"Robinhood Inc: savior of small investors or master of the silent raid?"

An introduction to the neo broker and a look at some figures.

Company presentation

Robinhood Markets, Inc. is a financial services company based in Menlo Park, California, founded in 2013 by Vladimir Tenev and Baiju Bhatt. It has made a name for itself primarily through its innovative, commission-free trading platform that democratizes access to stocks, ETFs, options and cryptocurrencies.

Historical development

With the vision of democratizing financial trading and making it accessible to everyone, Robin Hood got off to a rapid start. Within the first year, the company had already gained almost one million users and processed transactions worth over one billion US dollars. Since then, Robin Hood has developed into one of the defining players in the field of neo-brokerage, which continues to grow and set new standards.

Business model

Robinhood operates as an online broker and relies on a diversified business model. The main sources of revenue include:

- Order flow payments: Robinhood receives compensation from market makers for routing trade orders.

- Interest income on client balances: The company earns additional revenue through interest on deposits or credit card usage

- Premium subscription (Robinhood Gold): For a monthly fee, customers gain access to enhanced features and exclusive benefits.

Core competencies

At the heart of Robin Hood's business strategy is the provision of a user-friendly platform for trading financial instruments. This includes:

- Commission-free trading: users can trade stocks, ETFs, options and cryptocurrencies without transaction costs.

- Intuitive user interfaces: Both the mobile app and the web platform are characterized by their ease of use, which appeals to young, technology-savvy target groups in particular.

Future prospects and strategic initiatives

Robinhood is pursuing ambitious plans to further expand its offering and compete with established brokers. These include the trading of index options and futures, which are now available and will be expanded, as well as the expansion and extension of international markets.

Current performance of the Robinhood share

Over the year, Robinhood's shares have gained an impressive 98%, an increase that can be attributed to key internal company decisions. While shareholders who joined the company a year ago can be pleased with this development, the situation looks much bleaker for those who have been invested for three years. Even if you used a good cash tap at the time of the IPO, the share is still down 55% since August 26, 2021.

Development of the figures and future challenges

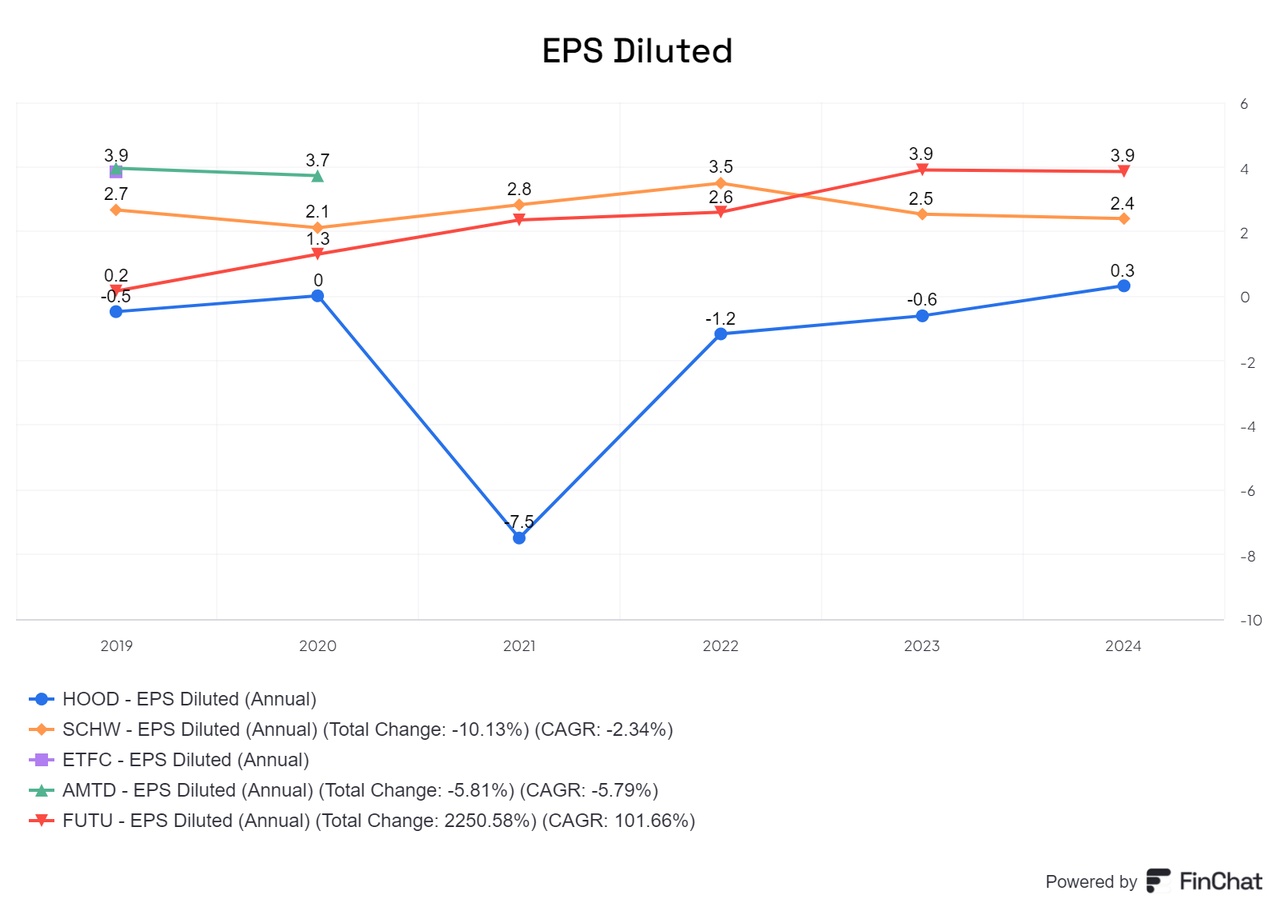

(Image 4&7)

Robinhood has recently been able to increase both its turnover and gross profit, and the company has even reported a positive net profit since the fourth quarter of December. Projects within the company are also progressing rapidly and the once negative reputation seems to be gradually improving. On the surface, therefore, everything seems to be going in the right direction - the company has achieved a turnaround and appears to be living up to increased expectations. However, caution is required, particularly with regard to two key factors: interest rate dependency and customer behavior.

Point 1: Sustainability of customer acquisition

One crucial aspect that causes concern is the issue of sustainability. Many Robinhood users are characterized by a high willingness to take risks, which often leads to losses. Given that the average account balance is currently around USD 4,000, this is an alarming sign, as the customer base is young and instead of saving capital for the long term, it is often gambled away. Previous measures to stop this trend have had little success, and initiatives such as the 401k plan have so far found little favor. Robinhood therefore remains highly dependent on the disincentives that lead to speculative behavior. If it is assumed that sustainable revenue can only be achieved by eliminating 25% of options trading and 50% of crypto trading, the company would quickly lose $151.25 million in revenue and find itself in a precarious position. So the question remains: can the business model be sustainable in the long term if it fails to fundamentally change its customer strategy?

(Image 9)

Point 2: Dependence on interest rates

Another potential problem is the heavy reliance on interest income, which accounts for 47% of total revenue - and not just this quarter, but for some time now. Even if part of this interest is of an operational nature and does not come solely from deposits or investments, it must be questioned whether Robinhood's approach as a broker can be successful in the long term. The situation is much more sustainable for established competitors. Without the interest income, Robinhood would clearly be in the red, which is problematic for a company of this size and structure. If interest rates were to halve, this would equate to a loss of revenue of USD 120.5 million.

(Image 5)

Conclusion

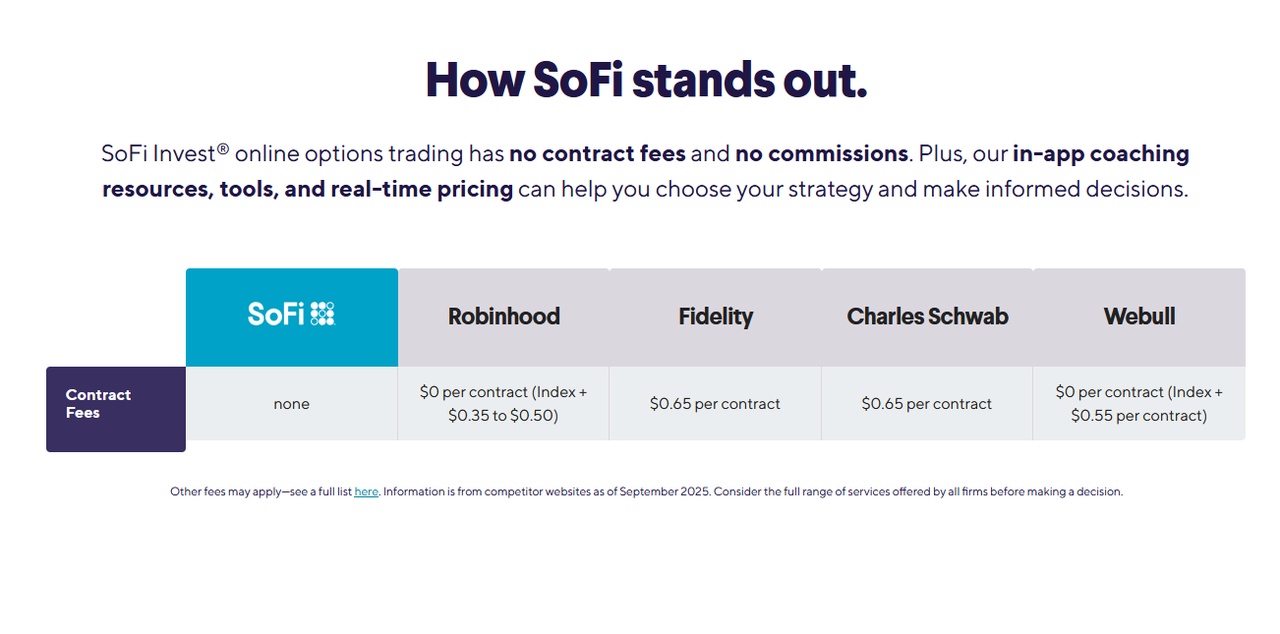

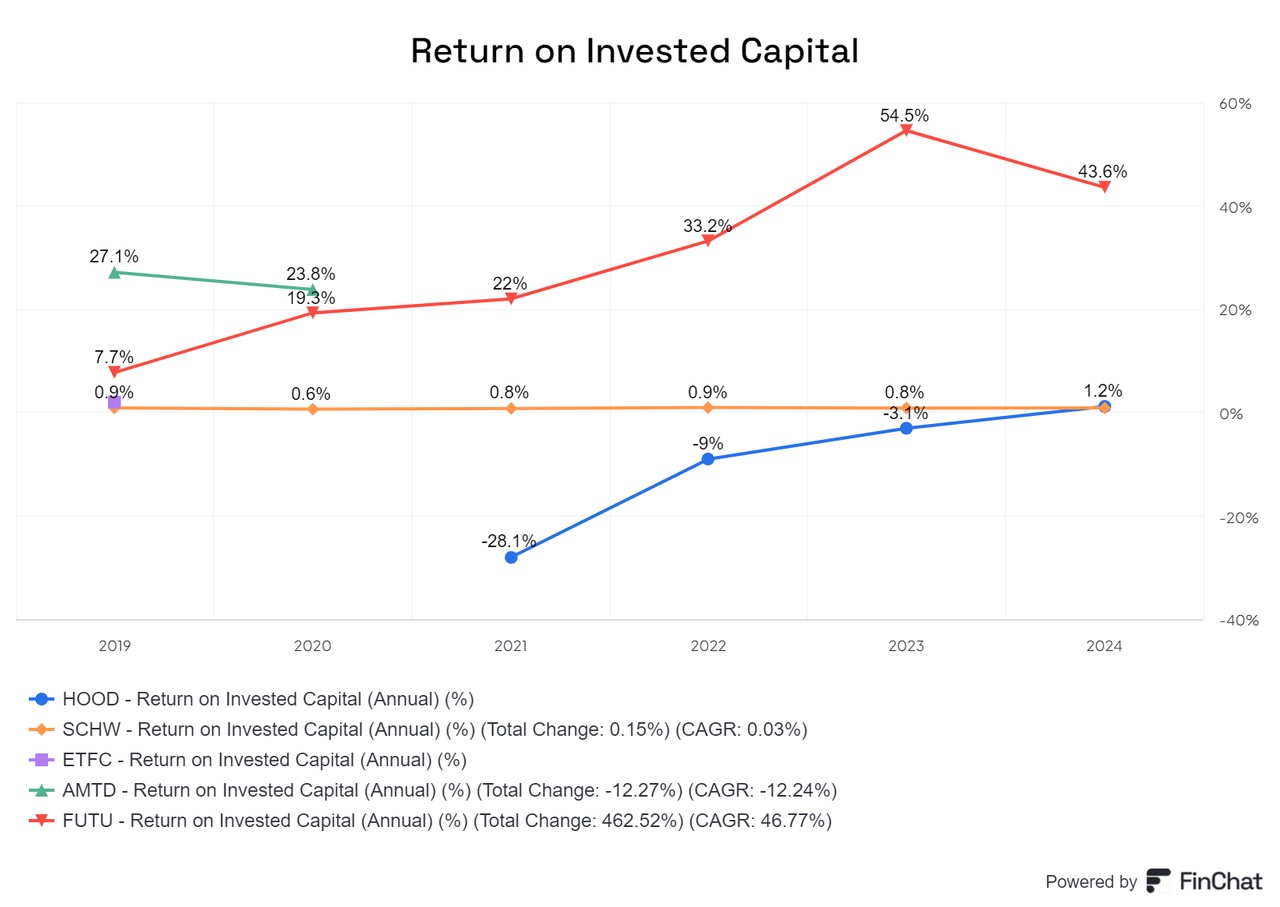

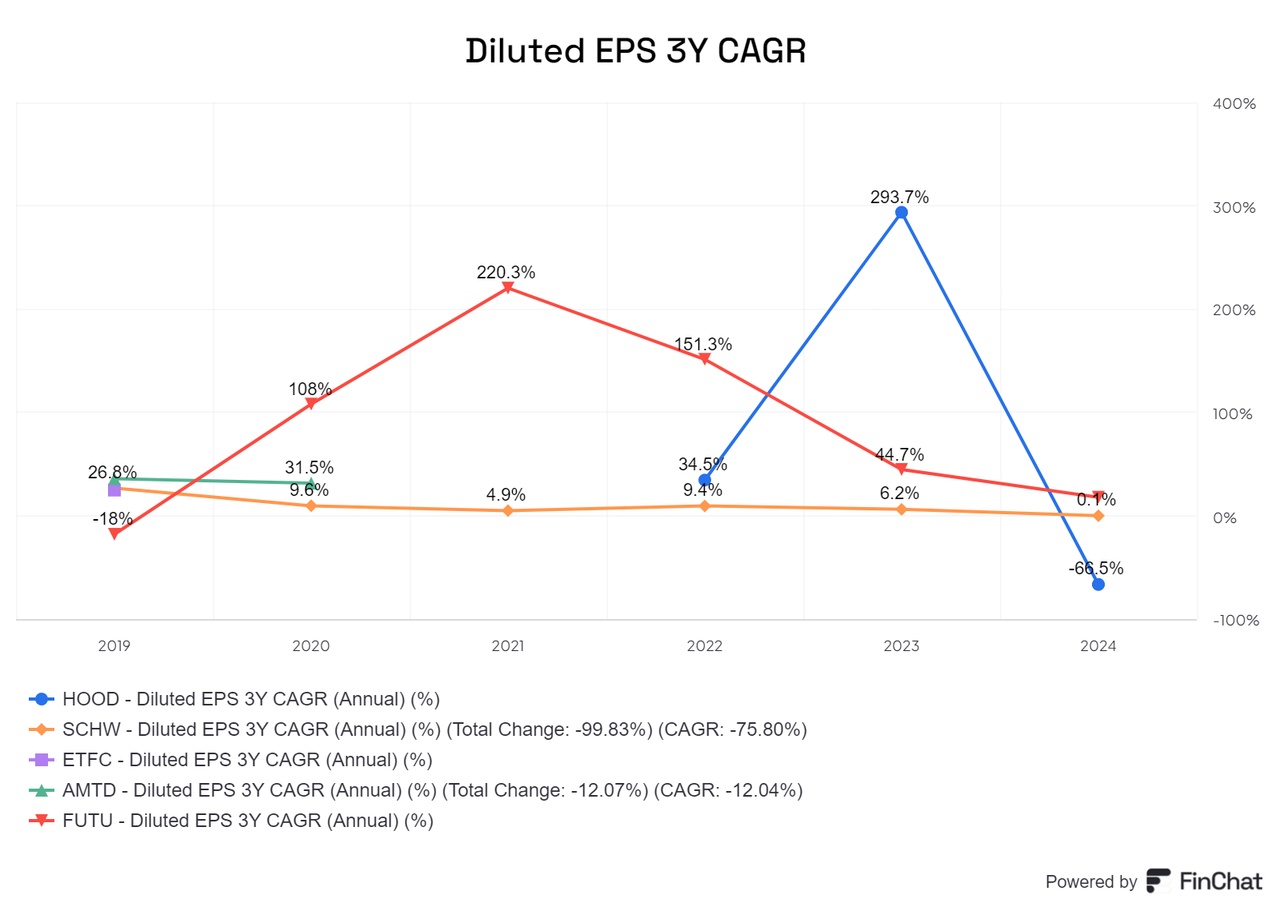

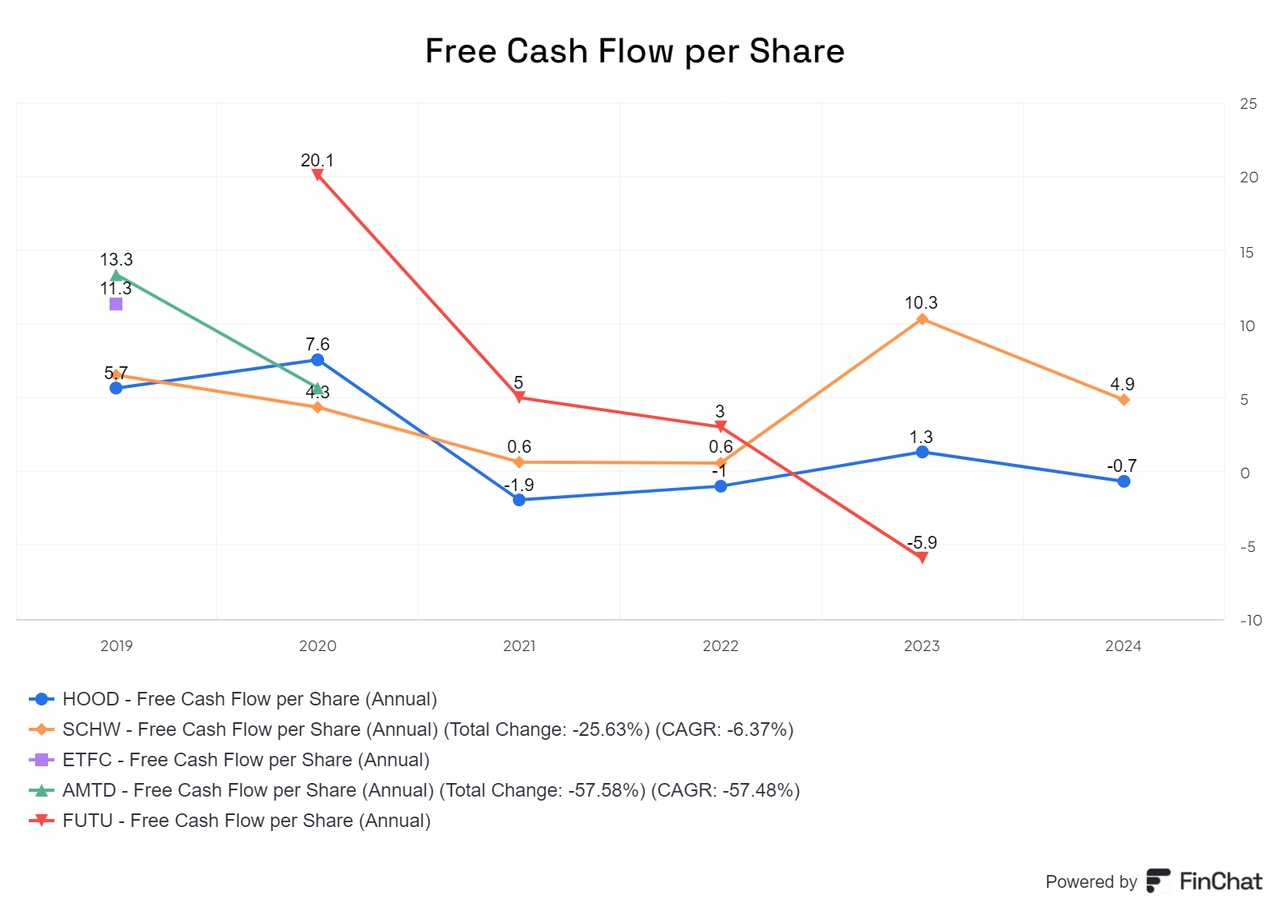

$HOOD (-3,19%) has undoubtedly made progress, repositioned itself strategically and improved its position. However, major challenges remain that cannot be solved overnight. The customer base consists mainly of risk-taking speculators rather than long-term investors. In addition, the company lacks the necessary size and stability to survive major challenges without slipping back into the red. Of course, my assumptions are extreme - there is no immediate reason why 50% of crypto sales should suddenly collapse - but they illustrate that Robinhood has not yet been a reliable investment and has still not proven that it can be one in the long term. The risk remains high and it will take some time and further positive developments to overcome the existing problems. For me, Robinhood therefore remains a candidate for the watchlist to keep an eye on. It should not be forgotten that more and more competition will enter the market and the comparison with other brokers who are already delivering reliable figures and whose growth story is far from over.

(rest of the pictures)

$SCHW (-0,9%)

$FUTU (-2,75%)

$AMTD