$PDD (-1,11%)

$601318

$EH

$OKTA (-1,38%)

$MDB (-0,5%)

$3690 (-0,52%)

$KSS (+1,41%)

$ANF

$CRWD (-0,44%)

$SNOW (-1,92%)

$HPQ (-1,8%)

$NTNX (-0,24%)

$NVDA (-1,17%)

$DHER (-0,09%)

$LI (-0,92%)

$DELL (+1,57%)

$S (-2,45%)

$IREN (-7,21%)

$ULTA (-1,47%)

$MRVL (-3,92%)

$AFRM (-3,92%)

$ADSK (-0,77%)

$BABA (-0,97%)

Discussione su PDD

Messaggi

49Quarterly figures 25.08-29.08.25

Small portfolio update If you're interested, you can add your two cents. Portfolio sale:

$CCL (+0,16%) One of my long-term stocks has been trimmed back from overweight (4%) to normal size (2.5%). A few months ago I bought at €15 and €17 and have now partially sold at €25. The share will not disappear completely for me. I am hoping for a recovery of €30+. If it falls below €20 again, I will slowly overweight again. This game has been played from time to time for the last 5 years and the positive management of the debt, in addition to the constant good news, slowly speaks for a breakthrough.

$BAYN (+0,51%) I bought in at the beginning of April at €22, but have now decided to close the position at just under €27. I actually wanted to hold the share long, but somehow I can't warm to it. Perhaps it will find its way back into my portfolio at some point.

$AVGO (-0,59%) In the April crash, I bought the stock at €151 (2% weighting) using a Lombard loan (10% portfolio size), among other things, and the position has now been closed at €224. More was not my target recovery to old ATH.

$9618 (-1,19%) Unfortunately, this position was closed with a minus of 13%. The reason for this was the annual rebalancing in which the China portion had become too large for me. As I was convinced by $1211 (-1,36%) , $BABA (-0,97%) and $PDD (-1,11%) JD had to give way.

Portfolio purchase:

$OXY (+1,93%) Bought another small tranche. After the 10% slump, I had some capital left over, which was invested at 36.50. One of my larger individual bets with a 5% portfolio weighting.

A new addition to the portfolio is $TX (-0,65%) with a small position of 1%. The reason sounds stupid, but it's a little chat GPT experiment. I wanted to be told which stocks were selected according to the Columbia Buffet approach. I was given 5 suggestions, some of which were frankly garbage. But this stock somehow got me hooked. Which is why I took the risk with only 1% of my portfolio (just over 1k).

Note:

My single stock portfolio Smartbroker plus makes up 2/3 of the asset class equities.

1/3 are Etf's with Trade Republic.

In total, equities make up 90% of my investable assets.

In addition to my three equity ETFs, TR holds my real estate REIT ($O (+0,45%) approx. 5%), as well as my gold ETC ($SGBS (-0,31%) 2.5%) and my gold miner Etf ($GDXJ (+0,21%) 2.5%) which make up the remaining 10%.

Approximate total assets 100k (more like 95k :/ due to volatility) but debt free (except for a 3.5k balance on the Lombard loan). I have been investing since 2020 and am 28 years young.

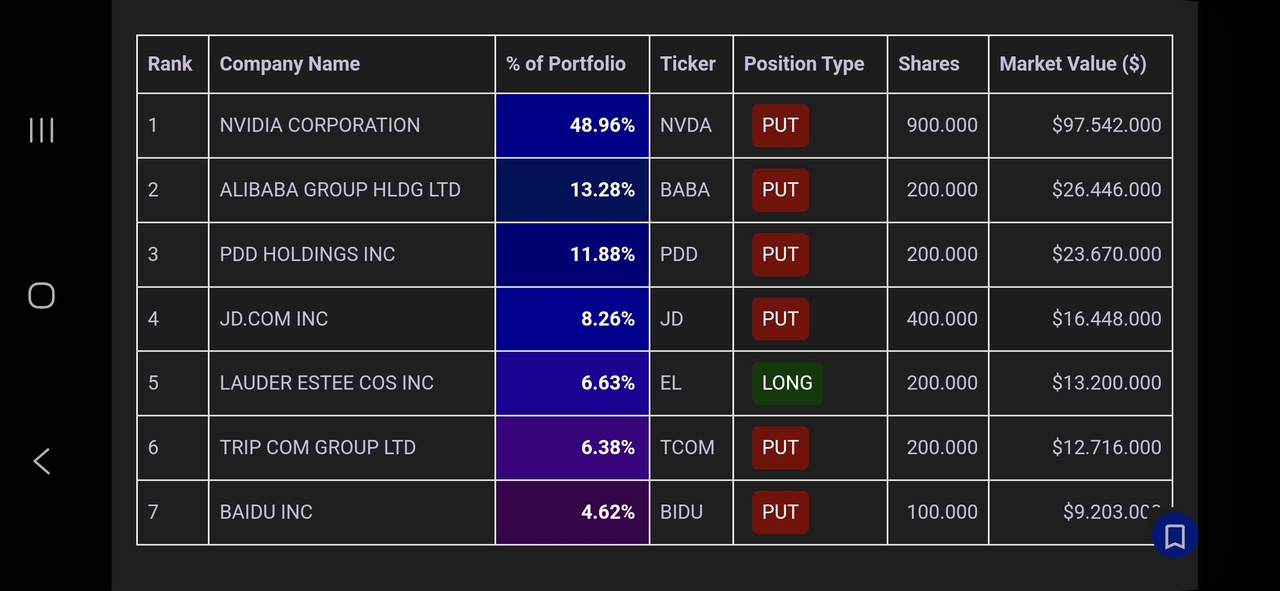

Portfolio Michael Burry Q1/25

That doesn't look very optimistic. 🤔

$NVDA (-1,17%)

$BABA (-0,97%)

$PDD (-1,11%)

$JD (-1,15%)

$EL (-1,17%)

$TCOM (-1,62%)

$BIDU (-1,66%)

Source: www.michael-burry.com

"IMPULSE BUYING? ONLY IF IT'S PDD SHARES" - PDD HOLDINGS: INVESTMENT THESIS

PDD Holdings operates the Pinduoduo and Temu platforms, two of the most important e-commerce initiatives today.

📌 Highlights of the report:

✅ Asset-light and scalable model, with strong use of data, gamification and digital inclusion - focused on price-sensitive consumers.

🛒 Pinduoduo dominates inland China with more than 900M MAUs, while Temu is growing rapidly in the West, already present in +70 countries.

💰 The company grew 67% CAGR (2019-2024) and, even with gross margins falling slightly (Temu's impact), it maintains solid operating margins (27.5% in 2024) and an ROIC of 94% (!).

💼 $PDD (-1,11%) has a robust balance sheet, with over $45B in cash, which could be used for strategic buybacks or acquisitions in the future.

🌍 The company operates in a competitive global market, facing players such as Alibaba, Amazon and Shein, but differentiates itself with an agile structure, a focus on cost-effectiveness and social user acquisition strategies.

⚠️ Risks? Yes: fierce competition, China-US regulatory tensions, and possible pressure on margins. Even so, PDD's model is proving to be resilient and highly efficient in converting revenue into cash.

📉 At the current price, the company appears to be fairly undervalued, offering a very interesting margin of safety for those who want exposure to the Chinese market.

📊 A company with solid fundamentals, structural growth, and potential for appreciation in one of the most dynamic sectors of the global digital economy.

🔎 If you want to know more about this investment opportunity, visit the full analysis at: https://substack.com/@dalemcapital/note/p-161005463

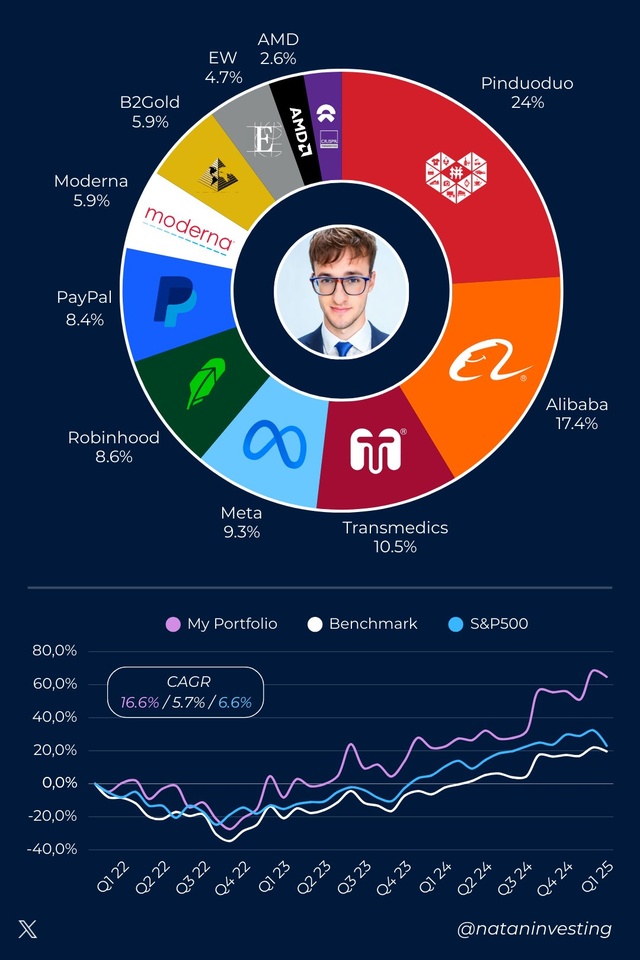

Q1 PORTFOLIO UPDATE

Natan YTD: +9.1%

S&P500 YTD: -4.6%

My positions: $PDD (-1,11%)

$BABA (-0,97%)

$TMDX (-0,48%)

$META (+0,33%)

$HOOD (-3,19%)

$PYPL (-1,46%)

$MRNA (-5,86%)

$BTO (+0,22%)

$EW (+0,11%)

$AMD (-4,24%)

ALLOCATION BY COUNTRY:

🇺🇸 US: 50%

🇨🇳 China: 42%

🇨🇦 Canada: 6%

🇨🇭 Switzerland: 2%

What do you think about my portfolio?

Pinduoduo Q4'24 Earnings Highlights:

🔹 Adj. EPS: ¥20.15 (Est. ¥19.68) 🟢

🔹 Revenue: ¥110.62B (Est. ¥116.03B) 🔴; UP +24% YoY

🔹 Operating Profit: ¥25.59B; UP +14% YoY

🔹 Net Income: ¥27.45B; UP +18% YoY

Segment Performance

🔹 Online Marketing Revenue: ¥57.01B; UP +17% YoY

🔹 Transaction Services Revenue: ¥53.60B; UP +33% YoY

Key Financial Metrics

🔹 Operating Expenses: ¥37.22B; UP +19% YoY

🔹 Sales & Marketing Expenses: ¥31.36B; UP +18% YoY

🔹 R&D Expenses: ¥3.78B; UP +32% YoY

🔹 General & Admin Expenses: ¥2.09B

Cash & Balance Sheet Metrics

🔹 Operating Cash Flow: ¥29.55B

🔹 Cash, Equivalents & Short-Term Investments: ¥331.6B

Management Commentary

🔸 Co-CEO Lei Chen: "We remained committed to driving sustainable growth for both our platform ecosystem and the broader supply chain."

🔸 Co-CEO Jiazhen Zhao: "Leveraging our digital capabilities, we continue to give back to consumers and support quality merchants."

🔸 VP of Finance Jun Liu: "Stable financial results supported by resolute execution of our high-quality development strategy."

JD.com - The Chinese e-commerce giant with potential for 2025?

JD.com - The Chinese e-commerce giant with potential for 2025?

JD.com ($9618 (-1,19%)) is one of the leading e-commerce providers in China and has established itself as a serious competitor to Alibaba. After struggling with economic challenges and regulatory problems in recent years, the question is: can JD.com regain its former strength in 2025?

Overview: What does JD.com do?

JD.com is a Chinese company that sells a wide range of products through its platform, including electronics, household goods and groceries. It operates both traditional e-commerce retail and an extensive logistics network that enables it to deliver products faster and more efficiently.

✅ JD Mall: The main platform for B2C e-commerce, which has a large market share in China.

✅ JD Logistics: A leading logistics company that also operates for other brands and platforms.

✅ JD Health & JD Digits: Subsidiaries operating in the health and digital services sectors.

✅ Collaborations with Walmart and Google: Global partnerships to expand reach and innovative strength.

JD.com relies on an integrated business modelthat ranges from logistics and cloud services to digital healthcare solutions, which sets the company apart from other competitors.

Competition: Who are the competitors?

🔸 Alibaba $9988 (-0,63%) (Tmall, Taobao): The largest e-commerce competitor in China with a broader market coverage.

🔸 Pinduoduo $PDD (-1,11%)

: An emerging competitor that has established itself through group buying and low prices.

🔸 Amazon $AMZN (-1,75%)

: Even though Amazon is less dominant in China, it still has a presence in the international market, especially in cloud services.

🔸 Meituan $3690 (-0,52%)

: Another player in online retail and on-demand services, especially in food delivery.

JD.com has the advantage that it has a strong logistics network and a good B2B business However, it continues to be burdened by competition and regulatory challenges in China.

Opportunities: Why could JD.com make a comeback in 2025?

✅ Strong growth in logistics and cloud: JD Logistics and JD Cloud offer promising growth opportunities, especially in international business.

✅ Expansion into rural areas: JD.com has a strong presence in rural areas of China and could benefit from broader urbanization and increasing demand.

✅ Resurgent e-commerce market: Despite economic uncertainties, the Chinese e-commerce market is expected to grow in the long term - JD.com could benefit greatly from this.

✅ Innovations in FinTech and healthcare: JD.com has made great strides in FinTech and digital health solutions in recent years. These sectors could provide stable revenues in the future.

✅ Reduced regulatory uncertainty: After years of regulatory challenges, the situation in China could stabilize, making the market attractive for JD.com again.

Risks: What could continue to weigh on JD.com?

⚠️ Regulatory uncertainties: The Chinese state still retains significant influence over the market, and new regulations could weigh on JD.com.

⚠️ Competitive pressure from Alibaba & Pinduoduo: Strong competition from Alibaba and Pinduoduo remains a major challenge.

⚠️ Weak consumption in China: Weak economic recovery and falling consumer spending in China could slow growth.

⚠️ Dependence on B2B: JD.com generates a large proportion of its sales in the B2B sector. A slowdown in this market could affect growth targets.

⚠️ Geopolitical risks: Tensions between China and the West could have a negative impact on business activities, particularly in international trade and cloud services.

Conclusion: turnaround opportunity or value trap?

JD.com has the potential to benefit from the growth areas of logistics, cloud and FinTech in 2025. The company has been through tough times in recent years, but the fundamentals remain strong. If JD.com can maintain its market position in China and successfully expand into new business areas, it could make a remarkable comeback.

What do you think? Can JD.com take off again in 2025 or will it remain under pressure? 🚀

Opinion on China

Hello,

I wanted to hear your views on the China stocks / China situation. Basically I am bullish on China but open to all arguments / points of view.

I am currently still holding $BABA (-0,97%) (Alibaba) $1211 (-1,36%) (Byd) $PDD (-1,11%) (Pindudu) $9618 (-1,19%) (JD). I have sold $700 (-0,58%) (Tencent) (+- 40%) in the last China high October / September.

At that time I sold all China stocks (alibaba byd tencent) completely (almost optimal moment through 2 sales tranches) due to the exaggerated reaction after the press conference, despite my personal bullish attitude, with 10-50% profit margins per stock. After the exaggeration flattened out, I got back in (approx. 10-20% lower than the exit point) in November / December. Tencent was replaced by jd and pdd but will continue to be monitored.

I am currently in the situation of considering jumping out again, but I see the current performance for almost 1-2 months differently than in the first phase in October.

The shares have not risen as sharply and the current news is, in my opinion, different from back then. This makes it difficult for me to see the current situation as an exaggeration like back then, when there was only the government promise. Furthermore, many of the shares are established companies with currently still low -> fair valuations. Do you think the world is slowly making up for the neglect or is it just being exaggerated again?

Many large investors have generally been getting back into China for years in medium to large style, which is why I am still bullish.

I am aware of the political risk, which everyone has been reminded of since the Alibaba crash.

I'll share my individual share portfolio to show you the current weighting there.

I have another portfolio with TR with etfs, 1 reit (approx. 10%) and 1 physical gold and miner etf (both 5%). I have just under 40% individual stocks/60% etfs reit gold cash

Podcast episode 73 "Buy High. Sell Low."

Podcast episode 73 "Buy High. Sell Low."

Subscribe to the podcast to beat cancer.

00:00:00 Donald Trump inauguration

00:15:40 Tempus AI A40EDP $TEM (-4,23%)

00:26:00 Groupon $GRPN (-1,03%)

00:30:20 Palantir $PLTR

00:35:00 Insider Trading

00:40:20 Netflix $NFLX (-5,23%)

00:59:00 Adobe AI $ADBE (-0,92%)

01:01:00 Alibaba $BABA (-0,97%)

$9988 (-0,63%)

01:07:40 Baidu $BIDU (-1,66%)

$9888 (-1,64%)

01:15:15 JD com $9618 (-1,19%)

$89618

$JD (-1,15%)

01:16:40 PDD Holdings $PDD (-1,11%)

01:19:00 Xpeng $9868 (-1,25%)

$XPEV (-1,08%)

01:21:00 Nio, BYD, Xiaomi, Huawei $9866 (+0,43%)

$NIO (+0,34%)$1810 (+0,18%)

$XIACY (+0%)

$81810

01:28:00 Li Auto $AUTO (-2,67%)

$LI (-0,92%)

01:35:20 Bitcoin $BTC (+0,74%)

Spotify

https://open.spotify.com/episode/4xzXvdMeMtWs5fgYoQaNHU?si=3JuxaaqaQ2KM55PHh5IYWg

YouTube

Apple Podcast

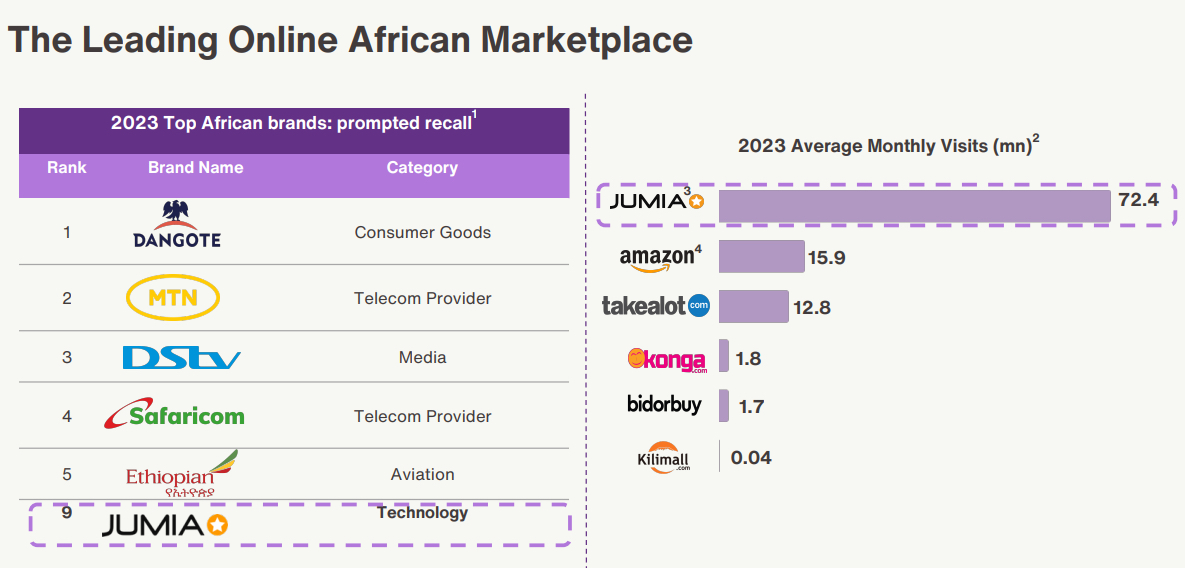

$JMIA (-3,26%) - Company presentation (difficult market/great potential):

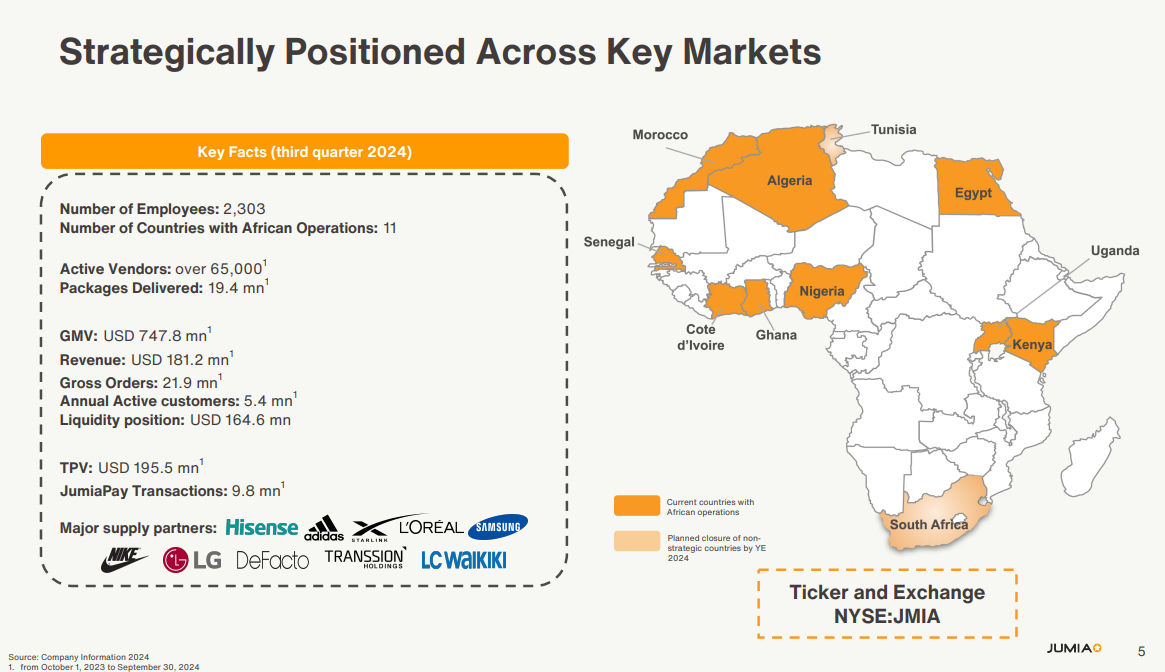

$JMIA (-3,26%) is an online trading company operating in Africa. The company offers a wide range of products such as electronic goods and fashion.

It offers payment, food delivery, credit and flight booking services.

They stand out in the African e-commerce landscape. Their innovative platform is revolutionizing traditional retail by offering a diverse range of products and services online that are tailored to the specific needs of the African market. The company's integrated payment system, JumiaPay, enhances the customer experience through a seamless, secure transaction process. Jumia's logistics network, designed to overcome regional challenges, ensures efficient delivery, strengthening the company's position as a leader in African e-commerce.

$JMIA (-3,26%) was founded in Lagos Nigeria in 2012 by two former management consultants Jeremy Hodara and Sacha Poignonnec.

$JMIA (-3,26%) is active in 11 African countries: Nigeria, Egypt, Morocco, Kenya, Ivory Coast, South Africa, Tunisia, Algeria, Ghana, Senegal, Uganda

$JMIA (-3,26%) Logistics enables the convenient and reliable delivery of goods. It consists of a large network of rented warehouses, pick-up stations for consumers and drop-off points for sellers, as well as more than 400 local external logistics service providers. Their logistics partners and facilities are seamlessly integrated and managed through their proprietary technology, data and processes.

$JMIA (-3,26%) is taxable in Berlin, the development team is based in Portugal and the actual headquarters are in Dublin .

For this reason, and because the nationality of the two CEOs is French, there are various doubts that $JMIA (-3,26%) is an African company, as is claimed in the self-promotion.

- In March 2016, the company managed to raise 50 million euros in venture capital

- As Africa's first "unicorn", the technology start-up reached a valuation of over 1 billion US dollars

- In April 2019, the company made its stock market debut on the New York Stock Exchange, raising capital of USD 196 million

- Jumia's share price initially tripled within the first three days of trading before settling back around the initial price a month later

- Among other things, the share price was negatively affected by the allegation made by the US portal Citron Research that Jumia had reported false key figures prior to the IPO.

Arguments for $JMIA (potential/giant market opportunities):

- Africa's e-commerce penetration is only ~5%, compared to over 20% globally, suggesting huge upside potential

- Africa's population is projected to account for 25% of the world's population by 2050 (a huge untapped consumer base)

- With an average age of 19.7 years - a young, digitally savvy consumer base.

- Internet penetration is growing rapidly and is expected to reach 65% by 2030, driven by affordable smartphones and growing infrastructure.

- $JMIA (-3,26%) is active in 11 major African markets and covers over 70% of the continent's GDP and internet users.

- Market leader in logistics: $JMIA (-3,26%) Processed 5.6 million parcels on Black Friday and has a delivery infrastructure that covers urban and rural areas

- Fintech expansion: JumiaPay increased transactions by 40% year-on-year, creating opportunities in Africa's underserved regions with banking services

- Financial upside and synergies: Jumia's market capitalization is USD 554 million, the company trades at only about double its revenue

- 1.7 billion Africans will join the consumer economy by 2030, driving demand for e-commerce

- Strong growth figures: GMV (Gross Merchandise Volume) +33% YoY (currency adjusted) showing robust demand.

- Orders +18 % YoY, driven by the success of Black Friday.

- Growth in the interior of Nigeria: +44 % YoY,

- Solid financial position: USD 164.6m in cash reserves - ample liquidity for future investments. Operating losses are falling every quarter, demonstrating cost discipline and efficiency gains.

- Attractive valuation: Trades at ~2x sales and 1.7x EV/sales, well below peers in high-growth markets. Market capitalization of USD 554m positions Jumia as a small-cap with significant upside potential.

- Strategic implementation: Focus on domestic expansion, procurement efficiency and adaptation to local markets. Utilization of logistical capacities: 5.6 million parcels were handled during the Black Friday season (+24% year-on-year).

- Long-term potential: Positioned as Africa's leading e-commerce platform. Benefits from improved infrastructure, increasing internet penetration and growing consumer acceptance.

- The African e-commerce market is expected to grow exponentially from USD 30 billion in 2024 to over USD 75 billion in 2030.

The anxiety around Jumia often revolves around a single question: what happens when giants like $AMZN (-1,75%) , $BABA (-0,97%) or $PDD (-1,11%) decide to enter the African market?

At first glance, this is a legitimate concern. But this perspective overlooks the essence of e-commerce success in Africa. It's not about flashy apps or sprawling warehouses in cities - it's about solving the logistical puzzle. And that's where Jumia's advantage lies. Africa's logistical challenges are unprecedented. In many regions, physical addresses are not a given, but a rarity, making deliveries difficult and turning traditional e-commerce models on their head.

$JMIA (-3,26%) operates in an environment where customers often live miles away from hubs and there are no traditional delivery points. This is where Jumia has built its moat. It's more than an e-commerce platform, it's a logistics powerhouse designed to tackle the complexities of the continent. It's not just about delivering parcels. Jumia's network connects remote and rural regions that global competitors may not be able to serve. Take Nigeria, for example. With a population of over 200 million, the consumer base extends far beyond the urban centers of Lagos. Selling products is one thing, reaching underserved regions with sparse infrastructure is another and this is where $JMIA (-3,26%) strength.

The logistics system is not easily replicated and is a barrier to entry that global giants must reckon with. International players eyeing Africa have a difficult choice: invest billions in building a comparable infrastructure or partner with $JMIA (-3,26%) whose network has already proven itself in markets such as Ghana, Kenya and the Ivory Coast. In either case $JMIA (-3,26%) benefit from this. The company is the natural ally - or rival - for any e-commerce player trying to gain a foothold in Africa. And $JMIA (-3,26%) is constantly improving its market position and is not satisfied. Operational improvements are further consolidating its position. Consolidating smaller warehouses into larger, technology-enabled facilities and optimizing fulfillment centers in core markets such as Nigeria and Ghana reduces $JMIA (-3,26%) inefficiencies. These changes not only reduce costs, but also create scalability, allowing the company to expand deeper into untapped regions where there is little competition.

Of course, the macroeconomic backdrop is tough. Currency devaluations and volatile markets weigh heavily on $JMIA (-3,26%) 's operating environment. But its logistics network remains an irreplaceable asset that global competitors struggle to replicate, even with significant investment. A current outstanding key figure underlines this: Over 50% of orders from $JMIA (-3,26%) now come from outside the major cities, a testament to its reach and resilience.

Western companies often dream of penetrating African markets, but constantly fail. Deciphering the African logistics code has proved too complex, and currency risks are driving many to retreat. Meanwhile $JMIA (-3,26%) is flourishing. It is adapting to challenges that others consider insurmountable and consolidating its leadership position.

Can competitors catch up? A question that is often asked ?

At the moment, they can't really. Jumia's logistics network is more than an operational tool, it's a fortress. This system, built to withstand Africa's unique challenges, is the foundation of its success. It is also the core of its strategy, the playbook of $AMZN (-1,75%) , $MELI (-2,36%) , $BABA (-0,97%) to follow.

Building a strong logistics network to create lasting barriers to market entry. The latest Black Friday results (as briefly outlined above) underline this potential. Orders increased by 18 % year-on-year, while GMV (Gross Merchandise Volume) grew by an impressive 33 % in constant currency.

However, significant currency devaluations in key markets such as Nigeria and Egypt dampened reported GMV growth to just 2%. Despite these headwinds, Jumia's underlying business demonstrates its ability to weather macroeconomic storms. The customer retention metrics speak for themselves. The total number of customers rose by 9% and orders increased by 18%.

A 44% increase in physical goods orders from regions outside Nigeria's major cities. This expansion into the interior of the country underlines the untapped potential that Jumia is beginning to develop.

The switch to an asset-light model is also paying off. Jumia Logistics recorded a 24% increase in parcel volumes, underlining the efficiency of its operations. On the supply side, international procurement is booming. The number of items from global sellers has risen by 31 %.

This diversifies the platform's offering to meet growing consumer demand. This diversification is critical to cementing Jumia's role in Africa's dynamic e-commerce landscape. And yet the market has not caught up. Despite this progress, Jumia's valuation is still not dependent on the dynamics of its core business.

Continued improvements in logistics, geographic expansion and customer acquisition could provide the basis for significant upside potential

However, the way forward will not be easy. Currency fluctuations in key markets and dependence on cash reserves pose risks. But Jumia offers a rare opportunity to enter one of the fastest growing e-commerce markets in the world. $JMIA (-3,26%) is far from over - it is just beginning.

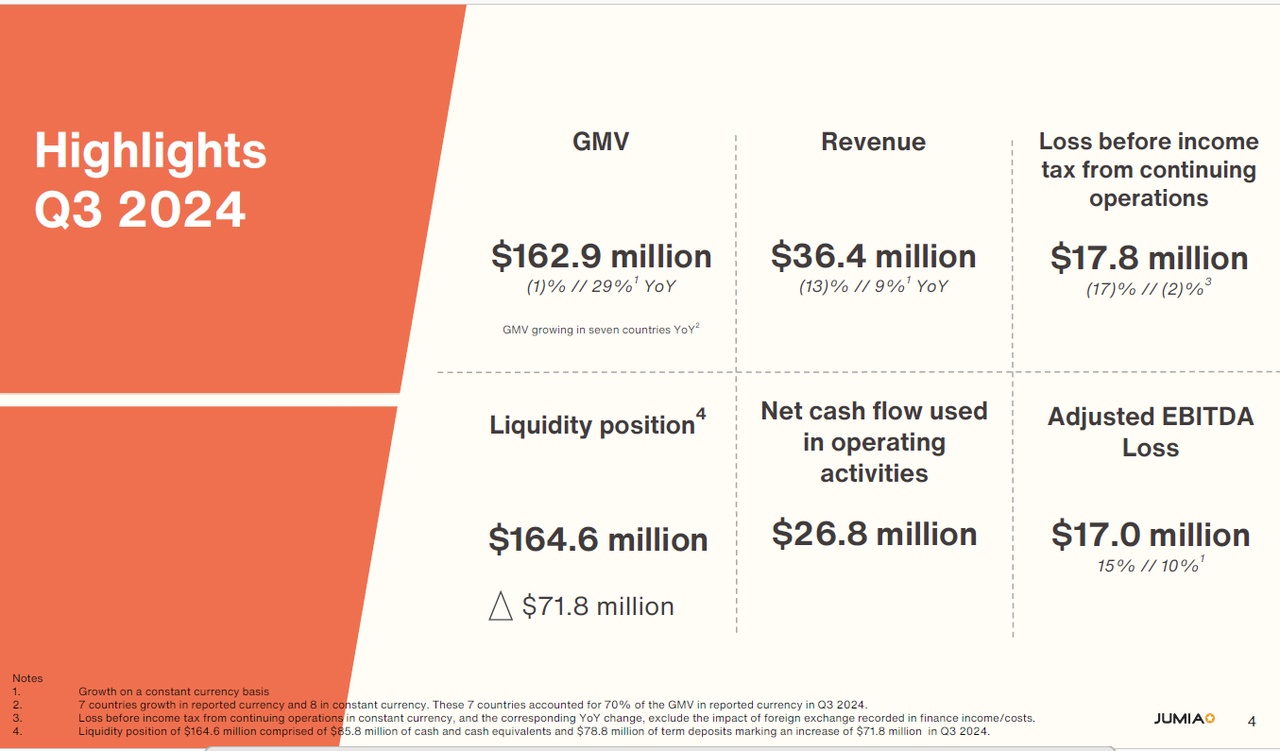

Earnings highlights for the third quarter of 2024:

- Revenue of $36.4 million, down 13% YoY, or up 9% in constant currency

- GMV of $162.9 million, down 1% YoY, or up 29% in constant currency

- Operating loss of $20.1 million compared to $18.3 million in the third quarter of 2023, up 10% YoY, and up 6% in constant currency

- Adjusted EBITDA loss of $17.0 million compared to $14.8 million in the third quarter of 2023, up 15% YoY, and up 10% in constant currency

- Loss before income tax from continuing operations of $17.8 million in the third quarter of 2024, down 17% YoY or down 2% in constant currency

- Liquidity position of $164.6 million, an increase of $71.8 million in the third quarter of 2024, that includes the net proceeds from the August 2024 At-the-Market (ATM) offering, compared to a decrease of $19.0 million in the third quarter of 2023

- Net cash flows used in operating activities of $26.8 million compared to $24.0 million in the third quarter of 2023

- Summary and personal opinion: $JMIA (-3,26%) Blend of market leadership, operational improvements and growth in untapped regions, positions the company for exponential growth. At current levels, it could be a rewarding, very long-term investment in one of the most promising markets in the world, even if the environment is very challenging and the investment naturally carries a lot of risk. A takeover by a major player such as $AMZN (-1,75%) , $MELI (-2,36%) , $BABA (-0,97%) could also be possible, as setting up your own logistics is very difficult and costly. ✌️

$AMZN (-1,75%) , $MELI (-2,36%)

$BABA (-0,97%) , $SE (-4,92%) , $PDD (-1,11%) , $JD (-1,15%) , $9618 (-1,19%) , $9988 (-0,63%) , $CPNG (-1,1%) , $EBAY (-0,4%)

+ 1

Titoli di tendenza

I migliori creatori della settimana