Liberation Day on April 2, 2025 was just two months ago, but it feels more like two years ago on the stock markets.

The markets have become accustomed to Trump's mood swings and the old adage is proving true once again: political stock markets have short legs

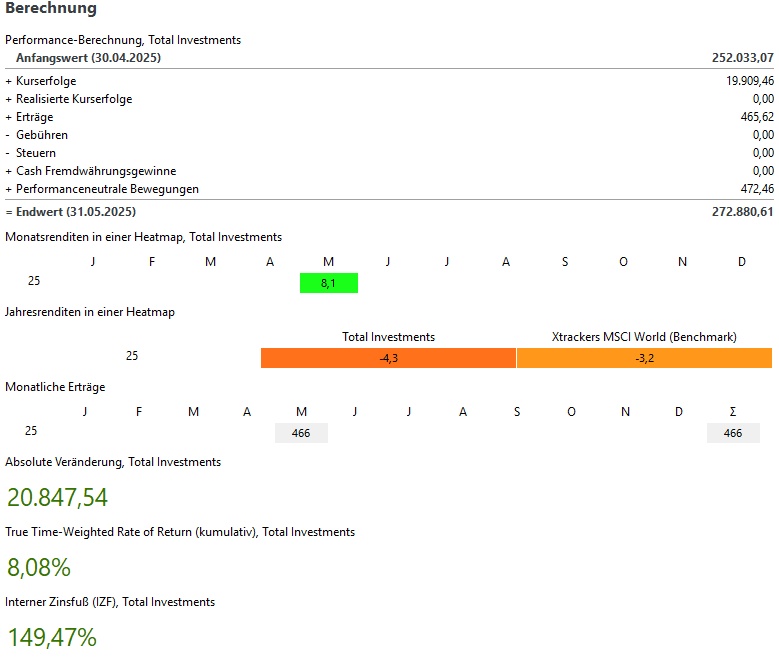

Monthly view:

My portfolio saw a massive rise in May and May 2025 is the second best month in the last 5 years with +8.1%. Only November 2021 was marginally better at +8.5%.

This corresponds to price gains of ~20.000€.

The MSCI World (benchmark) was +3.6% and the S&P 500 +6.1%.

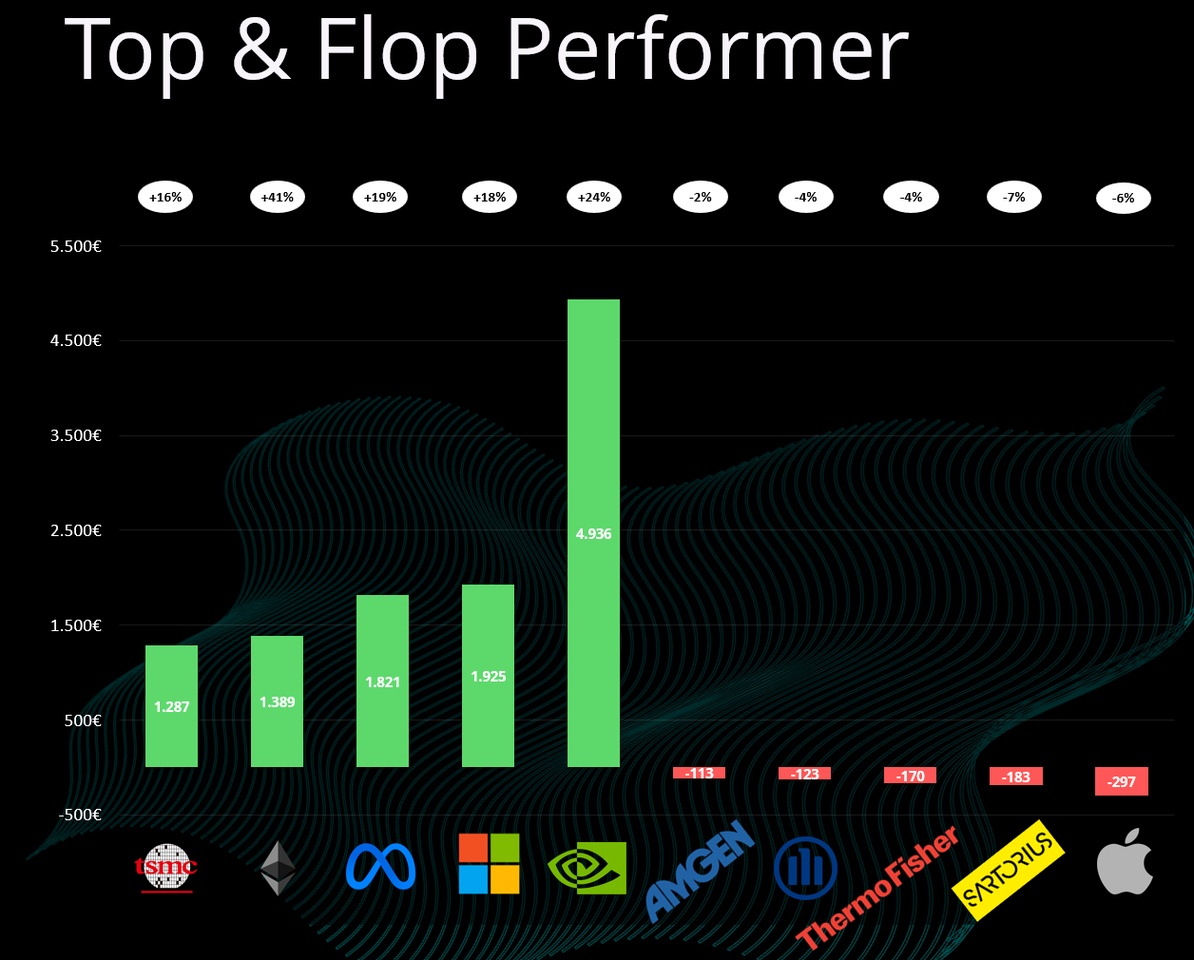

Winners & losers:

A look at the winners and losers shows a completely different picture in May than in the last 2 months - Suddenly everything is green again.

On the winners is mainly made up of the stocks that have fallen in recent months: US tech

In 1st place is NVIDIA $NVDA (+1,31%) with price gains of almost €5,000. This is followed in 2nd & 3rd place by Microsoft $MSFT (+1%)

and Meta $META (+1,13%) with price gains of just under €2,000 each. 4th place goes to Ethereum

$ETH (+0,61%) with ~€1,400 price gains, finally making up some ground on Bitcoin $BTC (+0,38%) . In 5th place is another tech stock with TSMC $TSM (-1,36%) and +1,300€.

On the losers' side looked very relaxed in May. The biggest loser was Apple $AAPL (+2,46%) with just under €300 in share price losses. In 4th place was Allianz $ALV (-3,54%) with -120€, although this also corresponds to the dividend discount after the payout. So it's really significant when the dividend discount leads to a share ending up on the flop list of the month.

The performance-neutral movements in April were ~€500 - these are still lower at the moment due to the house building issue.

current year:

In the YTD my portfolio was still at -12,4% clearly in the red. Thanks to the strong May, it is now only -4.3%, although the MSCI World is still slightly better off at -3.3%.

In total, my portfolio currently stands at ~273.000€. This corresponds to an absolute decline of ~€12,000 in the current year 2025. -14.000€ of this comes from exchange rate losses, slightly offset by ~1.700€ from dividends / interest and ~3.200€ from additional investments.

Dividend:

- Dividends in May were +22% above the previous year at ~465€

- German equities were in the lead with Allianz $ALV (-3,54%) and Deutsche Bank $DBK (-4,23%) - Both with ~€120 (gross) dividend

- In the current year, dividends after 5 months are +25% over the first 5 months of 2025 at ~1.620€

I have reached another milestone with regard to the rolling 12-month view. For the second time, I have received over €3,000 in gross dividends for the last 12 months. This figure has now risen to over €3,100- However, the fall in the US dollar is still having an impact on my dividend forecast - unfortunately, the growth rates in the second half of the year do not look very good compared to the previous year

Buying & selling:

- I bought in May for 885€

- 520€ shares

- 265€ ETFs

- 100€ crypto

- Sales There were none in May

Adjustment of savings plans for the second half of the year:

After a long time, there will be adjustments to my savings plans for the second half of the year. With Starbucks $SBUX (+1,82%) Apple $AAPL (+2,46%) and Hershey $HSY (+0,67%)

three shares will be removed from the savings plans. Starbucks and Apple will remain in the portfolio, Hershey is still open.

I will be adding Allianz $ALV (-3,54%)

which I have held in my portfolio for many years and bought individually in 2020.

In addition, the London Stock Exchange $LSEG (+0,5%) and Iberdrola $IBE (+1,72%)

will be added to the portfolio.

I go into these adjustments in detail in the YouTube video (see next section).

YouTube:

My portfolio update for May can be seen there again in the usual form.

Unfortunately, things are a little quieter there and here on getquin at the moment.

There are some private and professional issues at the moment that are taking up a lot of time.

Video: https://youtu.be/Pe59Z287-Zs

Goal 2025

I haven't really set myself any goals for 2025 due to the topic of building a house. A fixed savings rate is difficult to implement due to the issue (unforeseen costs and the like).

A dividend target will also be very difficult due to the high volatility of the US dollar.

That's why I'm focusing on other topics this year, especially building a house and possibly one or two successes in terms of YouTube.

How did May look in your portfolio?

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy