Mid-May 2025 finds the dry bulk market charting turbulent seas. Capesize vessels ride a bullish wave, Panamax struggles with Atlantic oversupply, Ultramax/Supramax sees regional disparities, and Handysize holds steady with balanced fundamentals. China’s shifting imports, U.S. tariff relief, and potential peace talks shape the horizon, while monsoon seasons and logistical hiccups add complexity. This sector is a bulker navigating global trade winds—let’s dive into its journey.

🚢 Capesize: Riding a Bullish Wave

Rates Rebound

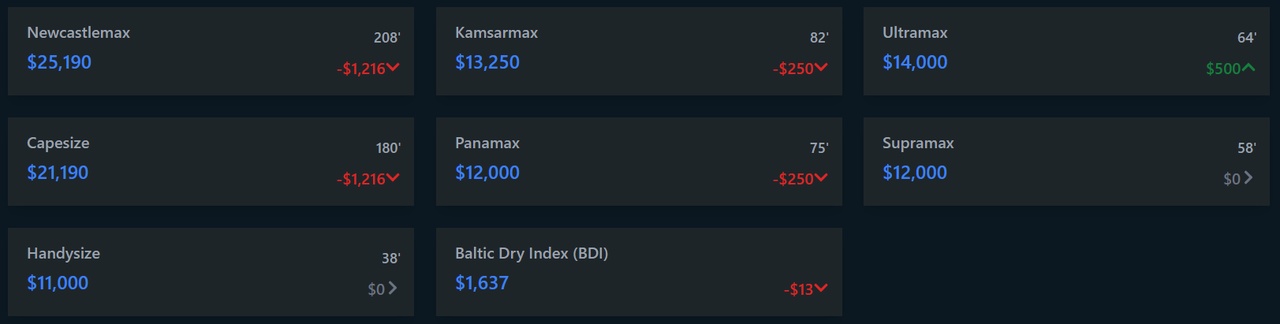

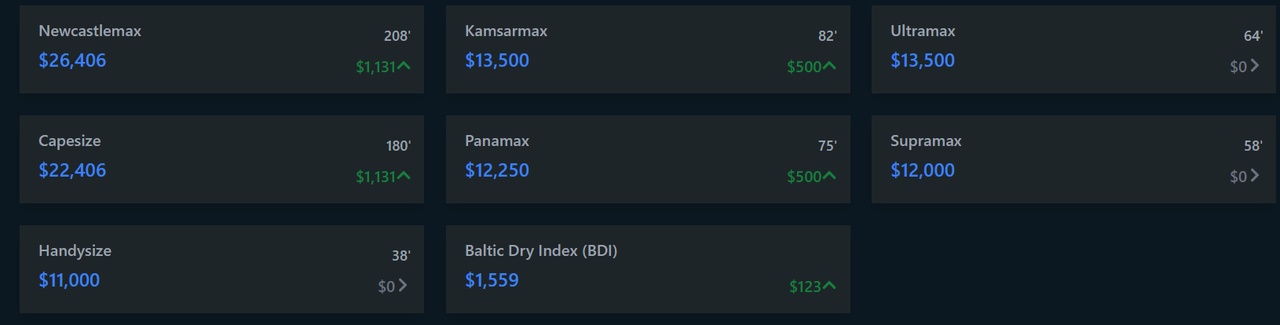

Capesize vessels, the behemoths of bulk, close the week on a firm note. The Baltic Capesize Index (BCI) 5TC recovers $2,382 week-on-week to $16,736 per day. West Australia-to-China (C5) rises to $8.195 per metric tonne (pmt), up from low-mid $7 levels. Brazil-to-China (C3) firms to $19.405 pmt, finding a floor at $18.00 mid-week. The fronthaul C9 index surges, reflecting North Atlantic tightness. Clarksons reports Capesize spot rates at $16,500 per day, up 9% week-on-week, driven by miner engagement—Capesize sails with renewed momentum.

Cargo Currents

Pacific markets see robust enquiry, with East Australia maintaining peripheral volume and miners pushing rates. Atlantic demand strengthens from South Brazil and West Africa, despite logistical issues [San Nicolas loader breakdown]. Far East spot tonnage thins slightly, though June ballast lists remain heavy. A 180,000-dwt vessel fixes at $19 pmt for early June Brazil-to-China, up from sub-$18 levels. China’s iron ore imports [1.12 billion tonnes in 2024, up 6%] and bauxite flows [110.2 million tonnes, up 11.2%] fuel demand—Capesize thrives on tightening tonnage.

Global Tides

U.S.-China tariff relief [24% cut, effective May 14] boosts trade sentiment, indirectly supporting Capesize via Brazilian routes. Potential peace talks [Russia-Ukraine, Iran] could spur reconstruction demand, per Star Bulk’s Petros Pappas, adding upside. China’s domestic iron ore production [up 7% in 2024] and coal import declines [down 8.3% in Q1] temper gains. Clarksons forecasts 1.5% dry bulk demand growth in 2026, lagging 2.5% fleet growth, but tight North Atlantic tonnage signals near-term strength—Capesize navigates with bullish caution.

🌾 Panamax: Atlantic Struggles Persist

Rates Under Pressure

Panamax vessels, vital for grain and coal, face a lackluster week. The Baltic Panamax Index averages $11,800 per day, down 5% week-on-week. Atlantic fronthaul rates slide, with an 82,000-dwt vessel dropping from $20,000 to $14,000 mid-week for a U.S. East Coast-to-India run [Continent delivery]. Pacific rounds hold at $9,500-$10,000 per day, with an 82,000-dwt vessel fixing at $11,000 for East Coast Australia-to-Japan. East Coast South America (ECSA) softens, with June oversupply looming—Panamax grapples with bearish sentiment.

Regional Ripples

Atlantic markets weaken as growing tonnage outpaces demand, particularly from North Coast South America (NCSA). Trans-Atlantic runs see wider bid-offer spreads, with sub-index fixtures. ECSA grain [Brazilian soybeans, 19.6 million tonnes in Q1] provides short-term support, but ample June tonnage pressures rates. Pacific markets remain flat, with long tonnage lists and scarce NoPac cargoes. A 5-7 month period fixture at $13,750 [82,000-dwt, China delivery] reflects cautious optimism—Panamax seeks a demand spark.

External Currents

U.S.-China tariff relief boosts Brazilian soybean exports [up 9% year-on-year], supporting Panamax tonne-miles. Potential Red Sea normalization [post-Houthi ceasefire] could shorten Pacific routes, per Bimco’s Paul Pathy, reducing demand. China’s coal import decline [down 8.3% in Q1] and weak macroeconomic signals limit upside. Clarksons’ 2026 forecast [2.5% fleet growth, 1.5% demand] and monsoon-related cargo drops in West Coast India add headwinds—Panamax navigates with guarded hope.

⚓ Ultramax/Supramax: Regional Disparities

Rates Hold Mixed

Ultramax and Supramax vessels, versatile mid-sized carriers, show regional contrasts. The Baltic Supramax Index stabilizes at $11,600 per day. U.S. Gulf and South America maintain strength, with a 58,000-dwt vessel fixing at $17,850 for Fazendinha-to-Otranto. Indian Ocean rates shine, with a 64,000-dwt vessel at $20,000 plus $200,000 ballast bonus [Saldanha Bay-to-China]. Asian markets soften, with a 63,000-dwt vessel at $17,000 [Surabaya-to-Thailand]. Continent-Mediterranean rates dip, with limited enquiry—Supramax balances localized gains with Asian weakness.

Market Movements

U.S. Gulf and South America see steady demand, though trans-Atlantic runs ease late-week. Indian Ocean activity remains robust [South Africa-to-China], but monsoon season looms. Asian markets lack impetus, with a 58,000-dwt vessel at $12,500 [Singapore-to-China]. Continent-Mediterranean markets stay subdued, with downward rate pressure. Star Bulk’s sale of five Supramaxes [average age 17 years] to Chinese buyers signals fleet renewal—Supramax seeks catalysts amid holiday slowdowns.

Broader Waves

U.S.-China tariff relief supports Brazilian grain routes, boosting Supramax tonne-miles. Potential peace talks [Ukraine reconstruction] could lift demand, per Star Bulk. China’s reduced coal imports [down 8.3% in Q1] and stricter environmental regulations pressure older vessels. Clarksons’ 2026 forecast [2.5% fleet growth, 1.5% demand] and 5% newbuild deliveries in 2025 add risks. Indian Ocean strength offers upside, but Asian oversupply and monsoon slowdowns cloud prospects—Supramax sails with cautious resilience.

🛳️ Handysize: Steady Amid Quiet Seas

Rates Remain Flat

Handysize vessels, nimble bulk carriers, maintain balance with minimal activity. The Baltic Handysize Index (BSHI) holds at $9,900 per day. South Atlantic rates stabilize, with a 36,000-dwt vessel at $15,500 [Recalada-to-NC South America]. U.S. Gulf softens, with a 37,000-dwt vessel at $10,500 [Hampton Roads-to-Continent, coal]. Asian rates steady, with a 38,000-dwt vessel at $13,500 [CJK-to-Continent, concentrates]. Mediterranean markets remain soft, with a 37,000-dwt vessel at $7,000 [Bejaia-to-Samsun]—Handysize anchors in regional stability.

Trade Flows

South Atlantic balances steady grain demand [Brazilian exports, 71% soybeans] with growing tonnage. U.S. Gulf faces pressure from lengthening lists, depressing rates. Asian markets stabilize, with cargo volumes [concentrates, steel] offsetting tonnage increases. Mediterranean and Continent markets lack fresh enquiry, staying positional. Pangaea’s 17 Chinese-built Handysizes benefit from U.S. tariff exclusions [below 80,000 dwt]—Handysize relies on localized demand pockets.

Influencing Factors

U.S.-China tariff relief boosts Brazilian grain routes, supporting Handysize. Potential Red Sea normalization could reduce Asian tonne-miles, per Bimco. China’s grain production [up via genetically modified crops] and coal import declines [down 8.3% in Q1] limit upside. Clarksons forecasts 6% Handysize fleet growth in 2026, outpacing 1.5% demand. C3is’ debt-free Handysizes [$16,202 per day average] signal resilience—Handysize seeks momentum in a flat market.

🌐 What’s Moving It: Trade Shifts and Geopolitical Winds

Commodity Currents

China’s iron ore imports [1.12 billion tonnes, up 6%] and bauxite flows [110.2 million tonnes, up 11.2%] drive Capesize demand. Brazilian soybean exports [19.6 million tonnes in Q1, up 9%] boost Panamax and Handysize tonne-miles. Indian Ocean trades [South Africa-to-China] support Supramax, but China’s coal import decline [down 8.3% in Q1] and domestic grain production [up via GM crops] reduce volumes. Monsoon season in West Coast India threatens Supramax cargoes—commodity shifts steer bulker dynamics.

Policy and Trade Pressures

U.S.-China tariff relief [24% cut, effective May 14] supports Brazilian routes. Potential peace talks [Russia-Ukraine, Iran] could spur reconstruction demand, boosting tonne-miles, per Star Bulk. U.S. tariff exclusions for vessels below 80,000 dwt benefit Pangaea’s Handysizes. Red Sea normalization risks tonne-mile losses, per Bimco. Clarksons’ 2026 forecast [2.5% fleet growth, 1.5% demand] and China’s domestic production [iron ore up 7%] pressure rates—policies shape the bulker path.

🌐 Market and Stocks: Balancing Volatility and Value

Stock Signals

Dry bulk stocks navigate mixed currents. Star Bulk $SBLK (+1,18%) reports a $462,000 net profit [Q1, down from $74.9 million], with a $0.05 per share dividend and $74.4 million in share buybacks. Pangaea $PANL (+5,67%) posts a $2 million adjusted net loss [Q1], cutting its dividend to $0.05 per share and launching a $15 million buyback. EGD Shipping Invest boosts its KCC $KCC (+1,85%) stake to 6.04% [$900,000]—stocks reflect resilience amid weak rates.

Investor Compass

Capesize benefits from China’s imports and Atlantic tightness, but oversupply risks linger. Panamax struggles with coal declines, though Brazilian grains offer hope. Supramax leans on Indian Ocean demand, while Handysize stabilizes with tariff exclusions. Star Bulk’s Supramax sales [31 vessels, $500 million] and Pangaea’s buybacks signal undervaluation. Potential peace talks and tariff relief could lift tonne-miles. Investors balance geopolitical upside with 2026 fleet growth [2.5%-6%]—strategies target long-term value.

Sector Horizon

Tariff relief and peace talks fuel optimism, but China’s import declines [coal down 8.3%] and monsoon slowdowns pose risks. Clarksons’ 2026 forecast [earnings softening] highlights oversupply, particularly for Supramax/Handysize. Capesize and Panamax benefit from long-haul trades, while stocks like Star Bulk [undervalued] and C3is [debt-free] offer opportunities if demand holds—investors navigate short-term volatility with supply constraints.

🌐 Outlook: Charting the Next Voyage

Market Projections

Capesize ranges $16,500-$19,000 per day—tight tonnage drives gains—bullish. Panamax at $9,500-$14,000—Atlantic weakness persists—challenged. Ultramax/Supramax at $11,600-$20,000—Indian Ocean strength fades—mixed. Handysize at $7,000-$15,500—South Atlantic stabilizes—steady. Monsoon season and fleet growth signal volatility—2026 could soften for smaller vessels.

Strategic Course

Capesize leverages China’s iron ore and bauxite imports, but Panamax needs grain demand to rebound. Supramax relies on Indian Ocean trades, while Handysize banks on South Atlantic stability. Tariff relief, peace talks, and 2026 fleet growth [2.5%-6%] challenge margins, but China’s import surge and supply constraints offer upside. Investors must navigate trade shifts while betting on fundamentals—strategic moves will define bulker fortunes.

Your Call

Will Capesize’s bullish run lead the charge, or can Handysize’s stability steal the spotlight? Share your take—let’s conquer the markets! 🚢

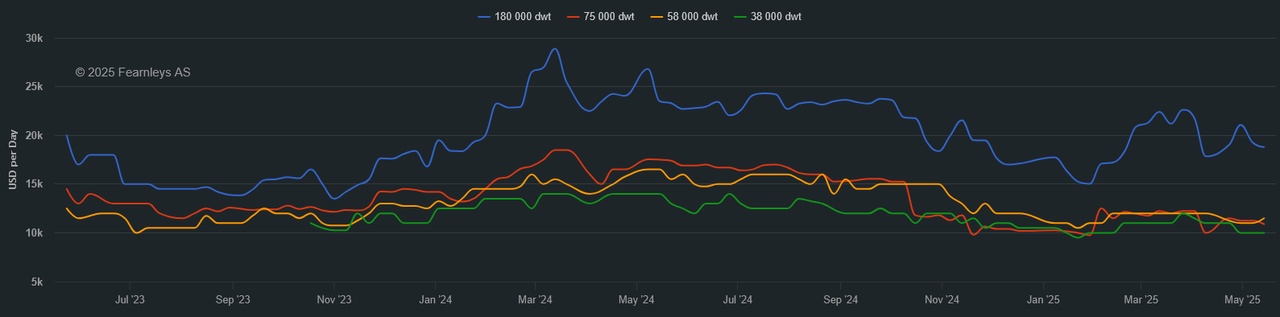

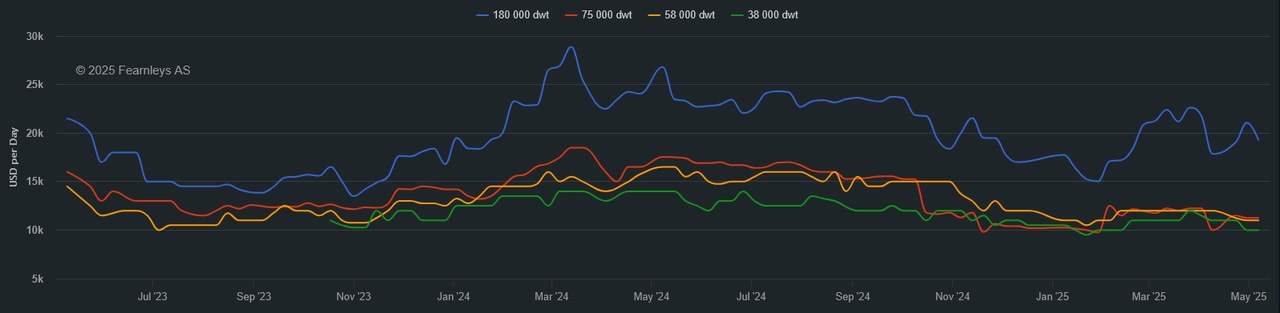

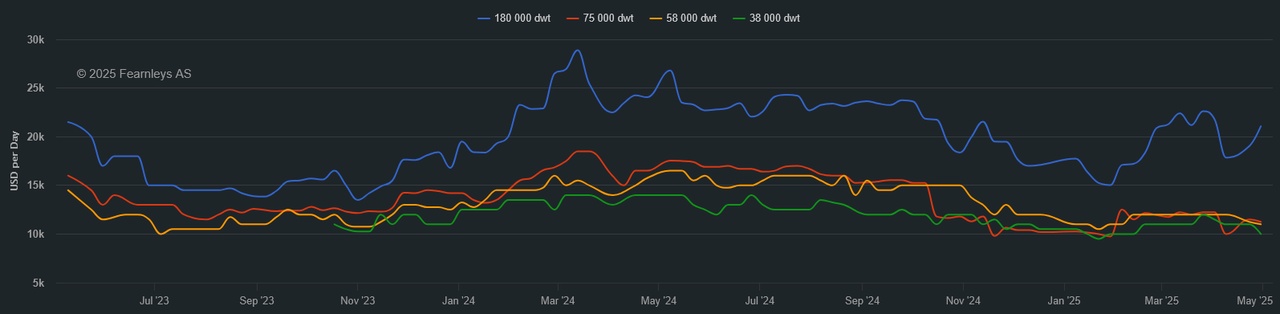

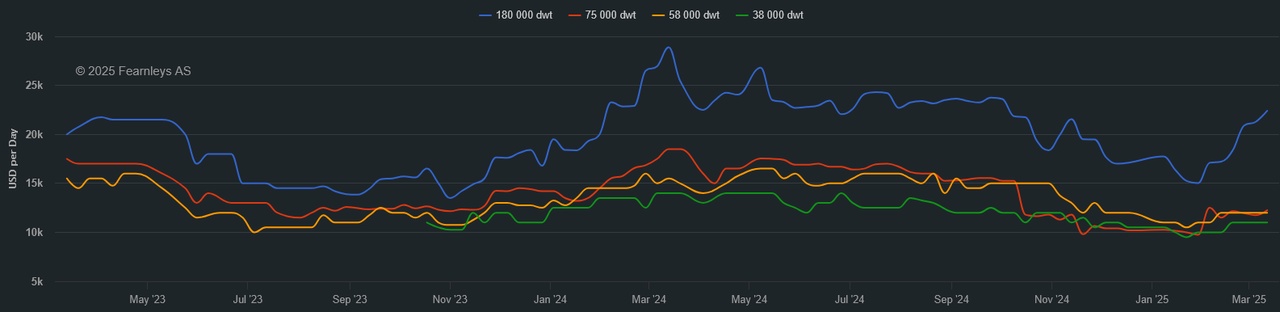

1 Year T/C Dry Bulk - May 14th