Hey everyone 👋🏼

I'm 22, in my second year of training as a mechatronics technician for refrigeration technology and have been working intensively on the topic of investing for a good year now.

I currently earn around €820 net per month, although I usually earn more due to overtime and assembly work. It's not the world, but I wanted to learn early on how to make more from less. My goal is to reach the €10,000 deposit mark by the end of 2026.

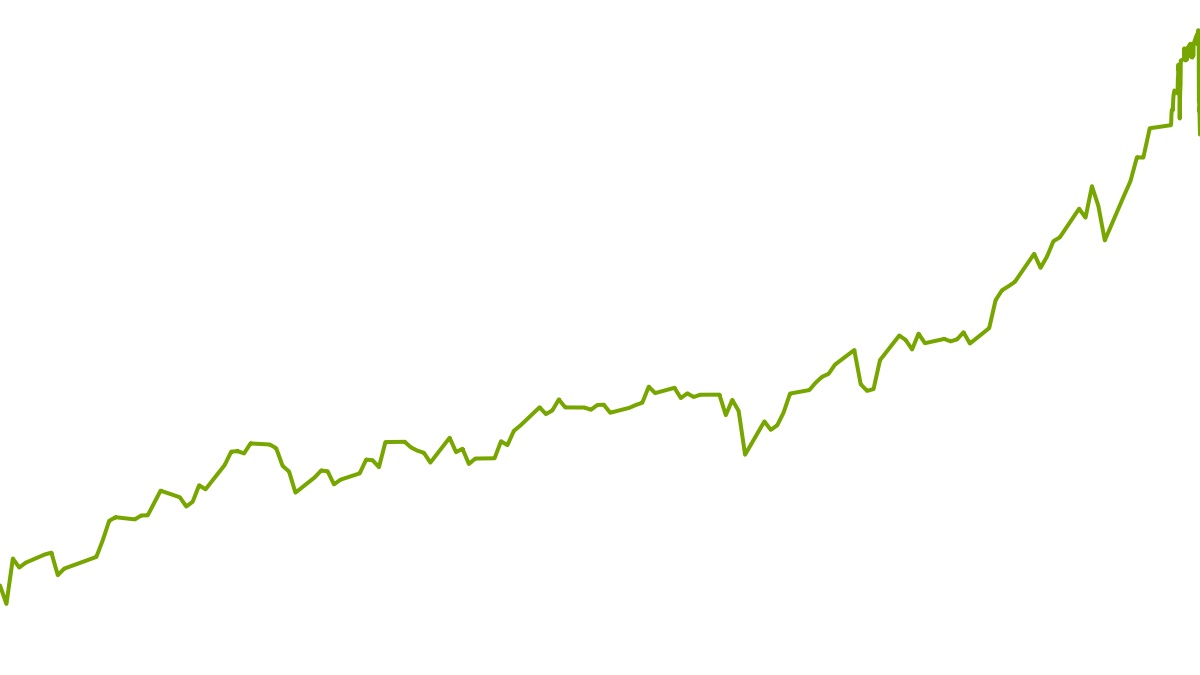

I'm currently at just under €5,000, which is a pretty proud milestone for me.

📈 My savings plan runs at €100 a month - split into two versions. However, I usually try to invest additional small sums in individual stocks when opportunities arise or I deliberately buy more.

Why exactly these shares and ETFs?

I deliberately opted for a mix:

Long-term trend + future sectors

$IWDA (-3,61%) MSCI World (ETF): The solid basis. Broad diversification, global economy, buy & hold...no experiments.

$AMD (-10,01%) AMD & $NVDA (-6,14%) Nvidia: AI, chips, data centers the backbone of the digital future. Started getting in here early.

$ILMN (-3,47%) Illumina: Exciting biotech company in the field of genome research. Risk but also huge future potential.

$PATH (-10,71%) UiPath: For me, process automation is an often underestimated game changer.

$TTWO (-2,88%) Take-Two Interactive: Gaming has been with me for a long time. GTA6 is just around the corner. There's a lot of fantasy going on here.

$ALB (-7,74%) Albemarle: Raw materials for batteries (lithium) is another sector that can benefit greatly from e-mobility.

My strategy in the event of fluctuations:

I'm not a fan of panic or FOMO.

When prices rise: I rejoice but don't get cocky.

When it crashes: I take a deep breath, analyze and usually stay invested or stock up.

I learn with every setback.

I see my portfolio as my long-term project and not as a short-term gamble.

What investing has changed for me:

It may sound cheesy, but:

I've been spending money more consciously since then.

I think twice more often about whether I really need something and what it means for my goals in the long term.

And that feels good.

I'm excited to see how the next few months develop. 📆

And if any of you are pursuing similar goals or strategies - I look forward to sharing!