The share price of the aerospace company $RKLB (-0,23%) is shooting to a new record high today - driven by a surprising analyst upgrade and growing euphoria surrounding the Neutron rocket program. But can the hype last in view of the already sharply increased valuation?

Citigroup fires up price target to 50 dollars

The latest boost is no coincidence: the investment bank Citigroup has raised its price target for the share from 33 to 50 dollars - one of the most bullish forecasts on Wall Street. The bank cites significantly higher revenue expectations until 2029 as the reason, driven by booming demand for commercial satellite launches and defense contracts.

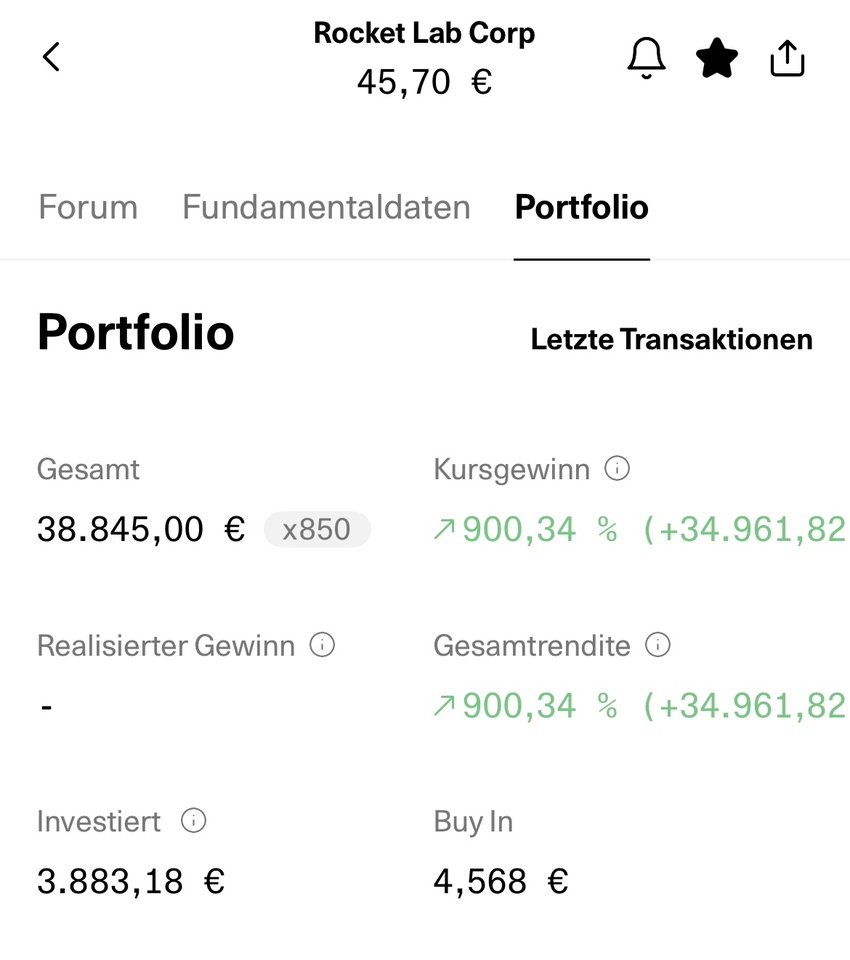

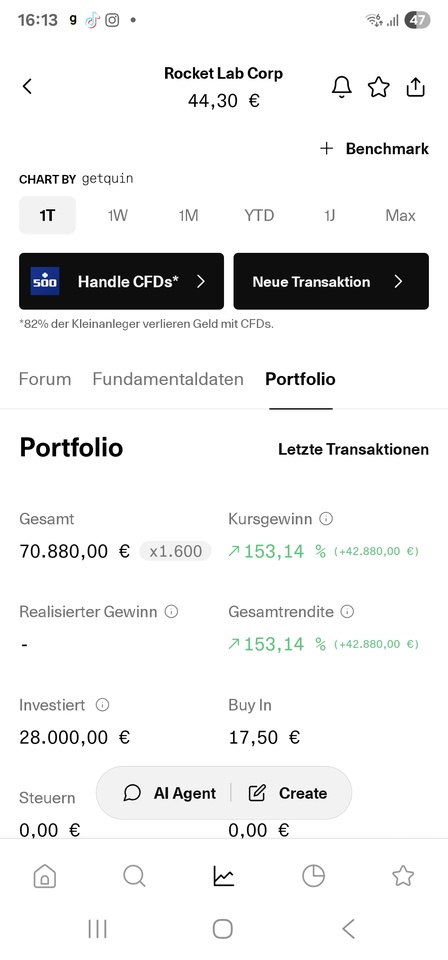

The markets immediately rewarded the realignment. With a gain of over 10% today and almost 70% since the beginning of the year, Rocket Lab is one of the top performers in the aerospace sector. However, the valuation is ambitious: The company is trading at 34 times expected annual sales - a premium that would only be justified by the fulfillment of high growth expectations.

Advertisement

Sollten Anleger sofort verkaufen? Oder lohnt sich doch der Einstieg bei Rocket Lab USA?

Neutron rocket as a game changer?

However, the real driver of investor euphoria lies in the future: the first mission of the new Neutron rocket is scheduled for the second half of 2025. If the launch is successful, Rocket Lab could join the league of major space companies and land lucrative government contracts - including possible missions for the US National Security Space Launch Program.

The recent partnership with the European Space Agency (ESA) also underlines the company's growing standing. But the crucial question remains: Can Rocket Lab meet the high expectations - or is it in danger of crashing after the rocket launch?

https://www.boerse-express.com/news/articles/rocket-lab-aktie-raketenstart-zum-allzeithoch-809027