What can be done better here? The aim is to build up capital.

$O (+2,65%) Should fly out in the next few days

Messaggi

551What can be done better here? The aim is to build up capital.

$O (+2,65%) Should fly out in the next few days

💭 Since the absurd increases of the past year, I have increasingly wondered: is it worth selling part of my portfolio? Stocks look increasingly overvalued, and I wonder if we haven't already reached the limit. How do you approach this? Do you take profits, stay put or switch to other investments? Curious about your thoughts! 💬

Also feel free to react on my positions!

$AMZN (-0,02%)

$AAPL (+0,65%)

$TSLA (+9,97%)

$O (+2,65%)

$ASML (-0,38%)

$ATKR (-6,47%)

$PYPL (+3%)

$DIS (+0,84%)

$AVHNY

$SOF (+0%)

$UMICY

$IWDA (+0,72%)

$EIMI (-1,88%)

$XDEW (+1,03%)

$

So and a little tidying up again... But without additional purchases... I don't really know where it's worthwhile right now. I'll end up putting everything into an ETF :D The state coffers will be happy - but I'm happy to do something for the non-existent government ;)

Out are:

$VICI (+1,98%) and $O (+2,65%) half each

$CVX (+0,94%) - bought a week before the election

$TSLA (+9,97%) - bought a week before the election

$SFM (+4,46%) - Thank you @Simpson for the great share. I had seen it at some point in your SparplanDepot and saw how well it was doing, so I got in at some point.

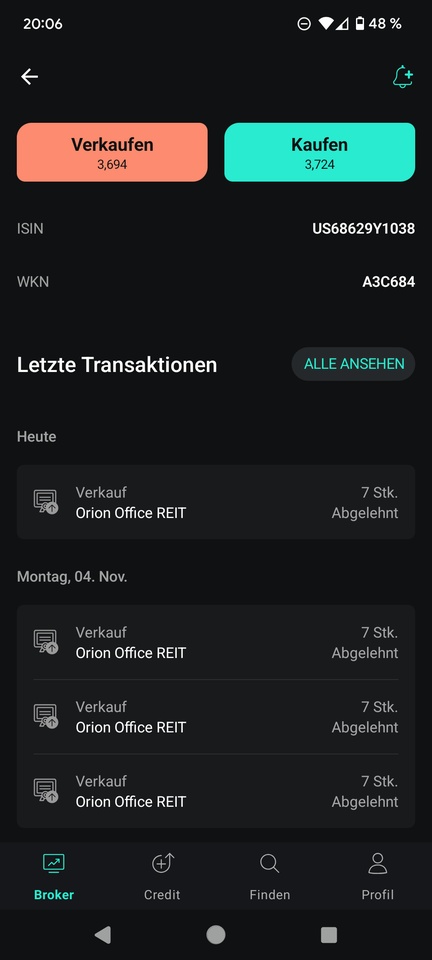

Hello dear people, I am trying to #scalablecapital to sell the Orion Office share ( $ONL (+3,26%) ) to sell. I got it at a Realty Income ( $O (+2,65%) ) spin off.

More information: https://www.realtyincome.com/investors/press-releases/realty-income-completes-spin-orion-office-reit

However, my sales folder keeps getting rejected. 🤔

Have you ever had something like this?

I don't enter a stop or a limit, I just want to get rid of the shares. Scalable Capital hasn't given a reason, but I haven't contacted support yet either.

Perhaps one of you has some experience.

$O (+2,65%) Realty Income remains favorably valued. REITs are also extremely strong today - in combination with the turnaround in interest rates, I think it is quite attractive.

https://investment-traders.com/realty-income-reit-und-dividenden-champion/

$O (+2,65%) Small additional purchase out of turn, will probably not remain so cheap forever due to future interest rate cuts.

Realty Income

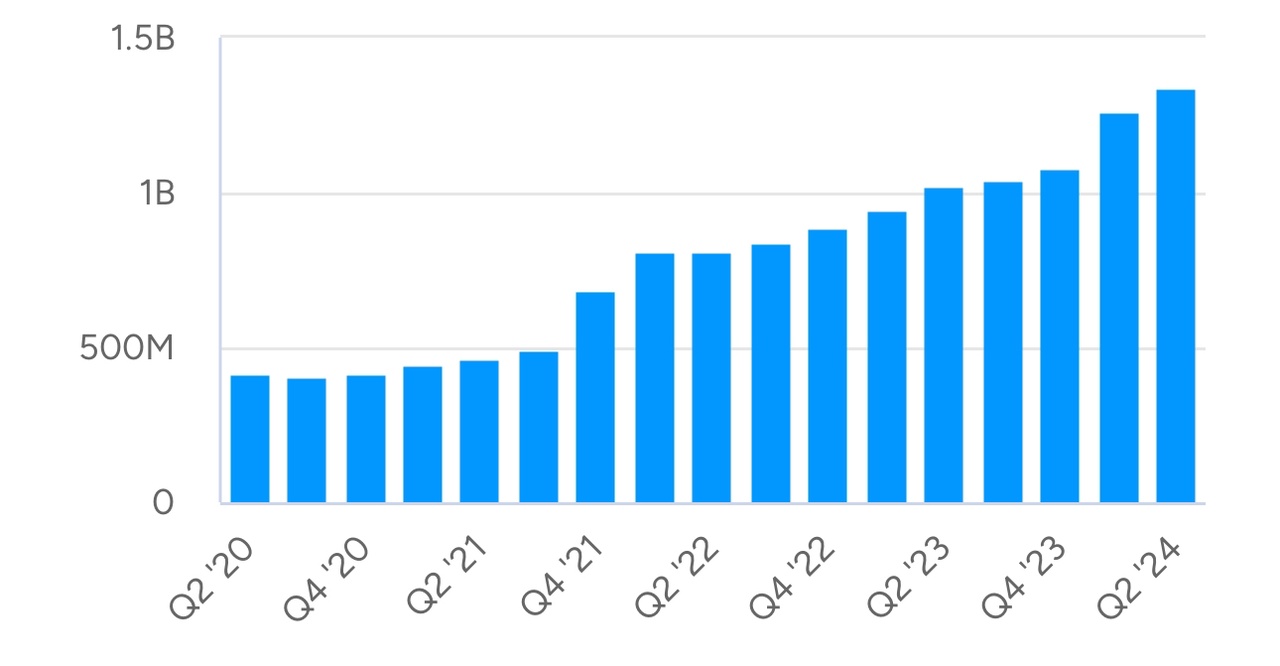

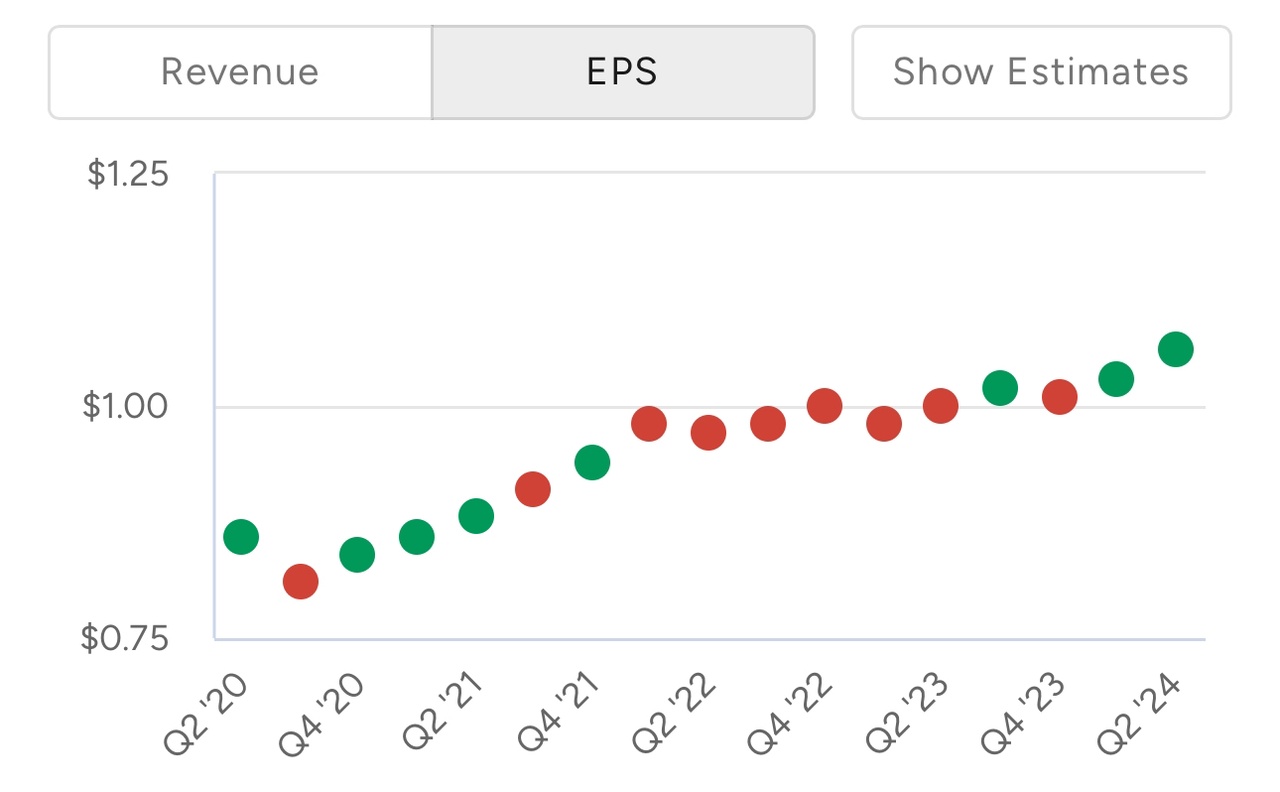

$O (+2,65%) has just announced its quarterly figures.

The earnings per share (EPS) is $1,05 and fulfilled the expectations of $1,05.

The turnover amounted to $1,33 billion and is slightly below expectations of $1,34 billion.

Tomorrow evening our time Realty Income

$O (+2,65%) will release its quarterly figures figures.

Analysts' expectations are as follows:

The estimated turnover: 1,26 billion USD, while the earnings per share (EPS) are expected to be 1,07 could reach USD 1.07.

I migliori creatori della settimana