Having been a more or less silent reader here for a few years now, I would like to introduce myself, my investor history and my goals. I would also be pleased to receive portfolio feedback.

About me: 31, married for 6 years, Dinki (double income, no kids), savings rate currently approx. 1200€ (my wife invests a similar amount separately), live in a condominium with a garden that has not yet been paid off, hobbies: traveling and gardening.

If you don't want to read everything, I've divided the introduction into three chapters:

-My stock market history

-Portfolio allocation

-Targets/Plans

My stock market history

I started with the stock market in 2020 when I started my first real job. But I had no idea, no specific goals and was actually totally overwhelmed by the huge choice. As I come from a very humble background and had nothing to do with financial education, let alone wealth, it was hardly surprising. I just knew I had to do something about the nasty "pension gap". After all.

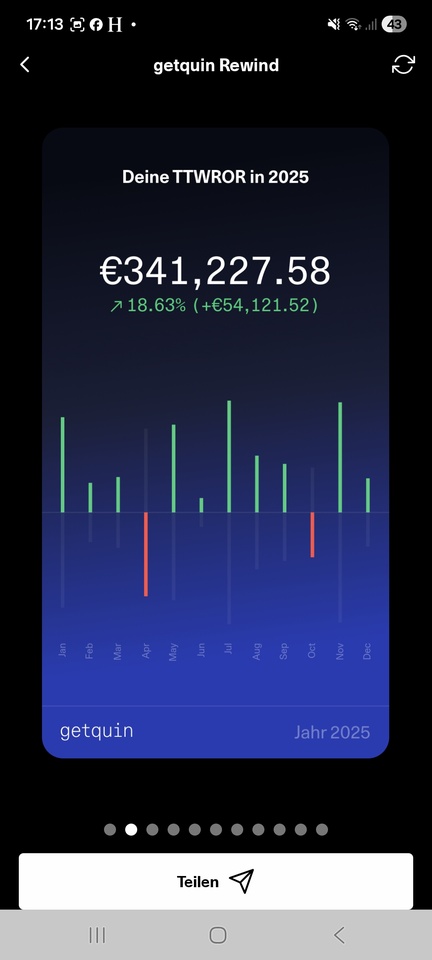

So of course I made all sorts of beginner's mistakes: trading back and forth, watching out for hypes, buying blindly, fomo, only looking at dividend yields, investing in 100 different shares with very small amounts, constantly changing my "strategy", buying the occasional unsuspecting co-note. It's amazing that I made 1-2% p.a. at all.

Then I sold all the stuff in the meantime to have money to finance our property and basically started again.

I realized that the previous approach was nonsense, as I had educated myself further in financial matters, not least because of and motivated by getquin. So I switched to a "concentrated" portfolio with a core ETF and 25 shares and a focus on dividends, a little gold and even less Bitcoin. But at the end of 2024, I also realized that managing this portfolio, if you want to do it properly (reading quarterly reports, constantly reanalyzing companies, etc.), is too time-consuming for these relatively small amounts.

So I decided to leave out the individual shares. At the same time, I read a lot and took the articles on strategy diversification and asset diversification to heart. It simply couldn't have been ACWI Buy and Hold. At that time he published @Epi published many articles on his 3xGTAA strategy, which was well explained and researched with a lot of effort and really tested something that I could also imagine for my portfolio. So the Wikifolio came at just the right time for me.

In this respect, I have divided my portfolio as follows since January 2025 (new start also in my Getquin portfolio):

Portfolio allocation

30% 3xGTAA

25% gold

25% Equities ETFs

20% Bitcoin

The rather large number of ETFs is due to the fact that I like to have ACWI 50/50 Eur-hedged and unhedged in order to be less exposed to currency fluctuations ( $SPP1 (-0,77%) and $SPYY (-0,01%) ). The $IWDA (-0,01%) still comes from 2021, into which my capital-forming benefits flow. $XNAS (-0,45%) is fed by the cashback from the Traderepublic credit card. It's kind of nice to see what happens to that little bit of cashback every month.

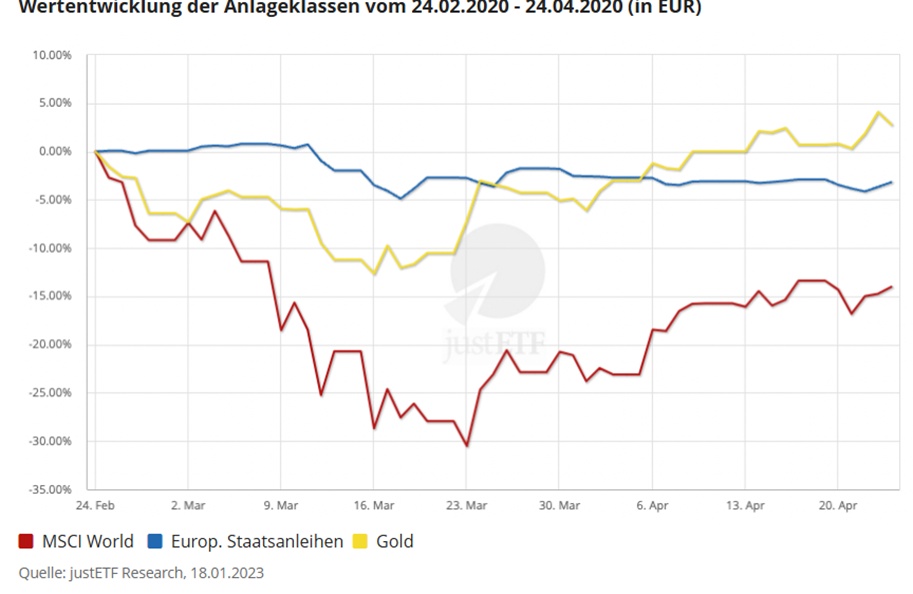

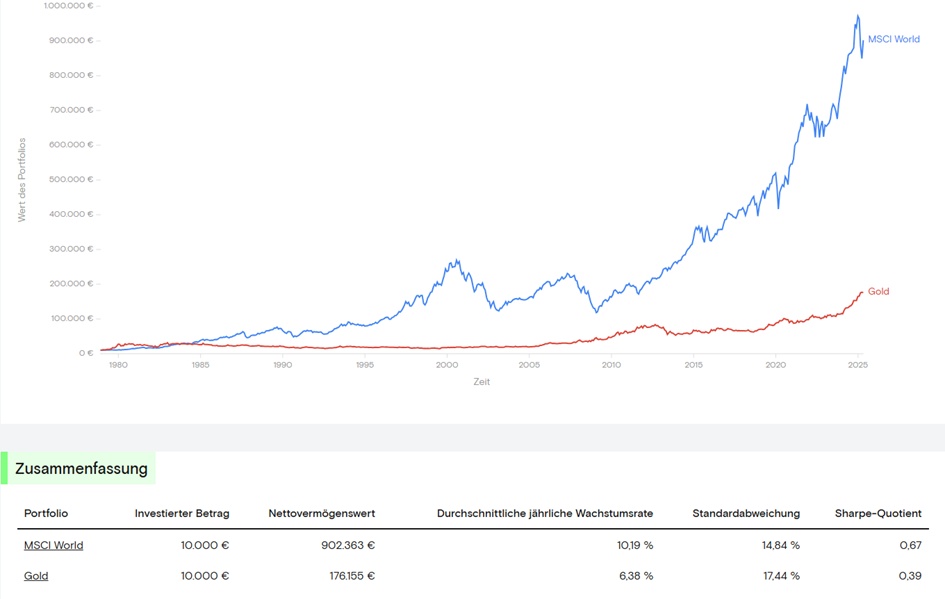

Overall, I think this portfolio is sufficiently diversified and concentrated in terms of strategies and asset classes. In addition, the return should be well above pure ACWI buy and hold and yet not have extreme drawdowns like this one. It is important to me to have various uncorrelated asset classes, but still have a strong overall return.

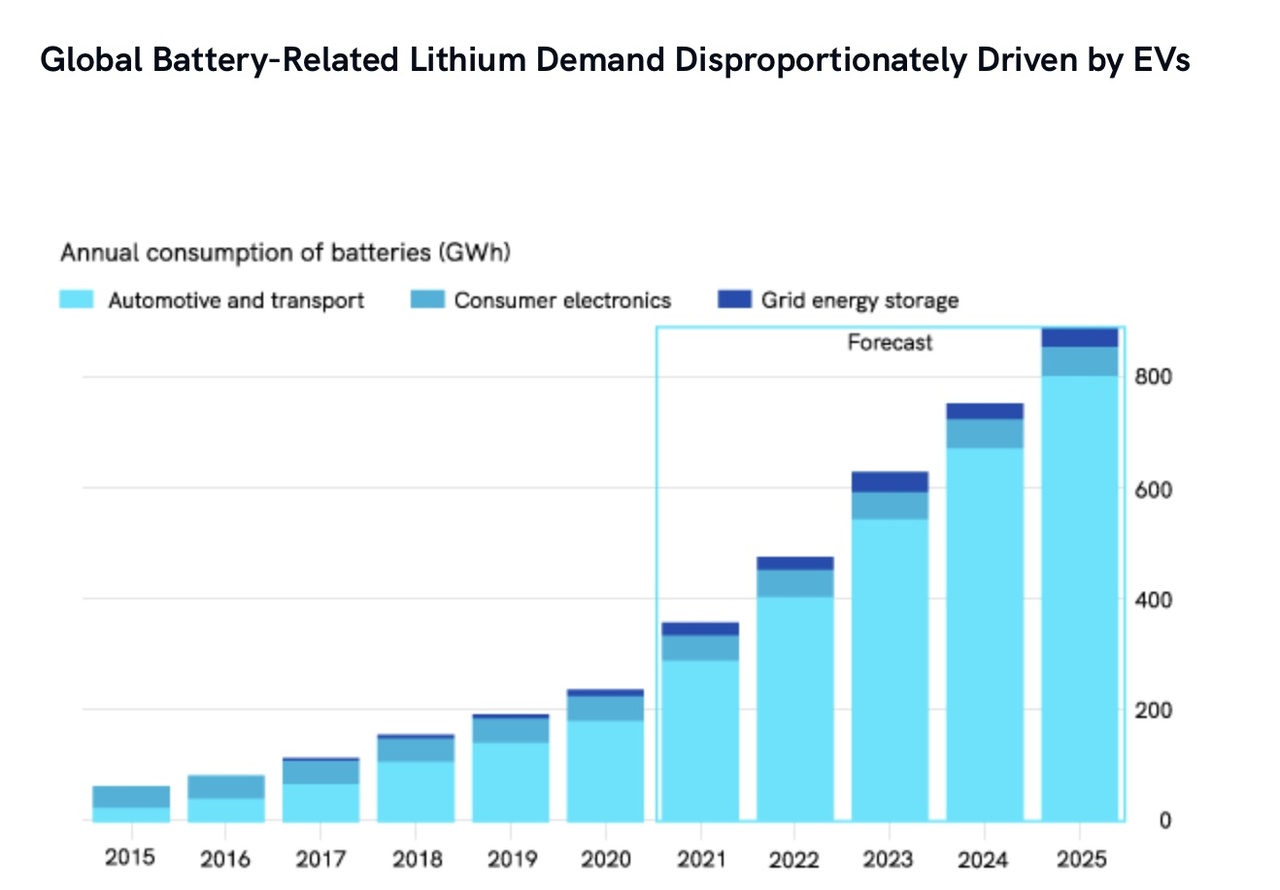

Bitcoin $BTC (-5,98%) does harbor risks for deep drawdowns, but also opportunities. I myself consider Bitcoin to be an extremely good store of value that will see further adaptation.

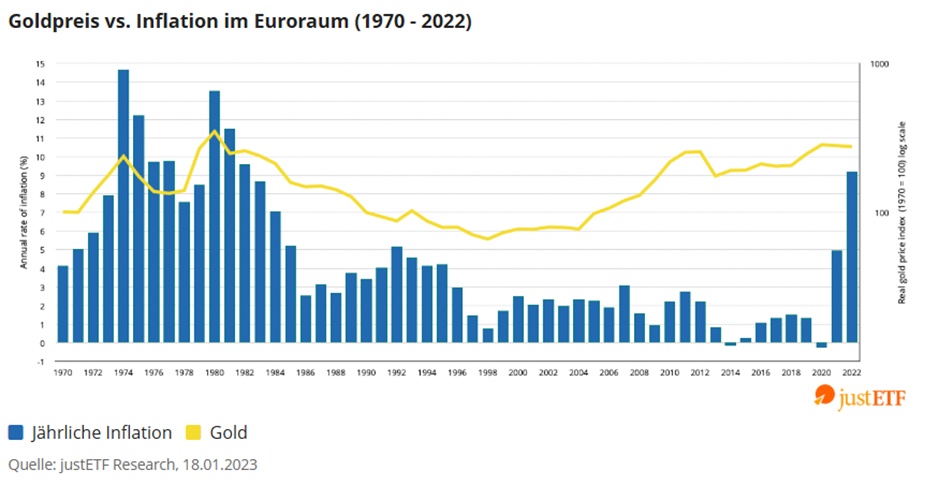

Gold $965515 (-8,12%) has a very high share due to its low correlation with other assets. This level will be maintained for at least another six years, as the final installment for our property of around €30,000 will then be due. If the stock markets/Bitcoin/3xGTAA are at a low at that time, the final payment can be covered by the sale of gold alone.

Goals/plans

Without goals, of course, everything is nothing. We would like to pay off our property in the short to medium term (approx. 6 years to go). The amount of the final installment should come from my portfolio. Depending on how the assets are doing, we will sell accordingly. Due to the rather high savings rate, I don't see any risk of not being able to raise 30,000 in 6 years, which is why I won't save this sum in cash. The risk of losing money seems higher to me if the money is not invested for this time. Special repayments are not an issue, as the interest rate is 0.8%.

Once the rather high monthly installments are gone and 1-2 promotions are added (the first one will be next year), the wealth accumulation will really take off. Low costs and high income will be an incredible lever.

In the medium to long term (10 years+), the portfolio will be used to be away from Germany for at least part of the year, preferably in winter. Depending on how things go in Germany, perhaps even longer or permanently. Ideally without having to rely on earned income. In any case, we have already chosen a country for this and have already traveled extensively. We haven't yet decided whether we want to buy one (or more) properties there, but there are many indications that we will.

Basically, there is no target amount that I am chasing, the aim is to accumulate as much wealth as possible over the next few years with a fixed strategy in order to become as independent as possible.

Thank you for all the great contributions over the last 5 years, many of them have helped me a lot, made me think and research and ultimately turned a clueless beginner into a slightly less clueless beginner. And if you like: please roast my portfolio :)