Introduction

It has now been a little bit over a month since I published my first portfolio review. I started this portfolio on July 23 and will continue to share monthly recaps from now to, hopefully, a very long time. My goal with these updates is simple: transparency. They are to document performance regularly, explain my investment process, and create a track record of decisions that I can learn from and reflect on over time. I will focus on what worked and what did not, while keeping the macro picture and long-term perspective over short-term volatility in mind. As I pointed out in my last review, I strive to become a hedge fund manager, and while there is still a long way to go, and many lessons to be learned, this portfolio will be my primary credential for the future.

Unlike a traditional investor letter, this recap is designed to be professional yet approachable, so it can serve as a portfolio log and as a resource or inspiration for anyone interested in equity investing. Yes, I am doing this primarily because I love investing and diving into company reports and stock market news, but I also want to share my journey and hopefully be able to use my passion in a professional setting. Every month, I will share performance vs. benchmark indices, most suitable to asset allocation, highlights of the strongest and weakest performance, and any changes I have made to my portfolio. This is not about sugarcoating results. Since I genuinely want to improve, there is no point in trying to sweet talk mistakes and slip-ups. Over time, this series should build a narrative of my investing journey, through wins, theses, and most importantly long-term performance and improvement. My daily commentary usually serves as an opinion piece on companies on my watchlist or the most recent macro news, while these monthly recaps are intended to provide a comprehensive guide on my investing principles and execution.

Portfolio Performance

For the month of August, my portfolio delivered a strong +5.25% total return. Not a bad start for month one, but it is always important to remember that short-term gains are not the most meaningful metric. Consistency is key. Nevertheless, to put this month’s return in perspective, here are important benchmarks:

- S&P 500: +3.33%

- Nasdaq 100: +2.42%

- MSCI ACWI: +3.84%

This means the portfolio outperformed both global and U.S. benchmarks in its first full month, which is encouraging.

However, the performance was not linear. The first few days were negative, but as the month progressed, companies reported earnings and news surfaced, several key holdings – particularly those in healthcare and fintech – drove strong upward momentum. This led to an intersection between my portfolio performance and benchmarks around the middle of the month. Since then, the portfolio has outpaced the market’s broader rally.

The outperformance cannot be attributed to one single stock, but rather a combination of multiple holdings reacting strongly. This is exactly how I want my portfolio to behave: diversified enough to avoid cluster risk, but concentrated enough to benefit meaningfully from each of my highest-conviction ideas. It is crucial to strike the balance between diversification and conviction, without sacrificing returns or risk management.

Allocation Snapshot

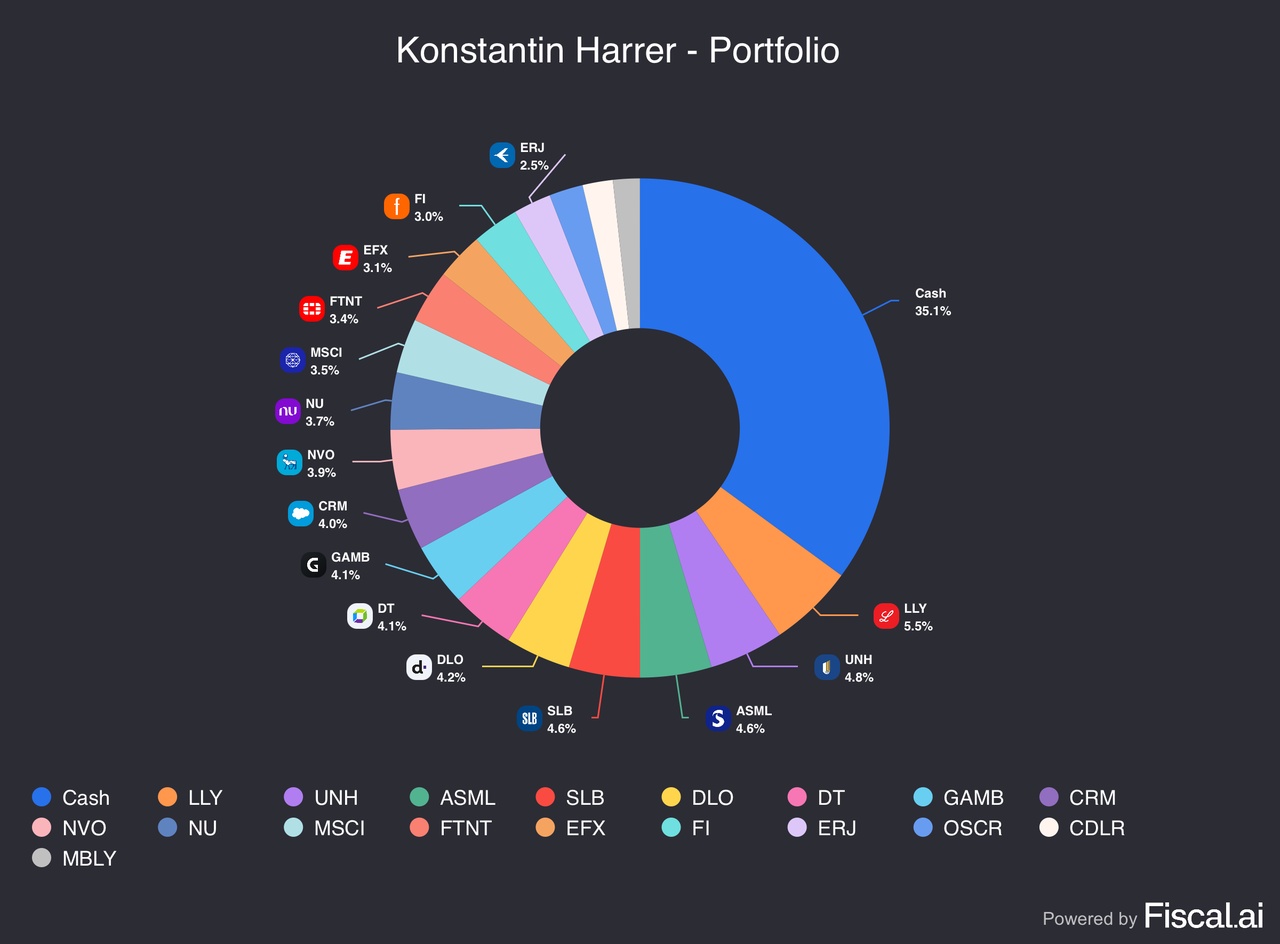

The portfolio currently consists of 18 equity holdings plus cash, with cash representing the single largest allocation at 35.1%.

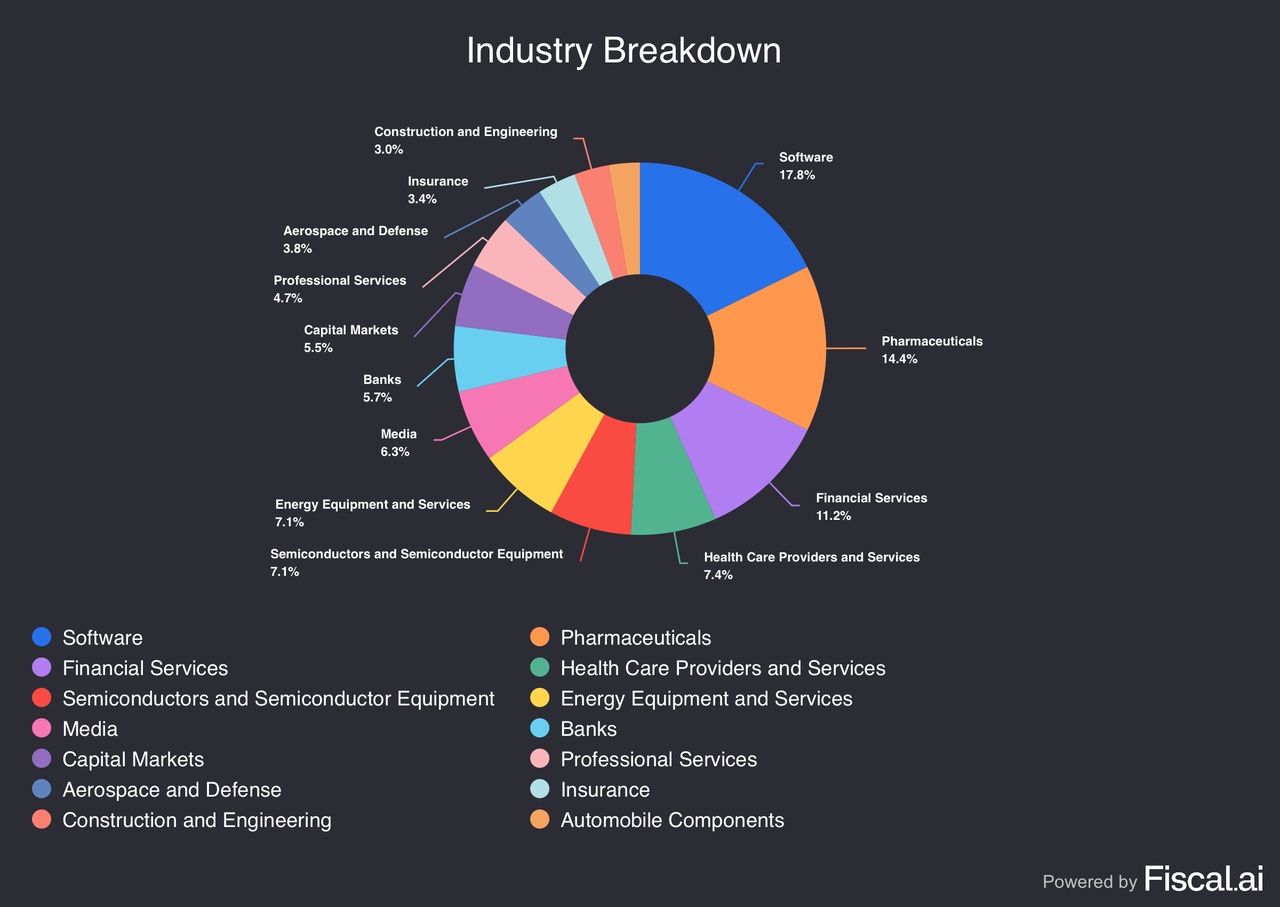

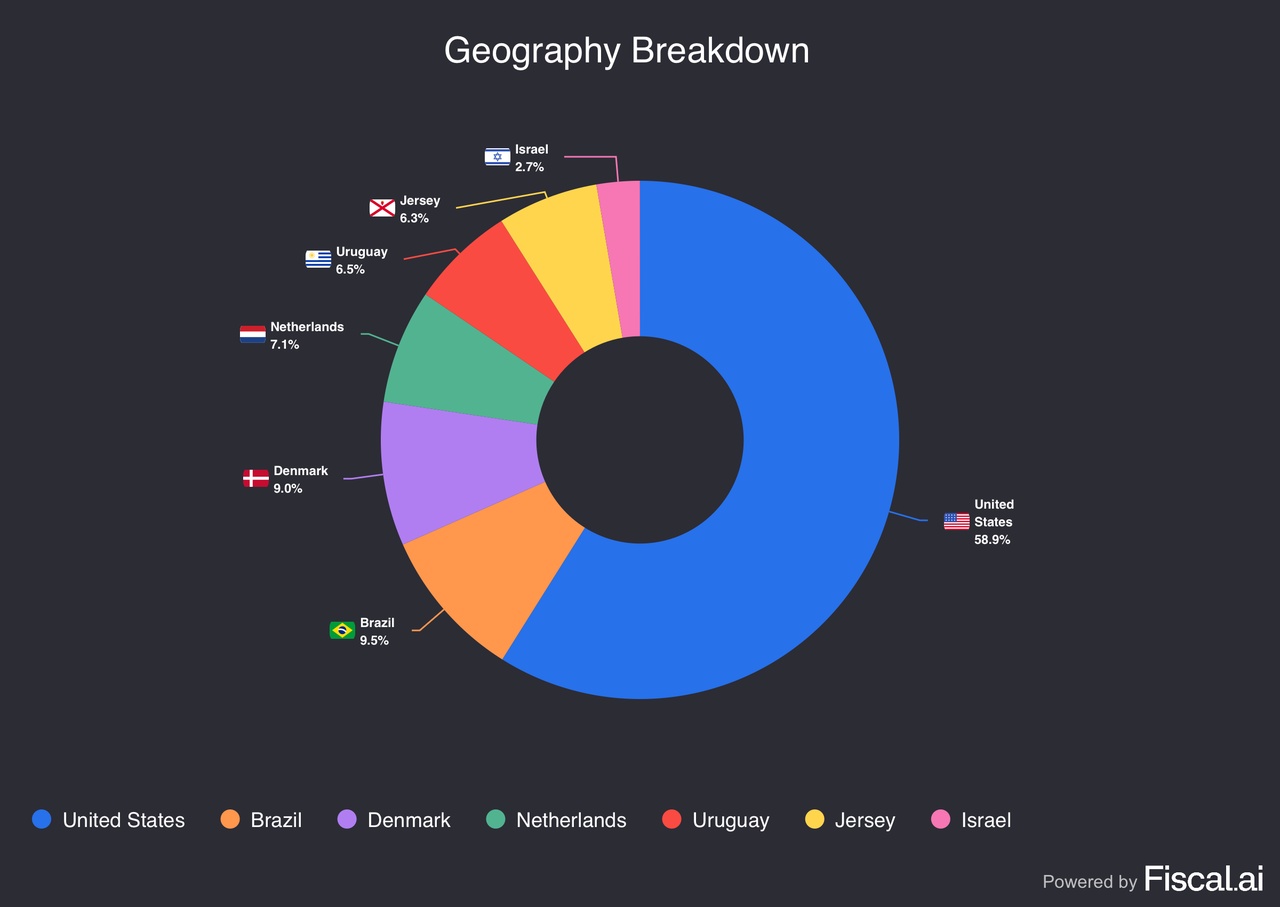

This is a short breakdown of my portfolio:

- Cash: 35.1%

- Largest equity holding: Eli Lilly (LLY) at 5.5%

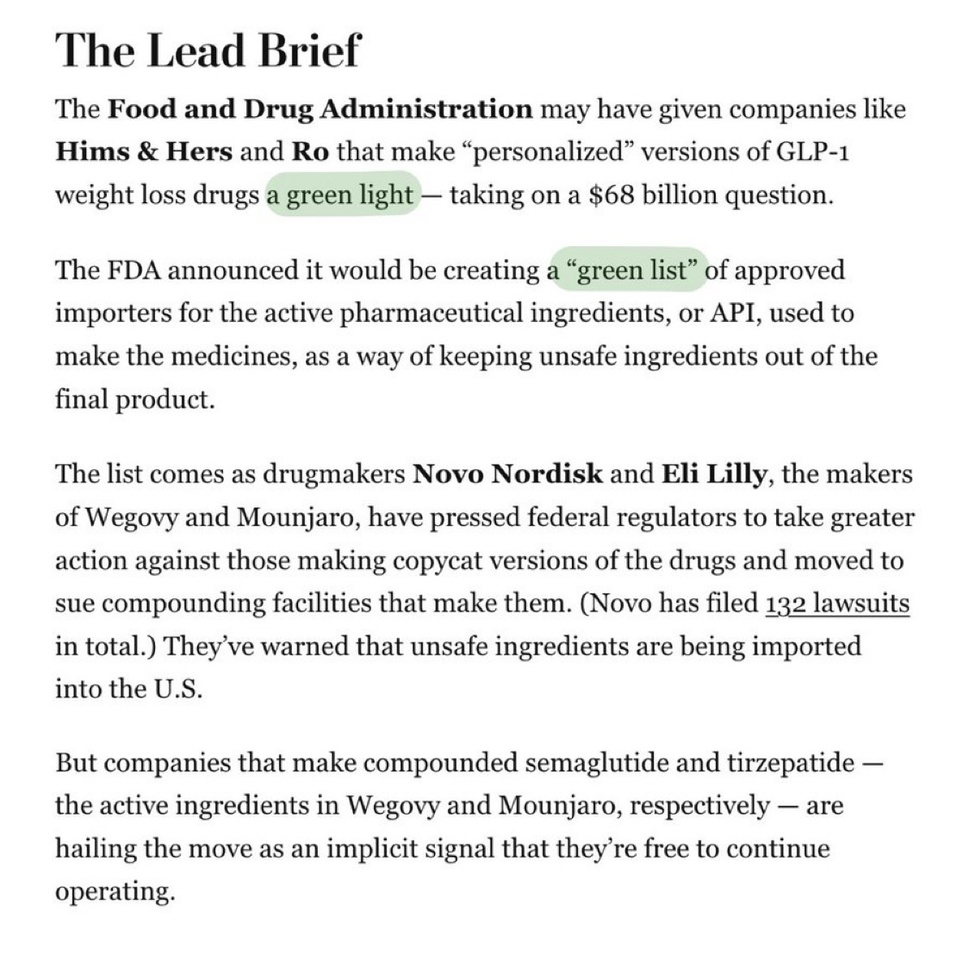

- Other top allocations include: UNH (4.8%), ASML (4.6%), SLB (4.6%), DLocal (4.2%), Dynatrace (4.1%), Gambling.com (4.1%), Salesforce (4.0%), Novo Nordisk (3.9%), and Nu (3.7%).

The high cash balance is intentional. As this is the first month of the portfolio, it is important not to rush into not-well-enough researched positions only to reduce the cash quota. Even for my highest-conviction positions, like LLY or ASML, I want to remain disciplined with entry prices and only buy on pullbacks, after I initiate my first tranche. As I emphasized in my last report, I aim to invest opportunistically in great companies at discounts, and reduce my cash balance to below 10% by the end of the year. In fact, over the course of August I already reduced my cash position from 56% to 35%, by adding to and opening new positions, especially during the first half of the month.

However, I am not in a rush to close my cash holding right now, since I am convinced that this rally off the April lows is highly unsustainable, considering the economic tensions and tariff regime in place. AI hype is driving this rally, and if the enthusiasm cools down, some interesting opportunities could present.

Since I aim for high returns with acceptable risk management, the exposure to fast-growing industries like fintech and software comes naturally. However, I also own more defensive players in the energy and healthcare spaces that, in my opinion, offer a healthy risk/reward ratio not recognized enough by the market. Indeed, some of the companies I hold fall on the more expensive spectrum, but they also boast immense growth and potential for the future. My focus does not lie on momentum or trends, but rather fundamentals and underlying prospects.

Strongest & Weakest Performers

Strongest performers:

- DLocal posted strong earnings in a volatile market environment, which led to a jump in the stock of more than 40% the day after. I remain extremely bullish on the company, with a forward P/E ratio of 23, reflecting a more than fair valuation even after the recent rally. The fintech disruptor is revolutionizing payment solutions across emerging markets, with still a massive TAM left.

- UnitedHealth recovered more than 30% from the lows hit at the beginning of the month, due to improving sentiment and the news of several super-investors, most notably Buffett’s Berkshire Hathaway, opening a position in the healthcare giant. The company has a very healthy balance sheet and a strong moat as the largest health insurer worldwide, and that is not even taking into account all its other ventures.

- Nubank outperformed on strong user growth (over 127 million customers across Latin America) and rising profitability. As the leading neobank in Latin America, Nu delivers >25% annual growth and holds a stellar position. The TAM is hard to overlook, as the neobank operates in one of the most underbanked regions worldwide.

Weakest performers:

- Salesforce slightly recovered from recently hit lows, while still underperforming the broader tech sector due to a perceived lack of AI implementation. However, Salesforce is the largest provider of CRM services worldwide and in a very good position for a recovery if any good news hits. The company has not taken part in the recent rally and could be in for a rebound.

- Gambling.com sold off after solid earnings due to a cautious outlook. Online betting is inherently cyclical, and the current economic situation does not look great. However, Gambling.com is already trading at an extremely cheap valuation. Somehow, the market still finds a way to send the stock further down.

In both cases, I view the weakness as sentiment-driven rather than structural. Investors’ confidence is shattered at the moment. However, my theses on these companies have not changed. I think both of them are misunderstood and victims of short-term focus, rather than the broader picture.

Portfolio Activity

Because this was the first month, most activity was centered around building initial positions. I deliberately capped position sizes at ~3–5% each, which allows me to add more over time if conviction grows or valuations improve.

- New Buys: SLB, FTNT, DT, CDLR

- Adds: CRM, GAMB, LLY, UNH

- Sells: M12

- Cash: Meaningfully reduced from >55% to ~35%

My portfolio is still “under construction.” While I reduced my cash position and invested aggressively, especially after earnings hit, I still hold a significant chunk of my portfolio in cash, which I plan to reduce by the end of the year. When I decide to buy into a company, I always do it in tranches and build a position over time, rather than buying all at once. Take Lilly for example: I opened an initial position in July and then bought multiple times this month after the earnings-related dip, and now I am almost 10% in the green with the position.

Market & Macro Context

Markets in August were shaped mainly by speculation around interest rate cuts and the earnings season, both of which contributed positively to my return. Several of my holdings jumped after stellar earnings, while others fell and therefore created opportunities to add, increasing long-term upside. Economic data was two-edged: while unemployment continued to increase, so did GDP, and tariff impacts were largely absorbed by corporations. My portfolio specifically profited from improving sentiment around some beaten-up healthcare names and increasing momentum for fintech and Latin American stocks. August has also been a good month for many tech investors due to continued growth and AI momentum.

Outlook

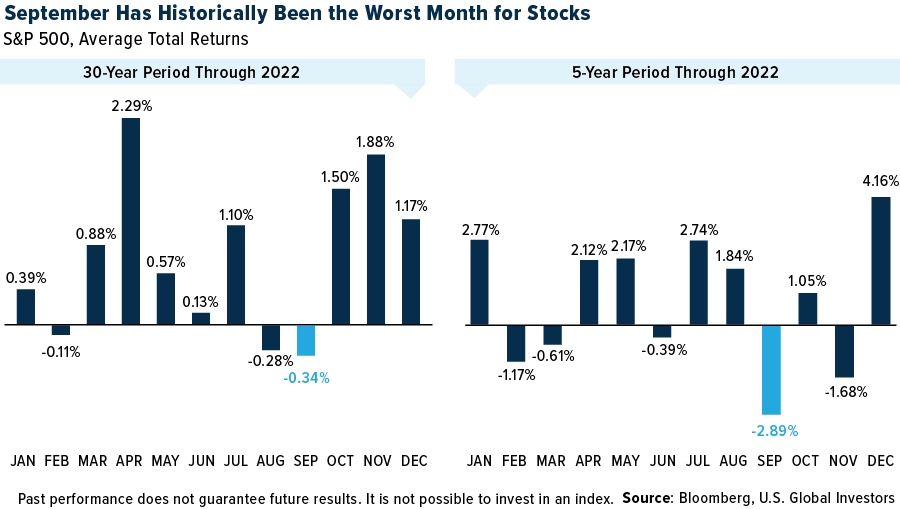

September historically is a very difficult month for markets. These are the key catalysts I will be looking at over the next month:

Jerome Powell has hinted at a possible rate cut at the next meeting, which the market has now priced in. It seems likely, at this point, that interest rates will be falling. However, if the Fed has a sudden change of heart, it could mean a cold awakening for stocks across the board.

On the other hand, if the most likely scenario – a rate cut – comes in, the already started shift from tech stocks to more cyclical industries profiting from lower interest rates could get a boost in September.

Apart from that, I still wholeheartedly believe that the current recovery rally from April lows is highly unsustainable and will eventually cool down, which could create buying opportunities. Whether that will be in September or a later month, I cannot determine. However, it seems strange to have such bullish sentiment ruling the markets, considering the tariff-inflicted strain on the economy. If signs of a cooling cycle thicken, markets could tumble very quickly.

Nevertheless, I am not worried about a broader pullback, since conviction is unwavering for the holdings in my portfolio. If anything, selloffs create possibilities to add to existing holdings or initiate new positions at attractive entry prices.

Closing Thoughts

This first month has been a promising start, with outperformance vs. benchmarks, and multiple adds to my highest-conviction positions. My strategy of investing opportunistically has proven correct so far. However, it has only been one month and I understand that markets fluctuate, which means that patience is key. While it is tempting to deploy cash all at once in order to ride the rally, that is not how I play the game.

In my daily comments I talked about many companies on my watchlist, some of which I will probably never own, because they do not reach my entry prices. That is not important. I have my eyes on countless stocks and continue to research new companies every day. There are always opportunities in the market, and often they are the ones most under fire.

Furthermore, I look forward to continuing this series monthly. Transparency, accountability, and consistency are the main goals. I strive to be the best investor I can possibly be, and this is my log. The target is as clear as ever: beating the market consistently and transforming that experience into the real world.

$ACWU (+0,37%)

$LYPS (+0,3%)

$CSNDX (+0,43%)

$LLY (-0,06%)

$UNH (-1,27%)

$ASML (+0,37%)

$ASML (+0,46%)

$SLB (+0,75%)

$DT (+0%)

$DLO

$CRM (+0,44%)

$GAMB (+0%)

$NOVO B (+0,61%)

$NVO (+0,71%)

$NU (-0,48%)

$NU

$MSCI (+1,21%)

$FTNT (+0,29%)

$EFX (+0%)

$FI (+0,26%)

$ERJ (+0%)

$OSCR (-5,98%)

$CDLR (-1,82%)

$CADLR (+1,75%)

$MBLY