From 18-year-old wannabe investment banker to successful private asset manager: my (bumpy) path to €300,000 in my custody account

Part 2 of X:

After a long road through the valley of tears: how buying MasterCard shares ended up

changed everything - This is probably the best way to describe the next stage of my investing life. After discussing my first steps on the stock market in the first part and realizing that I'm not the next Warren Buffett and that I've made just about every rookie mistake, after three years everything should finally be getting better, right? Unfortunately, that wasn't the case in 2017 and 2018. In fact, everything only got worse.

(Part 1: https://app.getquin.com/de/activity/PElWrODsmV) - Thank you for all the positive feedback!

Baseline & Spoilers:

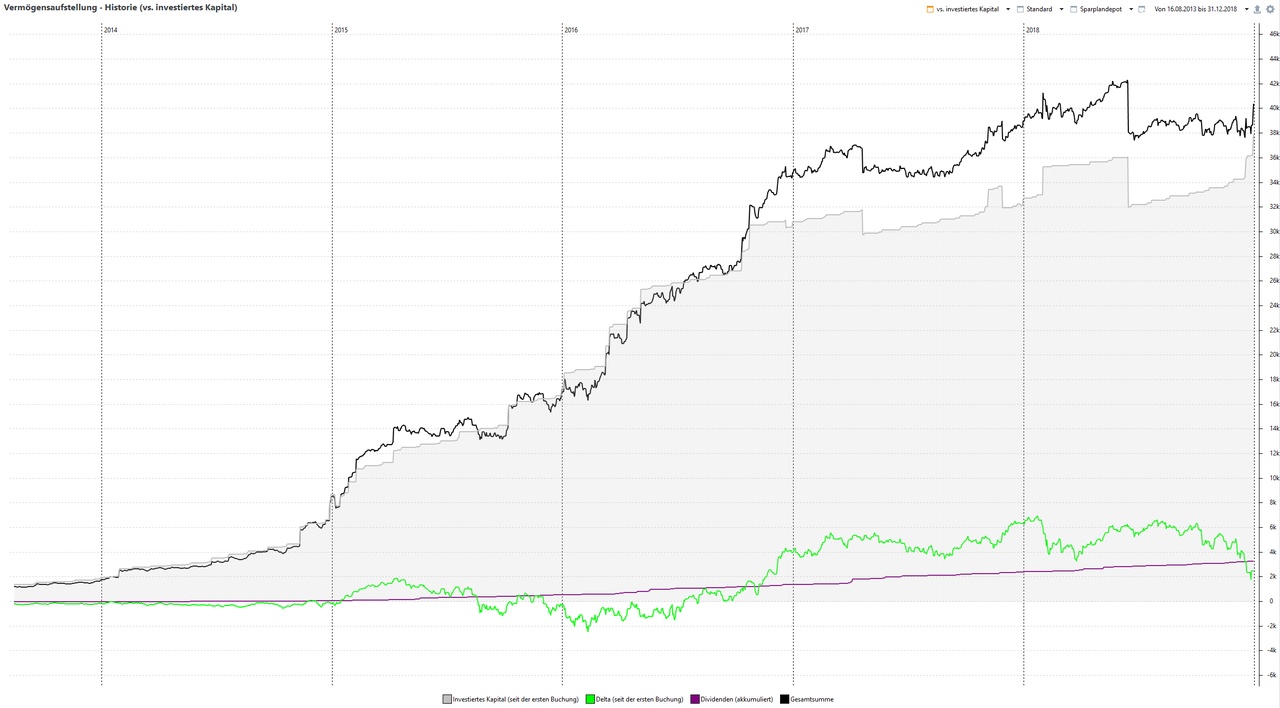

From 2013 to 2016, I did a dual study program and earned a small salary every month. As I was still living at home, I was able to save and invest around €30,000 during these three years. I also added around € 5,000 in capital gains and dividends. My portfolio balance at the end of 2016 was therefore around €35,000. Despite my poor stock selection, this was a sum I could be happy with as a 23-year-old.

Now let's jump forward 24 months: at the end of 2018, I had a portfolio balance of around €40,000, just a measly €6,000 more than two years earlier. In these two years, there were additional price losses of €3,500. In other words, I had managed to lose €600 on the stock market in 5.5 years, while the S&P 500 gained over 50% in the same period - a remarkable (negative) achievement! Only dividends of over € 3,000 in these 5.5 years led to a positive return on the bottom line.

But now let's take a look at what went so massively wrong in 2017 and 2018.

Personal income situation:

After I completed my Bachelor's degree at the end of 2016, I knew that I didn't want to stay with my training company. There was a strong focus on sales, which I personally never wanted to do. I therefore left the company and decided to make a new career start in my early or almost mid-20s.

Before my studies, I really wanted to go into investment banking in New York, but after my studies I suddenly didn't know what I actually wanted to do: "self-employed would be cool", "do I do another Master's", "do I study something completely different again?" - these were my thoughts at the end of 2016 and beginning of 2017. As I was registered as unemployed during this time, I had to keep going to job interviews, which were more or less forced on me by the job center. These were mandatory, as otherwise the money could have been cut (times before the citizen's allowance 😉). My highlight was a job interview at Vorwerk, and I'm not kidding: for an open position as a vacuum cleaner salesmanwho is allowed to move from door to door.

In mid-2017, I was then offered a job in a completely different area that had absolutely nothing to do with my bachelor's degree in business administration and started all over again. I received around €600-700 in unemployment benefit for 9 months and then only a trainee salary of €800-900. Fortunately, I was able to continue living with my parents and invest around €200-300 in ETF savings plans every month. However, I was only able to save around €2,000 in total in 2017.

A few weeks went by and I quickly realized that I was once again not happy with my new professional situation. So I knew I had to leave again. This time, however, I didn't want to just quit and turn up at the job center again. So I forced myself to keep going until I had something in hand. The subject of a Master's degree came up again. But it was also by chance that I got in touch with my former employer.

Long story short: At the beginning of 2018, after 1.5 years, I signed a new contract with my former employer (DAX company), albeit not in a sales role, but in head office/administration. Even though the salary increased significantly, this involved moving to another city. In addition to the rental costs, I also had to furnish an apartment. As a result, there was not much room for investment in the stock market in 2018 either. In total, "only" €5,000 was invested in 2018.

Portfolio performance:

As already mentioned, 2017 and 2018 were an absolute flop in the portfolio. No significant investments and a lousy performance.

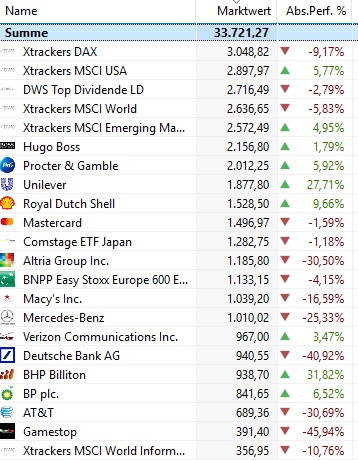

In hindsight, it's no wonder: at the time, my portfolio consisted of price rockets such as Hugo Boss $BOSS (-1,55%)

Deutsche Bank $DBK (-0,32%)

Macy's $M (-2,02%)

AT&T $T (+0%)

Verizon $VZ (+0,03%)

or Daimler $MBG (-1,69%) .

I was still convinced that tech and co. were far too expensive - I only bought what had a low P/E ratio and a (high) dividend yield. From a dividend perspective, that was great: in 2017, I received over €1,000 in dividends for the first time. I won't reach this mark again until 2020.

However, it also became clear to me that dividends are of little use if there are share price losses on the other side. On average over the two years, my return was a meagre ~2.5%. That was still more than was available on the call money account at the time - today such a return would hurt even more. But you don't have to sugarcoat it either: The performance was forgettable.

Bright spots:

But it wasn't all bad either: I took my first steps into crypto in the fall of 2017. Back then, there was a lot of Bitcoin hype for the first time. I had no idea about it yet, so I bought a participation certificate via the stock exchange as normal. I made a profit of almost €500 in just under three weeks. After that, the hype quickly died down again and I didn't get involved with Bitcoin and co. until the next hype in mid or late 2020.

If I had continued at the end of 2017 and bought Bitcoin regularly, my wealth would probably be a lot bigger today.

All in all, I can look back on the year

2017 but I can also defend myself a little bit: The performance in 2017 was around +7%, which was roughly in line with the performance of the MSCI World (+8%). Only the S&P 500 was significantly stronger at +20% (Trump and his "America First" policy have already had an impact here).

The year 2018 was not a good year on the stock markets overall, and most indices closed in the red. Nevertheless, my decline was greater than that of the S&P 500 and the MSCI World.

There were a number of negative factors in 2018, such as risks from the trade war between China and the USA, Brexit and global economic concerns. All of this was reflected in share prices, particularly in the final trading days of 2018. Once again, a shutdown was on the cards in the US because no agreement could or would be reached on raising the debt ceiling. Within a few days from mid-December, prices fell by 5-6%. This was the main factor behind the extremely poor performance over the two years.

The turning point:

Even though December 2018 was a bad month for the stock markets, in hindsight it was extremely good for me and my portfolio. In December 2018, I bought MasterCard $MA (+0,73%) and that was the turning point in my investing career.

I realized that my strategy (low P/E ratio, high dividend) would lead to nothing and discovered more and more the topic of "dividend growth" for me. MasterCard was the first stock to enter my portfolio that was in line with my new strategy.

Instead of a low P/E ratio of less than 10, the P/E ratio was suddenly over 30 and the dividend well below 1%, but growing strongly - just like sales and profits. A clear difference to companies like Macy's, Daimler and Hugo Boss in my portfolio.

My financial situation also improved significantly over the course of 2018. My net salary was around €2,500, and even though I had to pay rent and other costs, it became clear that I would be able to invest more again from 2019.

Asset development & return:

As described, the two years were too forgettable - but the learnings and my strategy change in hindsight extremely important for my future investing life.

Year

Deposit value

Return

2017 39.000€ +7%

2018 41.000€ -10%

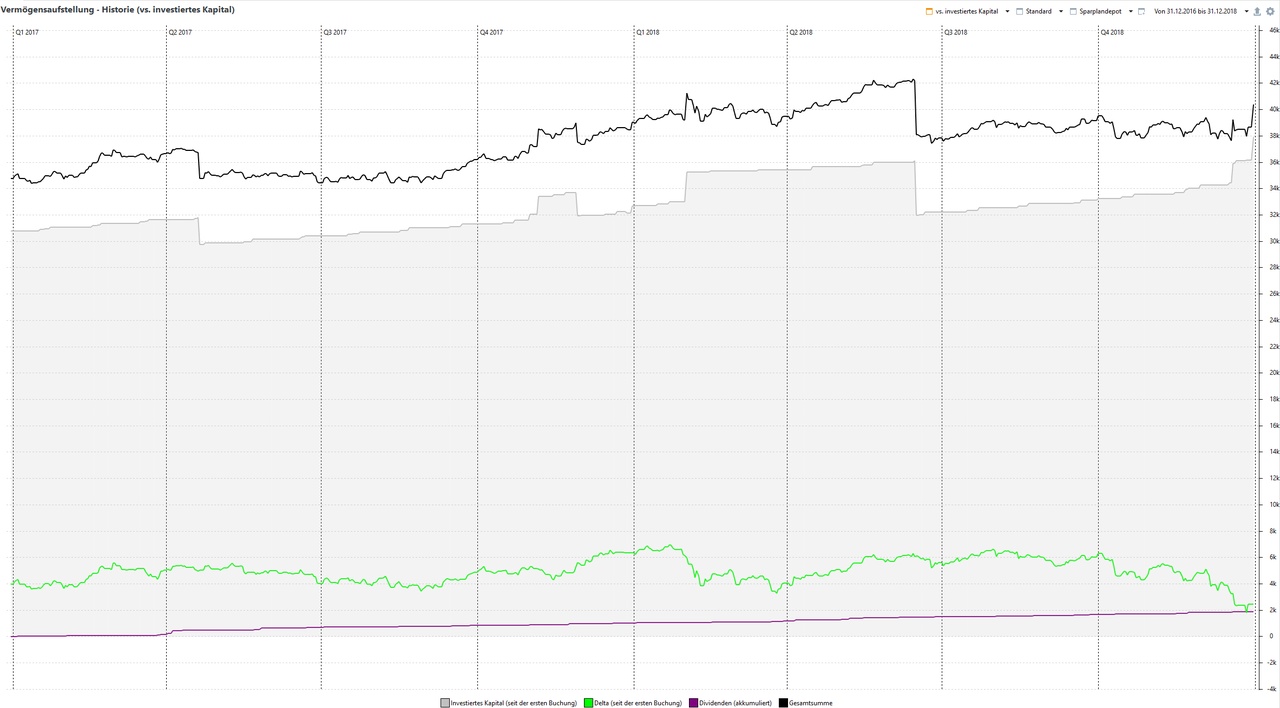

Vermögensentwicklung 2016-2018:

Vermögensentwicklung 2013-2018:

Outlook:

I had arrived professionally and was ready to build up a completely new strategy in my portfolio. Everything was ready for 2019! And everything should finally get better in 2019. But there will be more big mistakes in the next part (Wirecard, corona hype, China), but above all there will finally be successes!

In part 3, I will discuss the years 2019 to 2021. We will then break the €100,000 mark and even come close to reaching €200,000.