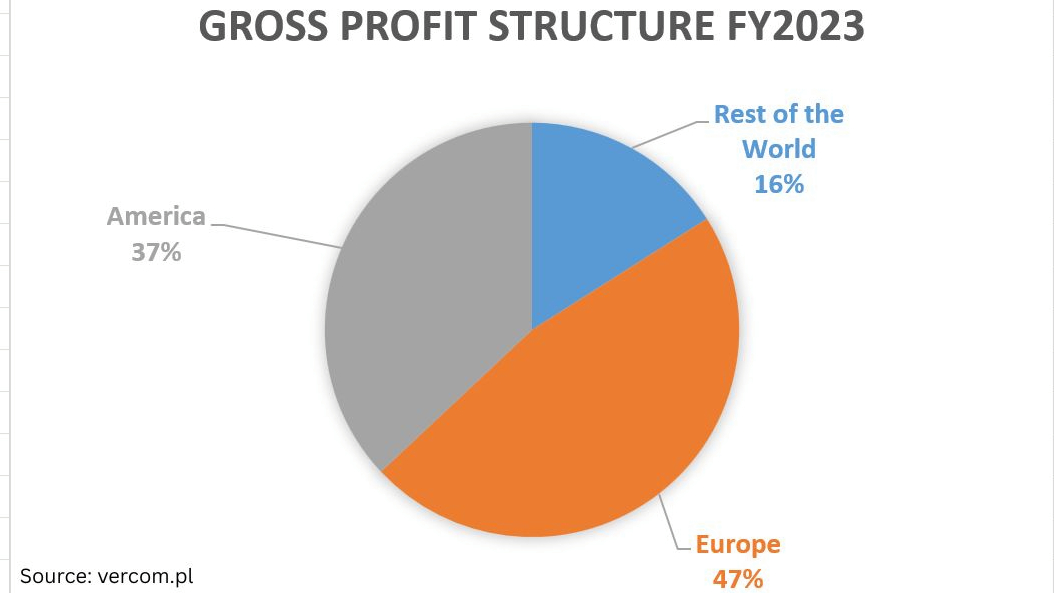

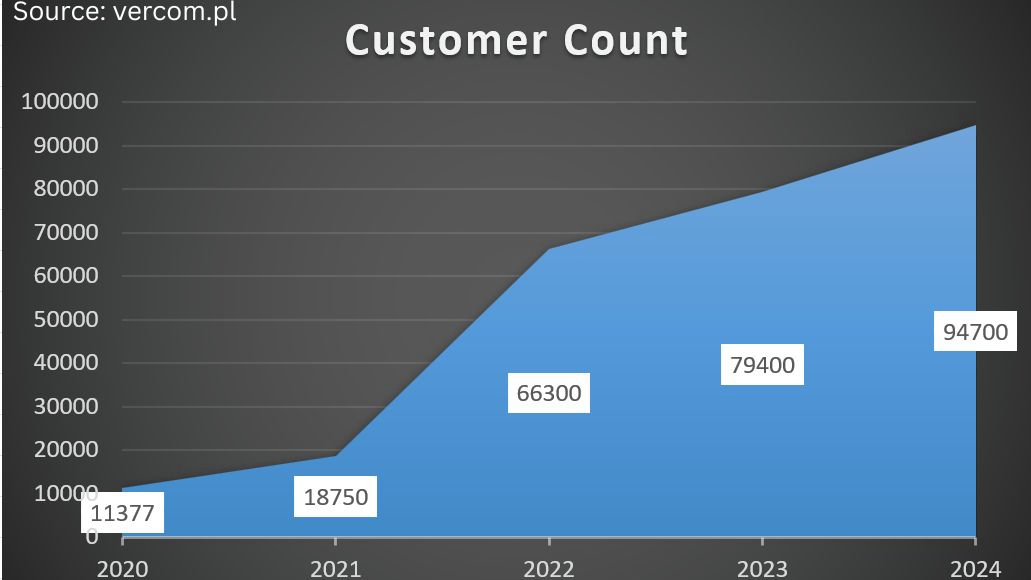

Over the last 20 years, turnover has grown by an impressive average of 40% per year (including Vercom). In the past financial year, turnover amounted to 657 million zloty, of which cyber_Folks itself accounted for only 160 million (24%). The remaining turnover comes solely from the investment in Vercom.

However, the company's own business is twice as profitable as Vercom with an adjusted EBITDA margin of 44.7%. Revenue increased by 14%, an acceleration of 1 percentage point compared to 2023.

https://investors.cyberfolks.pl/

Despite many acquisitions, cyber_Folks' debt is limited. The ratio of net debt to adjusted EBITDA is a healthy 2.1. Last year, 28 million zlotys were also distributed to shareholders in the form of share buybacks and dividend payments. The dividend yield is 1.2% and the payout ratio is around 40% of EBIT.

Latest business figures

Revenue increased by 32% to PLN 191 million in the first quarter of 2025, including Vercom and Shoper. Adjusted EBITDA grew disproportionately by 55% to 62 million zlotys (margin: 32%).

The turnover of only cyber_Folks increased constantly by 14%. The adjusted EBITDA margin rose to 49%. Unfortunately, actual profit figures are not published for the first quarter.

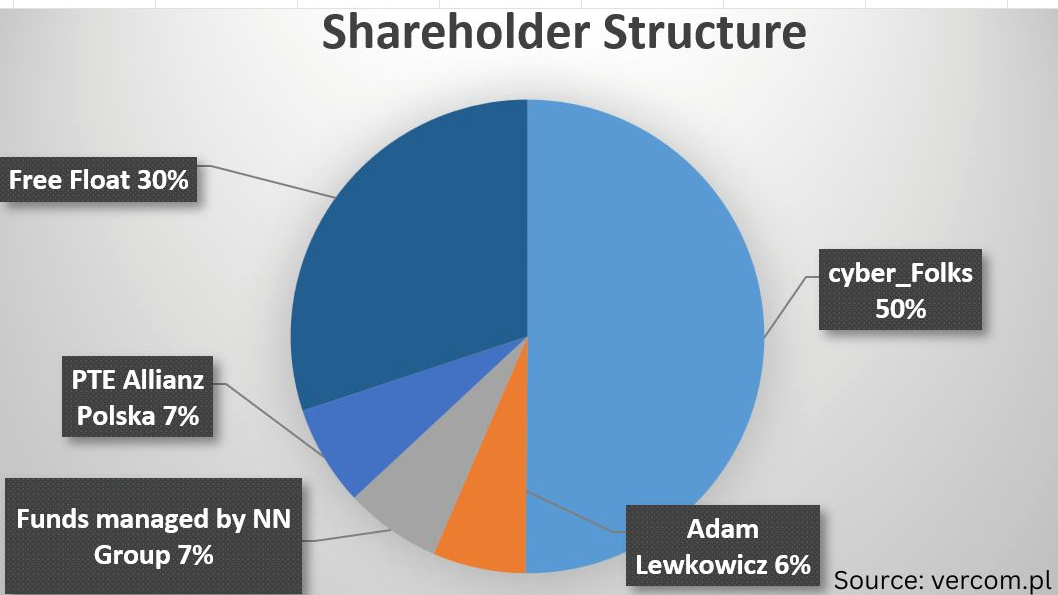

Holding structure

https://investors.cyberfolks.pl/

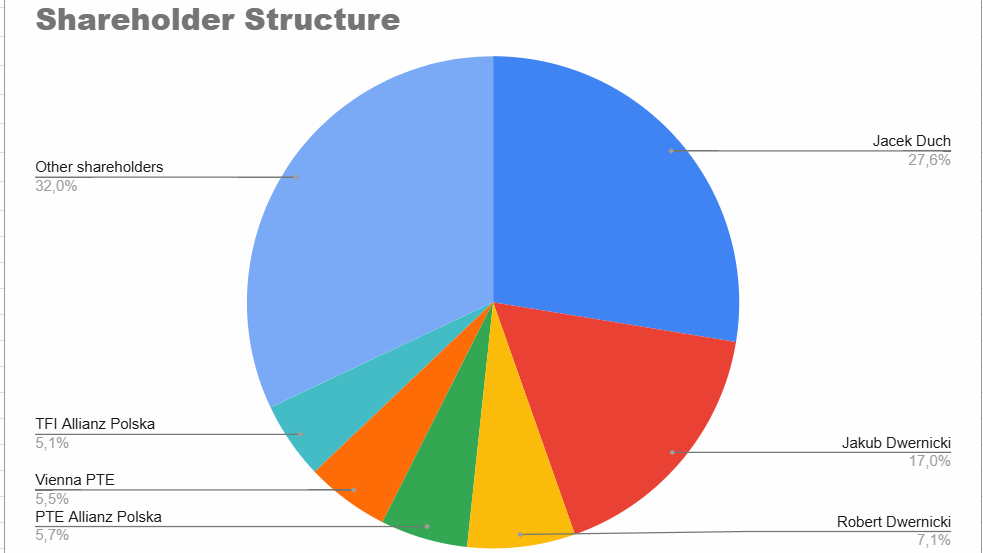

Jacek Duch: Chairman of the Supervisory Board of cyber_Folks

Jakub Dwernicki: Founder and CEO

Robert Dwernicki: no specific information found

TFI Allianz Polska: investment fund company

Vienna PTE: pension fund manager

PTE Allianz Polska: participation by Polish pension funds

Disclaimer

This is not investment advice. These are personal assessments that cannot replace professional advice. You can find the detailed and complete stock analysis on my free substack (link in profile).

Conclusion

For me, the corporate network of cyber_Folks and Vercom remains opaque.

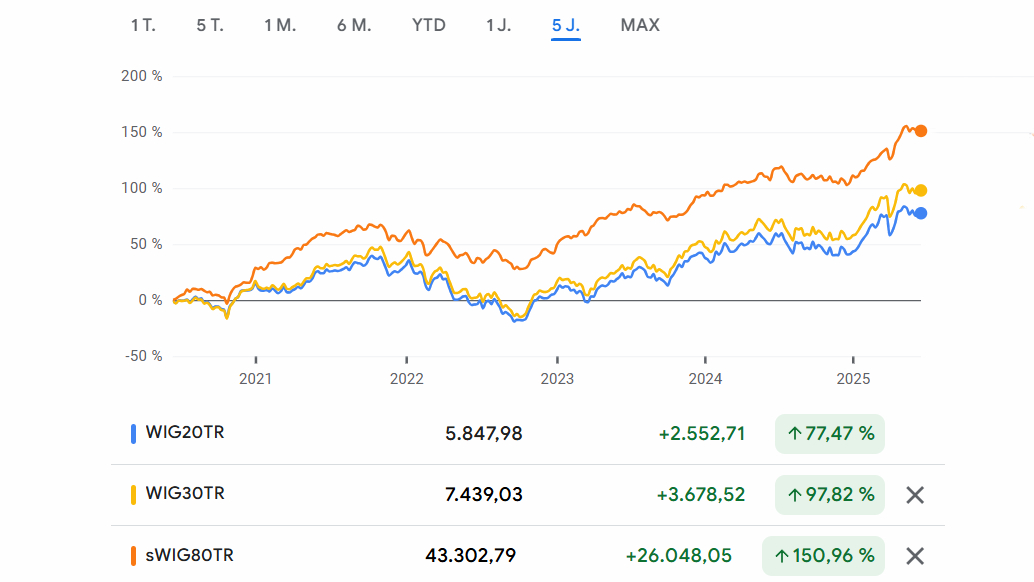

However, Vercom is certainly the most relevant for cyber_Folks' share price. It therefore makes no sense to me why an investment in Vercom is not considered directly instead of indirectly via cyber_Folks.

As an international investor, it is unfortunately difficult to understand and actively follow unknown stocks like cyber_Folks anyway. There is also the language barrier. Although some of the annual reports are in English, earnings calls and general meetings are primarily in Polish.

Announcement

In order to maintain the quality of my stock analyses, I will be abandoning my original goal of publishing a post every week after more than two months. In the coming months in particular, I have planned analyses of exciting companies for which I need more time for research. For the time being, I will therefore publish an article every two weeks.

Source