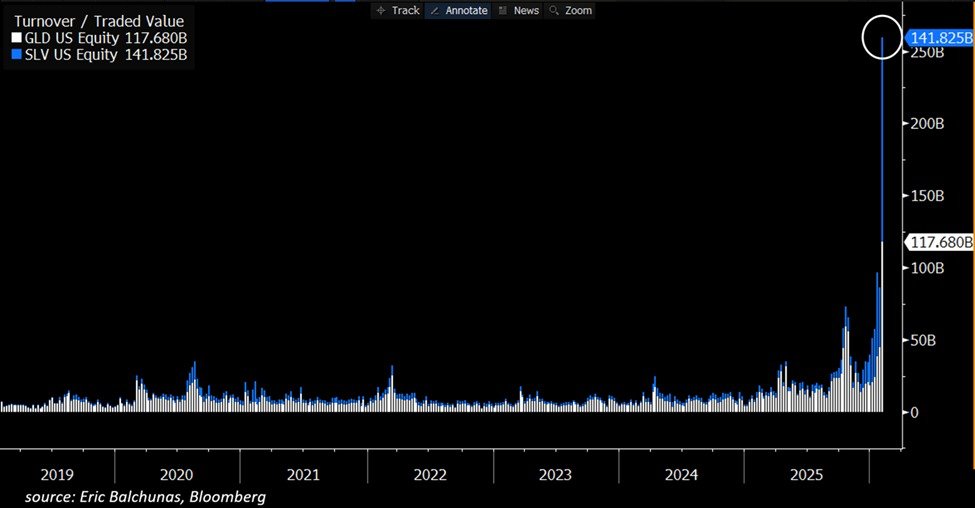

Trading volumes in gold and silver ETFs went parabolic. The largest silver-backed ETF, $SXAG (+0,02%) shattered records with over $40 billion traded in a single day, while $XAUT (-0,68%) matched it with an all-time high daily turnover of roughly $40 billion, eclipsing every other asset, including $TSLA (-0,35%) at around $35 billion.

The build-up was just as telling. One day earlier, $XAUT (-0,68%)

and $SXAG (+0,02%) had already printed $25 billion and $20 billion in daily volume. By week’s end, their combined activity reached a staggering ~$280 billion more than double the October 2025 peak and over four times 2020 levels.

This wasn’t speculative noise. It was liquidity moving with conviction, suggesting capital wasn’t chasing returns it was repositioning toward scale, depth, and durability.

Was this a one-week anomaly or the opening signal of a structural shift in how markets define safety and value?