$AAPL (-0,42%)

$MSFT (-0,32%)

$NVDA (-3,26%)

$AMZN (-2,35%)

$GOOGL (-3,46%)

$META (-1,55%)

$TSLA (+1,52%)

$AVGO (-14,32%)

$NFLX (+0,45%)

$AMD (-4,68%)

Absolute valuation levels

Above all Microsoft, Nvidia, Google, AMD and Amazon are quoted below their long-term median multiples.

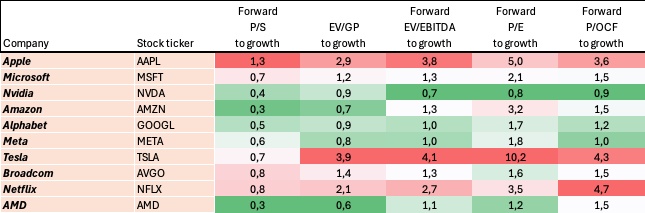

Valuation multiples compared to expected sales growth

If the expected sales growth by analysts over the next 3 years the following picture emerges...

- Per 1% growth, the following appear to be the most important Nvidia, AMD, Google, Meta and Amazon appear the most favorable.

- Apple performs less well here due to its slow growth, but the company is not generally unattractive as an investment, e.g. due to the high buybacks.

- Tesla appears expensive at first glance - however, the forward P/S is currently not excessively high due to the distorted earnings.

- Netflix had a good run and appears somewhat expensive compared to growth, at least on the basis of multiples. The situation is similar for Broadcom.

- Microsoft swims in the midfield.

What do you think of the valuation levels of Mag-7 & Co.