Disclaimer: the portfolio here is only for visualization on Getquin, after the hint of @Epi

I decided to create the whole thing as a wikifolio. Since I am planning to invest in the whole thing myself, I am of course happy about every reservation <3.

Wikifolio: https://www.wikifolio.com/de/de/w/wf000natxc

First of all, this is a short presentation of the companies, I will post more detailed articles in the coming days/weeks, otherwise this would go beyond the scope of this article. I look forward to your questions :)

I hope the formatting is ok so far.

The portfolio focuses on:

- Companies with strong economic moats (market leadership, high switching costs, unique assets and mission-critical products).

- Scalable business models with high/stable margins and strong free cash flow that can be efficiently reinvested (without innovation).

- Management teams with proven capital allocation skills and long-term incentives.

- long-term shareholder value

The Holdings:

Texas Pacific Land Corporation $TPL (-2,73%)

Texas Pacific Land Corporation, based in Texas, is one of the largest private landowners in Texas with approximately 880,000 acres in the Permian Basin. Founded in 1888 from the bankruptcy of the Texas and Pacific Railway, TPL generates revenue from oil and gas royalties, water rights, land leases and infrastructure services without being directly involved in exploration or production.

- Passive, high-margin modelTPL earns royalties from oil and gas production, land leases (solar, wind, pipelines, data centers, Bitcoin mining and many others) and water management (sales and purification), often with operating margins of over 70% as there are virtually no operating costs.

- Scalable growthIncreasing energy production in the Permian Basin drives royalty income without major reinvestment; water rights and infrastructure provide additional prime sources of growth.

- Capital-light modelLow investment requirements enable high payouts (dividends, share buybacks) while participating in rising commodity prices. In addition, land continues to be purchased which contributes to long-term value creation. TPL also has no debt.

- Historical performanceTPL has achieved annualized returns of ~20% over the last 10 years, driven by increasing energy demand and diversification.

- Unique "Moat": Owning non-replicable land in the Permian Basin creates an unassailable competitive advantage.

- Robust cash flowsRoyalty-based revenues are largely protected from operational risks and provide stability.

- Disciplined managementManagement has diversified the business model through water and infrastructure services and remains lean and efficient. Future focus on data centers (the Permian Basin is considered the ultimate hotspot for data centers in the US)

- Shareholder returnsUse of high free cash flows for dividends, special dividends and share buybacks to increase value per share.

Constellation Software $CSU (-0,41%)

Constellation Software, based in Canada, acquires, manages and develops vertical market software (VMS) serving niches such as local government, healthcare and financial services. With a decentralized model, it has acquired hundreds of small software companies worldwide and is considered the perfect compounder.

- Serial acquisitionsConstellation acquires small, cash-flowing VMS companies (typically USD 5-10m revenue) at attractive valuations, which enables consistent growth (~15-20% annualized returns since IPO in 2006).

- High returns on capitalAcquired companies generate stable, high-margin cash flows, which are reinvested in further acquisitions, creating a compounding effect.

- Stable revenuesVMS products have high switching costs and recurring revenues, which ensures predictability.

- Economic "moat"High switching costs and fragmented competitors in VMS markets protect against competition.

- Decentralized managementAutonomy for acquired companies promotes agility and efficiency.

- Outstanding leadershipFounder Mark Leonard is recognized as a master of capital allocation, with a focus on high ROIC acquisitions:

- Organic growthImprovement of acquired companies through cross-selling, price adjustments and product development.

- Capital efficiencyLow debt and reinvestment of cash flows in acquisitions rather than dividends to maximize long-term growth.

Heico Corporation $HEI (-3,31%)

Heico, based in Florida, is a leading manufacturer of aerospace and defense components, especially spare parts and repair services. It also serves niches in electronics and medical technology and is growing through acquisitions and organic expansion.

- Consistent outperformanceHeico has delivered ~18% annualized returns since 1987, driven by high-margin aerospace parts and strategic acquisitions.

- Acquisition-driven growthAcquisition of complementary companies to expand product offering and geographic reach. Over 70 acquisitions since 1995 have expanded market share in niche aerospace and defense markets.

- Stable demandGlobal growth and modernization in aviation, defense spending as well as the absolute necessity for repairs ensure long-term demand.

- Regulatory "Moat"Strict certifications (e.g. FAA) create high barriers to entry.

- Cost advantage and niche dominanceFocus on high-margin, mission-critical aviation components with limited competition. Heico's spare parts are often cheaper than OEM parts, which secures market share with high margins.

- Family-led management: The Mendelson family ensures long-term focus and discipline.

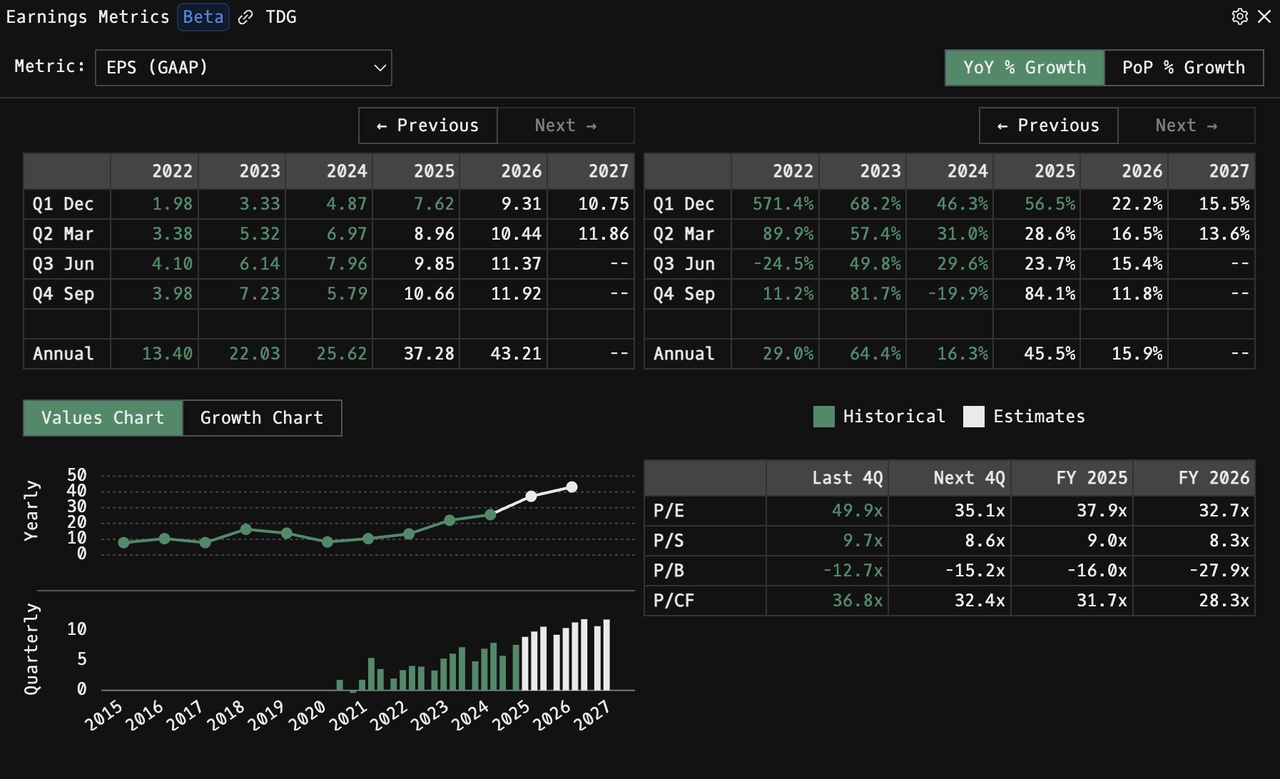

TransDigm Group $TDG (-0,29%)

TransDigm, based in Ohio, designs and manufactures specialized components for commercial and military aircraft, focusing on proprietary products with high margins and low competition. It is growing through acquisitions and pricing power.

- Excellent returnsTransDigm has generated ~24% annualized returns since 2007, driven by acquisitions, margin expansion and share buybacks.

- High-margin business: Mission critical products (e.g. actuators, sensors) enable pricing power and operating margins of over 40%.

- Capital allocationFree cash flow is used for acquisitions, debt reduction and shareholder returns, which increases the value per share.

- Value-enhancing M&AAcquisition of niche manufacturers, margin improvement through cost reduction and integration.

- Strong "Moat"High switching costs and regulatory barriers (e.g. FAA certifications) protect the market position.

- Pricing powerProprietary products with few competitors allow consistent price increases.

- Proven managementCEO Nick Howley has a disciplined acquisition strategy and is focused on shareholder value.

Parker-Hannifin Corporation $PH (-3,49%)

Parker-Hannifin, based in Ohio, is a global leader in motion and control technologies, including hydraulics, pneumatics and filtration systems for industries such as aerospace, automotive and manufacturing.

- Steady growthParker-Hannifin has achieved ~12% annualized returns over the past two decades, driven by diversification and acquisitions.

- High margins: Focus on high-quality, technical products ensures strong profitability.

- Capital allocationFree cash flow supports acquisitions, dividends (over 50 years of growth) and buybacks.

- Strategic acquisitions: Expansion of product lines and geographic presence through bolt-on acquisitions (e.g. Meggitt 2022).

- Market leadershipParker dominates niche markets in drive technology with a broad product portfolio.

- Diversified end markets: Exposure in aerospace, industry and energy reduces cyclical risks.

- Innovative strength: Investments in IoT, electrification and sustainable technologies ensure future growth.

- Operational efficiency: Use of lean manufacturing and cost discipline to secure high margins and finance growth.

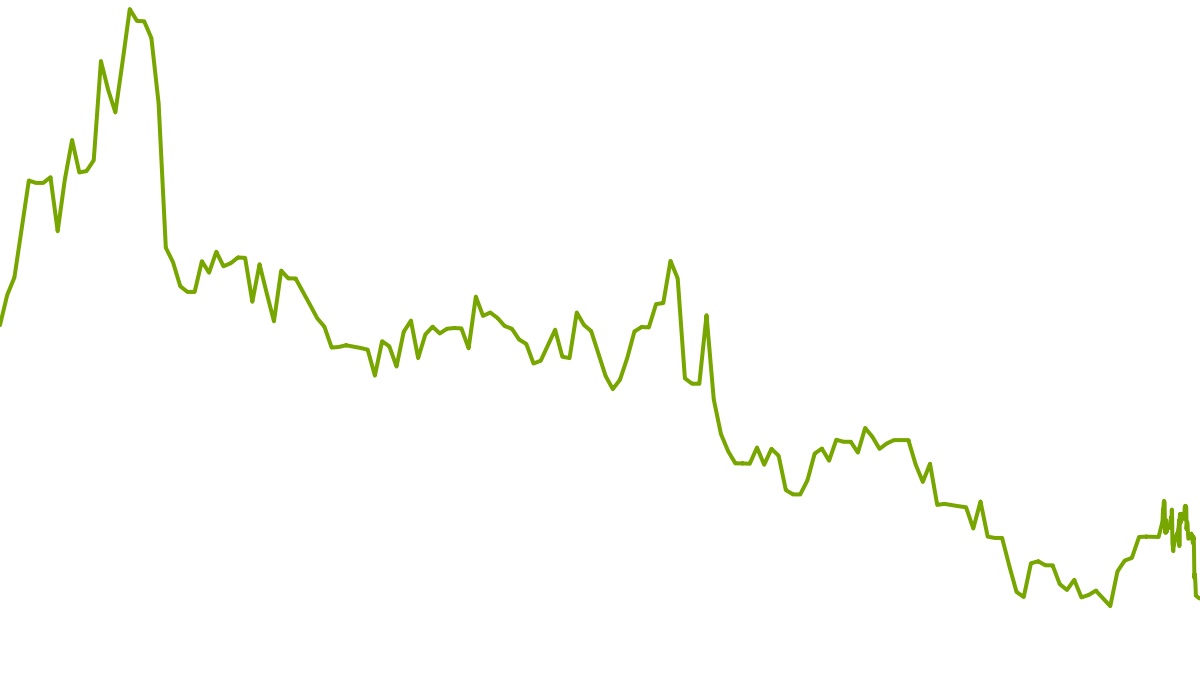

Fair Isaac Corporation $FICO (-2,99%)

Fair Isaac, based in California, is known for the FICO score, the leading credit scoring system in the US. It also provides analytics software and decision-making tools for industries such as banking, insurance and healthcare.

- Stable growthFICO Score generates predictable, recurring revenue while the software segment is growing at double-digit rates (~15% annualized returns over the last 10 years).

- High marginsSoftware and scoring services have low variable costs, enabling operating margins of over 30%.

- Long-term relevance: Credit risk assessment and analytics are essential for the financial industry.

- Dominant "Moat"FICO score has a quasi-monopoly position in the US with high switching costs for lenders.

- Innovation leadership: Investments in AI, machine learning and cloud analytics ensure future growth:

- Software expansion: Expansion of decision management software (e.g. fraud detection, customer analytics) to diversify revenues.

- Global reach: Expansion of scoring and analytics solutions into international markets.

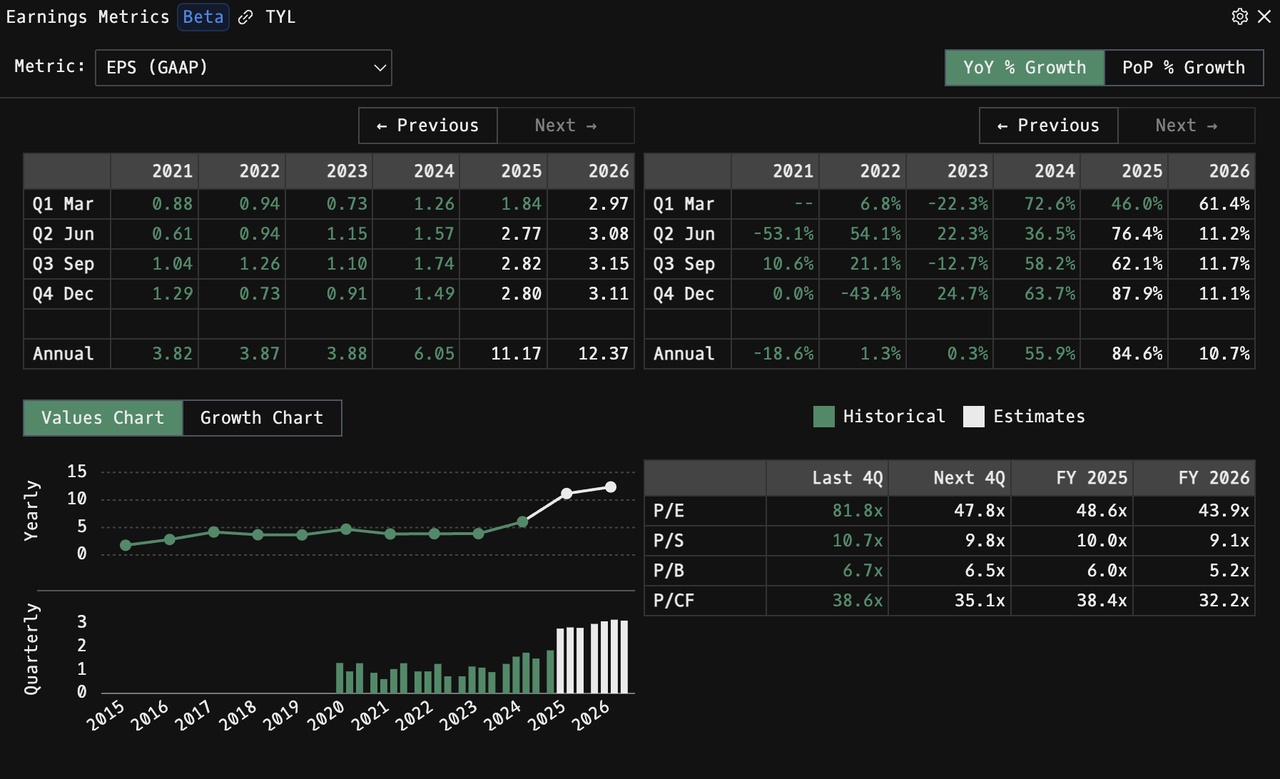

Danaher Corporation $DHR (-1,97%)

Danaher, headquartered in Washington, D.C., is a diversified conglomerate focused on life sciences, diagnostics and environmental solutions. It utilizes the Danaher Business System (DBS), a lean-based management framework, to drive efficiency and growth.

- Outstanding track recordDanaher has achieved ~26% annualized returns since 1978, driven by acquisitions and operational excellence.

- High returns on capitalDBS optimizes acquired businesses, increasing margins and cash flows for reinvestment.

- Resilient markets: Exposure to life sciences and diagnostics ensures stable, long-term demand.

- Market leadershipDanaher is a leader in niches such as laboratory equipment (e.g. Beckman Coulter) and diagnostics (e.g. Cepheid).

- Diversified portfolioBroad exposure reduces dependence on individual markets. Continuous reinvention and further development of the company, positioning Danaher for long-term growth:

- Strategic acquisitionsAcquisition of high-quality life sciences and diagnostics companies, integration with DBS to enhance performance.

- Operational excellence: Use of DBS to increase margins, reduce costs and accelerate growth.

- Innovation focus: Investing in research and development for cutting-edge technologies in genomics, diagnostics and environmental technologies.

Roper Technologies $ROP (-2,23%)

Roper Technologies, based in Florida, is a diversified technology company that provides software and hardware solutions for niche markets such as healthcare, energy and education. It is growing through acquisitions and organic expansion.

- Consistent growthRoper has delivered ~15% annualized returns over the last two decades through disciplined acquisitions and stable cash flows.

- High-margin businesses: Software and services generate recurring revenues with margins in excess of 30%.

- Capital efficiencyStrong cash flows finance acquisitions and dividends with high ROIC.

- Niche leadershipRoper dominates fragmented markets with high switching costs (e.g. healthcare software, water management systems).

- Strong management: Management excels at identifying and integrating high value acquisitions.

- Recurring revenuesSubscription-based software models ensure predictable cash flows.

- M&AAcquisition of market-leading companies in high-margin niche markets with stable demand.

- Organic growth: Improvement of acquired companies through product innovation and market expansion.

- Shareholder focus: Balance between acquisitions, consistent dividend growth and opportunistic buybacks.

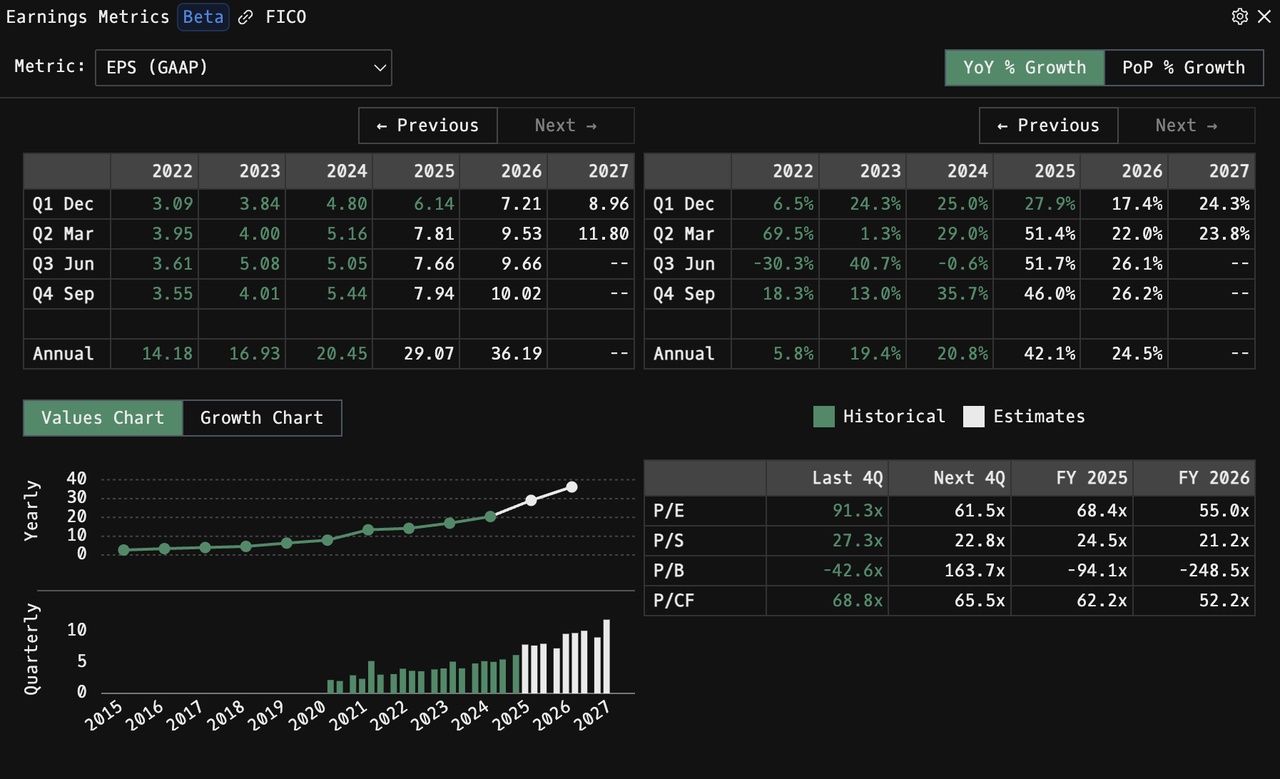

Tyler Technologies $TYL (-0,91%)

Tyler Technologies, based in Texas, is the leading provider of software solutions for the US public sector, serving municipalities, courts, schools and other government agencies. Its platforms digitize administrative processes.

- Stable growthTyler has achieved ~15% annualized returns over the last 10 years, driven by the digitization of the public sector.

- Recurring revenueSubscription-based software contracts provide stable, high-margin cash flows.

- Scalable model: New solutions can be rolled out to the large customer base with minimal additional costs:

- Market dominanceTyler is a leader in the public sector software market, with high switching costs for customers.

- Economic "Moat"Long-term government contracts and regulatory complexity keep competitors at bay. Deep integration into customer processes minimizes churn.

- Focus on the public sector: Expansion of software offering (e.g. court management, tax systems) to meet growing digitization needs.

- SaaS transformation: Conversion of customers to cloud-based, subscription-based models for higher recurring revenues and margins.

- Strategic acquisitions: Acquisition of complementary software providers to expand the offering and customer base.

Arthur J. Gallagher & Co. $AJG (-0,65%)

Arthur J. Gallagher, based in Illinois, is a global insurance broker and risk management services provider offering customized insurance solutions and advice to businesses and individuals.

- Stable growthGallagher has achieved ~14% annualized returns over the past 10 years, driven by acquisitions and organic growth in the stable insurance sector.

- Recurring revenues: Commission-based income from insurance renewals ensures predictable cash flows.

- Acquisition-driven expansion: Acquisition of small and mid-sized brokers to expand geographic and product reach.

- High return on investmentAcquisitions of small brokers generate immediate cash flows that are reinvested with attractive returns.

- Organic growthDeepen customer relationships through cross-selling and specialized risk management services.

- Scalable modelGallagher's platform enables efficient integration of acquired brokers, expanding client base and capabilities.

- Regulatory "Moat"Complex insurance regulations and client relationships create barriers to entry.

- Strong managementLeadership has a proven track record of disciplined acquisitions and organic growth.

- Operational efficiency: Optimizing operations to maintain high margins and finance further acquisitions.

The portfolio achieves the broadest possible diversification with targeted exposure to first-class compounders. Through acquisition strategies, the companies increasingly cover more and more niches within a sector, which simultaneously promotes diversification and growth.

I know that there are a few companies that would also fit in here, but I particularly wanted to include some that are less well known and not represented in most portfolios. For example, most people here already have Berkshire, Mastercard, Visa or other tech companies in their portfolios anyway.

The portfolio is not a standalone, or rather I see it as an addition to specifically bring compounders (which are also partly uninteresting for "beginners" due to the high share price) into the portfolio and thus directly overweight them, since as far as I know they are also underweighted in every ETF and therefore cannot provide any real added value.

If you want to invest in the Wikifolio, a share should have a weighting of >30% and will be rebalanced.

I am curious about the new ETF from @lawinvest let's see if we have a chance against the Ultimate Homer @Simpson have a chance against the Ultimate Homer.