Share analysis/share presentation ⬇️

Today we are talking about the company State Street: $STT (+1,37%)

What is State Street and what does it do?

State Street is a financial services company that specializes in investment management and investment servicing. They work with institutional investors and offer services such as asset management, risk management and securities lending. As a custodian bank, they manage assets and provide safekeeping. State Street also helps clients implement investment strategies and offers investment management services. Overall, State Street is a major player in the financial industry and offers a wide range of services to institutional investors.

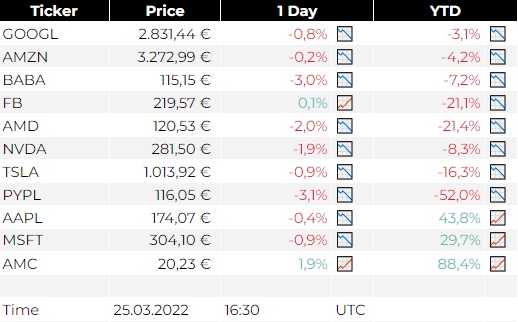

Market Capitalization:

State Street currently has a market capitalization of around EUR 21.6 billion.

Strengths of the share:

Some of State Street's strengths:

- Experience and Reputation: Founded in 1792, State Street has a long history in the financial industry. They have built a reputation as a trusted and reliable partner for institutional investors.

- Broad range of services: State Street offers a variety of services including asset management, risk management, securities lending and custodial services. This broad range of offerings enables them to meet the diverse needs of their clients.

- Technological innovation: State Street has positioned itself as a pioneer in the use of technology to provide innovative solutions for their clients. They continuously invest in the development of new technologies and rely on mobile applications and digital platforms to provide their clients with an efficient and user-friendly service.

- Global presence: State Street operates globally and has an extensive network of offices and partners. This global presence enables them to offer their services internationally and help their clients succeed in global markets.

- Focus on sustainability: State Street has a strong focus on sustainability and pursues a long-term, responsible investment strategy. They consider environmental, social and governance factors in their investment decisions and are committed to sustainable development.

Share weaknesses:

Here are some of State Street's weaknesses:

- Dependence on institutional investors: because State Street focuses primarily on institutional investors, there is some dependence on these clients. If the investment behavior or needs of these clients change, this could have an impact on State Street's business.

- Competition in the financial industry: The financial industry is highly competitive, and State Street competes directly with other financial services companies. Competition may result in State Street losing market share or being forced to offer its services at lower prices.

- Dependence on technology: Although State Street is considered a technological pioneer, there is always a risk of technical problems or security breaches. A failure of its systems or a loss of confidence in the security of its technology could affect client confidence.

- Regulatory risks: The financial industry is subject to strict regulation and State Street must ensure that it complies with all regulatory requirements. Changes in or violations of regulations could result in legal consequences and adversely affect State Street's business.

A little more about the business model:

State Street is a global leader in financial services, providing a variety of services to institutional investors. The company specializes in three main areas: Asset Management, Securities Services and Investment Research.

In asset management, State Street offers a wide range of investment products and solutions, including mutual funds, ETFs and customized investment strategies. The firm works closely with its clients to understand their specific investment objectives and help them effectively manage and optimize their portfolios.

In the area of securities services, State Street provides comprehensive services to institutional investors, including custody and administration of securities, transaction processing, risk management and regulatory compliance support. The company has an advanced technological infrastructure that enables it to provide efficient and reliable services.

In addition, State Street has developed strong expertise in the area of investment research. The company has a team of experienced analysts and researchers who provide market analysis, investment strategies and insights into various asset classes. These research services help State Street's clients gather information and make informed investment decisions.

A key area of focus for State Street is sustainability. The firm is committed to integrating ESG (Environmental, Social, Governance) factors into its investment strategies and promoting sustainable investing. State Street supports its clients in making responsible investment decisions and creating long-term value.

A little more about the industry:

State Street's industry is the financial services industry. State Street is a leader in this field, providing comprehensive services to institutional investors, including asset management, securities services and investment research. The company has strong expertise in asset management and helps its clients optimize their portfolios. State Street also places great emphasis on sustainability and promotes responsible investment.

When and where was State Street founded?

State Street was founded in Boston, USA in 1792. The company has a long history in the financial services industry and has been active for over 200 years. Since its founding, State Street has expanded its business worldwide and is now a global company with offices in several countries. The founding of State Street marked the beginning of a successful journey in which the company consolidated its position as one of the leading providers of financial services.

State Street's goal:

State Street's mission is to help its clients achieve their financial goals and manage their wealth effectively. The company strives to provide innovative solutions to meet the needs and challenges of its clients in the ever-changing financial world. State Street places great emphasis on transparency, integrity and acting responsibly. It works closely with its clients to develop customized solutions tailored to their needs. In addition, State Street is committed to sustainability and promotes responsible investing to create long-term value for its clients and society as a whole.

Your opinion:

Now I would like to hear your opinion on this stock in the comments.

I personally find the company very interesting and will continue to monitor it. It was an unknown company to me until recently, but that's exactly why I wanted to introduce the share to you.

What do you think of State Street and were you already familiar with this company?

Do you perhaps already have the share in your portfolio?

Please let me know in the comments.

This is of course not investment advice but just my own opinion that I would like to share with you.