Black Friday today?

Estee Lauder Azione Forum

AzioneAzioneDiscussione su EL

Messaggi

10Estee Lauder Q3 2024 $EL (-3,08%)

Financial performance

- Net salesEstée Lauder reported net sales of $3.361 billion for the three months ended September 30, 2024, a decrease of 4% compared to the same period in 2023.

- Operating profitThe company reported an operating loss of USD 121 million, a significant decrease from an operating profit of USD 98 million in the previous year.

- Adjusted operating profitAdjusted operating income : On a constant currency basis, adjusted operating income increased by 23% to USD 133 million, indicating improved operational efficiency despite the overall decline in sales.

Balance sheet overview

- Total assetsAs of September 30, 2024, total assets amounted to USD 21.317 billion, a decrease from USD 22.650 billion in the previous year.

- Total liabilitiesTotal liabilities decreased slightly to USD 16.233 billion, compared to USD 16.482 billion in the previous year.

- Shareholders' equityEquity amounted to USD 5.084 billion, compared to USD 5.342 billion in the previous year.

Details of the income statement

- Gross profitGross profit amounted to USD 2.433 billion, with minimal changes compared to the previous year.

- Diluted EPS: Diluted EPS was $(0.43), compared to $0.09 in the prior year, indicating a significant decrease in profitability.

Cash flow overview

- Operating cash flow: Net cash used in operating activities was $670 million, an increase from $408 million in the prior year, indicating higher outflows.

- Capital expenditureCapital expenditure decreased to USD 141 million compared to USD 295 million in the previous year, reflecting a prudent investment strategy.

Key performance indicators and profitability metrics

- Adjusted EPSAdjusted EPS was USD 0.14, an increase of 33% compared to the prior year, highlighting the resilience of the core operations.

- Effective tax rate: The effective tax rate for the second quarter is estimated to be approximately 43%.

Segment information

- AmericasNet sales decreased by 1%, with challenges in North America partially offset by growth in Latin America.

- Europe, Middle East and AfricaNet sales decreased by 4%, mainly due to a decline in the global travel market.

- Asia PacificNet sales fell by 11%, led by declines in Mainland China and Hong Kong SAR.

Competitive position

Estée Lauder continues to face challenges in the prestige beauty segment, particularly in China and the Asian travel market. However, the company sees potential for growth opportunities resulting from new economic stimulus measures in China.

Forecasts and management comments

- Sales forecastThe company forecasts a decline in reported and organic net sales of between 6% and 8% for the second quarter of financial year 2025.

- Earnings guidanceReported diluted net income per common share is estimated to be between USD 0.02 and USD 0.19.

Risks and opportunities

- RisksRisks and opportunities : These include the continued slow growth in the prestige beauty sector in mainland China, the challenging retail environment in the Asian travel market and macroeconomic factors such as currency volatility and inflationary pressures.

- OpportunitiesPotential growth in the medium to long term due to economic stimulus measures in China.

Summary of results

Estée Lauder faced challenges this quarter, resulting in a decline in net sales and an operating loss. The company is navigating through a complex market environment, particularly in China and the Asian travel market, which has negatively impacted its financial performance. Despite these challenges, strategic investments are being made to support future growth and innovation. The reduction of the dividend reflects a prudent approach to maintain financial flexibility. Looking ahead, Estée Lauder aims to capitalize on potential growth opportunities while managing the risks of the current economic environment.

Positive aspects

- Increase in adjusted operating profitAdjusted operating profit increased by 33% to USD 159 million, indicating improved operational efficiency despite the overall decline in sales.

- Growth in Latin AmericaThe Americas region saw growth in Latin America, particularly with high single-digit growth in Brazil, supported by strength in the make-up category.

- Online growth in the USAThe company experienced double-digit online growth in the United States, driven by the launch of seven brands on Amazon's US premium beauty store.

- Strategic product innovation: New product innovations within the Advanced Night Repair and Revitalizing Supreme + product lines contributed to sales growth in Europe, the Middle East and Africa.

- Gross margin expansionThe Profit Recovery and Growth Plan led to an expansion of the gross margin, which is a positive indication of cost management and pricing policy.

Negative aspects

- Decrease in net salesThe company reported a 4% decline in net sales, with significant declines in key regions such as Asia/Pacific, where a decline of 11% was observed.

- Net lossThe company reported a net loss of USD 156 million, mainly due to charges related to Talcum litigation settlements.

- Challenges in China and the Asian travel marketConsumer sentiment in China has deteriorated, leading to a further slowdown in the prestige beauty market and low conversion rates in the Asian travel market and Hong Kong SAR.

- High effective tax rateThe effective tax rate for the second quarter is expected to be around 43%, which will have a negative impact on net profit.

- Withdrawal of the forecast for the full year: Due to increasing uncertainty over the timing of market stabilization in Mainland China and the Asian travel market, the company withdrew its forecast for FY2025, indicating a lack of visibility on future performance.

$EL (-3,08%) | Estée Lauder Q1 Earnings Highlights:

🔹 Adjusted EPS: $0.14 (Est. $0.09) 🟢

🔹 Revenue: $3.36B (Est. $3.37B) 🔴; DOWN -4% YoY

🔹 FY25 Guidance Withdrawn due to uncertainty in China and Asia travel retail recovery 😕

🔹 CUTS Dividend by 47% 😕

Q2 Guidance:

🔹 Adjusted EPS: $0.20 - $0.35 (Est. $1.09) 🔴; expected decrease of 77% to 60% YoY

🔹 Revenue Decline: Projected DOWN -8% to -6% YoY

Segment Performance:

Skin Care

🔹 Revenue: $1.53B; DOWN -8% YoY

🔹 Growth in EMEA and The Americas, led by Advanced Night Repair and Revitalizing Supreme+

🔹 Declines driven by La Mer and Estée Lauder in China and Asia travel retail due to lower consumer sentiment

Makeup

🔹 Revenue: $1.04B; DOWN -2% YoY

🔹 Declines led by M·A·C (North America softness) and Too Faced

🔹 Clinique up double digits, fueled by strong lip product performance and Amazon launch

Fragrance

🔹 Revenue: $630M; DOWN -1% YoY

🔹 Growth in EMEA and Asia/Pacific, driven by Le Labo and new BALMAIN Beauty launch

🔹 TOM FORD and Jo Malone London flat due to travel retail challenges

Hair Care

🔹 Revenue: $139M; DOWN -6% YoY

🔹 Driven by Aveda, reflecting shipment timing and North America salon softness

Regional Performance:

The Americas

🔹 Revenue: $1.19B; DOWN -1% YoY

🔹 Growth in Latin America, offset by softness in North America (M·A·C, Aveda)

Europe, Middle East & Africa (EMEA)

🔹 Revenue: $1.23B; DOWN -4% YoY

🔹 Decline led by Asia travel retail pressures and market deceleration

🔹 Gains in online and direct-to-consumer channels

Asia/Pacific

🔹 Revenue: $944M; DOWN -11% YoY

🔹 Double-digit growth in Japan, offset by softness in mainland China and Hong Kong SAR

Dividend Update:

🔹 Quarterly Dividend: $0.35/share, reduced by 47% from $0.66

🔹 Payable December 16, 2024, to shareholders as of November 29, 2024

✨ Who is the beauty king? A look at the stars of the cosmetics stocks ✨

For the development (company figures), a better view and more, check out the free blog: https://topicswithhead.beehiiv.com/p/wer-ist-der-beauty-k-nig-ein-blick-auf-die-stars-der-kosmetik-aktien

Company presentation

L'Oréal, the world's leading cosmetics group, is based in France and looks back on a history of over one hundred years. Founded in 1909, its portfolio today includes more than 35 brands spanning skin care, make-up, hair care and fragrances.

e.l.f. Beauty is an up-and-coming US cosmetics company that has stood for affordable yet high-quality products since it was founded in 2004. The brand is particularly popular with younger consumers.

Beiersdorf, a traditional German company founded in 1882, specializes in skin care products. The company is particularly well known for its NIVEA brand, which is synonymous with skin care worldwide.

Estée Lauder was founded in New York in 1946 and has developed into a leading provider in the prestige beauty segment. The company owns over 30 luxury brands and is an established player on the international market.

Historical development

$$OR (-2,66%) has grown through constant innovation and strategic acquisitions and is now represented in over 150 countries.

$ELF (+4,57%) has experienced rapid growth in recent years, driven by digital strategies and the development of new sales channels.

$BEI (-0,46%) NIVEA has developed from a small pharmacy into a global company. The NIVEA brand was launched in 1911 and is now one of the best-known skin care brands in the world.

$EL (-3,08%) NIVEA grew from a small family business into an international cosmetics giant. Through international expansion and acquisitions, the company was able to diversify and constantly expand its portfolio.

Business model and core competencies

L'Oréal is based on a broadly diversified brand portfolio, intensive research and development and a strong global presence. The company operates in four divisions: Consumer Products, L'Oréal Luxe, Active Cosmetics and Professional Products.

e.l.f. Beauty focuses on affordable, trendy products and is increasingly using digital marketing strategies and e-commerce to appeal to young target groups.

Beiersdorf focuses on skin care and has extensive expertise in the development of innovative formulations. The company also operates a successful adhesives business with Tesa.

Estée Lauder specializes in prestige beauty products and excels in product innovation, luxury marketing and global distribution. The company is active in four main categories: Skincare, Makeup, Fragrance and Haircare.

Future prospects and strategic initiatives

L'Oréal is investing heavily in sustainability, digitalization and personalized beauty solutions. The company is also increasingly focusing on AI-supported technologies and expanding its portfolio in the area of "clean beauty".

e.l.f. Beauty plans to further develop its digital presence and expand into new product categories and international markets.

Beiersdorf is focusing on innovations in the area of skincare, particularly sustainable and natural products, while also investing in the digitalization of its brands.

Estée Lauder is aiming to expand into growth markets, particularly in Asia, and is focusing on strengthening its digital presence. The company is also investing in sustainable packaging solutions and "clean beauty" products.

Market position and competition

L'Oréal maintains its leading position in the global cosmetics industry with a market share of over 14%.

e.l.f. Beauty has established itself as a strong challenger in the mass market and continues to gain market share, especially among younger consumers.

Beiersdorf is a leading player in the European skincare market and competes directly with companies such as Unilever and Procter & Gamble.

Estée Lauder is the second largest cosmetics group in the world and dominates the prestige beauty segment. Its main competitors are L'Oréal Luxe and LVMH.

Total Addressable Market (TAM)

The global cosmetics market was estimated at around 430 billion US dollars in 2022 and is expected to grow to over 700 billion US dollars by 2030. This growth is being driven by rising demand in emerging markets, the boom in e-commerce and the trend towards natural and sustainable products.

For the development (company figures), a better view and more, check out the free blog :https://topicswithhead.beehiiv.com/p/wer-ist-der-beauty-k-nig-ein-blick-auf-die-stars-der-kosmetik-aktien

Conclusion

L'Oréal is undoubtedly the best value in the comparison. The company shows solid growth, has an attractive net debt to EBITDA ratio and is valued roughly in line with other companies in the cosmetics sector. Although it is unfortunate that the location in France leads to additional costs due to financial transactions and withholding taxes, this disadvantage is mitigated for long-term investors by the strong positioning. Looking at the industry, which is growing by around 5% annually, L'Oréal is in an excellent position. Moreover, the company does not shy away from M&A activities and the acquisition of brands. The capital efficiency of these transactions also appears positive, especially when considering the non-declining returns on capital. Overall, L'Oréal is the best approach to be invested in the cosmetics industry. However, L'Oréal does not have to be the only stock in the portfolio. A mix of L'Oréal and possibly Unilever or P&G could provide a good mix of different industries in the consumer goods sector.

I don't want to speak against the other companies.

Estée Lauder has a strong brand, but it remains to be seen how well the company can recover from its recent difficulties. Especially in the luxury cosmetics segment, such weakness leaves the impression that something is wrong.

Beiersdorf, on the other hand, is lagging behind the market. In my opinion, the company does not have the strongest brands and is also heavily dependent on Tesa. Nevertheless, Beiersdorf is growing sufficiently to offer good prospects for the future. However, as make-up is heavily dependent on brands, I do not see Beiersdorf as a convincing investment, even if there is perhaps more potential than I would expect.

Elf Beauty is aligned with the hype and trends in the industry and has proven that they are able to actively manage this. However, the company is a little too small for me. Personally, I would prefer a broader range of brands in the cosmetics industry, which Elf does not offer to this extent.

For me, this means that an entry into L'Oréal at around 340 euros would be interesting. The value that came out of the DCF.

📣 All these stocks hit new 52 WEEK LOWS at some point today

📣 All these stocks hit new 52 WEEK LOWS at some point today

Boeing $BA (+1,21%)

Chevron $CVX (+0,94%)

Occidental $OXY (-0,67%)

Mobileye $MBLY

Bath & Body Works $BBWI (-4,3%)

Franklin Resources $BEN (-0,75%)

Cleveland Cliffs $CLF (-3,4%)

Conoco $COP (+0,01%)

Coterra $CTRA (+0,97%)

Devon Energy $DVN (+0,89%)

Estee Lauder $EL (-3,08%)

Equinor $EQNR (+0,29%)

GlobalFoundries $GFS (-2,07%)

Halliburton $HAL (-0,29%)

Hess $HES

Nucor $NUE (-0,61%)

Mosaic $MOS

Schlumberger $SLB (+0,56%)

Stellantis $STLAM (-3,56%)

Top Golf $MODG (-1,9%)

Dave & Bysters $PLAY

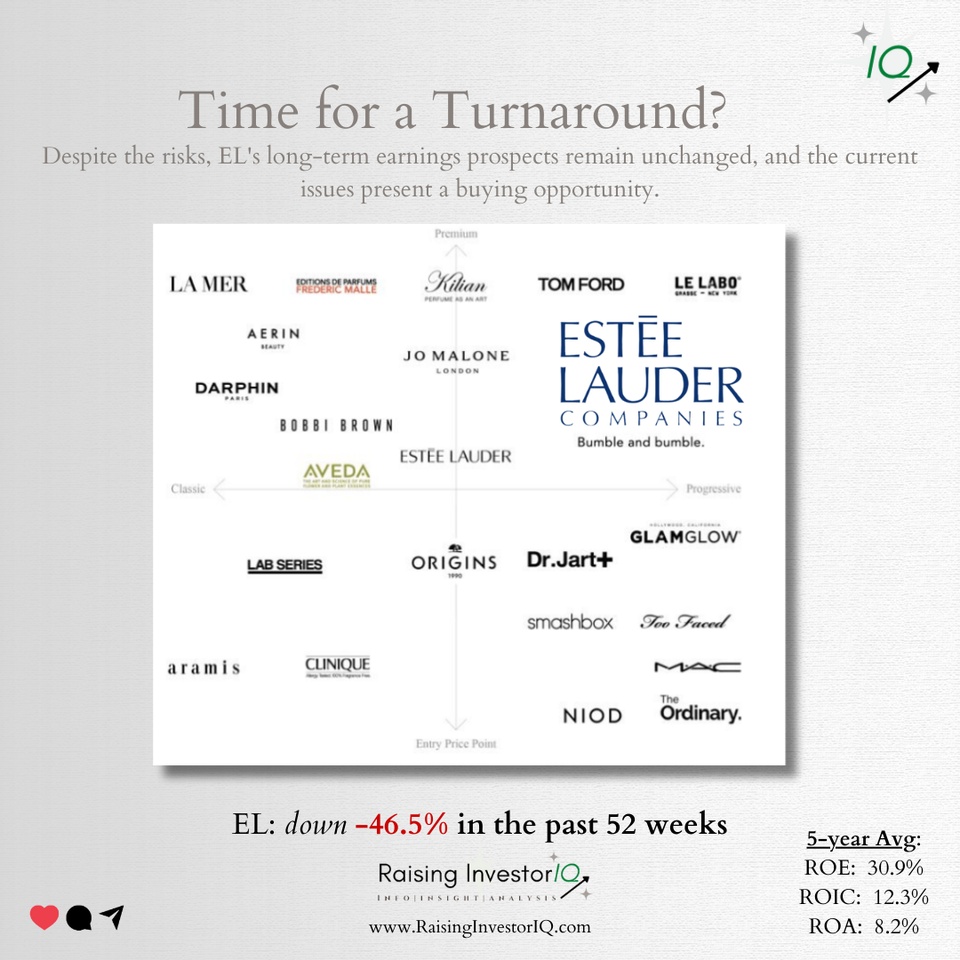

We've held a position in $EL (-3,08%) since 2015, and it's stock has been on our watchlist as a potential value play recently with the decline in its stock price.

Hard to time the turning point, but it's poised for a rebound with long-term upside. Strong brand with a durable competitive advantage and consistently attractive returns on capital. Just scooped up 50 more shares, as prices are now at decent levels and we feel confident in the long-term upside.

Have me over the weekend times further looked around here on getquin and find the input so far really super exciting! Under my last post was also the Estee Lauder share of @axr was mentioned. What do you think of the company? On 18.08. follow the quarterly figures - Remains for now on my watchlist! 💄

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗞𝗿𝘆𝗽𝘁𝗼 𝗚𝗲𝘀𝗲𝘁𝘇𝘁 𝗶𝗻 𝗕𝗿𝗮𝘀𝗶𝗹𝗶𝗲𝗻 / 𝗦𝗔𝗣 𝘇𝗮𝗵𝗹𝘁 𝗦𝗼𝗻𝗱𝗲𝗿𝗱𝗶𝘃𝗶𝗱𝗲𝗻𝗱𝗲 / 𝗕𝗲𝘆𝗼𝗻𝗱 𝗠𝗲𝗮𝘁 𝘀𝗰𝗵𝘄𝗮𝗰𝗵

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, BASF ($BAS (-5,27%)) , Swiss Re AG ($SREN (-0,8%)) and Energy Inc ($NRG (-0,11%)) present their quarterly figures.

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Union Pacific ($UNP (+0,35%)), Estee Lauder Companies Inc ($EL (-3,08%)) and Mowi ASA ($MOWI (-0,51%)) are trading ex-dividend.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

SAP ($SAP (-0,4%)) - German software giant SAP announces a special dividend of 0.50 cents to mark the company's 50th anniversary. The total dividend payout this year is €2.45 per share. "Our strategy of accelerating our transition to the cloud business is paying off. We have had an outstanding year with strong results and we want our shareholders to share in this success with an increased dividend," said CFO Luka Mucic.

Beyond Meat ($BYND (-6,66%)) - In the fourth quarter of 2021, Beyond Meat widened its year-over-year loss. After a loss of $0.400 per share a year ago, the loss for the quarter was $1.27 per share. Analysts had previously expected EPS of -$0.700. On the revenue side, things were also worse, with revenue at $100.7 million, down from $101.9 million in the same period a year ago. Beyond Meat thus underperformed analysts' estimates, which had amounted to $101.0 million in advance.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

On Tuesday, February 22, 2022, Brazil initiated a framework to legalize cryptocurrencies in the local market. The initiative could be a milestone for the growth and development of digital cryptocurrencies in Brazil.

The Brazilian Senate's Economic Committee jointly approved a bill to regulate cryptocurrencies, paving the way for a vote in the Senate and subsequent forwarding for further consideration. If the National Congress approves the bill, it will eventually be sent to President Jair Bolsonaro for approval.

Assuming the bill is accepted, it will become part of law. In this case, Brazil will become the first major Latin American country to have clear rules and regulations for investing in digital cryptocurrencies.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗦𝗔𝗣'𝘀 𝗖𝗹𝗼𝘂𝗱 / 𝗕𝗮𝘁𝘁𝗲𝗿𝗶𝗲-𝗔𝘂𝗳𝘁𝗿𝗮𝗴 / 𝗘𝗹 𝗦𝗮𝗹𝘃𝗮𝗱𝗼𝗿 𝗯𝗼𝘂𝗴𝗵𝘁 𝘁𝗵𝗲 𝗗𝗶𝗽 / 𝗞𝗿𝘆𝗽𝘁𝗼 𝗶𝗺 𝗻𝗲𝘂𝗲𝗻 𝗞𝗼𝗮𝗹𝗶𝘁𝗶𝗼𝗻𝘀𝘃𝗲𝗿𝘁𝗿𝗮𝗴

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Allstate ($ALL (+4,14%)), Barrick Gold ($ABX (+0,47%)), Brookfield Asset Management ($BAM), CSX Corporation ($CSX (+1,82%)), Dow, Inc. ($DOW (-4,21%)), DuPont de Nemours ($DD (-2,43%)), Estée Lauder Companies ($EL (-3,08%)) and Moët Hennessy Louis Vuitton ($MOHF (-2,82%)) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Li Auto ($LI (-6,75%)) presents its figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

SAP ($SAP (-0,4%)) - SAP CEO Klein says SAP is becoming one of the largest cloud companies in the world. The focus on the cloud is expected to attract new investors to the software giant. After announcing a new strategy about a year ago, SAP's share price had crashed 20 percent in one day. Klein said that decision had been the right one and that the future lies in the cloud. SAP shares were up 2.76 percent at times on Monday to 117.33 euros.

Stellantis ($STLA (-3,56%)) - German lithium producer Vulcan Energie wins a major contract from Opel parent car company Stellantis. Vulcan is to supply between 81,000 and 99,000 tons of battery-grade lithium hydroxide to the auto group for at least five years starting in 2026. The lithium is to be extracted from thermal water from the Upper Rhine Graben. By simultaneously using the heat of the water extracted from the depths, the lithium is to be CO2-neutral. In view of the growing electric car boom, Vulcan Energie is considering going public.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

El Salvador - Salvadoran President Nayib Bukele celebrated Black Friday by buying the dip again for 20% off. Five million US dollars were invested again and the total Bitcoin ($BTC (+0,41%)) rose to 1,220 BTC for El Salvador with a value of about 66.3 million US dollars.

The Federal Government - The coalition agreement of the new federal government mentions crypto for the first time. The new coalition wants to make the "European Financial Market Supervisory Law" fit for crypto assets and companies. A level playing field between traditional finance and "innovative business models" is to be advocated.

Follow us for french content on @MarketNewsUpdateFR

Titoli di tendenza

I migliori creatori della settimana