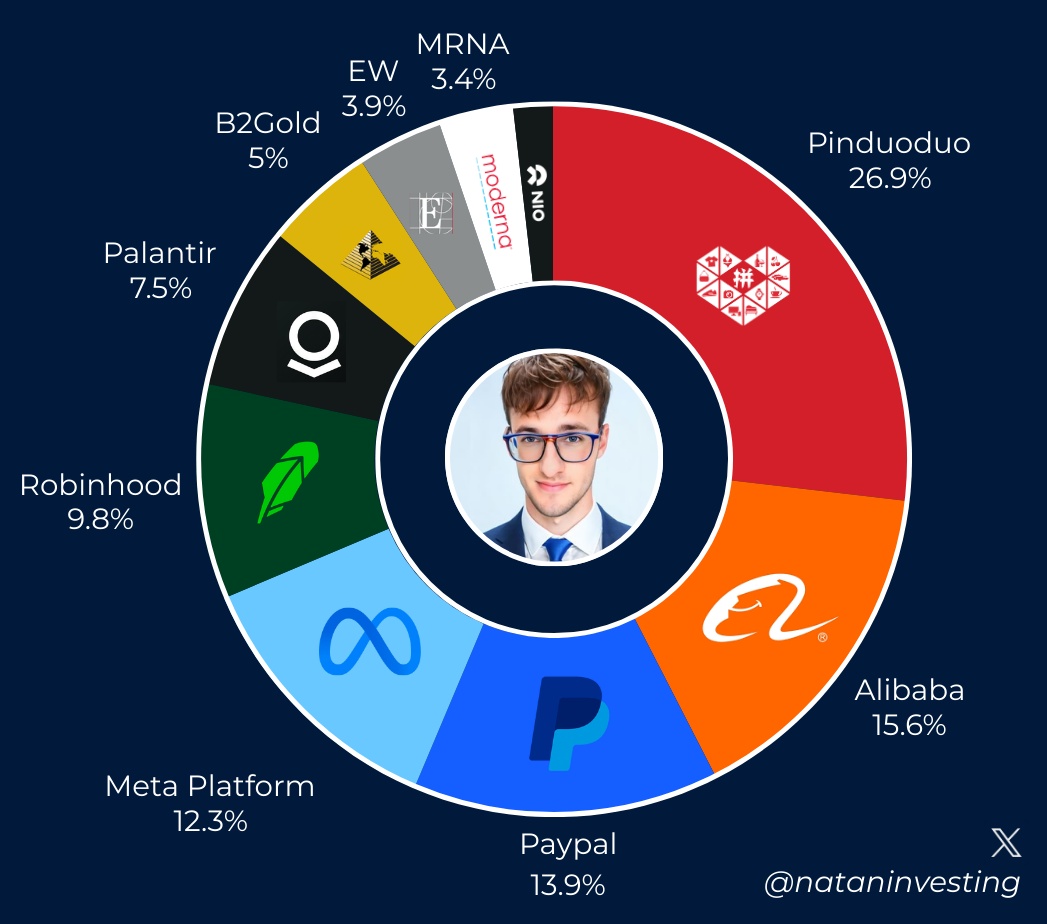

What do you think about my portfolio allocation? $PDD (-5,98%)

$BABA (-5,18%)

$PYPL (+3%)

$META (+0,4%)

$HOOD (+5,61%)

$PLTR (+5,8%)

$BTO (-2,74%)

$EW (+2,14%)

$MRNA (-5,5%)

$9866 (-2,86%)

Pinduoduo ADR Azione Forum

AzioneAzioneDiscussione su PDD

Messaggi

38Week in review 05.10.

New all-time highs for Arista Networks, BlackRock, Caterpillar, Exxon Mobil, Fiserv, Jefferies Financial, Home Depot, Lockheed Martin, MetLife, Otis Worldwide, Piper Sandler, Stifel Financial, Unum Group, Vistra Corp.

New 52-week highs for Carvana, Juniper Networks, NextEra Energy, Palantir, Tanger, ZIM Integrated Shipping

BTC rises +10% in September, best September for Bitcoin in its history

Good labor market report on Friday in the US, recession / hard landing is canceled for now

Dock workers strike in the US ends thanks to strong wage increase, possible rising inflation due to long strike and crisis are canceled

Palantir breaks $40 mark for the first time since February 2021, +154% in 12 months #PLTRgang 🤜🤛👊✊

Alphabet imitates Microsoft and now also wants nuclear power for AI data centers

YouTube shorts can now be a maximum of three minutes long instead of just 60 seconds to compete with Instagram Reels and TikTok

Tesla disappoints with delivery figures in Q3 despite new record, shares fall 4%, rumors say a new Tesla model will be presented at the upcoming Robotaxi event on 10.10.

Microsoft now offers Office 2024 without a subscription fee for a one-off €149 for PC & Mac and ends HoloLens AR headset program

Amazon wants to increase advertising on Prime Video

New "affordable" Apple iPhone SE to arrive in 2025 and new iPad Mini, Mac Mini and Macbooks with M4 chip later this year (rumors)

Rivian lowers its production targets for 2024 due to supply bottlenecks, delivery figures for Q3 worse than expected as at Tesla, Rivian shares -3%

China stocks continue to rise thanks to money printers and stimulus program, weekly performance: +42% Alibaba Health, +30% Jinko Solar, +30% Meituan, +28% ZTE, +21% Ping An, +20% JD. com, +19% Kingsoft, +19% Weibo, +17% Pinduoduo, +14% Xiaomi, +13% BYD, +8% Alibaba, +7% Baidu

Oil price rises this week due to war in the Middle East, oil companies up and airlines down

Nike with mixed figures. Shares fall 6% in after-hours trading after the sporting goods company reported a significant drop in sales for the third quarter and canceled its annual targets. In addition, an investor day planned for November was postponed. Adidas shares much better this year.

BlackRock now holds $24 billion worth of Bitcoin, representing 2% of the total

MicroStrategy has now bought bitcoin 40 times in the last four years for a total of $10 billion

Coinase's own blockchain "Base" now holds $2bn total value locked, which is +370% since the beginning of the year

Boeing considers capital increase, strike has been going on for three weeks

German economy stagnates until the end of the year, slight improvement maybe in 2025

Inflation in Germany falls to 1.6%, but services increase by +3.8%

Rheinmetall with new order from Denmark for 16 Sky Ranger 30 including ammunition for air defense

EU car tariffs against China are now possible, German car shares rise

Profit warning at Stellantis and again at VW

Springer Nature - IPO successful, issue price €22.50, last price €23.05

>> If you want to read a review like this every week, leave a like & subscribe.

$AAPL (+0,65%)

$GOOGL (-0,6%)

$GOOG (-0,66%)

$TSLA (+9,97%)

$RHM (+1,63%)

$PLTR (+5,8%)

$BA (+1,21%)

$BTC (+0,2%)

$COIN (+8,63%)

$MSTR (+1,77%)

$MSFT (+0,15%)

$RIVN (+3,15%)

$AMZN (-0,02%)

$9988 (-5,04%)

$PDD (-5,98%)

$NKE (+0,58%)

$ADS (-1,81%)

$BLK

$VOW (-2,5%)

$STELLA

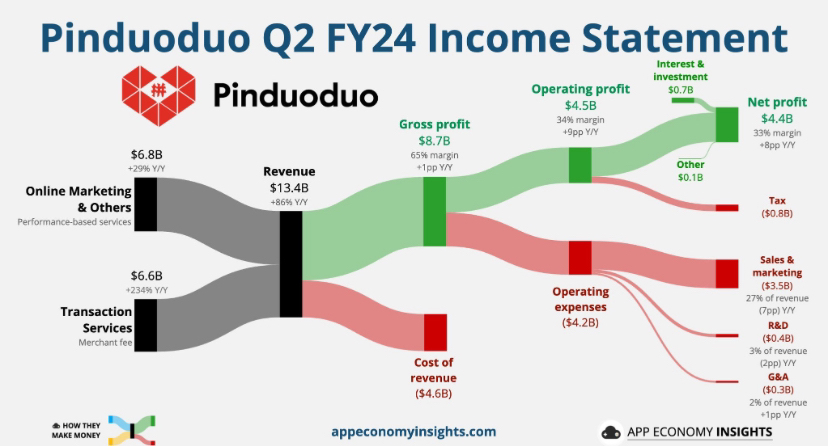

Pinduoduo Income Statement $PDD (-5,98%)

$PDD Pinduoduo Q2 FY24.

• Revenue +86% Y/Y to $13.4B ($0.6B miss).

• Non-GAAP EPS $3.20 ($0.41 beat).

Jun Liu, VP of Finance:

"Looking ahead, revenue growth will inevitably face pressure due to intensified competition and external challenges. Profitability will also likely be impacted as we continue to invest resolutely.”

$PDD (-5,98%) | Pinduoduo Q2 FY24 Earnings Highlights:

🔹 Adjusted EPS: ¥23.24 (Est. ¥20.43) 🟢

🔹 Revenue: ¥97.06B (Est. ¥99.42B) 🔴; UP +86% YoY

🔹 Operating Profit: ¥32.56B; UP +156% YoY

🔹 Operating Margin: 36% (Est. 29%) 🟢

Segment Performance:

🔹 Transaction Services Revenue: ¥47.94B (Est. ¥50.02B) 🔴; UP +234% YoY

🔹 Online Marketing Services Revenue: ¥49.12B; UP +29% YoY

Key Metrics:

🔹 Net Income: ¥32.01B; UP +144% YoY

🔹 Net Cash from Operating Activities: ¥43.79B; UP from ¥23.40B YoY

🔹 Cash and Cash Equivalents: ¥284.9B as of June 30, 2024

CEO and Executive Commentary:

🔸 Mr. Lei Chen, Chairman and Co-CEO: "While encouraged by the solid progress we made in the past few quarters, we see many challenges ahead. We are committed to transitioning toward high-quality development and fostering a sustainable ecosystem.

"We will invest heavily in the platform’s trust and safety, support high-quality merchants, and relentlessly improve the merchant ecosystem. We are prepared to accept short-term sacrifices and potential decline in profitability.""

🔸 Ms. Jun Liu, VP of Finance: "In the past quarter, our revenue growth rate slowed quarter-on-quarter. Looking ahead, revenue growth will inevitably face pressure due to intensified competition and external challenges. Profitability will also likely to be impacted as we continue to invest resolutely."

🔸 Mr. Jiazhen Zhao, Executive Director and Co-CEO: "We are committed to nurturing a healthy and sustainable ecosystem where high-quality merchants thrive. We will vigorously support high-quality merchants while firmly tackling low-quality ones, continuously building a healthy and sustainable ecosystem."

I bet on $PDD (-5,98%) quarterly results but unfortunately it didn't work out.

I sold the 14 stocks and now i wait to reinvest it in the other stocks i already own in my portfolio.

I made this type of bet already a few months ago for the quarterly results of $NVDA (-0,03%) and that time it was a winning bet. You lose some, you win some. This is life. Now we move on and focus on other stocks.

$PDD (-5,98%) - Pinduoduo Q2 - Earnings Highlights:

- Adjusted EPS: ¥23.24 (Est. ¥20.43)

- Revenue: ¥97.06B (Est. ¥99.42B) ; UP +86% YoY

- Operating Profit: ¥32.56B; UP +156% YoY

- Operating Margin: 36% (Est. 29%)

Segment Performance:

- Transaction Services Revenue: ¥47.94B (Est. ¥50.02B) ; UP +234% YoY

- Online Marketing Services Revenue: ¥49.12B; UP +29% YoY

Key Metrics:

- Net Income: ¥32.01B; UP +144% YoY

- Net Cash from Operating Activities: ¥43.79B; UP from ¥23.40B YoY

- Cash and Cash Equivalents: ¥284.9B as of June 30, 2024

Titoli di tendenza

I migliori creatori della settimana