The second article on the refund of withholding tax on Norwegian shares. You can find the first part with instructions and preparations for registering with the Norwegian authorities here: , Quellensteuerrückerstattung Norwegen Teil 1 . Once again, please note that this application is only possible for tax residents in Germany.

As a placeholder $EQNR (-5,86%) , $HAUTO (+0,55%) , $VAR (-1,47%) , $MOWI (-2,47%) , $MPCC (+2,77%) , $TEL (+0,85%) , $AKRBP (-3,37%) , $TOM (-1,67%)

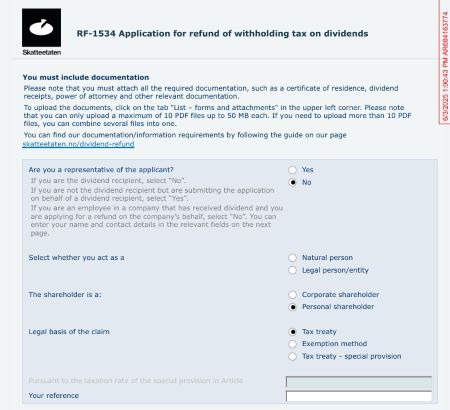

Open the start page Altinn – Start - the language to English and if you have activated the automatic Google translator you can even go to German - log in, go to International, then log in without social security number/D-number, enter user name and password and log in. To find the right form, enter RF_1534 in the search, then the form Request for refund of withholding tax on dividends will open. You have a kind of "menu field" on the left-hand side which you can use to switch to the individual pages of the form.

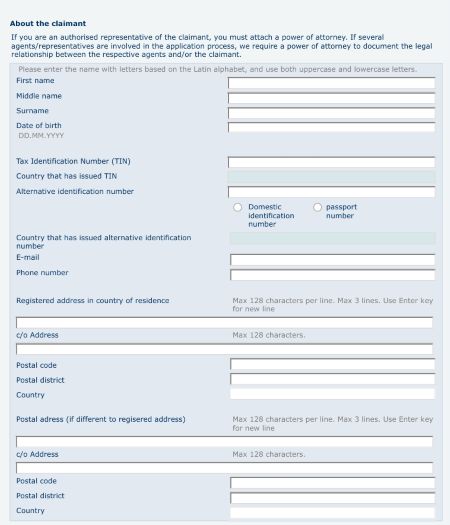

Fill in the two pages for the applicant. Don't forget the tax ID ( Tax Identification Number ), but this is a mandatory field anyway. In the large field Registered address in country of residence, enter only the street and house number.

You will now need the dividend vouchers showing the withholding tax deduction.

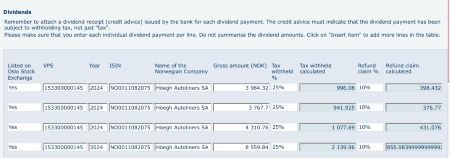

Then open the Dividends form. There you will see three lines for your entries, which can be expanded as required.

In principle, you must enter Yes in the first field for the question of stock exchange listing in Oslo. This is the case if the ISIN of your share begins with NO... . In the second field, enter the VPS number of the depositary of your shares. This is clearstream, the currently valid number is 153300000145. In some forums you can still find the old number beginning with 05. In the third field you enter the year for which you are applying for the refund, up to 5 years retroactively are possible. Then enter the ISIN of your share as you can see it on the dividend voucher and the name of the company according to the voucher. In the sixth field, enter the dividend payment in Norwegian kroner according to the receipt. The number formatting requires the decimal point to be entered as a period! Then enter the percentage tax deduction, in this case 25%. You can choose different percentages for the refund claim. Take 10% here! Even if it is tempting to enter the full 25%, it works but will be displayed as an error when the form is checked at the latest. Repeat the whole process until you have entered every single dividend statement. So do not add up the dividends from one year, each payment must be entered individually.

This is actually the main task if you have several shares from Norway in your custody account. Once this is done, continue to the payment details page. Under Account Type, click on Other account and enter Euro as the currency, unless you have a corresponding foreign currency account with your bank. Then enter the IBAN and, to be on the safe side, the BIC and the name of the bank.

If there is anything else you would like to say about the application, you have the opportunity to make a note at the bottom of the page.

That's almost it. At the top left above the form name, go to the menu item List - Forms and attachments. You can now upload all dividend statements here. Once again the important note: You can a maximum of 10 PDFs of 50 MB each attached. One PDF is the certificate of residence. If you still have more than 9 individual receipts, combine them into one PDF by company and attach it.

Done, click on check and if everything is ok the document will be sent and you will receive a confirmation in your account.

Finally, a few comments:

Pay attention to the time limit in the form, so that it doesn't end and you have to type in all the entries again from the beginning.

There are a few brokers in Germany who will do this work for you for a fee. There you would have to apply for advance exemption from withholding tax. According to my research, and also confirmed in writing, DKB definitely does this. However, this is only a partial exemption, i.e. this 10%. The remaining 15% must be reclaimed via the tax return.

You can apply directly to the Norwegian tax authorities free of charge.

If you would like to take the route I have described, then quickly obtain your certificate from the tax office and submit the application at the beginning of the new year. Experience has shown that the decision and the refund are possible within a short time. Later in the year, waiting times of at least 6 to 9 months are common. Fortunately, there is even interest on the amount to be refunded if the authorities take longer to process the application. The transfer of the refund may be subject to a fee at some banks, ask your broker how much this is.

I hope this has made you a little less afraid of the refund and if you have any questions, please use the comments function. Greetings from your grandpa 😉😇