Dividend payout received ✅

Discussione su STAG

Messaggi

33Tips for the portfolio 🙏

Hello everyone and have a nice Sunday. I would like to hear your opinion, hard-hitting and honest, on my current portfolio.

I would like to emphasize up front that I have only been investing money since the beginning of 2023. My journey started directly with the tough crypto market. But good thing... As a result, I am very much in the plus with BTC and some altcoins... and very much in the minus with others... that's life 😁

I got into the stock market and my ETF savings plan in May 2024.

Since then, I've been investing in these 3 ETFs every month:

1) $IWDA (+0,71%) 50% - currently + 6.1%

2) $EIMI (+0,47%) 30% - currently + 6.6%

3) $RBOT (+0,81%) 20% - currently + 8.6%

Also bought some individual stocks such as $MSTR (+1,18%) , $COIN (+7,93%) , $PLTR (+2,24%) , $RIOT (+6,22%) and many more. I am also strongly up on the majority of them.

I monitor the markets on a daily basis and am increasingly looking for opportunities to pick up good and interesting ETFs or, in some cases, individual stocks (focus on dividends)

I have now made the following adjustments or added stocks (ETFs) in recent months:

I have included the two from jpmorgan as distributing etfs to generate additional cash flow. Getting money every month is just a good feeling and I thought I'd rather do it with these etfs than look for additional individual stocks.

The $TDIV (+0,14%) I have read a lot here and then decided to include it because it is doing really well and looks very interesting 🔥😎

So I now own 6 Etf's and sometimes I have the feeling it would be better to only have 2-3. But I find the 3 new distributing etfs really appealing due to the monthly or quarterly cash flow.

Individual stocks with a focus on dividends and which I have bought heavily in the last few months are :

2) $O (-0,02%)

And brand new since last week

I would like to say goodbye to the following values in the near future:

So there would be 11 stocks or securities in my long-term portfolio that I would like to save monthly or via DCA over the next 20-30 years.

I'm still new to the world of investing. Just under 2.5 years is nothing I would say. I would therefore be grateful for any tips on what I should possibly change or improve.

The dividends from the individual shares and ETFs always go into the $IWDA (+0,71%) because I want to increase its share, which alone should make up at least 50% I would say!

Unfortunately, I currently only have €350 to invest each month. But I currently have almost 100k in the markets. Most of it is in cryptos... but at the end of the year everything will be completely liquidated and then I'll have some cash to invest again!

Now it's your turn.

Thanks in advance.

Best regards

Chris 👋🤝😎

Additional dividend stock?!

Hi everyone, to be honest, I work on my portfolio almost every day. But I would also like to say in a timely manner: Hey, that's good now... The savings plans run monthly, I don't stress myself and look at the portfolio in a few years and see what the compound interest effect has created 🔥🤩🚀

I also still have Bitcoin and crypto, but I trade anti-cyclically and in a 4-year cycle. Will most likely liquidate everything at the end of the year 🔥💰

My portfolio currently consists of the following ETFs + individual stocks:

3) $RBOT (+0,81%) all 3 are accumulating and have been running for almost 1.5 years now.

I also bought these 3 etfs (distributing) a few weeks ago. I became aware of them here on the site and found them very attractive due to the monthly cash flow. I think it's better to have such etf's than other individual stocks.

4) $TDIV (+0,14%) (quarterly)

5) $JEPQ (+0,67%) (monthly)

6) $JEGP (-0,28%) (monthly)

I find the dividend yield on all 3 etfs very nice and high.

I also have these 5 dividend stocks:

2) $O (-0,02%)

And 5) $STAG (+0,5%)

But I would like to sell Stag because the dividend growth is not so big and strong for me... and maybe get $D05 (-0,87%) instead? The dividend growth looks very strong there... Or which stock would you recommend?

I would be interested in your opinion on the portfolio or the individual stocks.

Thanks for any feedback, whether criticism or praise.

I would like to save all the stocks in the long term and then have a nice big portfolio in 20-30 years and receive a great cash flow 🔥💰🤝

Best regards

Chris

so if I've understood correctly, you have 6 Etfs, which would definitely be too many for me.

Also, how can you not have Allianz?🤯And Allianz should fit perfectly into your strategy - top company and top dividend that is increased every year. Have fun and continued success in building your wealth.

Best regards :)

Dividend strategy

This is my first post, so please don't hate. 🙂

I've been using the dividend strategy for a year now because it motivates me to stick with it. The simple one-ETF solution is too boring for me in the long run - I have more fun following individual stocks from time to time.

So far, I've mainly invested in dividend ETFs, and I want to keep it that way. However, I would like to add a few individual stocks to my portfolio to make it more interesting.

My goal is a maximum of 10 individual stocks so that I don't lose track. Here are the stocks I'm currently looking at:

- Realty Income ($O (-0,02%) )

- Main Street Capital ($MAIN (-0,07%) )

- Agree Realty ($ADC (+0,42%) )

- STAG Industrial ($STAG (+0,5%) )

- BlackRock ($BLK (+0,14%) )

- The Home Depot ($HD (+0,7%) )

- Munich Re ($MUV2 (+0,37%) )

- Chevron ($CVX (-0,47%) )

- American Electric Power ($AEP (+0,65%) )

- Waste Management ($WM (-0,55%) )

- Sixt Vz. ($SIX2 (+1,11%) )

My questions for you:

👉 Are these stocks generally suitable for a dividend strategy?

👉 Is there potential for improvement in terms of sector and country allocation?

👉 Is there a stock that you think should definitely not be missing?

Looking forward to your opinions and tips!

1. i invest with different weightings in all 11 sectors (according to GICS), i.e.

Basic Materials

Communication

Consumer Discretionary

Consumer Staples

Energy

Financial

Health Care

Industrial

Technology

REITs

Utilities

2 I hold 3 to 5 stocks per sector. This means I am well diversified overall.

3. selection of dividend stocks

I apply the following criteria when selecting stocks:

a) Payout ratio (POR) --> <75% (über drei Jahre hinweg; 1 Punkt)

b) Verschuldungsgrad --> <200% (über drei Jahre hinweg; 1 Punkt)

c) Dividendenwachstumsrate (Dividend Growth Rate DGR) -->>10% ideally over 3,5,10 years (up to 3 points)

d) Return on sales --> >5% (over 3 years; 1 point)

e) Equity ratio --> >=30% (over 3 years; 1 point)

f) Return on equity (RoE) --> >=15% (over 3 years; 1 point)

g) KCV (Price-Cashflow-Ratio; P/FCF) --> <20 (1 Punkt)

i) Free Cash Flow Marge (Free Cashflow Margin;FCM) -->between 5% and 30% (over 3 years; 1 point))

j) Annual earnings growth --> 8%-12% (over 5 years; 1 point)

This makes a maximum total of 12 points if a share fulfills all criteria.

I also add the total return (price gain + dividend). It should be >10% over 1, 3, 5 and 10 years (maximum 4 points).

This makes a maximum total of 16 achievable points.

4. researching all this by hand is tedious. Very tedious. That's why I built a screener with Google Sheet. All I have to do is enter the abbreviation of the share and the points are awarded for all the criteria mentioned, plus of course the total number of points. I use wisesheet.io as a data source in Google Sheet - they provide all the key figures including the history. An excellent extension for Google Sheet.

5. from the 20 to 30 stocks in each sector, I select the 3 to 5 with the highest scores.

6 I look at their business models and study the companies.

7. if everything fits, the selected shares are added to the portfolio.

8 I have defined my target, the total amount I want to invest. This amount is allocated according to the sector key and so I know in which sector or in which shares I am still investing or which I have bought enough of.

9 I buy from the dividend payouts (usually according to Levermann)

This gives me a clearly structured process at the start and avoids any gut feeling. Instead, I focus on long-term quality. And I feel very comfortable with that.

Now to the titles you mentioned. I ran them through the screen. Here are the results:

$O --> 8 out of 16 points (although we shouldn't rate the payout ratio for REITs; I'm sure you know the reasons)

$MAIN --> 10 out of 16 points

$ADC --> 9 out of 16 points

$STAG --> 8 out of 16 points

$BLK --> 14 out of 16 points

$HD --> 14 out of 16 points

$MUV2 --> 14 out of 16 points

$CVX --> 11 out of 16 points

$AEP --> 12 out of 16 points

$WM --> 14 out of 16 points

$SIX2 --> 12 out of 16 points

From my point of view, or according to my criteria, there are some very good stocks, some would not be for me, because there are better alternatives.

In the REITS sector, for example, I would take a look at $VICI (14 out of 16 points) or $PLD (13 out of 16 points).

Feel free to get in touch if you need help. Hope it helps with the composition of your portfolio.

Summary Q1 figures STAG

STAG Industrial ($STAG (+0,5%) ) had a strong start to 2025 and significantly exceeded analysts' expectations of USD 0.18 with adjusted earnings per share (EPS) of USD 0.49. At USD 205.57 million, revenue also exceeded forecasts (USD 200.84 million) and grew by 8.1% year-on-year. The share reacted positively with a rise of 2.6% following the publication.

Key figures

- EPS0.49 USD (vs. expectation: 0.18 USD)

- TurnoverUSD 205.57 million (vs. expectation: USD 200.84 million)

- YoY sales growth: +8,1 %

- Occupancy rate: 95,9 %

- Renewal rate Q1: 85,3 %

- Bar rental growth for new lettings: +27,3 %

- Linear rental growth: +42,1 %

Operational highlights

STAG reported strong operating figures, including a solid new letting rate and double-digit rental growth in contract signings. 78.5% of the new leases and renewals expected for 2025 have already been concluded. The company also generated a one-off net profit of USD 49.9 million from the sale of a property.

Investments & portfolio activities

- Acquisitions3 properties (393,564 sqft) for USD 43.3 million

- Disposals1 property (337,391 sqft) for USD 67 million

Outlook

CEO Bill Crooker emphasized the solid operating foundation and the potential for sustainable growth through a strong balance sheet, diversification and liquidity.

Monthly review March 2025 - tangible assets in deep red, I have topped up

The first quarter of 2025 is over. In March, real assets recorded declines, both in equities and ETFs and especially in cryptocurrencies. The markets have become increasingly volatile. While many are panicking, I have been enjoying the first signs of spring, hiking and continuing to winter bathe diligently.

For the past month of March 2025, I present the following points:

➡️ SHARES

➡️ ETFS

➡️ DISTRIBUTIONS

➡️ CASHBACK

➡️ AFTER-PURCHASES

➡️ P2P CREDITS

➡️ CRYPTO

➡️ AND OTHER?

➡️ OUTLOOK

➡️ Shares

There was a considerable setback in March, and not just in equities. The reason for this is the customs issue, on which I have already formulated my thesis, which many believe to be correct. To summarize briefly: Markets are being depressed to get investors into bonds, which lowers bond yields and allows US debt to be refinanced at a lower interest rate. After the refinancing of short-term US government bonds, the tariffs are put into perspective and the next upswing follows, which Trump can boast about. Whether this assumption is correct remains to be seen. However, it would make sense in the long term to slash US spending. Even if the D.O.G.E. does a good job, you can't cut everything without incurring the displeasure of the population.

A look at the depot shows the front-runner $AVGO (+2,26%) and its companion $NFLX (-0,79%) both currently only 150% up, despite a significant setback. I am unimpressed by this development, as the capital market is always facing worse times, which will be followed by better ones. According to André Kostolany, it is now the "shaky hands" that are significantly triggering the sell-off. Yes, change your perspective: the red sign in your portfolio is irrelevant, now is the time to buy more. Enormous overvaluations in tech stocks have been reduced and they may now be available at a fairer price. There are also attractive defensive value stocks on offer, ideal for a dividend portfolio.

Second and fourth place in my individual share portfolio are still occupied by $WMT (-0,47%) and $SAP (-2,4%) . Walmart can now prove that it acts as a stable anchor in the portfolio even in bad times. In sixth place is a stock that I did not expect to be in the top 10. Like me, many of you have shares in $WM (-0,55%) but the stock I am looking for is its competitor: $RSG (-2,58%) . I have been watching the rise of this stock even before the pressure from Trump and I am happy about it. This is an example of a defensive stock. Garbage collection is necessary and Republic Services, like Waste Management, will literally turn garbage into gold for shareholders 50 years from now. Anyone complaining about their portfolio being down 50% probably has too much tech and too little defensive. My overall portfolio currently stands at around -12%. That's OK in the current macro environment.

Which brings us to the subject of performance: $NKE0 (-0,95%) and $DHR (+0,19%) returned around -39% at the end of March.

➡️ ETFs

They are also recording significant losses. It is important to remain calm and continue investing. Such phases are part of the game. I will not repeat further details.

➡️ Distributions

In March, I received 31 distributions on 15 payout days. I am grateful for this additional income stream. Everyone should build up such additional income.

This time, the distributions from my three large ETFs were not made on March 31, but in the first few days of April. This means that there should theoretically be 34 distributions. Numerous corrections and cancellations of dividends from REITs were not taken into account. With $O (-0,02%) , $OHI (-0,43%) , $LTC (+0,5%) and $STAG (+0,5%) there were therefore some cancellations and new dividend distributions. Although this was a major bureaucratic effort, it was usually a cause for celebration. This is because the REITs initially distribute dividends from current net income. If there are then corrections in the following year, it is determined that a distribution is also made from the already taxed retained earnings. This subsequently reduces the company's tax burden and I have noticed that I pay less capital gains tax and solidarity surcharge. So more cash in my pocket for reinvestment.

➡️ Cashback

In March, I received a small amount of income from an expense report, which I invested directly in my custody account. More on this under subsequent purchases.

➡️ Subsequent purchases

The additional purchases were financed from the expense report and, above all, from the bonus paid out by my employer. I am grateful for this, as my employer is not doing well at the moment.

I made numerous additional purchases in several ETFs that are in my small old portfolios. I invested smaller sums $GGRP (+0,4%) , $JEGP (-0,28%) , $SPYW (+0,11%) , $FGEQ (+0,91%) and $SPYD (+0,56%) and bought a larger sum in shares of the $IWDP. On the last Friday in March, I checked my portfolio and realized that, despite careful use of the surplus, there was more cash left than I had expected. I therefore made a small additional purchase in the $VNA (+0,14%) . For me, Vonovia (like the REITs) is a kind of hedge against my own rising rent.

➡️ P2P loans

With my last P2P platform, Mintos, there were no interest or redemption payments. I still intend to withdraw all funds where released. I would even accept a full write-off to get out of the platform. The remaining amount is no longer relevant to me.

➡️ Crypto

Crypto investors continued to experience significant volatility in March. The double top predicted by some does not seem to be materializing and the indicators do not currently point to a steep rise. I am studying the charting and the macro environment for crypto, although I still have a lot to learn here. Patience and calm are still required. I am sticking to my cycle strategy, the macro situation confirms me, so there is no need for me to take any action.

➡️ And what else?

I'm currently deepening my knowledge of AI. The posts on my Instagram channel that I published in March (and others that will follow in April) were created with the help of AI. I explained my approaches, beliefs about finance and the frugal lifestyle, and my goals to AI. The AI then created suggestions for Instagram posts, including prompts and allowing for a week break at the end of the month.

There is still a lot for me to learn. I am using AI more and more intensively and deeply in my professional and private life. While colleagues are happy that an AI can write emails for them, I use it much more extensively, for example to have technical content and its effects on departments and companies explained to me at work or to have economic relationships explained to me in my private life. In addition to ChatGPT, I particularly like Grok by X, as this AI always asks questions and thus enables a fluid conversation. The AI doesn't just reproduce facts, but also evaluates my ideas and classifies them, for example whether I should already use part of my nest egg to buy more quality stocks at favorable prices. Her suggestion was perhaps to wait until after the refinancing of short-term US government debt, when there might be less downward volatility in the market. This recommendation is based on my thesis mentioned above.

March was also a month of fasting for me, not for religious reasons, but because I want to and always intend to. I like to use the time after fasting to change my habits, adjust my diet and vary my sports units and routines. For me, this is particularly easy after fasting - the time afterwards generally feels like a new beginning.

➡️ Outlook

In April we will continue to see negative signs in the portfolio. I have now placed a limit order, which I hope will be triggered. The annual electricity bill is also due. I'm curious to see how much will be returned, the refund will certainly go into the custody account. It will also become clear whether I will increase my discount due to higher electricity costs. Until then!

Links:

Social media links can be found in my profile, you can also take a look at the Instagram version of my review.

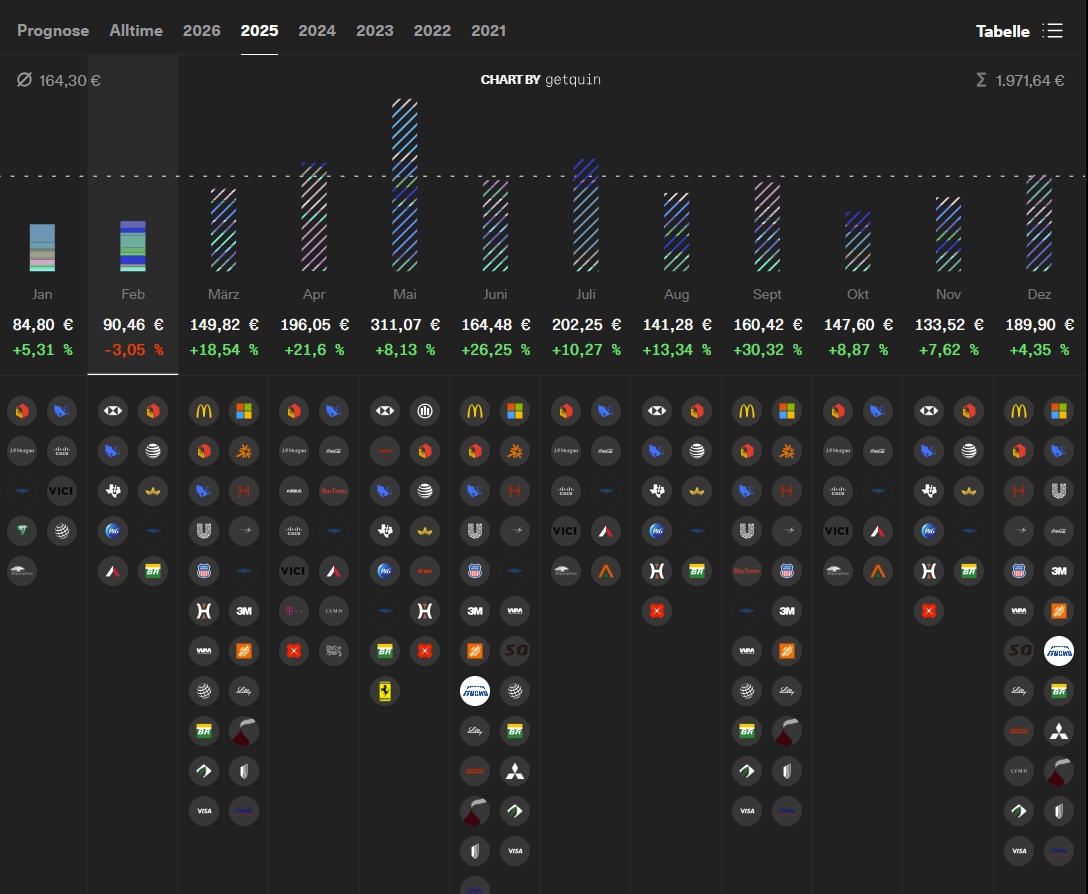

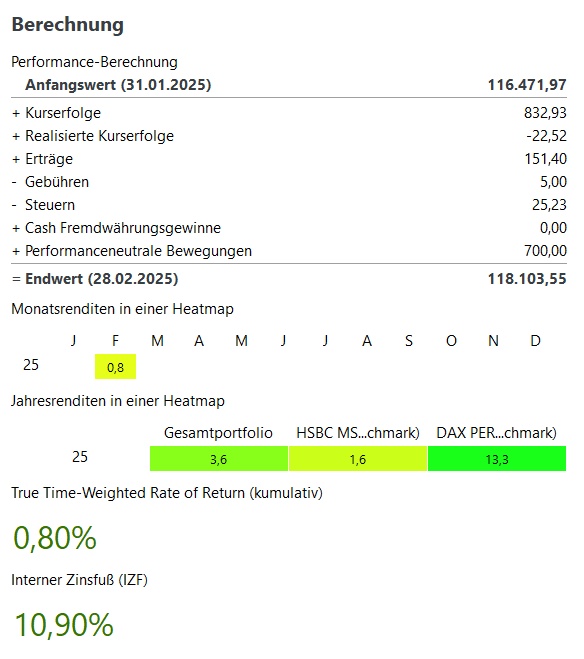

Review of February 2025

The second month of 2025 is already over. Time is flying by again at breakneck speed and one event or statement follows the next this year. It's crazy what's going on at the moment and at the same time the market is somehow saying "I don't care".

Up down, up down, the markets are becoming more volatile and yet, or precisely because of this, my February was almost at +/-0.

But one thing at a time.

In February I achieved a plus of 0.8%. With my portfolio size, this corresponds to a value of almost €900. Not particularly good compared to the Dax (+3.77%), but still very respectable compared to the HSBC MSCI World (-2.49%).

Unfortunately, things do not look any better over the year (YTD).

The Dax is running away with 13.3%, while the MSCI World is bobbing along at 1.6%. Here, too, I was at least able to beat the World, but I still lag miles behind the DAX.

Overall, however, I am still very satisfied. As I don't have a lot of tech in my portfolio and my stocks are (mostly) rather stable, there is often no outperformance of the stocks and if there is, it is only marginal.

My high and low performers in February were (top 3):

$HSY (-0,54%) Hershey +15.63%

$T (+1,96%) AT&T +14.07%

$NESN (-0,82%) Nestle +13.10%

$ADM (+1,64%) Archer Daniels -8.57%

$UNH (+0,84%) United Health -13.16%

$TSLA (-2,6%) Tesla -27.59%

Dividends:

In February, I received a net €123.62 from a total of 10 distributions.

Compared to February 2024 (€99.26), this was an increase of 24.54%

Investments:

Due to the construction work on the house last year, the focus continues to be on building up the nest egg and saving up a "leisure account" again, as everything was really used up completely last year and only the custody account remained.

The savings plans will of course continue unabated, but individual investments are probably not possible for the time being.

Purchases and sales:

I have parted with Mercedes ( $MBG (+0,86%) ) and Medical Properties ( $MPW (+2,39%) ).

I then added to Lockheed Martin ( $LMT (-1,33%) ), Hershey ( $HSY (-0,54%) ) and Petroleo Brasileiro ( $PETR4 (-0,65%) ).

My savings plans remain unchanged, but it is quite possible that I will stop them for the time being in order to build up investment cash again.

Savings plans (350€ in total):

- Realty ($O (-0,02%) )

- STAG Industrial ($STAG (+0,5%) )

- Gladstone Invest ($GAIN (+0%) )

- Hercules Capital ($HTGC (-0,2%) )

- Cintas ($CTAS (+0,05%) )

- LVMH ($MC (-1,89%) )

- Monster Beverage ($MNST (+0,23%) )

- Microsoft ($MSFT (+0,6%) )

Goals 2025:

My goal is to have €130,000 in my portfolio at the end of the year. The goal is to be achieved by reinvesting the dividend, making payments and, of course, increasing the share price. The share price increase is of course impossible to predict in any way, so the motto is: if the share price falls or does not rise enough, more cash is needed.

This comes from selling useless stuff on eBay, additional income from e.g. "neighborhood help" etc. The worse the share price, the more additional cash has to be raised.

Target achievement at the end of February 2025: 37.41%

So I'm on the right track (so far). I'm curious to see what else will happen in 2025 and hope that the crash, which seems to be getting closer and closer, will take a little longer (so that I can continue to accumulate cash).

How was your February? Are you happy so far? I think that, due to the volatility, the portfolios in February are far more spread out than they were in January or even at the end of last year.

Portfolio

Hi, I'd like to hear your opinions on my portfolio.

I also welcome your suggestions for etfs in 2025 with stable growth and that pay dividends. I'm analyzing this ETF to invest in the near future $JEGP (-0,28%)

My focus is to have good assets that pay dividends and over time be able to refresh my investments with those same dividends. This way I can also get a good average price depending on the ups and downs of the market in the long term.

Since November 2024, I've been investing in shares such as $KO (-0,14%)

$STAG (+0,5%)

$VZ (+0,72%)

$VICI (-0,5%)

$O (-0,02%)

$PZZA (+2,26%)

$BMW (+0,87%)

$T (+1,96%) etc.

As for cryptos, I'm betting on Solana and Xrp.

In my opinion, these are two assets that could increase in value over the long term.

I have Solana in coinbase, which currently pays 8%, thus also generating recurring payments.

So at the moment I have 80% in shares and reits, and I also want to acquire etfs.

And 20% in cryptos.

Happy 2025 to everyone and good investments!

Titoli di tendenza

I migliori creatori della settimana