$KDP (+0,02%)

$7751 (-3,85%)

$NXPI (+0,52%)

$WM (-0,56%)

$CDNS (-0,72%)

$BN (-1,19%)

$SOFI (+1,4%)

$UNH (+2,77%)

$AMT (+0,77%)

$UPS (+8,53%)

$BNP (-3,96%)

$NVS (-2,93%)

$DB1 (-2,2%)

$MSCI (-0,54%)

$ENPH (-0,16%)

$BKNG (-0,03%)

$LOGN (-1,03%)

$V (-0,07%)

$MDLZ (-0,08%)

$PYPL (+14,58%)

$000660

$MBG (+0,73%)

$BAS (-0,53%)

$UBSG (+0,45%)

$SAN (+0,16%)

$CVS (+1,31%)

$OTLY (+1,1%)

$GSK (+0,52%)

$ETSY (-0,73%)

$CAT (-0,33%)

$KHC (-0,35%)

$ADYEN (-0,53%)

$ADS (-0,32%)

$AIR (-0,89%)

$SBUX (-0,21%)

$CMG (-0,06%)

$META (-0,08%)

$KLAC (-0,09%)

$MELI (-0,35%)

$WOLF (-0,38%)

$GOOGL (-0,1%)

$EQIX (-0,55%)

$MSFT (-0,17%)

$CVNA (+1,59%)

$EBAY (+0,29%)

$005930

$6752 (+2,1%)

$KOG (-0,53%)

$VOW3 (+0,25%)

$GLE (+0,86%)

$LHA (+0,2%)

$STLAM (+2,23%)

$SPGI (-0,1%)

$MA (-0,36%)

$PUM (+0,07%)

$AIXA (-0,58%)

$FSLR (+0,18%)

$AAPL (-0,21%)

$REDDIT (-0,95%)

$AMZN (+0,37%)

$NET (-0,35%)

$MSTR (-0,36%)

$GDDY (-0,44%)

$TWLO (+0,37%)

$COIN (+0,25%)

$066570

$CL (-0,27%)

$ABBV (-0,2%)

$XOM (-0,54%)

Discussione su MELI

Messaggi

122Quarterly figures 27.10-31.10.25

It's about time

Finally I 1. had enough cash and 2. Meli was once again pulled down by Mister Market at the beginning of October without any reason, so I was finally able to get my first Meli share. I've been waiting to get in since December 2024.

Briefly on the important things like figures etc.:

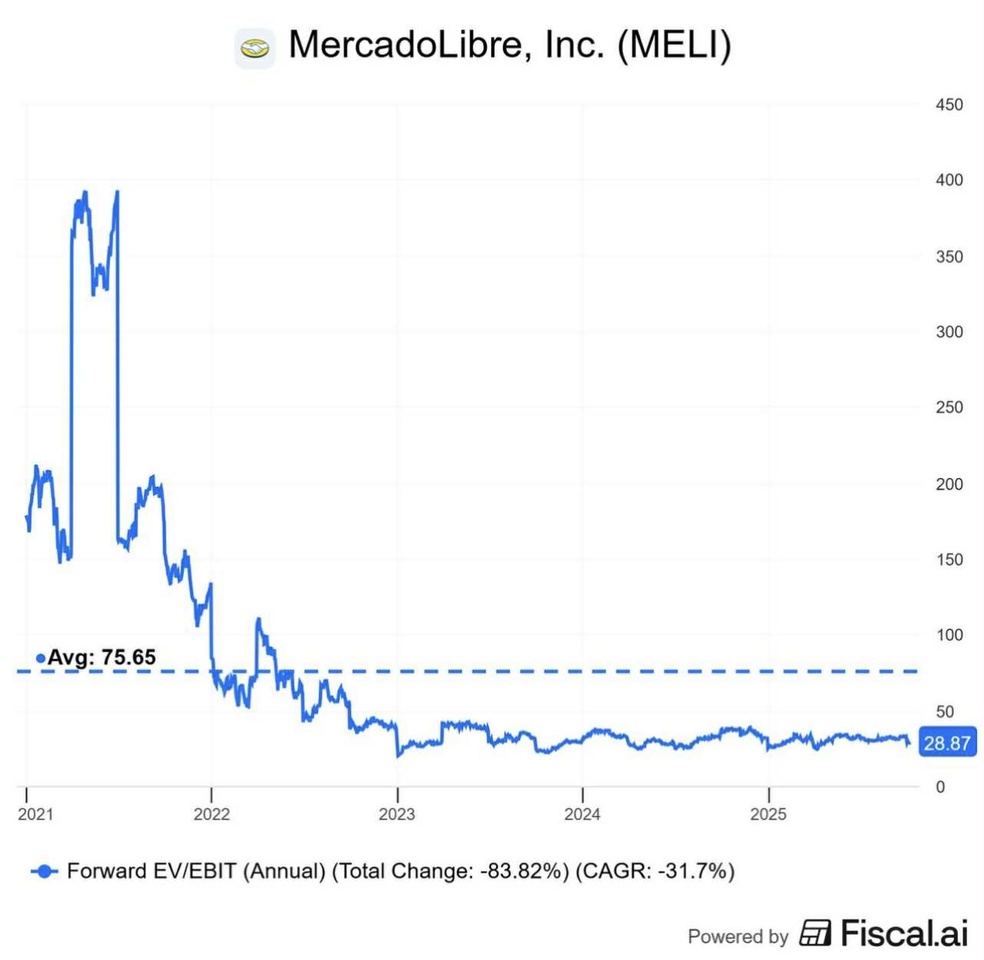

- Multiple Contraction is pretty massive at Mercado Libre, since the last highs in 2021 the stock has now made a whopping +12%

- In the meantime:

- Sales +617%

- EPS +1400%

- P/E ratio has fallen from 700+ to now approx. 37

- Future sales growth is expected to be 50% this year, then 33% and 20-25% over the next 5 years

- Margin should also increase from just under 8% to 15-16%, which will have a very positive impact on EPS and share price

- Strategically, Meli is well positioned, especially its e-commerce business continues to grow rapidly, also driven by the physical moat of the growing number of logistics centers in Latin America

- Financial Services with Mercado Pago grow 39% (dollar-adjusted!)

I would love to buy more $MELI (-0,35%) but I have to put something aside for a move :/

Mercado Libre: The Latin American Moat Nobody Is Pricing In

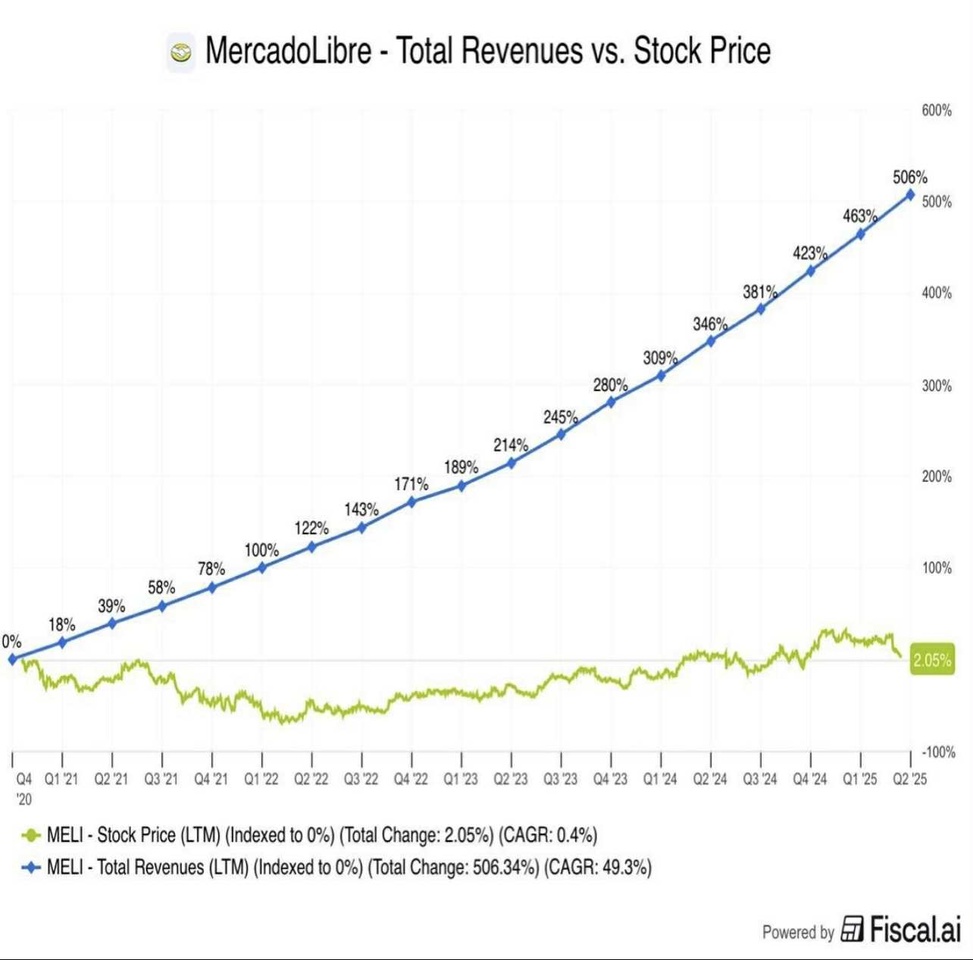

Despite a six-fold surge in revenues and spectacular execution, Mercado Libre $MELI (-0,35%) stock has barely budged since 2021, leading to the paradox of what might be one of the market’s greatest disconnects between company growth and investor sentiment. This article dives deep into the numbers, business segments, and why today’s valuation may signal a historic opportunity.

Business Model: Building an Unassailable Moat

Mercado Libre isn’t just “the Amazon of Latin America.” The company has methodically created its own moat with an e-commerce platform, digital payments, fintech innovations, and robust logistics that span the continent. Its strategic combination of marketplace (Amazon), fintech (PayPal), and merchant enablement (Shopify) is delivering rapid, compound growth across multiple verticals.

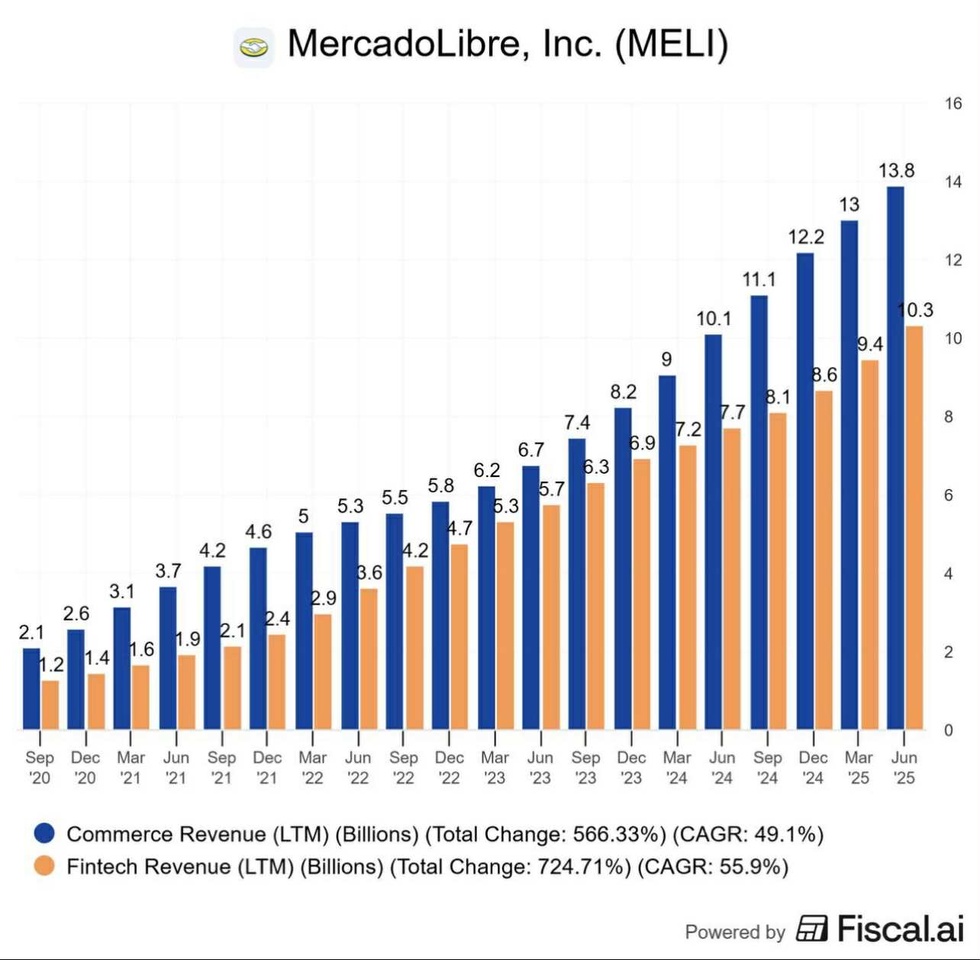

- E-commerce revenue has grown at a CAGR of 49.1%, hitting $13.8B by mid-2025.

- Fintech, the company’s second engine, exploded with a CAGR of 55.9%, reaching $10.3B over the same period.

- Commerce and fintech together compound the competitive advantages, driving adoption and recurring user engagement at scale.

Explosive Financial Growth: Revenue and Free Cash Flow

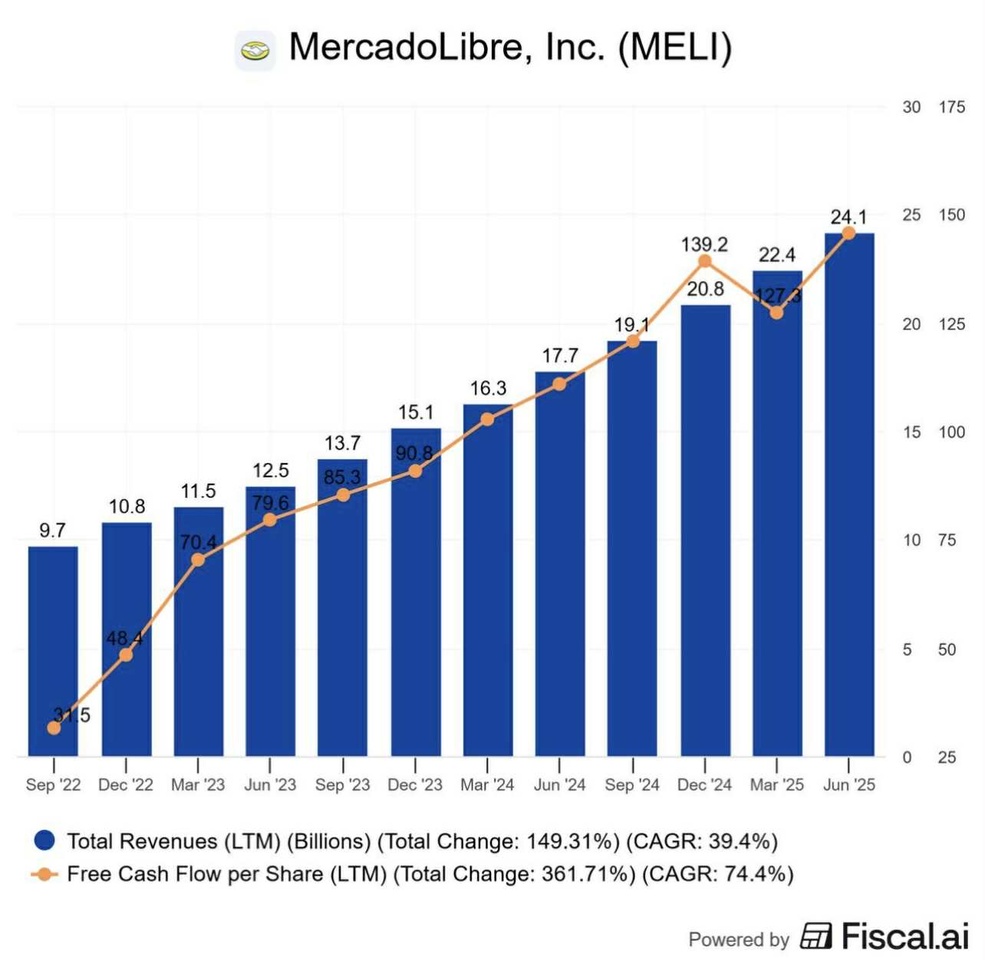

The topline story is almost hard to believe: since 2021, total revenues have skyrocketed over 500%, from less than $2B to above $14B. The company’s “flywheel” dynamic is obvious; user growth, merchant growth, and platform engagement are all translating into higher transaction volumes and revenue.

- Total revenues reached $24.1B LTM in June 2025, with a CAGR of nearly 40% since 2022.

- Free cash flow per share, a critical profitability metric, surged 361% (CAGR: 74%) in the same period, signaling Mercado Libre’s ability to turn top-line expansion into bottom-line results.

- The company’s strong financial discipline means reinvestment into new product launches while maintaining robust margins.

Valuation Paradox: Is Mercado Libre Critically Undervalued?

Yet the share price tells a different story. Since 2021, MELI stock is essentially flat (+2%), even as fundamentals have soared. This mismatch is starkly visible in forward EV/EBIT multiples:

- The forward EV/EBIT ratio collapsed by 83.8%, from peaks above 300x to just 28.9x in 2025 (CAGR: -31.7%), a multiple near historic lows for the company.

- Such a drastic contraction rarely persists when the company’s growth trajectory is this strong, especially in light of sector leadership and margin expansion.

- This signals that investor sentiment, not fundamentals, is driving the current share price. Historically, companies that build a strong moat and deliver outsized growth tend to dramatically outperform from such valuation troughs.

Segment Dynamics: Commerce, Fintech, and Logistics

Both e-commerce and fintech revenues are compounding quickly. The company’s investments in logistics, payment processing, and omnichannel capabilities are extending its competitive lead:

- Commerce revenue LTM reached $13.8B in June 2025, showing scale but also resilience against local competitors.

- Fintech revenue, under the MercadoPago and credit segments, advanced even faster, perhaps reflecting the growing importance of digital finance in Latin America’s fast digitizing economies.

Outlook: Why Now May Be the Turning Point

The convergence of explosive growth, robust cash flow, and deepening competitive advantages positions Mercado Libre for future market leadership. With valuation metrics at multiyear lows and continuous moat expansion, investors may be staring at a rare opportunity:

- Margin expansion continues with cost controls and scale, improving profitability quarter after quarter.

- The absence of significant stock price appreciation in the face of fundamental strength could catalyze a powerful re-rating if sentiment shifts.

Conclusion: Hidden Giant, Contrarian Play

Mercado Libre’s fundamentals paint a picture of an unstoppable Latin American digital titan, yet its valuation is stuck in the doldrums. Historically, such disconnects resolve with outperformance as the market aligns with the real business story. For disciplined investors, Mercado Libre presents not just growth but deep value—an opportunity that arises only when capital markets lose sight of fundamentals.

Oct 17 / Amazon & MercadoLibre — Stronger Than the Market Admits

Two Titans, Two Continents, Similar Playbook

Sometimes, if you want to invest in a certain business model, you can find multiple similar companies. And yes, Amazon and MercadoLibre have a closely related core business. However, they are so much more — in different ways. Both are ecosystem builders, not just online shops. Two conglomerates of commerce, logistics, payments, and data. Both dominate their respective continents. And, right now, both are under pressure, exactly the kind of pressure that tests conviction and might open opportunities.

Amazon’s issues aren’t new. AWS growth has slowed to the high teens, the retail segment has lost much of its appeal (to investors, at least), and AI expectations haven’t all been fulfilled. All these reasons led to a lack of performance for Amazon. The company is down this year, while the rest of the Mag7, and quite frankly, the market is running away. When you’ve built one of the most profitable infrastructure businesses in the world, markets suddenly expect miracles every quarter. That’s the curse of scale. Jeff Bezos constantly selling shares doesn’t help either. But even with that, you still have the world’s most sophisticated e-commerce and logistics network, one of the fastest-growing ad businesses on the planet, and a cloud empire that will keep compounding as AI usage expands. While Google Cloud and Azure are growing faster, investors should keep in mind that AWS is still the indisputable leader.

MercadoLibre (MELI), on the other hand, is what Amazon was a few years ago. Still smaller, but growing rapidly, and building up an unprecedented commerce ecosystem. MELI has another tailwind Amazon never had: many people in Latin America are first-time users of digital services. With phone and internet adoption, MELI is able to basically create customers out of thin air. Customers that don’t know (and don’t need to know) anything else, because MELI’s services are convenient and universal. All business segments continue to grow at double-digit rates, its marketplace dominance is untouchable, and ventures like its FinTech are rounding out the investment case. If you believe in Latin America’s long-term digital adoption, you can’t not believe in MercadoLibre. I am already heavily betting on this trend with Nu, but I wouldn’t mind adding to my conviction if the opportunity arises.

Both Amazon and MELI sit in that rare category of businesses where the short-term headwinds are simply the price of building something indestructible (which they have already done, to an extent). Their moats don’t just exist, they expand with every second they exist. While others chase the next AI narrative or speculative small caps, these two compound in silence, through infrastructure and habit.

I’m not pretending they’re cheap. I’m just saying they’re inevitable in the long run. Amazon below $200? I’ll buy. MercadoLibre below $1,800? Same story. Those are the levels where long-term investors make their best entries, not traders chasing momentum. We are only 10% away from my entry points, and I am excited.

For now, I don’t hold either yet. But these are the stocks you can buy, fall asleep, and wake up years later with a smile. They are the ultimate “peace of mind” growth plays.

Time to buy

$MELI (-0,35%) is down ~10% this week because Amazon announced that it wants to expand in South America or something like that.

Anyways, I believe in MercadoLibre and took this opportunity to purchase some stock at a discount.

Well, South america is Hard for logistic and I also believe that MercadoLibre will hold his Moat

Nice run but let's focus

$TMUS (+0,05%) was one of my first purchases, had a nice run but I see more potential in different positions and as this has kind of become a Micro-Position I decided to liquidate it and reporpuse it for $MELI (-0,35%)

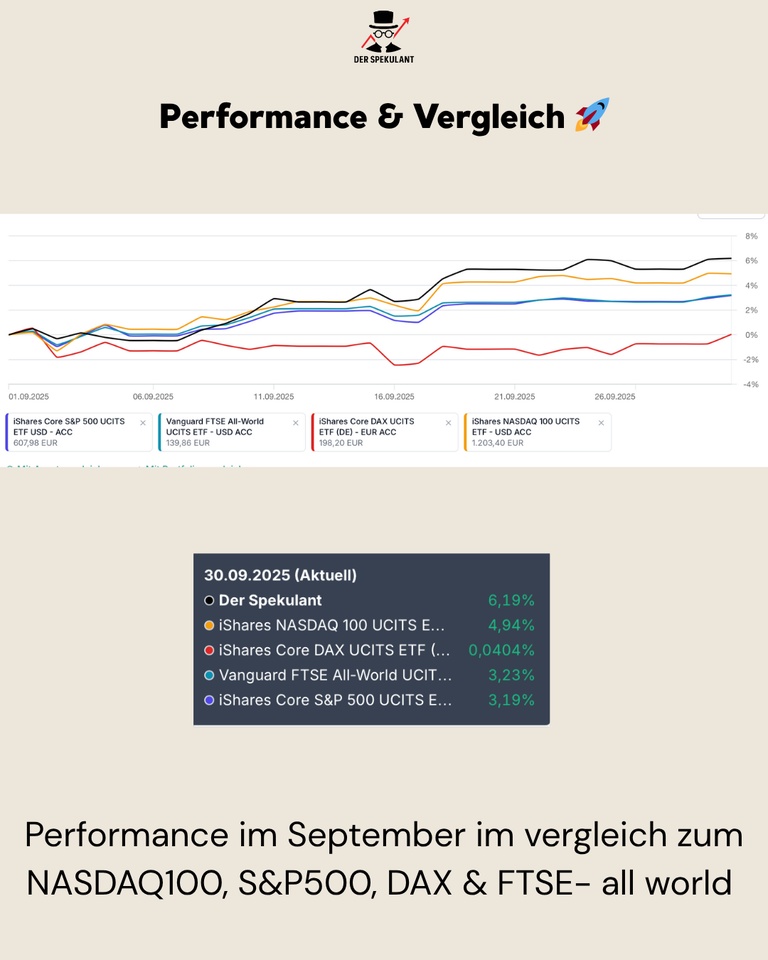

📊 My September 2025 portfolio update: strong performance & clear winners

September was a successful month - my securities account climbed to 38.827 € and gained +6,19 % significantly more than the major benchmarks (NASDAQ100: +4,94 %, S&P500: +3,19 %, FTSE All World: +3,23 %). I was thus able to clearly beat the market again. 🚀

1. performance & comparison 🚀

My portfolio benefited from a balanced mix: while individual techs performed well, other sectors provided additional stability. Particularly striking: the outperformance compared to the DAX & S&P, which were comparatively weak in September.

2. my savings plans & allocation 💶

As usual, my ETF savings plans continue to run consistently - with a focus on the solid foundation of MSCI ACWI $ACWI and World Small Cap $WSML (-0,46%). In addition, capital flows monthly into Berkshire Hathaway (B) $BRK.B (-0,38%) as a flexible, defensive allocation with optional cash flow leverage in a crash scenario.

In addition to the securities, I also invested € 180 in an original oil painting by Luciano Torsi in September - a small but deliberate step into alternative real assets. I am thus adding an aesthetic, real asset with long-term value retention potential to my allocation.

3rd top mover in September ✅

The list was headed by IREN $IREN (-2,11%) (+76%), which benefited from the strong demand for AI data centers. Also American Lithium (+36 %) also showed strength. Alibaba $Baba (+35 %) made significant gains thanks to cloud growth, in-house chip development and the rejection of NVIDIA chips. Rheinmetall $RHM (+0,5%) (+17 %) continued to benefit from high defense demand, while the uranium sector (+16 %) and Crowdstrike $CRWD (+1,63%) (+14 %) also performed well.

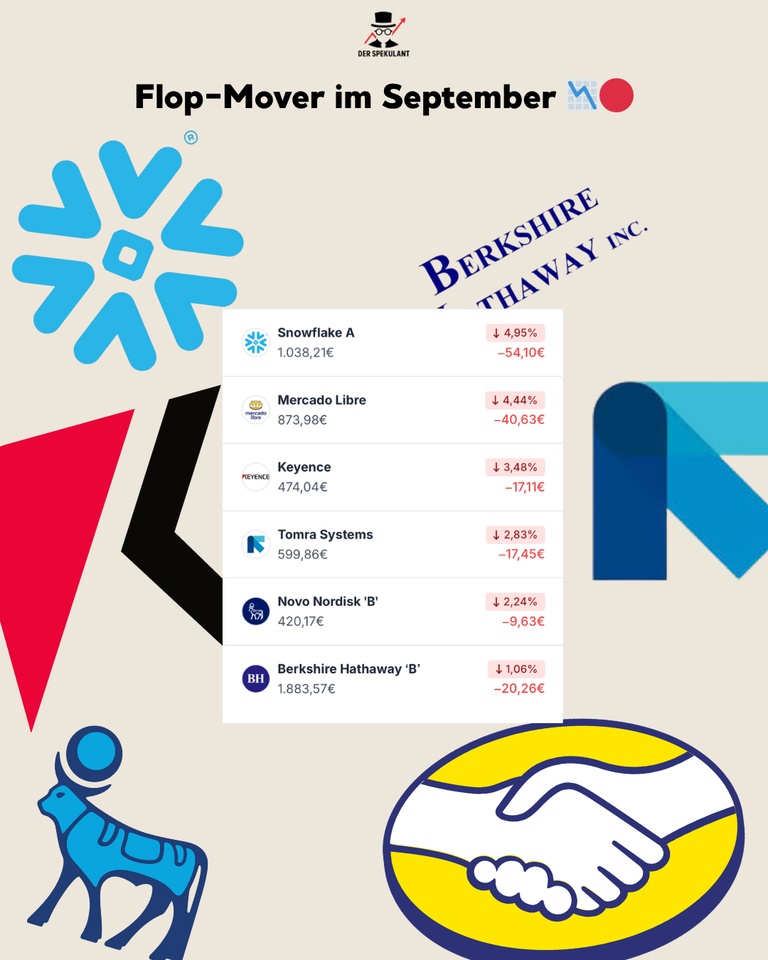

4th flop mover in September ❌

On the opposite side Snowflake

$SNOW (-0,17%) (-5%) lost some ground as investors became increasingly critical of its high valuation - despite solid figures. Also Mercado Libre

$MELI (-0,35%) (-4 %) also suffered from profit-taking after a strong summer rally. Keyence $6861 (-0,96%) (-3 %) and Tomra Systems $tomra (-2.8 %) corrected slightly without the fundamental picture deteriorating. The month was somewhat weaker for Novo Nordisk

$NOVO B (-0,77%) (-2.2 %), which continues to struggle with political risks and patent concerns in the GLP-1 segment. Even Berkshire Hathaway fell slightly (-1 %).

5. conclusion 💡

My September shows: Diversification pays off. Individual techs like Snowflake are correcting, but satellites like IREN and Alibaba are more than compensating for this. With the savings plan on Berkshire, I remain defensively prepared should volatility increase in Q4.

❓ Question for the community:

Which value surprised you the most in September - positive or negative?

+ 1

I also really like your great graphic underpinning.

You seem to be very creative.

It might be interesting to do a study on whether creative investors are more successful

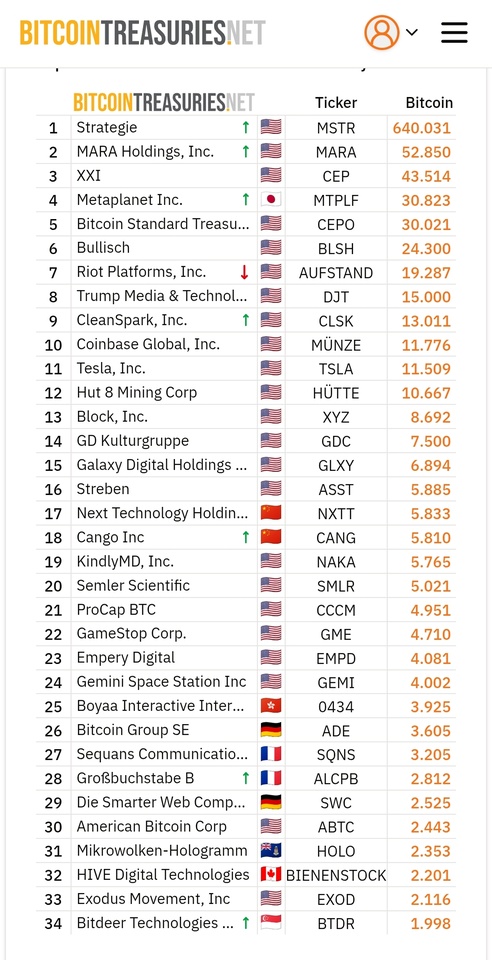

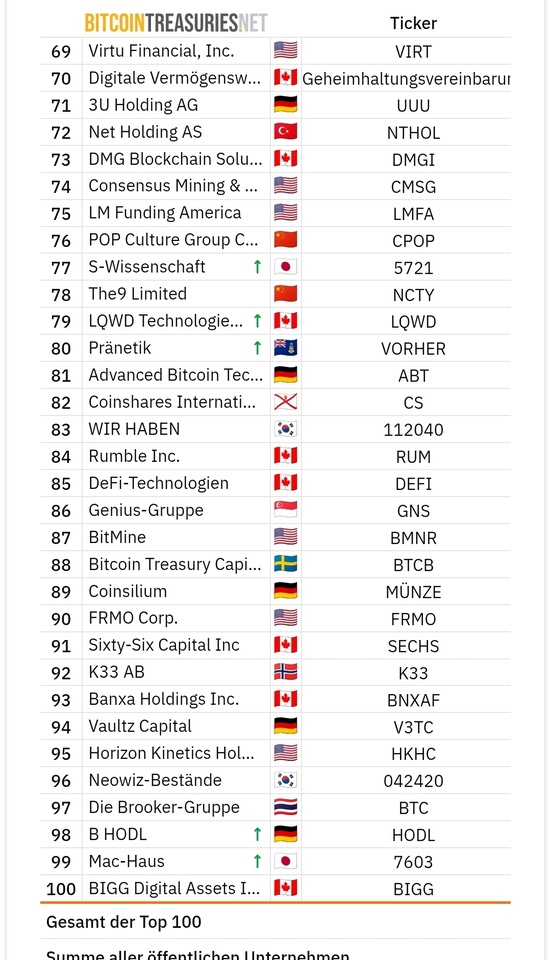

Crypto treasury, top or flop?

Hello my dears,

Opinions are divided right here.

And everyone says something different.

What is your opinion here? @stefan_21

permanent economic engines?

or rather a.

phase-out model?

Which companies do you still see at the forefront, and which would you rather stay away from?

Why can companies like Mara, Block or coinbase hardly benefit from this hype?

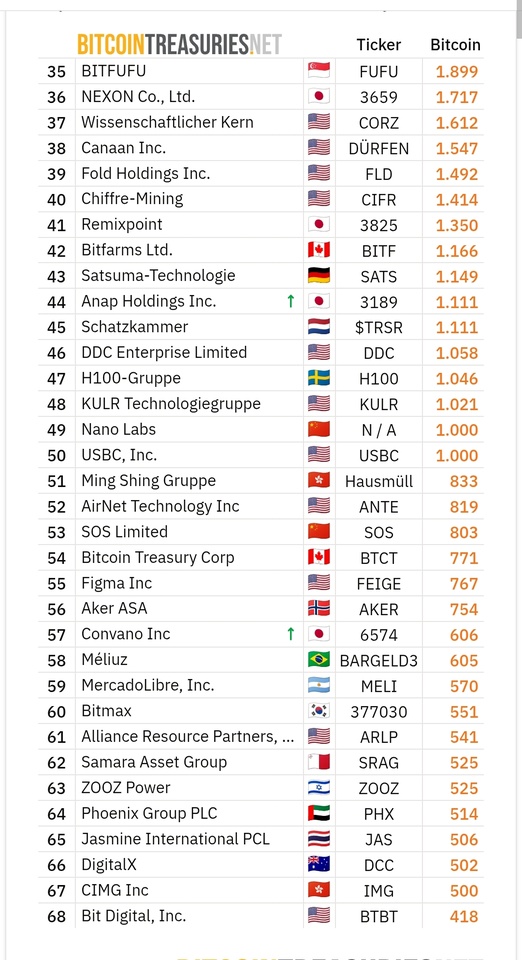

By the way, companies like

$MELI (-0,35%) hold 570 Bitcoin

$DEFI (-1,62%) hold 204 Bitcoin

$COIN (+0,25%) hold 11,776 Bitcoin

which makes the companies attractive in addition to their traditional business model.

And these companies tend to be my favorites because of their traditional business model.

Crypto treasury companies could become giants like Berkshire Hathaway in the long term, says analyst

Bitcoin balance sheets demystified - one in four companies worth less than their coins

A new analysis by K33 Research reveals how risky the strategy of many listed companies to fill their balance sheets with Bitcoin is. The market is punishing them - in some cases, the companies are worth less than their own crypto holdings.

21.09.2025 - 10:00 am

Bitcoin treasury: The house of cards is collapsing - one in four companies worth less than their coins

Treasurys in particular, which accumulate altcoins, will not survive in the long term in my opinion.

Sale Amazon

Today I have completely separated myself from my $AMZN (+0,37%) position today. The reasons for my decision:

○ Disappointing price performance YtD, especially in comparison with other Mag7 stocks

○ Nice price performance of approx. 40% since initial purchase in January 2024

○ No significant AI models and intentions recognizable. Could only become interesting for me again with the advent of humanoid robots

○ Reduction of duplication in the portfolio, as I am working with $MELI (-0,35%) & $9988 (-1,52%) in eCommerce and with $GOOGL (-0,1%) & $9988 (-1,52%) in the cloud sector to other stocks in the portfolio.

I will invest the freed-up capital in Hopfengold at the Oktoberfest in Munich at the weekend. The (hopefully) remaining amount will then flow into the $EQQQ. (-0,08%)

Titoli di tendenza

I migliori creatori della settimana