$RGTI (-1,09%)

- Revenue: $2.3M, -33% YoY

- Net loss: $153.0M vs $12.6M in Q4 2023

- Cash position: $217.2M as of December 31, 2024

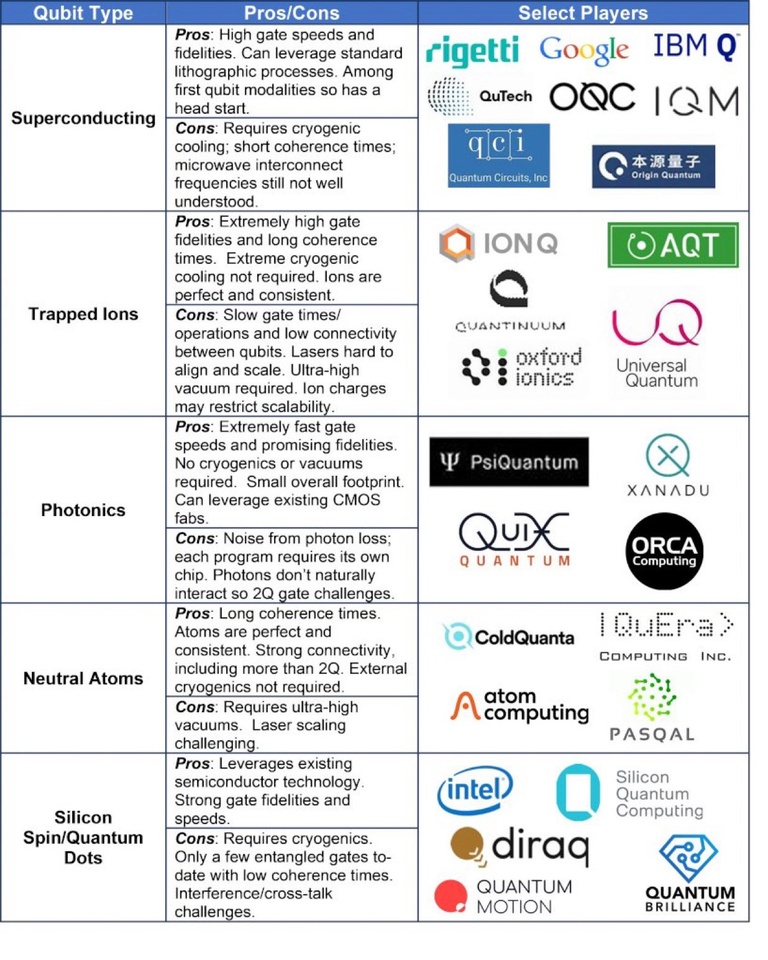

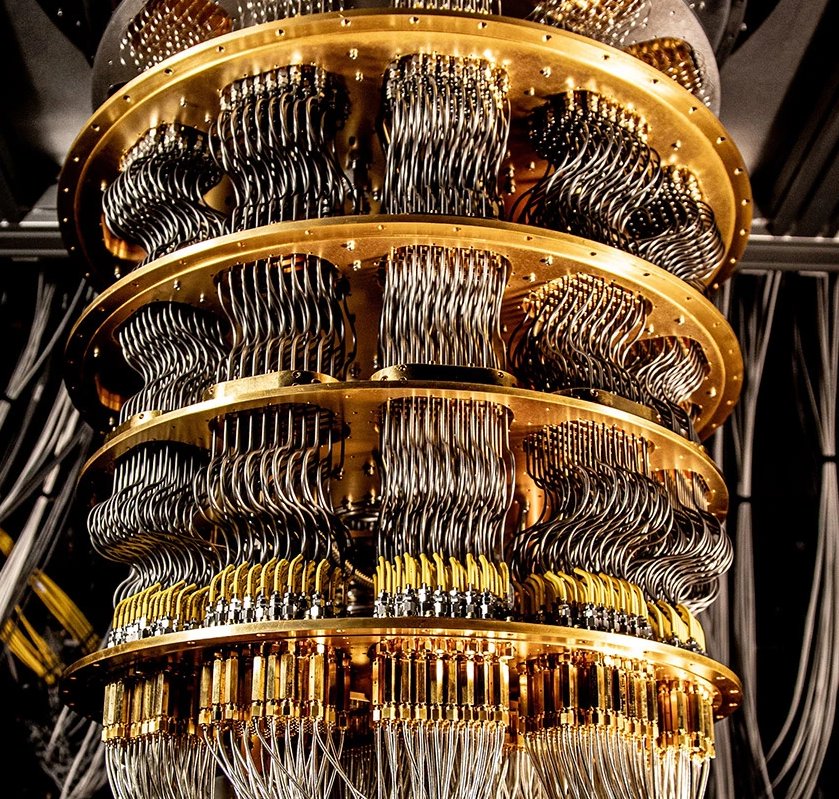

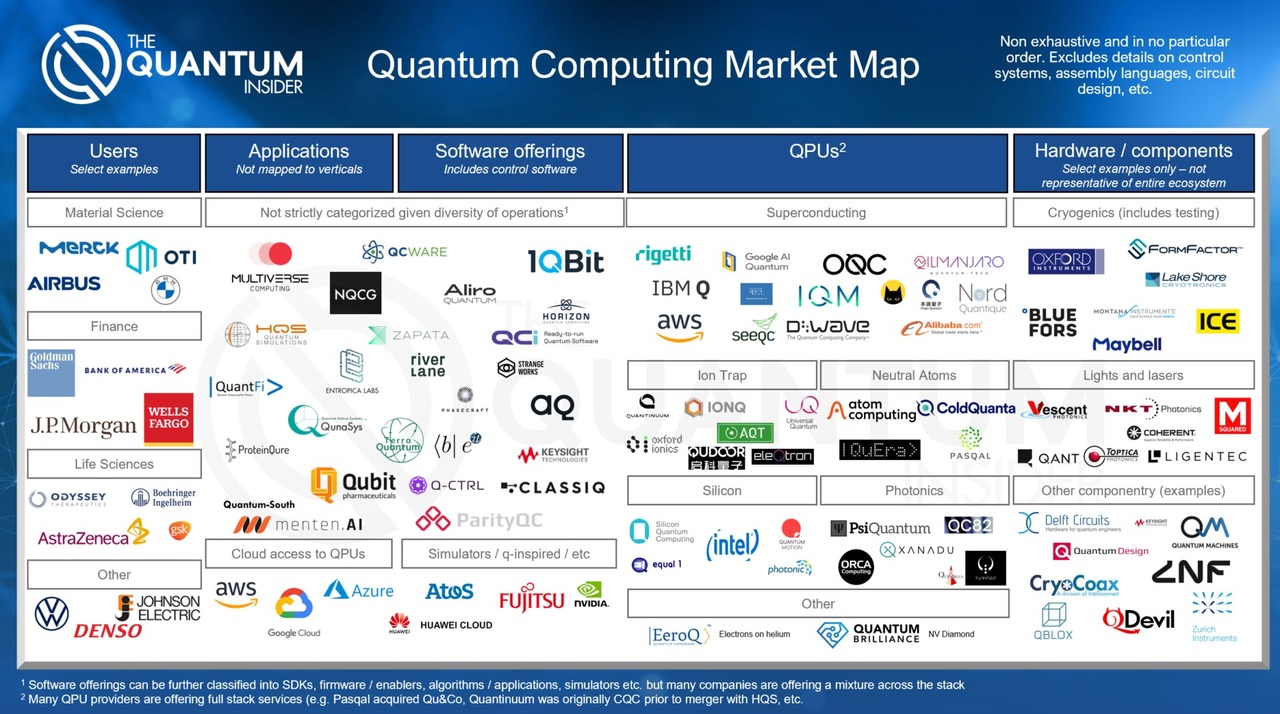

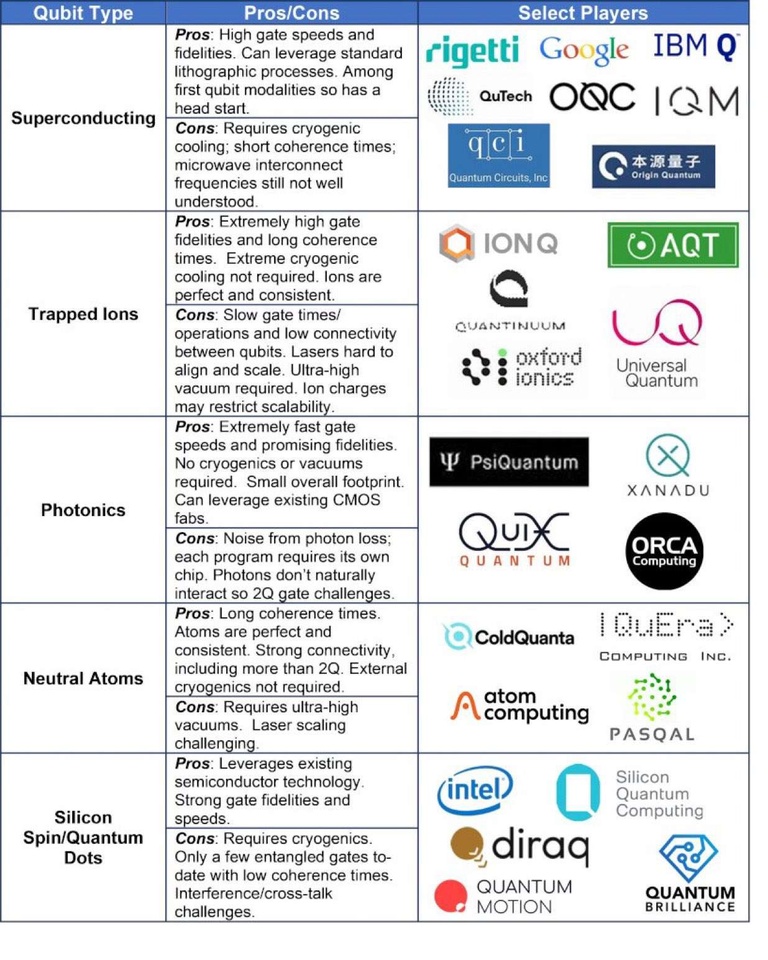

CEO Dr. Subodh Kulkarni: "We believe that superconducting qubits are the winning modality for quantum computers given their fast gate speeds and scalability. We've developed critical IP to scale our systems and remain confident in our plans to scale to 100+ qubits by the end of the year."

🌱Revenue & Growth

- Q4 Revenue: $2.3M vs $3.4M in Q4 2023 (-33% YoY)

- Full-year 2024 revenue: $10.8M vs $12.0M in 2023 (-10% YoY)

- Sold a Novera QPU to Montana State University in December 2024

- Released 84-qubit Ankaa-3 system in December 2024

💰Profits & Financials

- Q4 Operating loss: $18.5M vs $17.2M in Q4 2023

- Full-year operating loss: $68.5M vs $72.3M in 2023

- Q4 Operating expenses: $19.5M vs $19.7M in Q4 2023

- Raised $153.3M from equity offerings in Q4 2024

- Prepaid all remaining amounts owed to Trinity Capital

📌Business Highlights

- New strategic collaboration with Quanta Computer with $100M+ commitment from each side over 5 years

- Quanta will invest $35M to purchase Rigetti common stock (pending regulatory clearance)

- Launched 84-qubit Ankaa-3 system with 99.0% median iSWAP gate fidelity

- Successfully automated QPU calibration using AI-powered tools

- Research demonstrating optical reading technique published in Nature Physics

🔮Future Outlook

- Plans to scale to 100+ qubits by end of 2025

- Targeting 2x reduction in error rates from end-of-2024 levels

- Partnership with Quanta designed to accelerate development and commercialization

- Focus on complementary strengths with Quanta to develop quantum computing technologies

- Emphasis on modular approach to continue enabling partner integrations