"Build up stable assets. And leave the gambling to others."

"We want to decouple returns from rising stock markets to enable wealth accumulation even in stagnating and falling markets."

"Thanks to the more stable performance, we defuse poor entry and exit points to enable flexible short, medium and long-term investing."

That would be something, wouldn't it? Who wouldn't want all that? These are the promises that Finlium (https://finlium.com/).

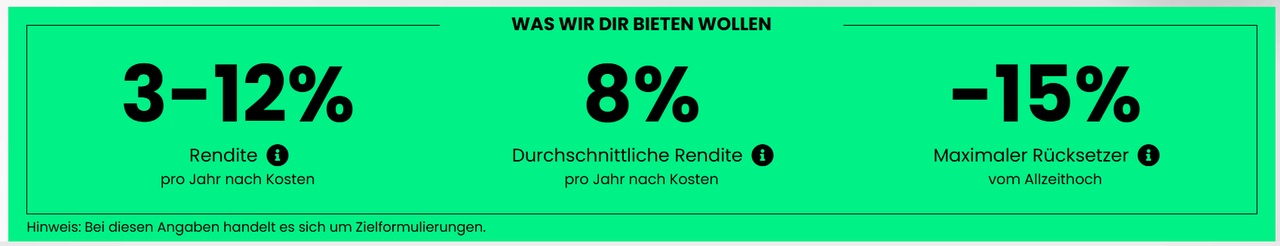

The specific targets also make you sit up and take notice. An 8% return p.a. without the stress of the stock markets is a tempting promise. The only problem is: it doesn't work (at least not yet).

After the fund was launched ($RY00 (-0,07%)) at the end of 2023, I found the concept quite interesting and started watching Finlium. At first, everything seemed to be going like clockwork and the performance chart, like that of a money market ETF with constant interest rates, only knew one direction: upwards to the right.

My first doubts arose during the small crash in summer 2024. Why did Finlium react so sensitively? But never mind, it quickly went up again. But if you look at the chart now, in the early summer of 2025, you have to seriously question whether the advertising claims are still valid. Since the launch of the retail tranche in December 2023, the fund has made -4%, YTD -14%. Needless to say, you would have done better with any global ETF.

How did the makers of Finlium actually intend to achieve their goal? With "stock index options"a "yield corridor" and "stochastic scenario modeling".

Okay, sounds good, but it doesn't work. I would say: Together with other failed ideas like $OD6H (+0,11%) into the garbage can with it.