Earnings next week

$$BRK.A (+1,48%) (Saturday)

Messaggi

30Podcast episode 58 "Buy High. Sell Low."

Subscribe to the podcast to see Bitcoin perform in Q4.

00:00:00 Iran & Israel, Buy The Dip

00:16:00 Portfolio performance, September review

00:36:00 Bitcoin, Crypto - ETFs

00:48:00 Hims & Hers

01:06:00 Novo Nordisk, Eli Lilly

01:13:30 Print dies

Spotify

https://open.spotify.com/episode/6qnlfoTcu6MYhqRWq7wJzH?si=5T-g9DHYSt6fFljTK2xjKA

YouTube

Apple Podcast

$LLY (+5,07%)

$NVO (+0,75%)

$HIMS (-0,18%)

$BTC (+0,46%)

$ETH (+0,58%)

$SOL (+1,6%)

$PLTR (+5,8%)

$SNOW (-1,55%)

$ABNB (-6,51%)

#gold

#silber

#palantir

$AMD (-0,12%)

$NU (+0,57%)

$P911 (-1,22%)

$GOOGL (-0,6%)

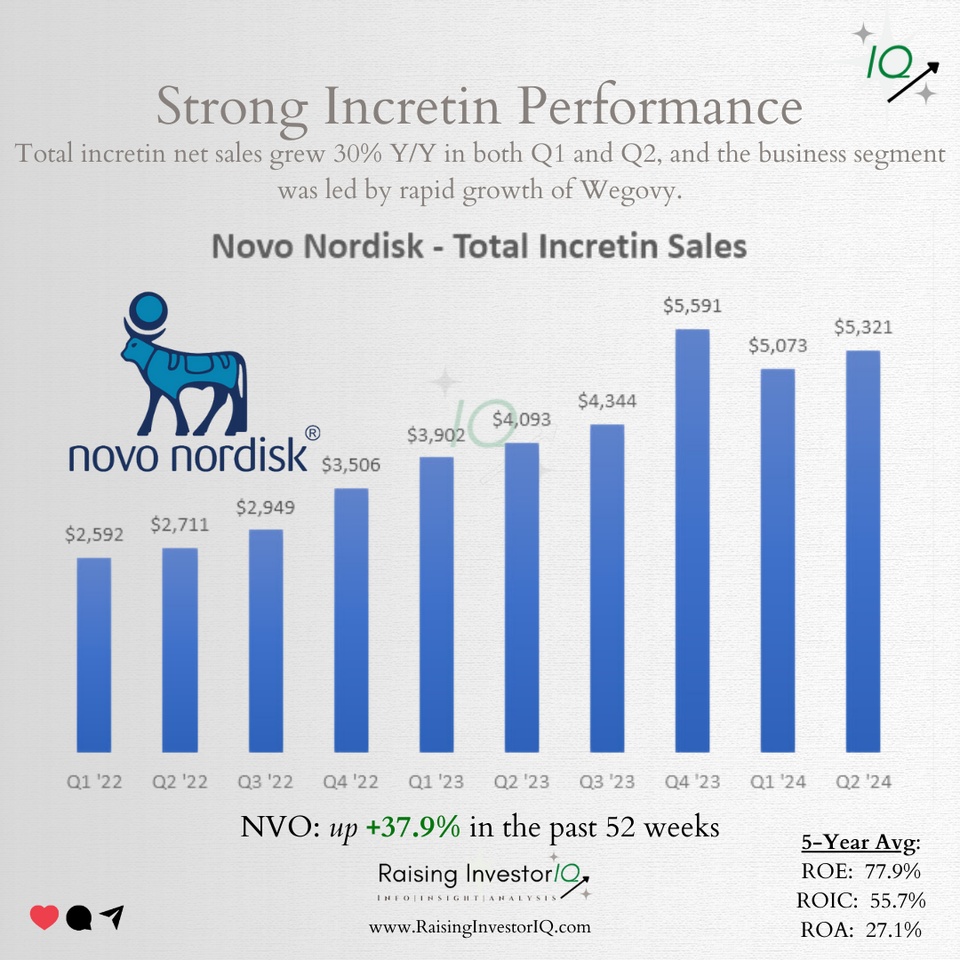

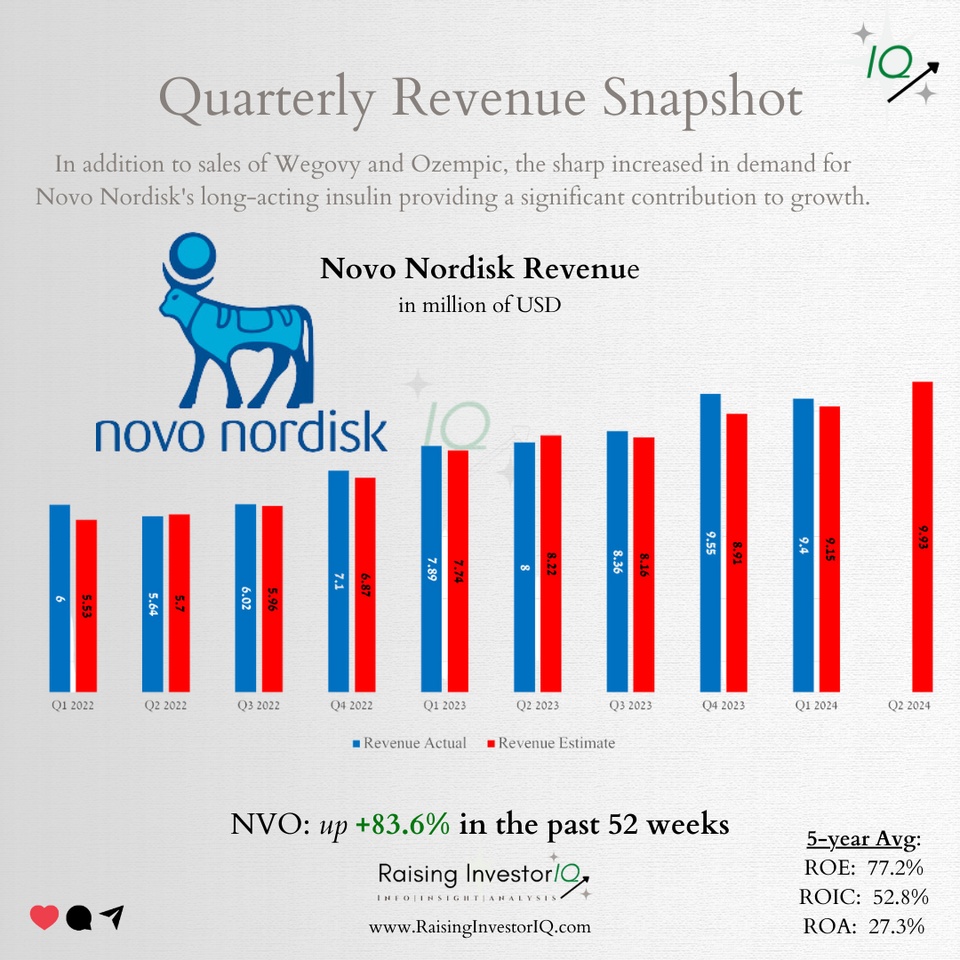

Supply constraints started to ease for $NVO (+0,75%), and it gradually increased the supply of Wegovy in the first half of the year. This has been reflected in weekly prescription numbers, which have increased considerably year-to-date.

I see room for outperformance in the second half of the year, but far more in 2025 and 2026.

$LLY (+5,07%)

$NVO (+0,75%)

$HIMS (-0,18%) | ELI LILLY LAUNCHES SINGLE-DOSE VIALS OF ZEPBOUND FOR WEIGHT LOSS IN U.S.

Eli Lilly has introduced single-dose vials of its weight-loss drug Zepbound in the U.S., offering 2.5 mg and 5 mg doses at $399 and $549 per month, respectively, via LillyDirect.

This move aims to increase supply amid high demand and address insurance coverage gaps.

Despite the new availability, Zepbound remains on the FDA shortage list. The vials are priced 50% lower than other GLP-1 obesity drugs, targeting patients who can't get reimbursement.

Hi guys,

I wanted to hear your opinion on my portfolio and on my strategy.

As you can see I currently own 7 stocks and 2 etfs. The etfs i plan on keeping them in the long term and i'm putting in €150/month in both of them.

Different story for the stocks.

The ones i wanna keep in the long term are $NVO (+0,75%)

$INFY (+1,37%) and $PYPL (+3%) and my plan is to add money whenever I can. I have money available to put in right now, i'm waiting for a good price and then i'll increase these 3 positions.

$GRAL (-1,81%) is a short-mid term investment. I'm really positive about what they're doing, I really like the company and i'll keep it for a while; at least until early 2026 when we will probably know if they can expand globally.

$NVDA (-0,03%) I plan to sell my position by the end of the year, hoping to make good profit, and put the money elsewhere (still don't know where).

$PDD (-5,98%) I bought some the other day as a short term investment hoping that the quarterly figures next week are good enough to make a decent profit and my plan is to sell them by the end of the month.

$DRO (-0,77%) I don't even wanna talk about it. Yes, I made a mistake. Yes, i lost money. And yes, i learned a lesson. Let's move on. I'll probably leave it there and forget about it.

I'm currently looking around to find interesting stocks and companies that i like and that i want to invest in and to keep in the long term, but for the meantime this is what I want to do.

If you have any suggestion please let me know. Thank you!

Podcast - Episode 51 "Buy High. Sell Low."

Subscribe to the podcast to get the fatties to buy the weight loss shots.

00:00:00 Novo Nordisk $NVO (+0,75%)

00:29:00 Eli Lilly $LLY0

00:38:00 Nvidia HS4PHR $NVDA (-0,03%)

00:50:00 AMD $AMD (-0,12%)

01:05:00 Intel $INTC (+0,53%)

01:25:00 Gold $4GLD (+0,04%)

$ABX (+0,47%)

$IGLN (+0,05%)

$EWG2 (-1,37%)

Spotify

https://open.spotify.com/episode/5lxqJBmJJrom4MFGte2FtU?si=R1DfxZG9T82P1SDbYS3zcQ

YouTube

Apple Podcast

$NVO (+0,75%) Technical analysis def doesn’t look good

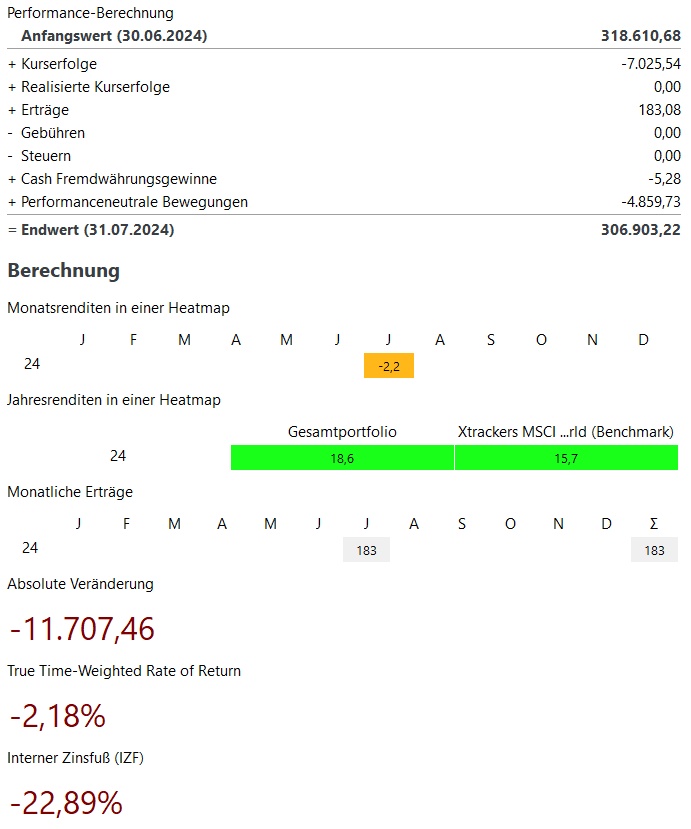

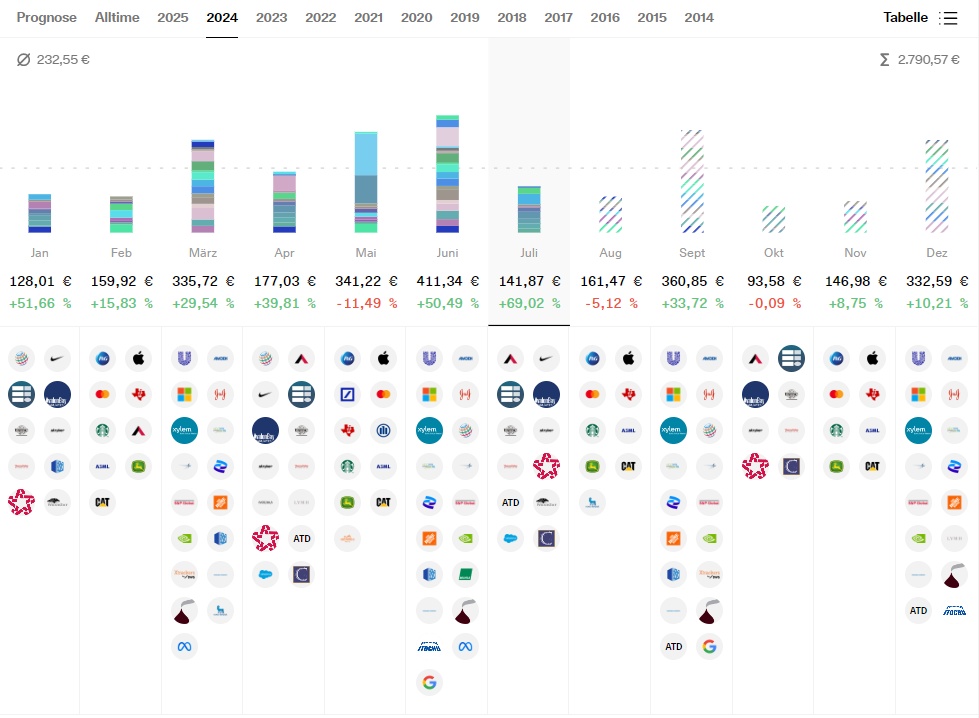

Depot review July 2024 - A red month with a conciliatory last trading day

After a long, positive period, July brings another significant loss for my portfolio and is the worst month of the year to date, just ahead of April.

Monthly view:

In total, July was -2,2%. This corresponds to price losses of ~7.000€.

However, as the previous month of June alone brought a return of +5%, the weak performance in July is not a major problem and the portfolio is still significantly higher than at the beginning of June, for example.

Winners & losers:

On the winners' side looks correspondingly poor this month. Bitcoin and Lockheed Martin are ahead with +500€ each. In 3rd-5th place are Unilever, Sartorius and ThermoFisher, three stocks that have tended to be on the losing side in recent months and years.

On the losers' side in July are mainly the winners of recent months. Above all Crowdstrikewhich mainly made negative (media) headlines in July. A loss of over €3,000 was recorded here. But the long-runner NVIDIA also ran out of steam this month with a loss of € -1,700. With Alphabet, Microsoft and ASML three other well-known tech high-flyers followed, each of which lost €1,000 in July.

The performance-neutral movements in July were -€5,000 despite investments, as I had to withdraw cash for private reasons. Nevertheless, I bought for ~€1,400 in July.

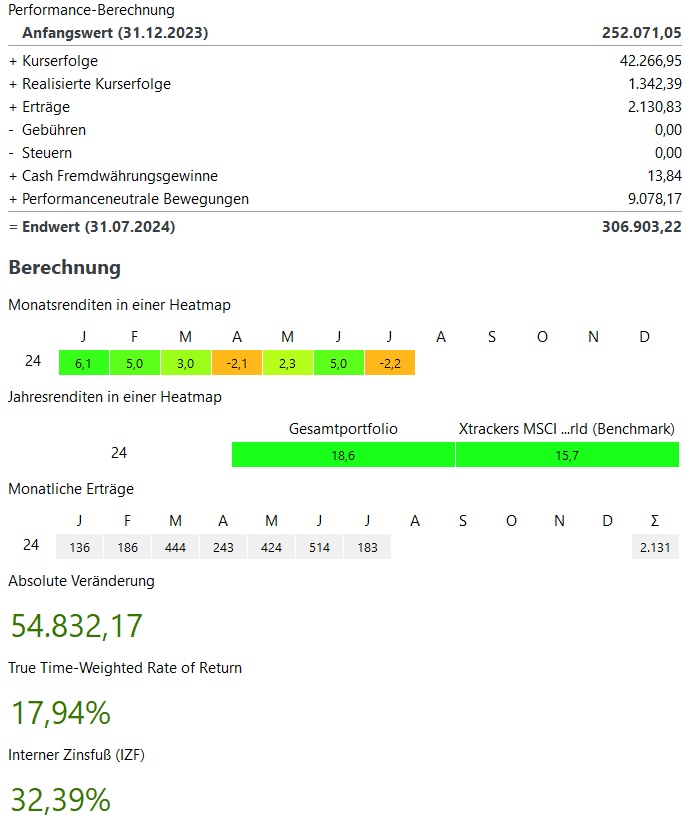

Current year:

My performance in the current year is +18,6% and thus above my benchmark, the MSCI World with 15.7%.

In total, my portfolio currently stands at ~307.000€. This corresponds to an absolute growth of ~56,000€ in the current year 2023. ~42.000€ of this comes from price increases, ~2.100€ from dividends / interest and ~9.000€ from additional investments.

Dividend:

Buys & sells:

Target 2024:

My goal for this year is to reach €300,000 in my portfolio. Due to the extremely positive market performance this year, my portfolio currently stands at ~€310,000. Even though I am in a worse position than at the end of June with ~€320,000 after the negative July and the larger cash withdrawal, I am still optimistic that I will meet and beat my target for the year.

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy

Both Eli Lilly $LLY (+5,07%) and Novo Nordisk $NVO (+0,75%) are disrupting the diet industry with their GLP-1 drugs, offering the potential for significant growth in the future.

$LLY (+5,07%) is on track to become the first trillion dollar drug-maker...😯

$PFE (-1,75%)

Pfizer Advances Weight-Loss Pill in Race to Lucrative Market

Pfizer said on Thursday it would advance a reworked, once-a-day version of its experimental obesity pill, danuglipron to clinical trials in the second half of this year, sending its shares 5% higher in premarket trading.

The drugmaker last year said it was focusing on danuglipron's development after scrapping a separate, once-daily pill due to concerns about liver safety.

Pfizer was testing both a once-daily modified release dosing and also a twice-daily form of danuglipron.

It said early study results supported a once-daily dosing, with a safety profile consistent with prior danuglipron twice-daily dosage studies, including no liver enzyme elevations observed in more than 1,400 healthy adult volunteers.

The Pfizer drug is part of the second-generation of weight loss pills, under development by companies including Eli Lilly $LLY (+5,07%) and Novo Nordisk $NVO (+0,75%) , that will offer patients more convenient dosing instead of injections.

SRC : REUTERS

I migliori creatori della settimana