Hello to all securities investors!

As requested, today I am presenting you with a detailed analysis of $MELI (+6,83%) to you!

Latest news about the company:

September 25:

The Argentinian e-commerce company Mercado Libre is planning to expand its expansion of its distribution or fulfillment centers, where products arewhere products are stored until they are purchased by consumers, to more than double to 21 logistics units by the end of next year. More than half of the distribution centers in this model will be located outside of São Paulo, the company said in a statement, in order to expand its presence in the Northeast, Center-West and South of Brazil. The new centers will be located in states such as Rio Grande do Sul, Pernambuco, Ceará, Bahia, Paraná, Rio de Janeiro and also in the Federal District. The expansion is already included in the e-commerce giant's investment in Brazil of 23 billion reais - around 4.166 billion US dollars - announced in March of this year.

Technical analysis:

MercadoLibre has been in an upward trend since mid-June 2022. At the beginning of August, we significantly broke through the ATH zone (all-time high) for the first time, which had already been marked by three highs in the past. This triggered a price gain of around 17%. In the last 14 days, around 5% of this was lost again.

I now expect a minor correction back to the €1650-1680 zone. I expect this correction for two reasons: Firstly, broken ATHs are usually retested, and secondly, a fair value gap has formed in this zone on the weekly chart.

After this correction, I expect the price to rise again, but probably not for long. It is impossible to predict whether it will break through the current high again. My assessment is based on the following observations:

Looking back to 2016, there was often a correction before the Christmas period. If the price was in an upward or sideways trend at this time and the correction was negative, it was often offset many times over the following spring. In every upward movement following the correction, at least the 2 Fibonacci retracement (based on the lowest and highest closing price) was reached.

Duration of the correction:

Average: 27.5 days

Max./min.: 52 days / 10 days

Median: 30.5 days

Start of correction:

- In 4 out of 6 cases, the correction started in December.

- In 4 out of 6 cases, it started by the beginning of January (never later than January 6).

- Even when the low point of the correction was reached in December, the impulsive price increase always started in January.

- No significant correlation was found between the duration and extent of the correction.

Based on these observations, I expect a correction between mid-November and early January. This could either move close to the € 1,403-1,454 zone or possibly even into the fair value gap at € 1,155-1,255. The decisive factor here will be the time component, which I attach more importance to in this case. A two-tranche entry could be important here.

Weekly chart:

Daily chart:

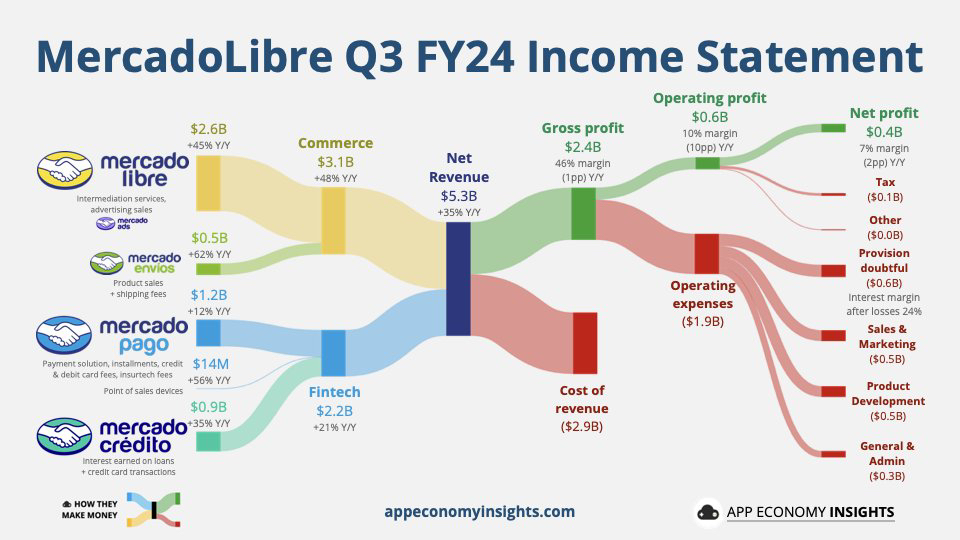

Fundamental analysis:

Current situation:

MercadoLibre continues to be the leading e-commerce player in Latin America, although $AMZN (-0,02%) aggressively expanding into the market, particularly in Brazil and Mexico. While Amazon focuses on a global strategy, MercadoLibre has the advantage of being better rooted locally and overcoming specific regional challenges such as logistics and payment solutions through MercadoPago. MercadoPago's strong focus on fintech gives the company a decisive advantage in a region where many people do not have access to traditional banking services. Both companies are benefiting from e-commerce growth in the region, but MercadoLibre remains the market leader in most markets.

Future prospects:

MercadoLibre's future looks promising, especially with the continued growth in the fintech and logistics sectors. MercadoPago, the payment platform, has great potential as many Latin American countries are still heavily dependent on cash. With the transition to digital payments and financial inclusion programs, MercadoLibre will play a central role. In addition, MercadoEnvíos' logistics division will be further expanded to meet the growing demand for e-commerce. The company plans to increase the number of its fulfillment centers, which will shorten delivery times and increase customer satisfaction. In terms of the macro environment, the prospect of falling interest rates in Latin America is a positive factor that could stimulate investment. In the long term, the potential is enormous, as the e-commerce market in the region continues to grow strongly. However, political uncertainties, particularly in countries such as Argentina, could be an obstacle to growth. However, MercadoLibre has proven that it can operate in challenging environments and is well positioned to benefit from digitalization. New investments in technology and logistics will be crucial to consolidate its market leadership.

Multiples:

When analyzing the multiples, I start with the second quarter of 2022, as the previous values were heavily distorted by MercadoLibre's high-growth phase. Unfortunately, I cannot show you my calculation tables due to the missing Getquin function.

P/S:

Highest quarters

- Median of all highest quarters: 6.1

- Average of all highest quarters: 5.96

- Median of the 3 highest of the highest quarters: 6.2

- Average of the 3 highest of the highest quarters: 6.23

Lowest quarters:

- Median of all lowest quarters: 5.0

- Average of all lowest quarters: 4.81

- Median of the 3 lowest of the lowest quarters: 4.2

- Average of the 3 lowest of the lowest quarters: 4.23

Current value: 6x

This data indicates a slight overvaluation. However, this aspect should only be taken into account with caution when making investment decisions.

Based on the current level, the following target can be envisaged: 4.8x

EV/Sales

Highest quarters:

- Median of all highest quarters: 6.1

- Average of all highest quarters: 6.09

- Median of the 3 highest of the highest quarters: 6.2

- Average of the 3 highest of the highest quarters: 6.23

Lowest quarters:

- Median of all lowest quarters: 5.05

- Average of all lowest quarters: 4.92

- Median of the 3 lowest of the lowest quarters: 4.5

- Average of the 3 lowest of the lowest quarters: 4.47

With a current value of 6x, a slight overvaluation could also be concluded here.

The target value is 4.8x.

Moats:

- Intangible assets : MercadoLibre has a strong market position.MercadoLibre has a strong brand in Latin America. Brand awareness and customer familiarity with the platform offer a significant competitive advantage.

- Customer switching costsBy integrating fintech and logistics services, MercadoLibre creates high switching costs. Users who rely on MercadoPago have an incentive to stay within the MercadoLibre ecosystem.

- Network EffectMercadoLibre benefits greatly from the network effect. The more users use the platform, the more valuable it becomes for sellers and buyers, further fueling growth.

- Cost Advantages: Thanks to its market leadership and growing economies of scale, MercadoLibre has cost advantages, particularly in the area of logistics (MercadoEnvíos), which the competition has difficulty catching up with.

Conclusion:

To summarize, MercadoLibre is a promising investment. In the long term, it is unlikely that the company will lose its position as market leader in Latin America - even against giants such as Amazon. MercadoLibre's strong competitive advantages mean that it is here to stay. MercadoPago in particular has significant profit potential. In the short term, however, I expect a significant correction between November and January. This phase could offer attractive entry opportunities.

My plan is as follows:

Purchase at €1,650-1,680

Buy at € 1,403-1,454

As soon as the probable "Christmas correction" is over, I will inform you about planned (partial) exits.

I will also keep you up to date on my specific purchase points!

Your stock duck