Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

Messaggi

175Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

Started at 10k at the beginning of the year and thanks to $RKLB (-6,93%) I have already reached my (I thought) unrealistic annual target.

When I look back on the last 9 months today, I am truly grateful.

@Shiya I had been introduced to an incredibly detailed company presentation on Rocket Lab ($RKLB (-6,93%)

) with an incredibly detailed company presentation.

I was super intrigued, did some more research myself and then jumped on the bandwagon - and with increasing conviction I added more with every dip.

My average entry level went up as a result, but it was worth it:

+116 % with currently 390 shares (until today, my target would actually have been 500 shares, but I also had to put something into one or two ETFs to spread my risk and also buy two medical stocks to limit my losses 😅) - but now: My first real "hundred-bagger moment" 🚀.

We want to do our garden in the spring 🌿 - without this tip (and my stamina during the sometimes violent setbacks 😜) we would probably need a loan.

After an exciting phase with a lot of movement in the share price Rocket Labseems to have stabilized - and at an impressively high level.

Despite the capital increase and insider selling, the upward trend remains fully intact.

Fundamentally, things are going well:

The entire Space & Defense sector is showing momentum - ETFs such as $UFO or $ITA are also breaking out bullishly.

👉 Conclusion: Healthy volatility, strong order books and a clear technical trend - everything continues to point to strength.

I remain invested and plan to sell the first only if Neutron really takes off by the end of the year (so much for the theory, let's see if I can hold out 😂

Perhaps a little emotional - but patience has not been a bad strategy here so far.

I think: Rocket Lab remains one of the most exciting space titles of the next few years.

The Sky is (still) the Limit. 🌌

Is there any news about $RKLB (-6,93%) ?

$IREN (-9,15%) has been number one on the IBD50 list for four weeks.

Criteria for making the list:

-Sales growth

-Share price increase

-Quarterly figures

...

I continue to see a lot of potential in Irish with a target of $100

Also interesting is place 5/6 $HOOD (-9,88%) and $PLTR (-7,09%) and $RKLB (-6,93%) 9th place.

My current savings plans are Iren and Rocketlab from the list.

In addition, in 15th place $HIMS (-8,47%) which are on the list due to the price increase. Nevertheless, I am no longer buying due to my allocation.

I always find the list interesting because there are new stocks to be found :) which I then analyze!

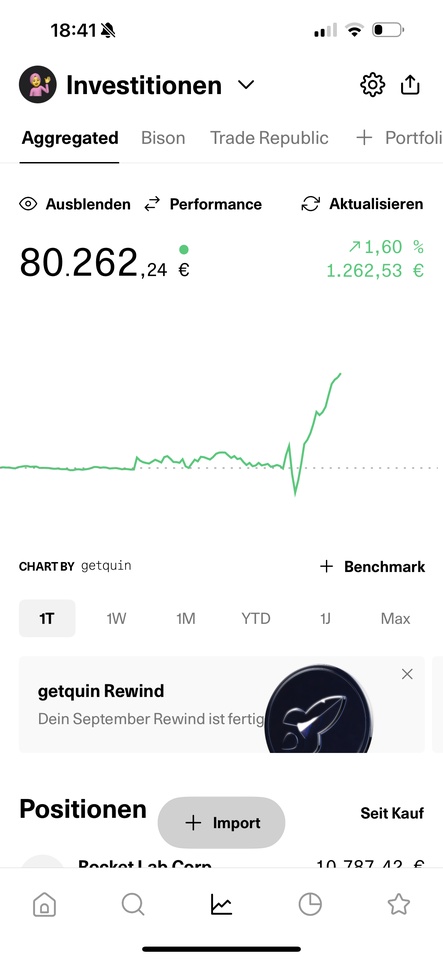

My goal was actually to maybe reach 80,000 by the end of this year. I cracked the 70,000 mark about 2 months ago. Thanks to $RKLB (-6,93%) and $NBIS (-5,26%) it went a little faster. It's only a snapshot, but I'm still really pleased. Road to 100,000 🚀

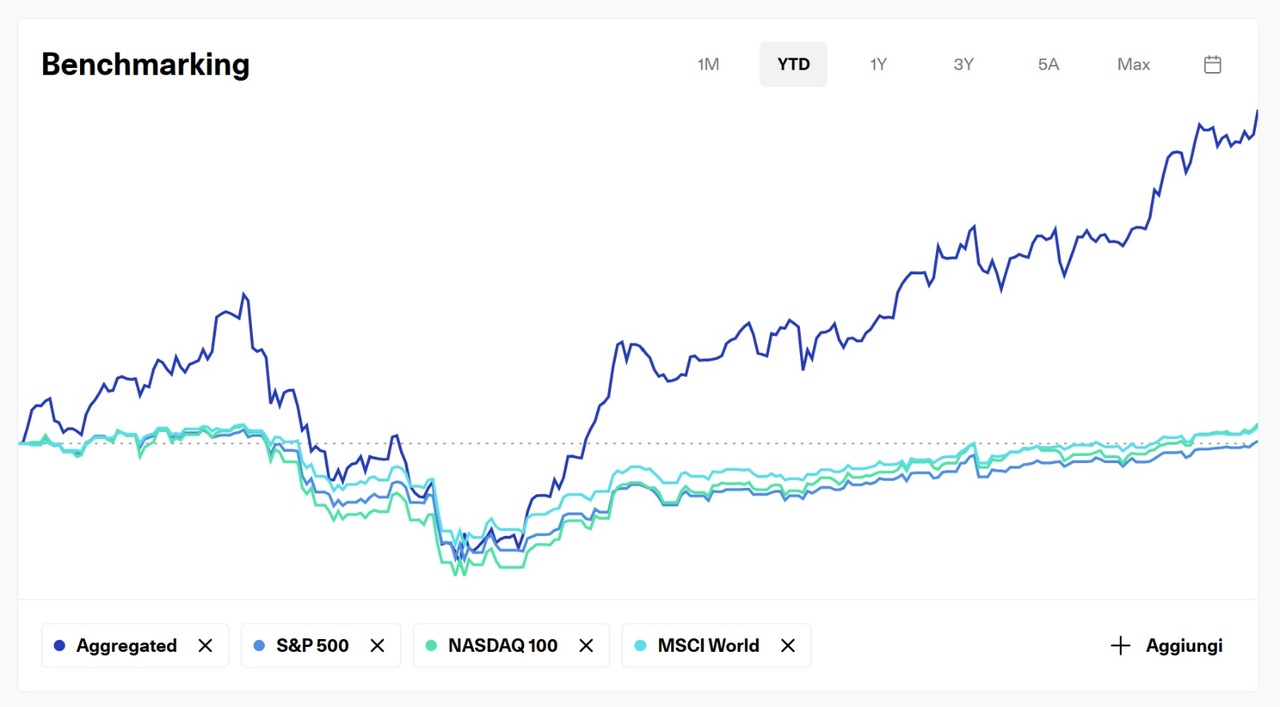

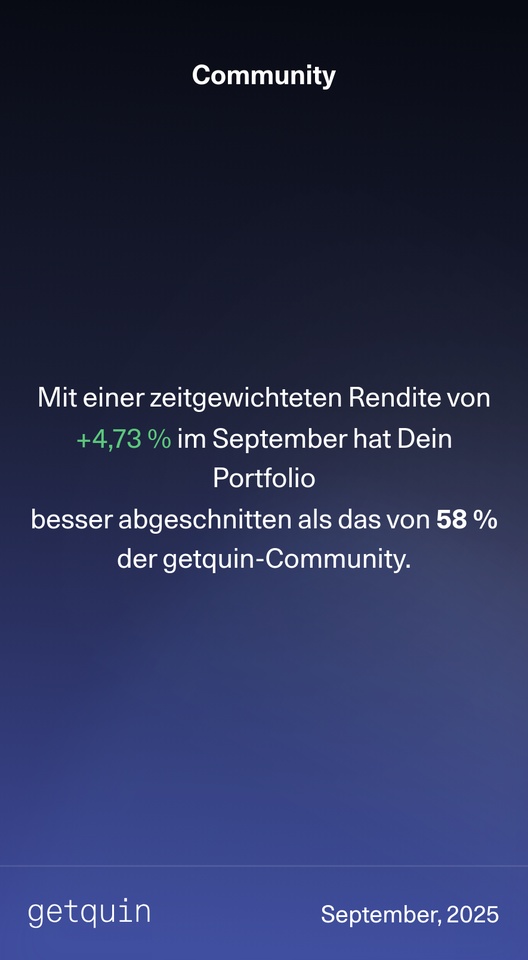

I'm actually quite happy with my performance in September, would say solid midfield.

My focus at the moment is on bringing more structure into the portfolio: fewer stocks, but a higher weighting, which of course also means more risk. I'm also currently holding a little more cash because I think the markets are quite highly valued at the moment.

My next tranches will probably go into $RKLB (-6,93%) and $SOFI (-10,55%)which I find super exciting at the moment.

What do you think? What are your top picks at the moment?

Bull Market Stock Portfolio Management.

Screenshot day.

$RKLB (-6,93%)

$NBIS (-5,26%)

$HIMS (-8,47%)

$OSCR (-4,92%)

$SOFI (-10,55%)

$AMD (-10,01%)

$DLO

$TMDX (-5,55%)

$AMZN (-5,92%)

$GOOGL (-3,4%)

$ISP (-1,98%)

$UNH (-5,78%)

$OPEN (-10,72%)

China is pumping $BIDU (-8,38%)

$BABA (-8,67%)

$JD (-6,72%)

Cripto, waiting for altcoin season

$AVAX (-10,42%)

$BTC (-1,92%)

$ETH (-2,9%)

$SOL (-4,37%)

$RENDER (-6,45%)

$KAS (+25,25%)

Not a breathtaking performance in September, but every plus is taken. As my portfolio still largely consists of $RKLB (-6,93%) and they haven't moved much, the portfolio has remained rather stable overall. But after the rapid rise in the summer, I would say a little break is more than deserved.

New positions in September: $3993 (-3,2%) and $INT (-12,36%)

October has already got off to a strong start and looks promising overall.

What are your course objectives for $ONDS (-12,99%) , $3350 (-2,4%) and $RKLB (-6,93%) ? at what price would you realize profits or liquidate the position?

I migliori creatori della settimana