This is the second monthly report of my ongoing competition between my dividend and options portfolios.

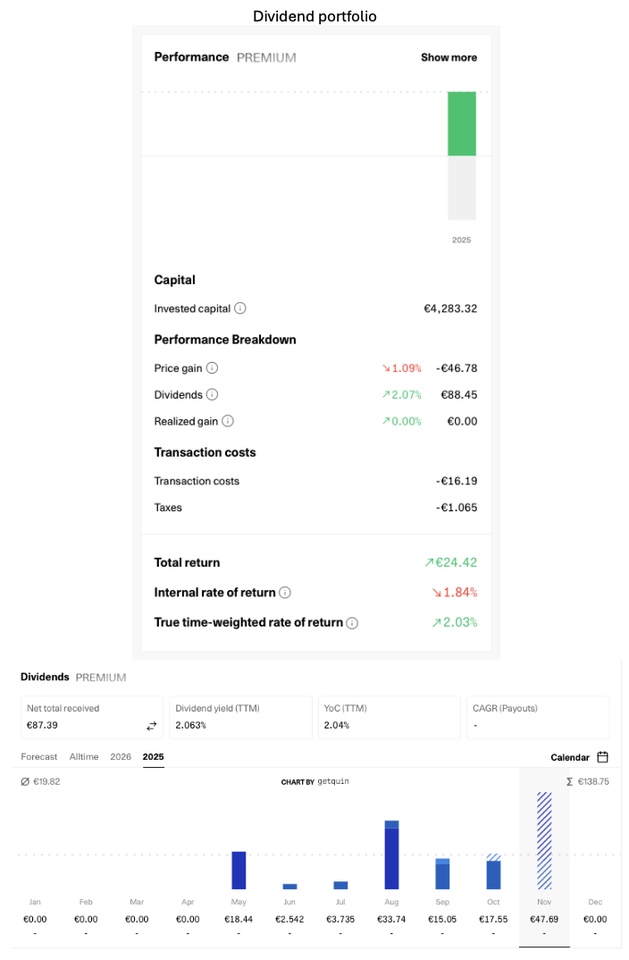

I’ve also realized that the title of this series is somewhat misleading — a true dividend investor would likely not select the same stocks or ETFs I did. Therefore, the performance of my “dividend portfolio” isn’t really comparable to my options strategy.

(If you’re interested in the original post, you can find it here: https://app.getquin.com/en/post/GMERLfWxXM/dividend-vs-covered-calls)

This is the reason that from now on, I’ll focus on reporting what actions I’ve taken regarding the options portfolio only, how often my stocks were called away, and how I’ve occasionally sacrificed paper gains in exchange for real, earned option premiums.

Over the past month, I added 100 shares each of $NU (+1,81%), $INFY (-0,21%), $AGN (+0,35%), and $NXE (+4,07%).

Here are the covered calls I sold:

$NU (+1,81%) ( 200 shares)

- Oct 24 ’25 16 CALL – $33

- Nov 14 ’25 17 CALL – $40

- Nov 21 ’25 17.5 CALL – $33

$INFY (-0,21%) ( 100 shares)

- Oct 17 ’25 17 CALL – $36

- Nov 21 ’25 17 CALL – $30

$AGN (+0,35%) ( 100 shares)

- Nov 21 ’25 7 CALL – €16

$NXE (+4,07%) ( 100 shares)

- Nov 21 ’25 10 CALL – $55

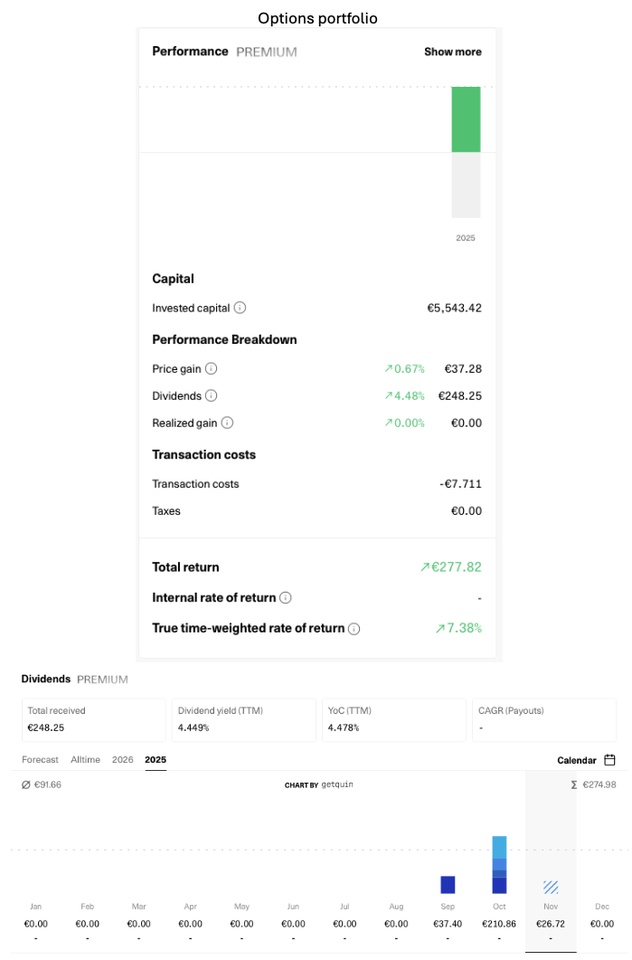

Total option premium income: €210 on a total investment of €5,543.

None of my stocks have been called away yet. Infosys came close — it’s currently in the money, and I’ve already factored in that it might get called away. If that happens, I’ll miss out on the dividend payments, but if the price drops again, I could collect an additional €26 in dividends.

Overall, October was a calm and positive month — no drama, no big surprises.

See you in the next update!