Adobe

$ADBE (-0,7%) has announced the extension of its Firefly-family with a video function for creative generative AI models announced. With the Firefly function, images and videos can be generated using prompts can be generated using prompts.

Adobe Azione Forum

AzioneAzioneDiscussione su ADBE

Messaggi

110ADOBE IS FACING SOME SERIOUS PROBLEMS

Reading time: 3 min.

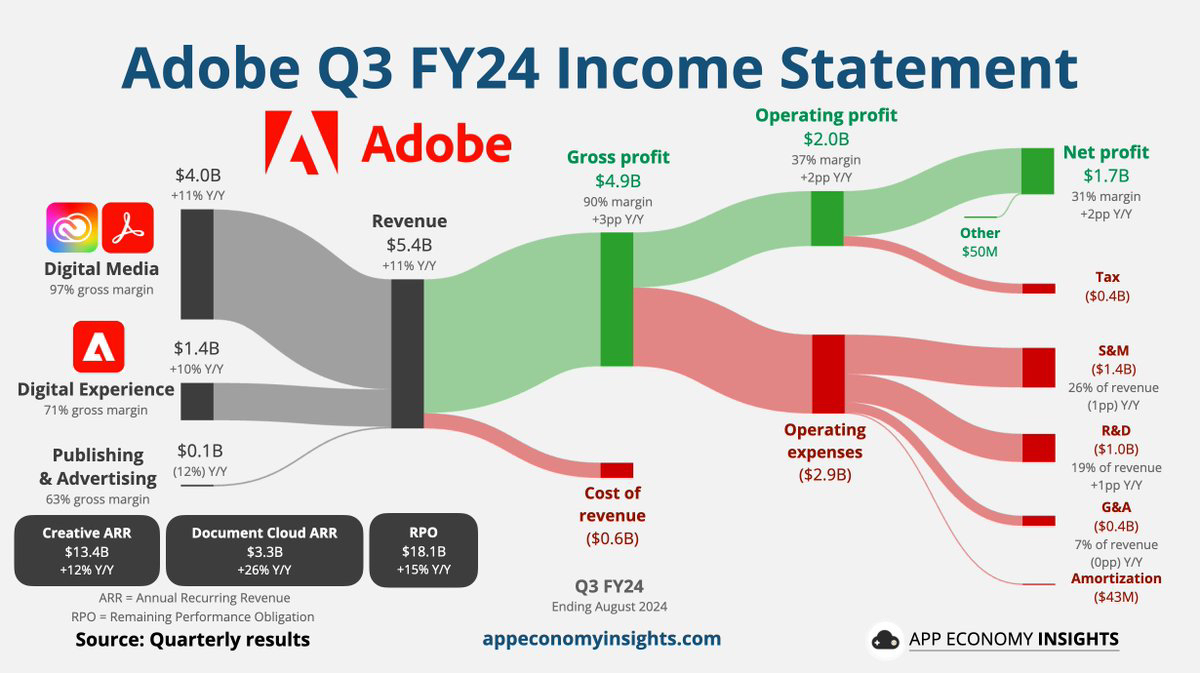

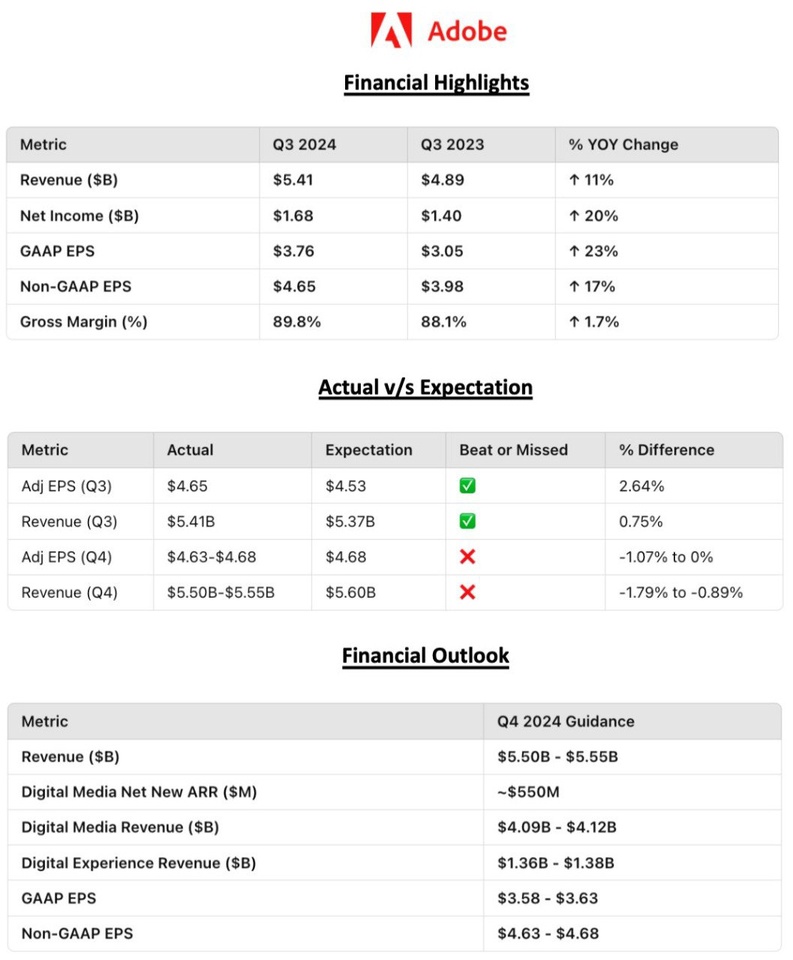

Recently $ADBE (-0,7%) has posted his earnings and it was a good quarter.... on the surface.

No, I am not going to talk about the outlook that send the stock down 10%.

I am going to talk about the bad business practices that Adobe has been perpetrating in this months (especially in the USA wich represent 60% of their revenue)

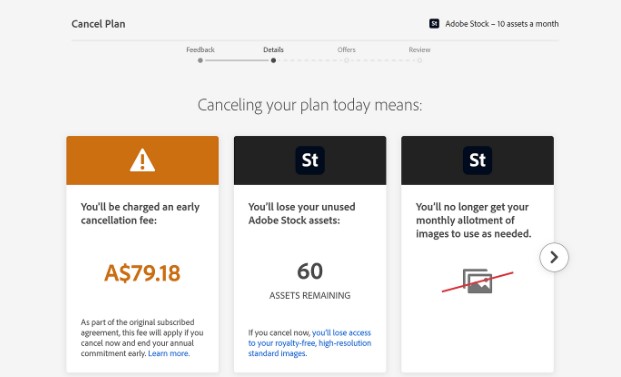

In the USA if you want to unsuscribe to Adobe monthly or annual plan of their products you have to pay a fee up to 50% of the value of your annual/monthly membership. Yes, you read it correctly. A fee to unsuscribe... that's crazy.

This was causing a lot of anger among users and the problem became so big that the FTC (USA Federal Trade Commission) took action against Adobe in order to stop this from happening.

Adobe tryed to defend his methods by saying that less than 1% of the revenue came from the "unsuscribe fee".

So, if less than 1% of revenue is causing all of these negative backlashes why they don't just remove it?

Well, because it is more than 1%.

Many users on Reddit (and on other forums) explained that they preferred keep paying for the 1 year membership rather than unsunscribe because the process was extremely difficult and, at the end, they were also gonna pay a big fee to unsubscribe.

In Europe if you want to stop a subscription service you can simply click on the "Unsuscribe" button or stop paying when you are no more interested in the service.

Many times there is also the possibility to flag if you want to stop the automatic monthly billing.

With Adobe (in the USA) this is not possible.

They removed the possibility to stop the automatic monthly charge and if you want to unsubscribe, especially if you have a business account, you have to call them several times begging to remove the membership.

Many Reddit's users said that they had to call 2-3 times, while others affirmed that it was easier closing their bank account and open a new one in order to stop the automatic monthly billing.

Unfortunately the bad news don't stop here...

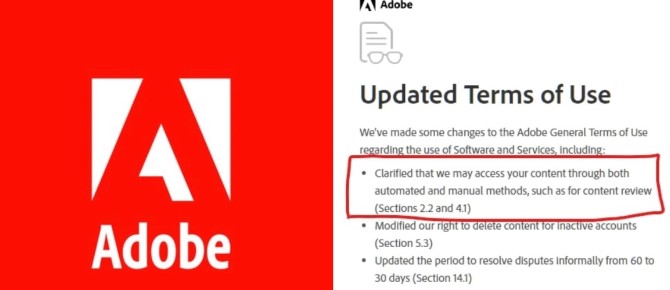

With the latest "Terms and conditions agreement", that every user was forced to accept in order to use their products, Adobe had the possibility to view, read and use in any possible way every file on your Pc.

Every..single..file.

Then, they'll use all of these materials to train their generative AI "Firefly".

This caused a lot more anger against Adobe and many users started to upload vicious files to damage "Firefly" learning.

When this news reached the Media and many posts on X reached over 30 milions views Adobe quickly changed their "Terms and conditions agreement" by saying that they will not use any file on customers Pc to train their AI and that Adobe can not see or use any file on a customer's PC.

Why Adobe didn't do that from the beginning?

Why did it take a lot of angry people on X and Reddit to change things?

Why management is so greedy?

They don't even realize that a lot of loyal paying customers are leaving Adobe's products for competitors or pirate versions of the Adobe software.

Adobe had a huge monopoly for years and management think that they can do whatever they want because customers don't have another choice.

Now, however, a lot of new softwares are popping up and Adobe monopoly is in danger.

Yet management is doing everything in his power to make their users angry and frustrated.

They prefer to reach a short-term profit instead of building a long healthy collaboration with their paying customers.

As an investor I have to take in consideration Management's actions and ask myself how much this is going to impact Adobe future growth and dominance in the market.

(For disclosure: I have a small position in Adobe and I am not planning to increase it.)

Test something. 🔮

$ADBE (-0,7%) still down after good figures. But I'm sure that the figures will come back into line next week and that's the basis for my buy.

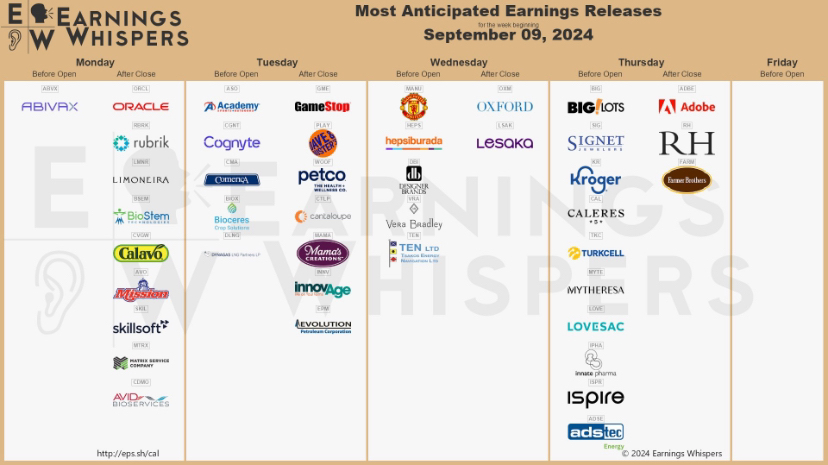

Adobe Earnings $ADBE (-0,7%)

$ZS (-0,19%) - Zscaler - Short

✅ Next stop - 126,26€

$ADBE (-0,7%) - Adobe - Long

✅ Next stop - 577,20€

$ABNB (-6,51%) - Airbnb- Short

✅ Next stop - 94,70€

❗️❗️❗️ Investments are speculative and carry a high level of risk. Every investment is unique and involves unique risks. When trading with shares and other securities, your capital is capital is at risk. ❗️❗️❗️

Feedback on my ETF and portfolio weighting

Hi guys, I've been a silent reader of many posts and discussions so far and thought I'd join in, because what better way to get feedback than to take opinions from strangers on the internet to heart?

About me:

I am 24 years old and come from Switzerland. I currently work in auditing and study business administration part-time. I started investing in March of this year. I would like to tell you that I thought about and defined an investment strategy BEFORE I started investing.

At the beginning, I mainly focused on individual stocks such as $ADBE (-0,7%) , $SPOT (+0,87%) ,$ENR (+2,43%) and $IFX (-0,83%) (which have performed well so far). Now I've realized that an ETF strategy is more sustainable than holding a lot of individual stocks, as I can't possibly keep up with every single company on a regular basis (annual reports, trends, etc.).

I started investing in ETFs with findependent (a Swiss broker). This broker buys ETFs automatically, with the advantage that you don't have to choose the ETFs yourself. Unfortunately, I noticed that the broker invested in 10 different ETFs, which I think is too much for a portfolio size of less than 15k, as I also hold other positions such as individual stocks.

So I am now reallocating and have found the following interesting ETFs at my neobank which I plan to invest in as follows:

$CSSX5E (-1,15%) 150 per month

$XDPU (+0,99%) 150 per month

$VWRL (+0,46%) 200 per month

I mainly plan a growth strategy, but hold 1-2 shares for the dividends. I plan a long-term investment of the products and don't think much of short-term gambles.

I will sell some individual stocks and put them into ETFs, I am still considering how heavily the ETFs and individual stocks are weighted overall in the portfolio, as I also hold a little $BTC (+3%) and alternative investments (whisky and LEGO). Does anyone have any tips on how I can define a sensible weighting?

Many thanks in advance for (critical) feedback :)

From my point of view, I can't say anything against your selected ETFs. Sp somewhat riskier but probably perform better than the World. The Euro etf is debatable. I have banned all of mine and put it in the World as the World always performs better and most stocks are in the World anyway. Maybe if you absolutely have to have something from the Euro, you should look for 2-3 individual stocks that you can invest in separately. As dividend stocks, perhaps Telekom and Allianz from the Euro ETF or LVMH

Hey GQ Community,

I hope you were able to enjoy this super hot day.

For me today was the first day of a 4 week summer vacation, well at least almost vacation, of course one of our dogs and my girlfriend got sick yesterday :D But we are still at home this week and will start a 2 1/2 week tour in a rented van on Friday, so all good so far.

My question:

From how much capital in the portfolio would you go for a forever hold dividend strategy + crypto (BTC/ETH)?

Brief introduction:

I am 35 years old. I earn 2600€ per month/x14 + annual bonus and every now and then a salary increase from IG Chemie, let's say about 3% every 1.5 years.

In addition, I have a part-time job which I have been doing for 12 years and which still brings me about 800-1400€ per month and occasional jobs which I usually do together with my girlfriend. Such as a wedding catering/bar ...

My portfolio has lost a lot after the setback last week and I currently have about 215k in the market + 15k cash reserve + 13K debt from my girlfriend to me... I've only been in the stock market for ~8 months and at the beginning I was very hesitant to pump money into it, made a few mistakes like selling too early or too late etc. and thus lost returns for the time being... I had not yet set up an ETF or a savings plan :F

So far it's a mix of dividend stocks aka $O (+2,65%)

$V (+1,22%)

$LMT (+3,53%)

$VICI (+1,98%)

$JNJ (+0,03%)

$BMY (-0,14%)

$MCD (+2,19%) etc..

and growth stocks aka $ADBE (-0,7%)

$CMG (+1,99%)

$NFLX (+0,37%)

$AMD (-0,12%) etc...

My idea now was to sell the growth stocks as soon as I generate even halfway some profit from them and put them into pure dividend stocks and also to get a world ETF or better a dividend ETF with distribution. Can anyone recommend one to me?

What do you think? Do you think 200k is enough to invest only in dividend stocks or do you think the strategy is not so great?

According to GQ, I am currently looking at around €3200 in dividends in 2025. On top of that, of course, there would be the sales of the current growth stocks that flow into dividend stocks.

What brings me to this question? I want to look less at the portfolio and of course generate monthly cash flow without having to worry too much about getting the maximum out of a stock. I want to be able to pay part of the rent or make other larger purchases without having to sell anything from the portfolio :)

Thanks for reading :)

Good afternoon,

I need your tips on what I should do. Shortly before August 1, I bought the ETF All-World $VWCE (+0,48%) ETF in large quantities at once (approx. 10,000 euros). I also bought shares in various tech companies such as Google $GOOGL (-0,6%) , Nvidia $NVDA (-0,03%) Amazon $AMZN (-0,02%) Adobe $ADBE (-0,7%) and Apple. The problem arose last Friday when various positions fell sharply by 8 to 16 percent. The position of the ETF $VWCE (+0,48%) itself fell by around 4 percent.

Although the percentage loss of the ETF is small $VWCE (+0,48%) is small (only 4 percent), but with a stake of 10,000 euros, the absolute loss of around 400 euros is still considerable.

Today I also read briefly about a possible economic recession, which could lead to the ETF $VWCE (+0,48%) could even fall by 30 percent. With an investment of 10,000 euros, this would mean a loss of around 3,000 euros.

In retrospect, I should have bought the shares monthly via a savings plan instead of all at once.

Should I now sell the shares and ETFs quickly at a loss or wait? That will also be painful, as the losses are already high.

Thank you in advance for your advice.

Titoli di tendenza

I migliori creatori della settimana