Hello everyone!

Since I explained the company Rocket Lab USA in detail in my first big post a week ago $RKLB (+2,93%) in my first big post and the post has been so well received with currently 8,000 views and more than 50 likes, I would now like to write another short version.

1.

Today's space industry could be compared to the early days of the internet. It is at a pivotal point in its development, with major advances being made every week around the world.

The global space economy is expected to grow to $1.8 trillion by 2035, up from $630 billion in 2023.

These developments will help tackle some of the world's biggest challenges, such as:

- Climate change

- disaster relief

- global communication gaps

- agricultural efficiency

Companies like $RKLB (+2,93%) are at the forefront, providing essential launch services and developing new technologies to drive both space exploration and commercialization.

2.

So where does this enormous value come from?

The projected value of the space economy comes from three main segments:

- Launches: reliable and cost-effective launch services are the backbone of any space operation. Companies like $RKLB (+2,93%) make it possible to launch satellites, cargo and ultimately people into orbit. Their efficiency and cost reduction will be crucial for the growth of the industry and the democratization of access to space.

- Spacecraft/satellites: Once in space, these assets provide essential functions - from communications and navigation to imaging, scientific research and much more. The demand for new satellites is growing as companies from different industries invest in satellite networks to support their services. $RKLB (+2,93%) The technology behind satellites also plays a key role in this area, but I'll come back to that later.

- Data and services: The largest and fastest growing segment. The information collected in space has applications in agriculture, climate science, disaster relief, logistics, finance and many other areas. Data and insights from space will drive innovation in AI and turn raw data into actionable insights that power countless industries.

Ultimately, while launch services and satellites are critical, it is the market for data and services that offers the greatest potential. This segment is expected to account for a significant portion of the projected $1.8 trillion space economy.

3.

Most immediately think, "Why invest in $RKLB, a 'launch company' when the real value is in space data and services?"

And with that, it's time to address the most common misconceptions about the company - $RKLB is not just a 'launch company', but a company for the entire space sector 👇🏻

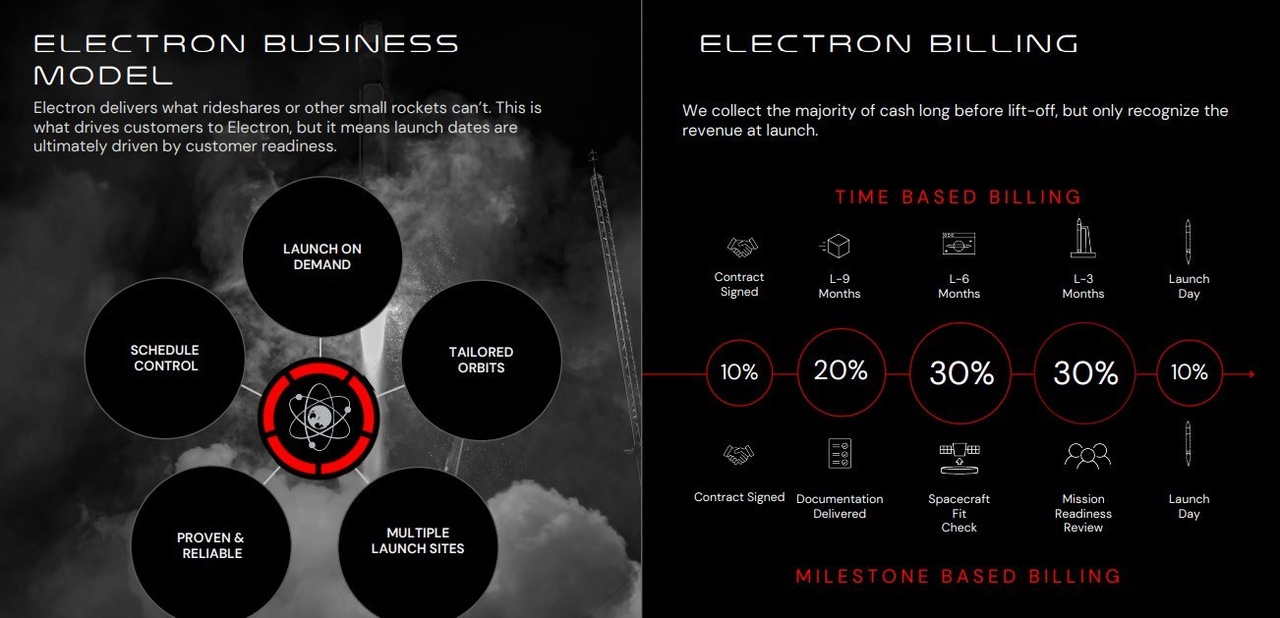

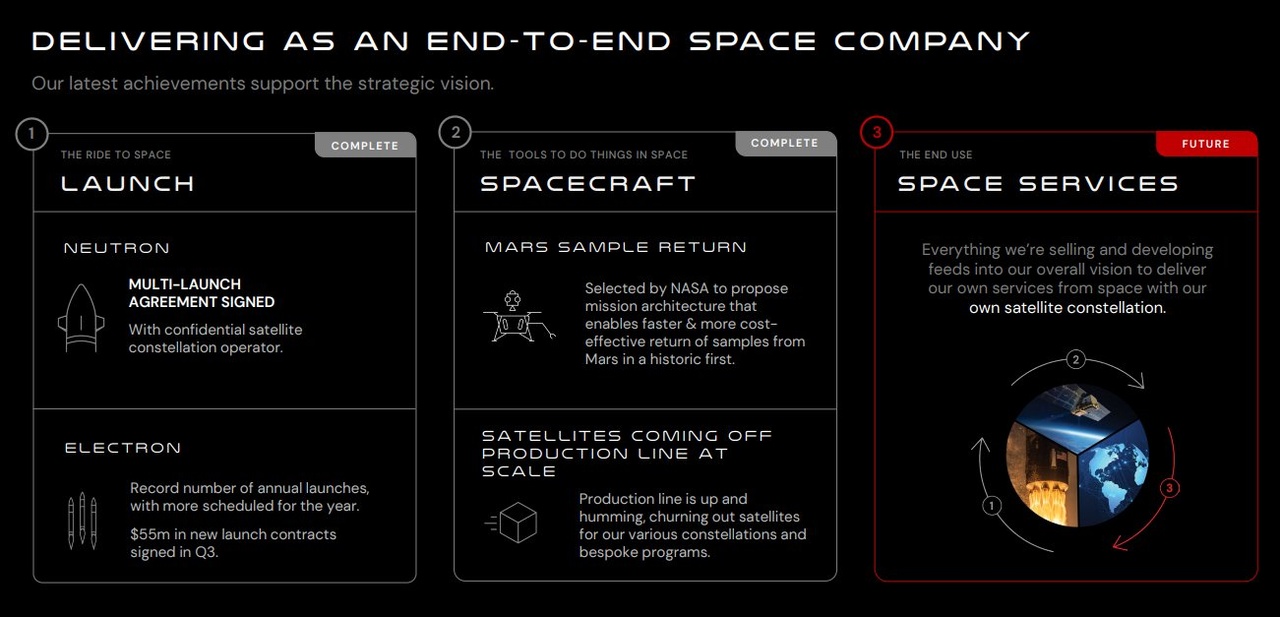

Of course, they are industry leaders in rocket launches - Electron for small launches and the upcoming Neutron to enter the medium launch capacity market - but that's only part of what they do.

Founder and CEO of $RKLB, Peter Beck, explains how the company is tackling the three key areas of space that I'll detail in a moment:

- The ride: the first step is getting to space, and $RKLB has mastered this with their Electron rocket and will soon succeed with Neutron, which will capture the medium launch market.

- The tools: Once in space, the real work begins. $RKLB doesn't just send things up - they also provide the spacecraft, components, software and ground systems necessary to make missions in orbit successful. They are already delivering this for commercial and government customers.

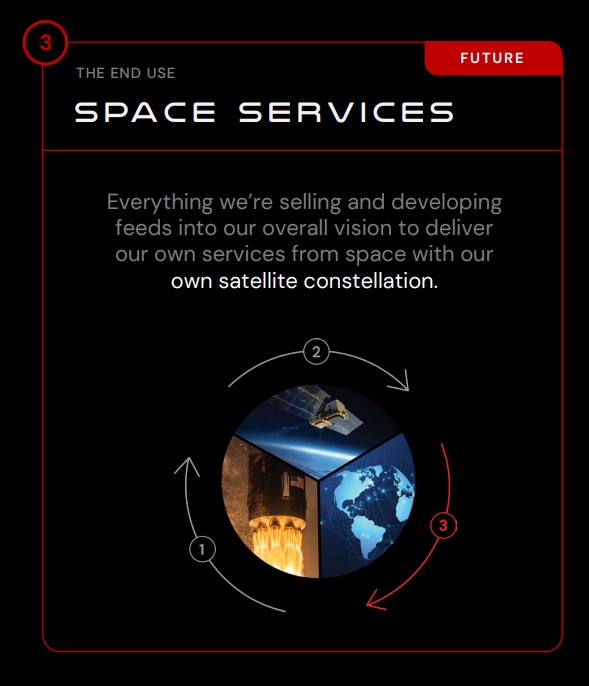

- The data and services: This is where the long-term value lies. By owning both the launch and spacecraft side, $RKLB can develop and deliver space capabilities like constellations without the delays and costs that other companies have (just like SpaceX did with Starlink). This positions them for long-term, recurring revenue at a high margin.

In short, $RKLB's vision goes far beyond rocket launches - they are building the infrastructure for a complete space ecosystem. This broader vision is critical to understanding their current and future successes.

4.

Let me dive into each part, starting with the launches.

Here we have both small and medium sized startups.

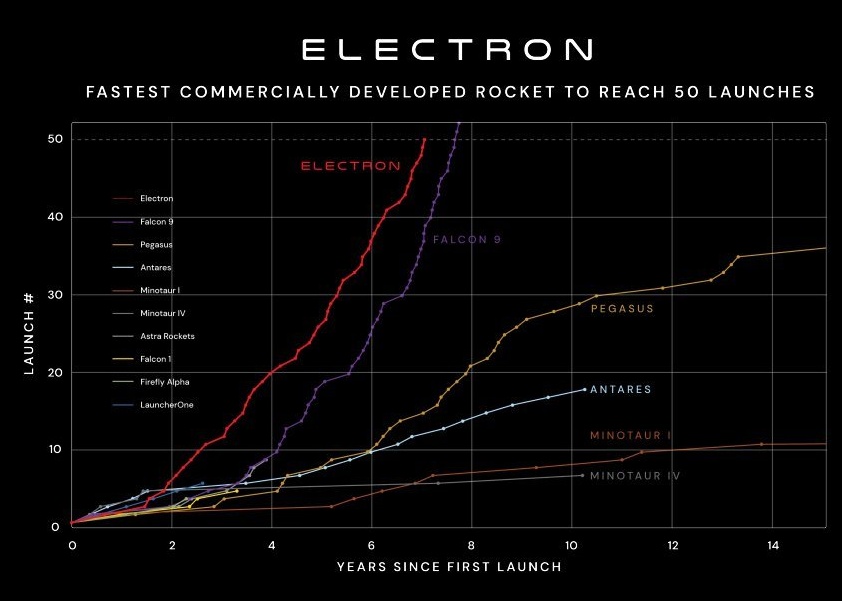

As the clear leader in small launches, $RKLB's Electron offers unique capabilities and has completed over 50 successful missions. With a price tag of about $8 million (up from about $5 million in 2017), Electron has played a critical role in access to space by enabling more companies to affordably launch their payloads. It is the fastest commercially developed rocket to reach 50 launches - and it is on track to be the fastest to reach 100.

The upcoming Neutron medium-lift rocket aims to break SpaceX's monopoly in the category and represents a significant growth catalyst for $RKLB (it is expected to be operational by mid-2025).

$RKLB's track record with Electron underscores its expertise in building reliable, market-leading rockets. By working closely with customers, $RKLB has tailored Neutron specifically to the needs of the industry. With Electron's success as a foundation, Neutron is expected to be equally successful and offers the company a compelling advantage.

With a launch price of approximately $60 million, Neutron will be a key driver of $RKLB's revenue growth and will transform the company's position in the launch market.

But Neutron's importance goes far beyond its potential commercial and government customers. I will discuss this later.

5.

The spacecraft side is also mostly complete, with only a few details missing. Many people don't realize that the Space Systems segment accounts for more than two-thirds of the company's revenue and grew more than 80% year over year last quarter.

The success of $RKLB with the Electron rocket paved the way for significant expansion and diversification. From 2020, the company expanded its focus beyond launch services to build a comprehensive range of space-related products to strengthen its position in the industry.

An important milestone in this realignment was the launch of $RKLB's spacecraft division. In 2020, $RKLB launched the Photon satellite platform, marking its entry into the spacecraft sector. Photon offers a complete satellite solution covering design, manufacturing and operations. This expansion transformed $RKLB from a launch provider into a full-service space company.

The company's expansion into space systems was not just limited to internal developments, but was actually strongly driven by a series of strategic acquisitions.

In 2020, they acquired Sinclair Interplanetary, adding expertise in satellite components such as reaction wheels and starfinders. This was followed by the acquisitions of Advanced Solutions and Planetary Systems in 2021, which improved mission simulations, flight software and spacecraft separation. In early 2022, the purchase of SolAero Holdings brought advanced solar cell manufacturing for space applications, and the acquisition of SailGP Technologies added key facilities in New Zealand.

By combining internal innovations such as the Photon platform with strategic acquisitions, $RKLB has positioned itself as a major player in both the launch and space systems markets, significantly expanding its service offerings and increasing its competitiveness.

It is important to note that $RKLB would already be cash flow positive with just Electron and the Space Systems segment (excluding the development costs of Neutron).

6.

Let's talk about space data and services:

$RKLB is very close to completing its full space ecosystem that will allow it to tap into this market, similar to what SpaceX did with Starlink.

The final piece of the puzzle is Neutron, which will complete the company's ability to build any spacecraft it needs, launch it on demand and deploy constellations at scale and at low cost.

There are numerous applications and business models enabled by the deployment and operation of spacecraft or satellite constellations. Once $RKLB completes its full space ecosystem, it will be able to pursue several opportunities.

Initially, I didn't fully understand the breadth of these applications, but they include services such as satellites providing imaging and data collection for agriculture, environmental monitoring, disaster management and defense; satellite communications with advances in real-time connectivity for IoT devices, autonomous vehicles and global networks; and the development of on-orbit manufacturing for specialized materials that can only be produced in a zero-gravity environment (such as high-precision optics, pharmaceuticals or even semiconductors). There is also the potential to outsource data storage or computing power to satellites in space, which offers multiple benefits, as well as space debris management services - a growing problem as the sector evolves - among many other potential applications.

One notable example: $RKLB has already built a spacecraft for pharmaceutical manufacturing in space with Varda Space Industries.

7.

The CFO of $RKLB on the market for orbital services and the company's approach 👇🏻

"The application market is highly fragmented, with many different verticals and successful business models in each of them. For example, earth observation has different layers.

The largest target is communications, the largest market. Even within communications, there are numerous opportunities for new services for consumers, businesses and governments.

We are not going to focus on just one area. We will enter multiple parts of the market and make multiple strategic bets. We plan to avoid the problems constellation operators face today by designing and manufacturing our own spacecraft, launching them with our rockets and operating them in orbit. This integrated approach allows us to focus on maximizing data management for our customers.

Ultimately, we will choose applications with significant scaling potential. We are not interested in small business applications, but are targeting opportunities that can generate hundreds of millions of dollars in revenue, or hopefully much more."

(Adam Spice, Chief Financial Officer of $RKLB (+2,93%) )

8.

Now that you understand the full picture of $RKLB and its ambitions, let me touch on some of the competitive advantages the company has over its peers.

1) Peter Beck (CEO)

Peter Beck's leadership has been instrumental in transforming $RKLB from a small startup to a major player in the space industry. His vision, creativity and hands-on approach have driven the company's growth and positioned it for future success. Peter Beck is a self-taught engineer and a key player in the industry.

2) Capital efficiency

$RKLB excels at developing rockets at a lower cost than the competition. Their development process allows for early identification and resolution of problems, avoiding costly rework later. The experience gained from the successful Electron program allows them to build fully operational engines like Archimedes (used for Neutron) without relying heavily on pre-testing. This strategy allows $RKLB to launch rockets faster and cheaper than any competitor.

3) Vertical integration

$RKLB's vertical integration is a significant advantage, as exemplified by the Electron rocket, which consists of 66,000 parts, most of which are 3D printed. This optimized manufacturing process increases efficiency and reduces costs. In addition, vertical integration ensures strict quality control of components, which is crucial for safety and performance in the aerospace industry. Overall, this gives $RKLB a significant edge over the competition.

4) End-to-end solutions

As Peter Beck mentioned, the space industry has traditionally been divided into segments. $RKLB aims to become the most complete end-to-end space company, with the potential to challenge SpaceX in the next decade.

For even more in-depth analysis, feel free to re-read my previous post, which was much longer and more in-depth.

I currently hold about 90% of my total portfolio in $RKLB (+2,93%) and can therefore sleep very peacefully. Even if the share price currently seems too expensive for many, I believe that you can still buy the share very cheaply today.

Today (January 7, 2025) we have reached the 30 dollar mark for the first time and thus a new all-time high.

I think we will be at least at 50$ per share by the end of 2025, depending on how the test of the Neutron rocket goes. Some are also predicting 100$ per share, but I don't want to speculate that far yet. I would rather remain conservative.

Of course, this is not investment advice.