Quick info: The following text is an AI-corrected translation from English. Some people may not like it, just don't read it, for everyone else this is the beginning of an exciting text.

For those in a hurry: The most important points in a nutshell

Revenue and growth: The Base network has proven to be an impressive source of revenue. In its first year alone, the platform generated around $74.4 million in revenue, mainly from so-called "sequencer fees" that users pay for transactions. Driven by exponential growth in user activity, Base has become one of the leading networks of its kind.

- A revolutionary cost reduction: Base's operating costs originally consisted mainly of storing transaction data on the secure Ethereum blockchain (layer 1). This changed abruptly with Ethereum's Dencun upgrade on March 13, 2024, which reduced these costs by over 99% by introducing so-called "blobs" (EIP-4844), a new, highly efficient way of storing data.

- Profitability with strategy: Base is demonstrably profitable and has achieved an on-chain gross profit of over $53 million since its launch. However, profitability underwent a remarkable evolution: after the Dencun upgrade, the gross margin exploded from around 22% to over 92%. At the same time, the absolute weekly profit paradoxically dropped by over 90% as Coinbase passed on the cost benefits directly to users to massively boost growth - a strategy that paid off.

- From a dollar to a fraction of a cent: for end users, the Dencun upgrade was a boon. Average transaction fees fell by more than 95%. An action like exchanging tokens, which previously cost around $1.00, is now often less than $0.005. This drastic cost reduction was the key catalyst for the explosion in users and transactions

Base: Coinbase's strategic on-chain initiative

After several months of testing and development, Base officially launched its public mainnet on August 9, 2023.

Technically speaking, Base is a "layer 2 scaling solution" for Ethereum that builds on Optimism's open-source OP stack. As a so-called "optimistic rollup", Base processes transactions bundled away from the Ethereum main blockchain and only passes on a compressed summary to it. This architecture allows Base to inherit the robust security and decentralization of Ethereum while offering users significantly faster and cheaper transactions.

This positioning makes Base a strategic stroke of genius for its parent company Coinbase. The rise of efficient Layer 2 networks and decentralized exchanges (DEXs) poses a long-term threat to the business model of centralized exchanges (CEXs) like Coinbase. Coinbase is proactively addressing this threat by launching its own L2 network. Instead of losing users to external on-chain ecosystems, the company is channeling them into an environment that it operates and controls itself. This is a defensive maneuver to protect its core business while opening up new revenue streams.

The business model of a Layer 2 sequencer

Base's profitability is based on the fundamental role the network plays as a layer-2 sequencer. In this function, Coinbase operates the node that sorts and bundles user transactions and transmits them to the Ethereum blockchain. This results in a clear business model with defined revenue streams and cost factors.

The revenue comes from the fees that users pay for processing their transactions. Each fee on Base is made up of two parts:

The L2 fee (execution fee), which remunerates the sequencer for the computing power on the Base network itself.

The L1 fee (security fee), which covers the estimated costs incurred by the sequencer for publishing the data on the Ethereum mainnet.

The sum of both components is the total fee for the user and represents the gross revenue for Base. A key element is the EIP-1559-based fee market, which allows users to voluntarily pay a "tip" (priority fee). In times of high network utilization, they can thus have their transaction brought forward.

The costs, or more precisely the "cost of sales", consist almost exclusively of the fees that Base has to pay to the Ethereum network for data storage and processing. These expenses are incurred when the sequencer publishes the bundled L2 transaction data on the L1 blockchain, anchoring the state of the Base network to the security of Ethereum.

This results in a simple formula for on-chain profitability:

Gross profit = total revenue (all user fees) - L1 data and security costs

Gross margin = gross profit / total revenue

This model creates a powerful economic feedback loop. If the demand for transactions on Base increases, for example due to a popular new app or high trading activity, there is competition for the scarce space in the blocks. Users who benefit most from fast execution are willing to pay higher priority fees. This bidding process directly drives up the sequencer's revenue. Base's revenue thus grows in proportion to the demand and economic value of the activities taking place on the network.

Financial performance over time

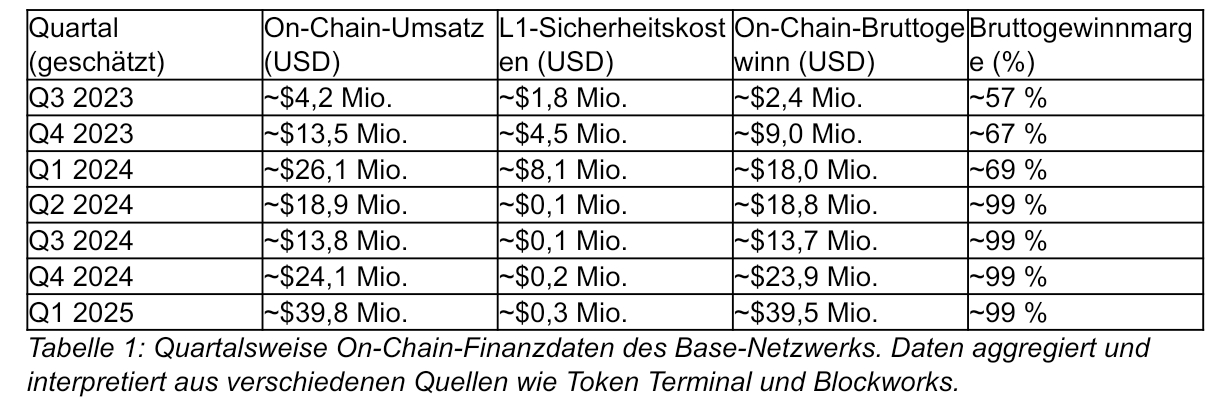

Q3 2023: Immediately after its launch in August, Base quickly gained momentum through the "Onchain Summer" marketing campaign and viral apps such as friend.tech. This initial phase created a solid base of user activity and revenue.

Q4 2023 & Q1 2024: The network saw steady organic growth in users and transaction volume, leading to a continuous increase in quarterly revenue.

Q2 2024: This quarter marked a turning point. After the Dencun upgrade, Base's L1 costs plummeted. Coinbase passed these savings almost entirely on to users in the form of drastically reduced fees. The result: despite a massive increase in transaction volume, the average revenue per transaction fell sharply, leading to a temporary dip in total revenue.

Q3 & Q4 2024: The strategy of prioritizing user growth over short-term profits began to pay off. The sheer scale of the transaction volume compensated for the lower revenue per transaction. The Coinbase report for Q4 2024 reported an impressive 99% quarter-on-quarter increase in "other transaction revenue" to $68 million, "largely driven by higher sequencer revenue on Base".

Q1 2025: The trend of massive transaction volume continued. However, Coinbase's Q1 2025 shareholder letter pointed out that the average revenue per transaction on Base decreased by 21% compared to the previous quarter. This shows that intense competition and network optimizations continue to push fees down, even as overall activity grows.

Aggregated on-chain data from Token Terminal summarizes this development: In the 365-day period from the end of July 2024 to the end of July 2025, the base network generated total revenue of $74.4 million.

Cost dynamics: the dencun effect

The expense side of the Base balance sheet is dominated by a single item: the cost of securing on Ethereum L1. And this item was structurally and permanently redesigned in March 2024.

Before the Dencun upgrade, Base, like other rollups, used a data field called "calldata" to send its transaction data to Ethereum. This method was secure but expensive, as L2s had to compete for scarce storage space with all other Ethereum transactions. In February 2024, for example, these costs amounted to a considerable $3.8 million for Base.

The Ethereum Dencun upgrade on March 13, 2024 introduced a revolution with EIP-4844 (proto-thanksharding). It created an entirely new, separate data market for L2s through a data structure called "blobs". Blobs are specifically designed for this purpose and are therefore dramatically cheaper than call data.

The effect was immediate and profound. L1 security costs became, as one analysis aptly put it, "virtually insignificant". Data shows that the cost for Base to post its data to Ethereum for the entire month of August 2024 was less than $11,000 - a world of difference from the millions of dollars per month before Dencun. A comprehensive analysis by L2BEAT for the full year (July 31, 2024 to July 30, 2025) puts Base's total L1 cost at just $4.93 million.

This combination of revenue and transformed cost structure has led to a dynamic profitability development. As of September 11, 2024, the Base network had generated a cumulative on-chain gross profit of $53.63 million since its launch, confirming the underlying profitability of the operation.

The profit margin trend tells an even finer story. A Galaxy Digital report comparing the 150 days before and after Dencun provides clear numbers:

Pre-Dencun: Optimistic rollups like Base were operating at an average gross margin of 22.65%.

After Dencun: This margin exploded to 92.3%.

This quadrupling of the margin is the direct result of collapsed L1 costs while retaining a portion of user fees.

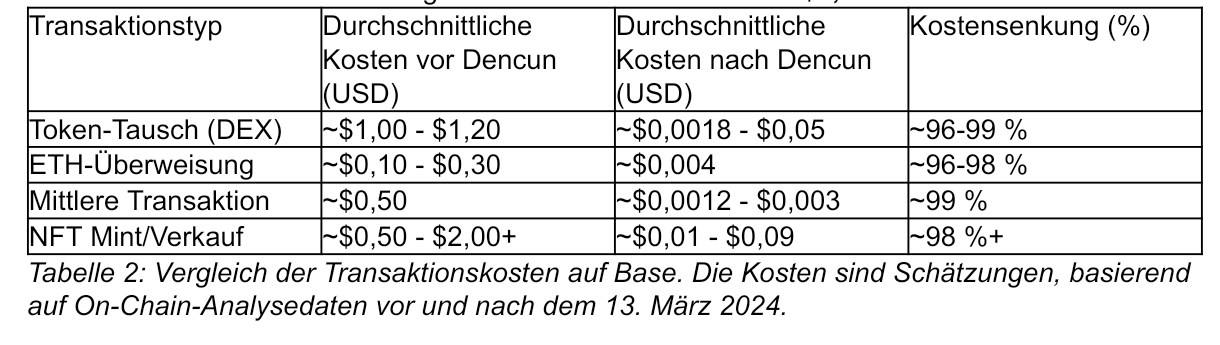

Economics for the end user: What does a transaction cost?

Between its launch in August 2023 and the Dencun upgrade in March 2024, Base already offered a significant cost saving over Ethereum, but the fees were still noticeable for users. The average transaction fee was around $0.50, more complex actions such as a token swap could cost around $1.00.

Dencun was a game changer here too. As the cost of the base sequencer plummeted, this saving could be passed on directly to users. The change was drastic:

After Dencun, median gas fees on Base dropped into the $0.005 range.

A token exchange on an exchange like Uniswap, which previously cost a dollar, was now possible for $0.0018 to $0.05.

A simple transfer of ETH now only costs around $0.004.

Conclusion and outlook: Base compared to the traditional financial world

The analysis of the on-chain data leads to a clear conclusion: the Base network is an undeniably profitable on-chain company. The Dencun upgrade was the decisive event that enabled a strategic realignment: short-term profits were deliberately sacrificed in order to lay a foundation for long-term, sustainable growth through radical fee reductions.

To understand the scope of this development, it is worth making a comparison with everyday financial transactions.

Round 1: Base vs. share trading

Share trading has become much cheaper in recent years, but "free" trading often comes with a catch.

In Europe: Investors are often faced with a mixture of flat fees and percentage costs. A broker like Trade Republic charges a flat fee of €1 per transaction. For an investor who invests €100, this fee means that 1% of their capital is lost from the outset. For smaller, frequent trades, this quickly becomes expensive.

In the USA: Large online brokers advertise with $0 commissions. However, hidden costs can also arise here due to order forwarding (payment for order flow).

The verdict: For a simple share purchase, modern brokers are competitive. But a minimum fee of €1 is literally hundreds, if not thousands of times more expensive than the sub-cent fees on Base.

Round 2: Base vs. international money transfers

SEPA vs. World: Within the European Payments Area (SEPA), euro transfers are often free. However, as soon as currencies are exchanged or money is sent outside this zone, the costs explode. Banks often charge 3-4 % in hidden surcharges and fees. A transfer from a non-euro EU country such as Bulgaria can quickly cost €20.

Fintechs & banks: Even modern services like Wise, which are significantly cheaper, usually charge a percentage (often 0.3 % to 1 %). For a transfer of $1,000, that's still $3 to $10. A traditional international transfer with a major bank often costs $45 to $50.

The verdict: There is no competition here. A simple transfer on Base costs around $0.005. Compared to a $45 bank transfer, the savings are astronomical. Base offers the efficiency of a SEPA transfer, but on a global, currency-independent level.

The microtransaction revolution and financial inclusion.

Saving a few euros on a transaction is already very good, but the real revolution of these near-zero costs lies in the new possibilities they open up.

The era of microtransactions: When a transaction costs less than a penny, it suddenly becomes possible to tip a content creator a few cents, buy an in-game item for a small amount or pay for a single item online without having to take out a subscription. This opens up completely new business models for the digital economy.

True financial inclusion: For people in developing countries, a transaction fee of $ 1- 10 can be a significant barrier. A fee of two cents is not. This radical affordability allows anyone with an internet connection to participate in the global financial system.

$COIN (+0,55%)

$CRCL (+9,38%)

$HOOD (+2,5%)

$ETH (+4,23%)

$OP (+2,12%)

$UNI (+6,78%)