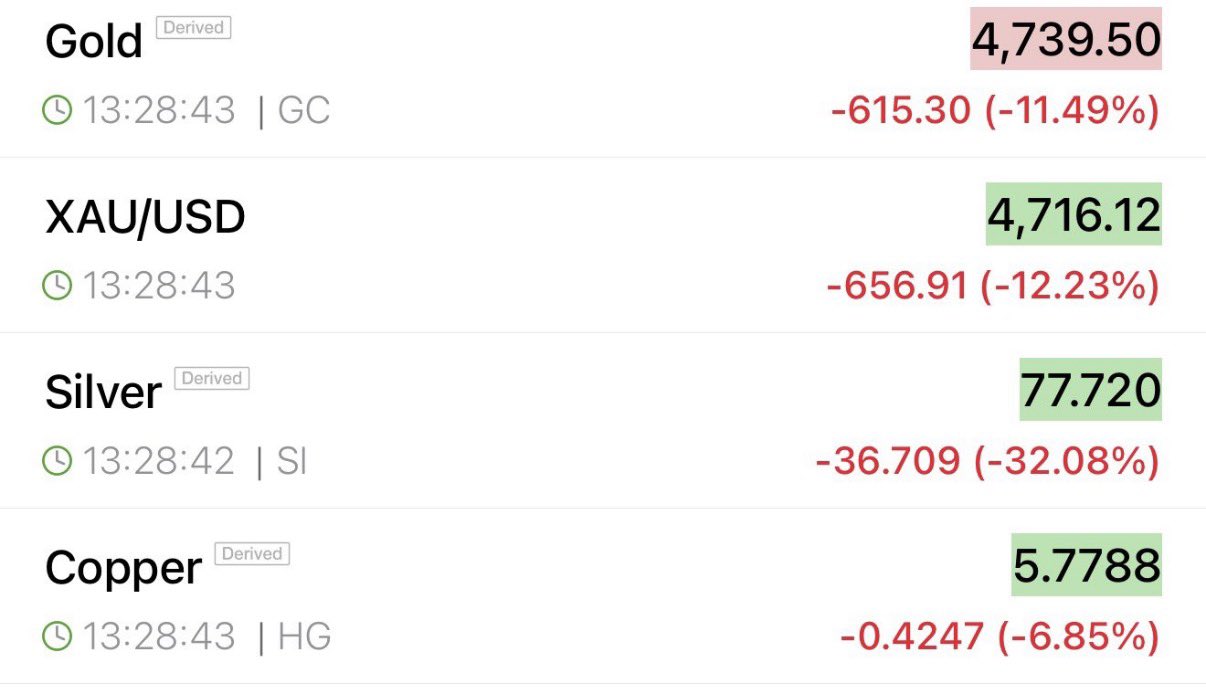

$XAUT (-0,68%) has always been the market’s quiet insurance policy something you hold, not something you watch tick by tick. Lately, that calm has cracked.

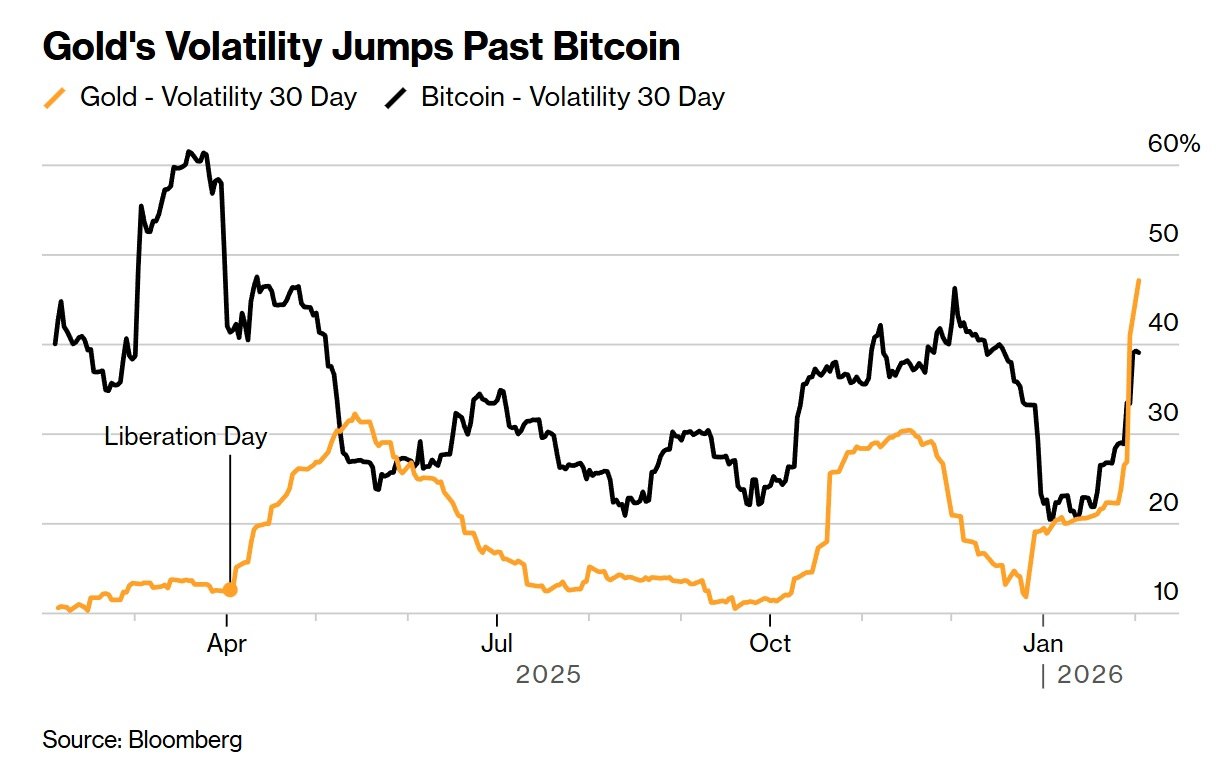

Bloomberg data now shows gold swinging with more intensity than Bitcoin. Not in a speculative frenzy, but under steady macro pressure that’s forcing capital to reconsider where it hides when uncertainty rises. The asset built for preservation is suddenly acting like it’s still trying to find its footing.

$BTC (-1,76%) long treated as the unpredictable one, is holding its ground while the traditional hedge absorbs the stress. It’s an inversion that feels subtle on the surface but meaningful beneath it.

When Stoplimit starts to move faster than perceived risk, are markets redefining what “safe” really means?