And once again expanded my largest position.

Discussione su SOFI

Messaggi

267Buy Sofi and Nebius!

I have now finally reorganized my portfolio and reduced the position in Novo Nordisk B ($NOVO B) by 50 % in order to invest the freed-up capital in Nebius and SoFi ($SOFI) and SoFi ($SOFI). I am thus positioning myself more clearly in the direction of growth.

Yesterday, the figures from LendingClub ($LC) showed that the loan business for SoFi will accelerate again in Q3 accelerate again in Q3. The new members should also grow towards one million million. At least that's what the data from Sensortower have shown.

With the increase in the Nebius-position, I want to increase my exposure in the AI data center sector further. The share is currently back where it was when the $18 billion deal with Microsoft was announced. I still see a lot of potential here over the a lot of potential.

Greetings Bubu :)

Portfolio update, concentration instead of diversification 📊

Hello everyone 👋

I have to be honest and say that the last few days have been a bit too exhausting for me. Following every company, and there have been more and more, has become too much for me 🤯 - and I realize how much time it takes to check the individual price movements (to always find the "best" entry). 🕵️♂️📈

I'm still young and actually want to fill my time with more effective things than constantly checking the prices. 📉📊📈

So I've drawn up a list of stocks where I think it's enough to look at the portfolio once a week or maybe even just once a month, because I assume that they will be higher in a year's time than they are now. 🚀

That's why I now only have seven companies in my portfolio and $BTC (-0,02%) 💰

Bitcoin:

All 7 stocks were increased, and all other positions were allowed out (I still have warrants, but these are also to be gradually reduced!).

$PNG (-2,35%) - (only a little, waiting for a setback)

$ONDS (+3,62%) (should also be out of the portfolio by the end of the year)

$SOFI (+2,85%) - (increased the most because the position was previously very small)

$BNTX (+0,44%) - (unfortunately there was no money left today 😅)

Each company has a weighting of approx. 10/15% in the portfolio. IREN and Kraken Robotics a bit more, because I see the biggest upside there 💶

I know that these are stocks that would probably give value investors gray hair 😅,

but I'm deliberately focusing on growth. And even if one or two stocks take off, I will have achieved my target return of 25% per year. 💪📈

Please give me feedback on whether you think it makes sense to have such a concentrated portfolio - or whether you would say that the time investment is worth it after all and I would be rewarded with a return. 🤔📊

Kind regards ✌️

Small investor 😁

Innovations Sofi and award as Robo Advisor No. 1 by Barrons 🚀🫡

Great prospects, think earnings will also be extremely strong 💪

Innovations:

1. level 1 options

2. crypto announcement

3. Galileo Services on AWS for SaaS

4. Southwest Rewards by Galileo

5. United Airlines Rewards by Galileo

6 World Payments

7 Web Traffic Insights from SimilarWeb

8. potential app download surge

9. 1st ROBO Advisor Award from BARRONS

✅ Low annual fees

✅ Built by experts

✅ Easy customization

✅ Free 30-minute session with a financial planner

✅ All in one app 🚀

$JPM (+1,87%)

$WFC (+2,22%)

$GS (+4,07%)

$MS (+2,76%)

$C (+2,1%)

$HOOD (+4,02%)

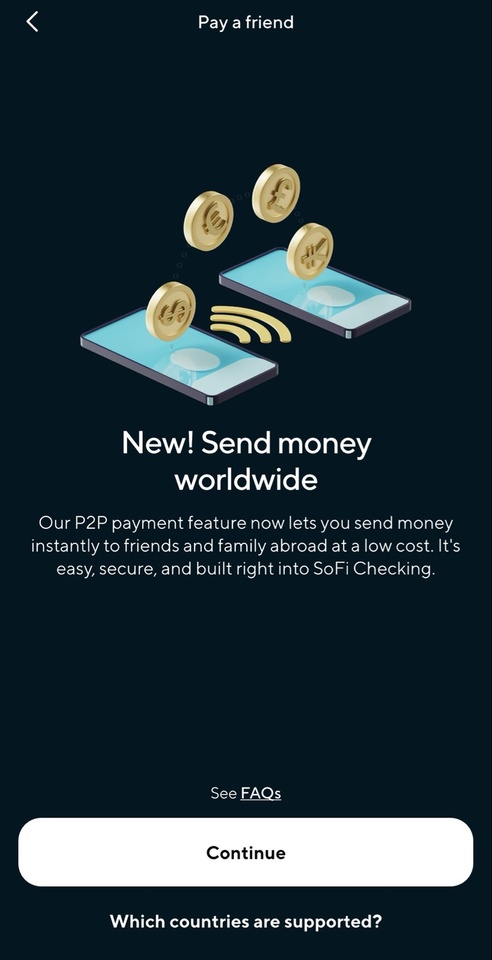

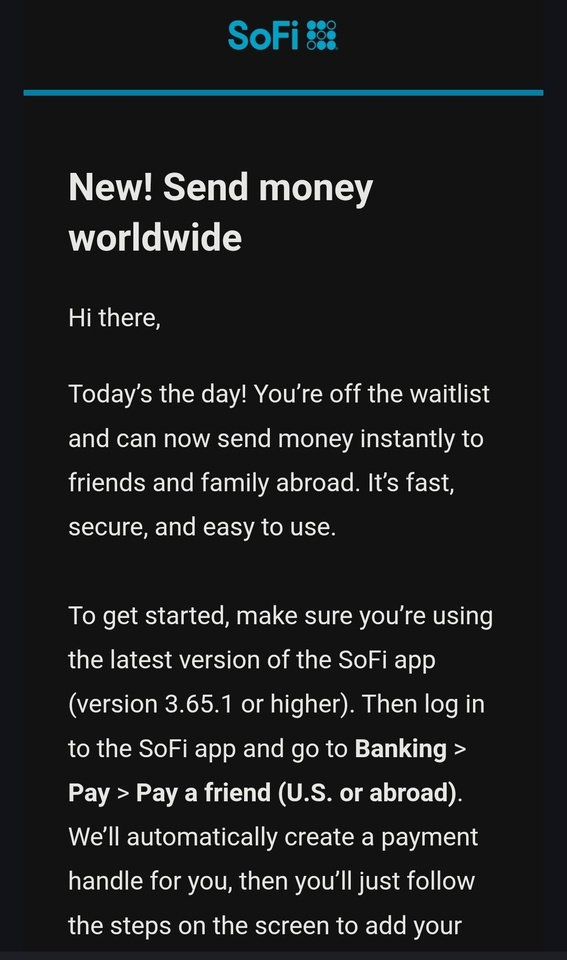

SOFI has officially launched worldwide payments 🫡

Worldwide instant transfers via Crypto Rails are live.

It is currently only available for Mexico, but will be expanded soon 💪

50$ costs about 50 cents

GQ Favorites - update

Almost 4 weeks have passed and let's take a look at the results.

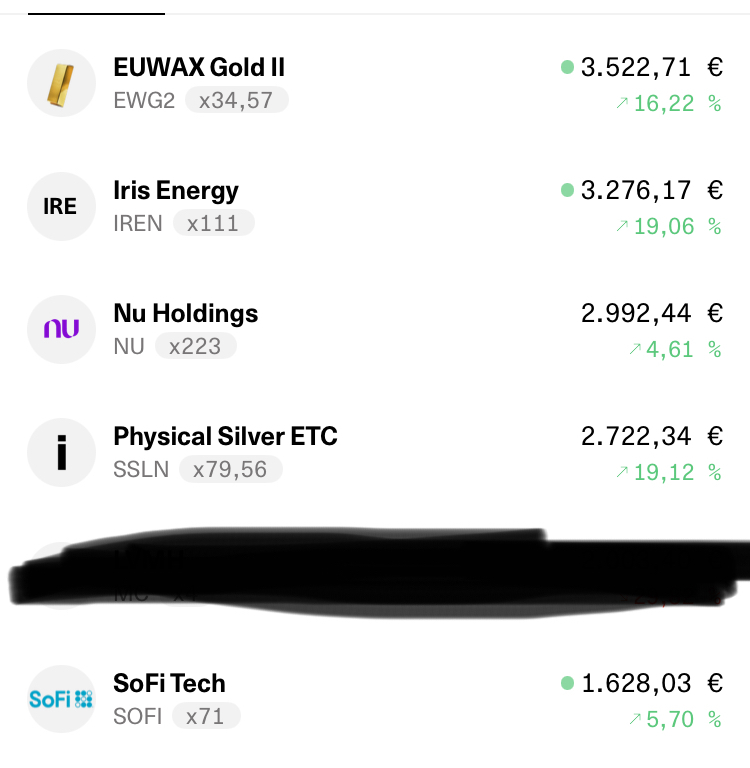

$IREN (+11,25%) makes her own kitchen party $EWG2 (+0,43%) and $SSLN (-0,83%) are now joining us.

$SOFI (+2,85%) and $NU (+0,33%) sit in the living room and sip their beer - steady grow.

TLDR: 14k -> 20k in .

Have a nice weekend. :-)

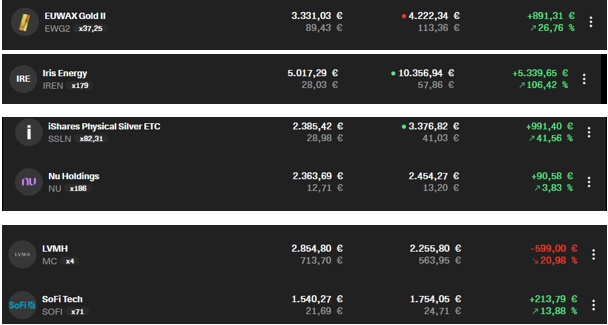

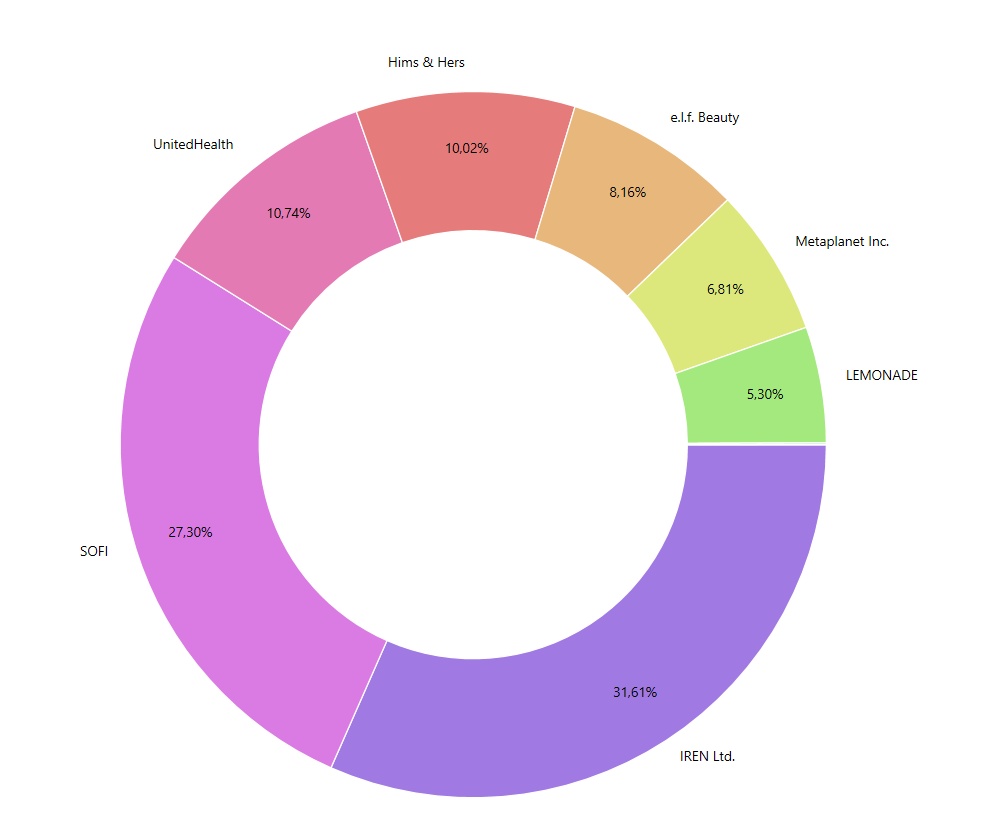

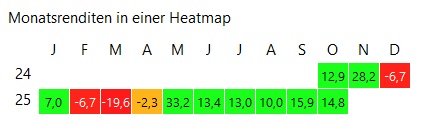

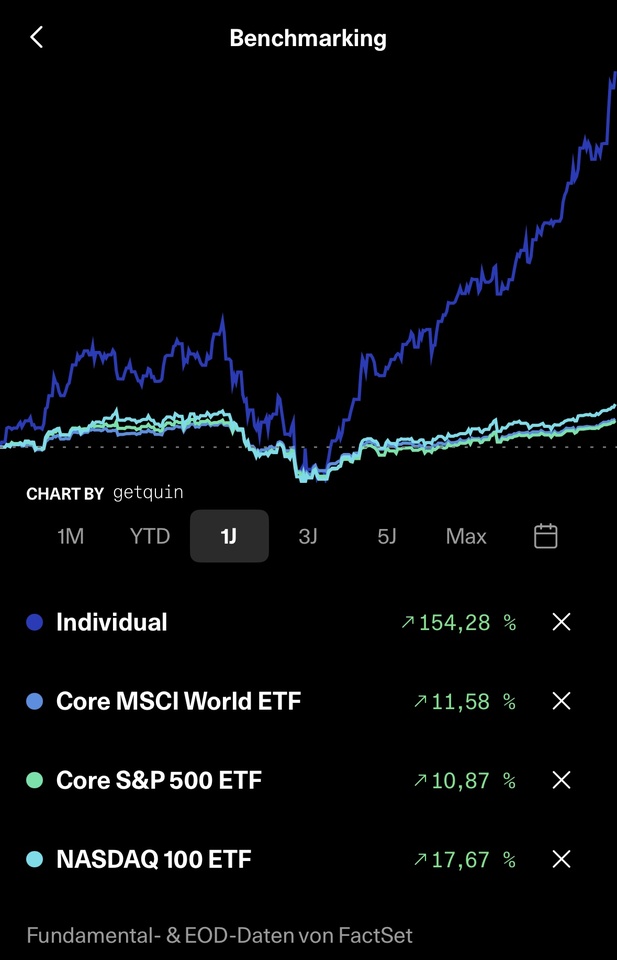

Annual performance Oct 2024-Oct 2025

$IREN (+11,25%)

$SOFI (+2,85%)

$HIMS (+1,27%)

$LMND (+1,4%)

$UNH (+1,21%)

$3350 (+9,49%)

$ELF (-1,58%)

Many would probably not have expected things to go so well after the weak start to the year.

But it shows me personally that my research, my confidence in my company selection and what I saw in the selected companies has paid off.

Not only once was I down more than 50% on the companies listed, but I constantly bought more and remained true to my selection, as nothing had changed in my opinion.

Yes, the portfolio is very focused and overweight, but I still believe that the positions will largely continue to outperform the market in the future.

And yes, you need strong nerves, I won't deny that, and you have to question your selection regularly, so it helps a lot if you take notes on why you bought the companies.

Believe in your convictions ✌️

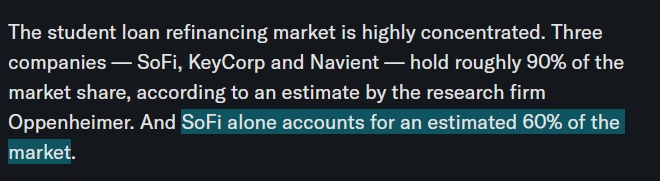

Trump administration considers selling parts of the 1.6 trillion dollar portfolio of government student loans 🚀

the Trump administration is considering selling off parts of the 1.6 trillion dollar government student loan portfolio.

SoFi already controls around 60% of the refinancing market. Any move to offload these loans could give the company a huge pool of prime borrowers to refinance, directly boosting volumes and margins.

Thank you my dear

Sofi.

Bring it on. Bought last week. $SOFI (+2,85%)

Wanted to buy again today but unfortunately didn't manage to become liquid.... 🫡

Titoli di tendenza

I migliori creatori della settimana