Discussione su RDDT

Messaggi

11Successful together

#momentum Strategy week 33

Hello my dears,

stocks mentioned so far were

$MP (+3,04%)

$NBIS (+9,49%)

$LMND (+1,4%)

$AAPL (+1,23%)

$BMNR (+3,32%)

$ELF (-1,58%)

$9868 (+0,65%)

$XPEV (+0,81%)

$UCG (-2%)

$PRY (+1,22%)

$G1A (+1,27%)

$LOTB (-1,88%) +10% $UFPT (+0,32%) +9,34%. $AHT (-0,41%) 7,15%. $UNH (+1,21%) 20,26%

$ETH (-0,23%)

$NB (+2,97%)

$VLA (-0,1%)

$HOT (+1,97%) +13%. $CWCO (+0,66%) +14%

$ALV (+0,33%) +6,4 %. $MAIN (-0,58%) +5,3%. $TUI1 (+0,27%) +18,3%

$RDDT (+6,34%) . $GUBRA (-2,55%)

$ONDS (+3,62%)

$IREN (+11,25%)

My shares would be

$MU (+5,61%) +17%. $GILT (+4,07%) +20%. $APP (+5,16%) +17%

The shares are for identification purposes only.

And does not constitute a buy recommendation.

An analysis and evaluation of the multiples should definitely be carried out here.

You are also welcome to share your results with us.

I look forward to hearing more about your performers.

Momentum strategy, being successful together.

Hello my dears,

What do you think of the idea that we might share our weekly winners once a week.

This way we discover all the stocks that are currently showing high momentum.

These might be suitable for a short-term trade.

But we might also discover a long-term investment.

Stocks that are just breaking out due to a story, good figures, new innovations, approvals, etc

And are perhaps not yet on the radar of the community.

What do you think of my idea?

Who's in and which day do you think makes sense?

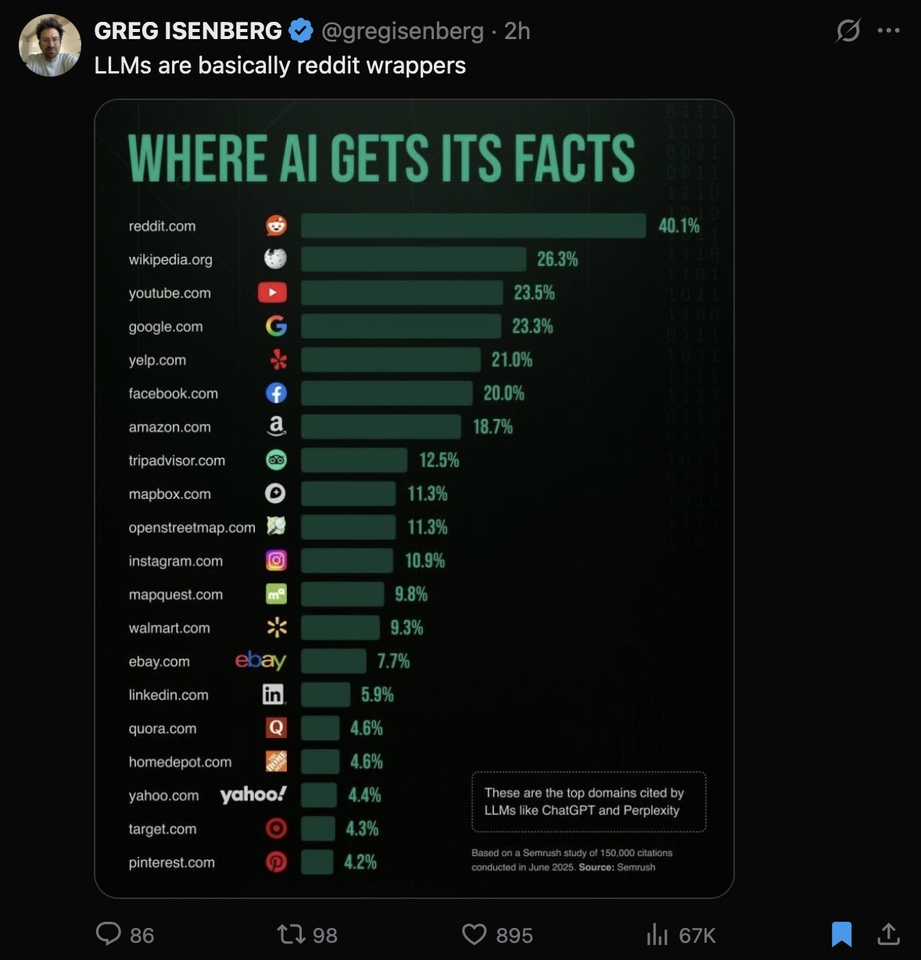

Reddit's Early Growth Signals: Analysts Predict Surging Ad Revenue and Market Potential

$RDDT (+6,34%) B.Riley analysts highlighted that Reddit is still in the early stages of growth, with significant potential to exceed expectations within its category. This perspective is supported by the company's impressive 48.7% revenue growth and remarkable gross margin of 89.25%. They foresee substantial growth in advertising revenue, attributing it to an expanding user base and improved monetization strategies, including enhancements to the ad platform and an increase in ad inventory

User Engagement and Growth Reddit

$RDDT (+6,34%) Reddit's user base is rapidly expanding, with impressive growth rates in daily active users (DAU). In the second quarter of 2024, the company reported 91.2 million DAUs, a 51% year-over-year increase, surpassing consensus estimates by approximately 8%. This acceleration in user growth is attributed to several factors, including improved user experience, enhanced retention strategies, and more effective content discovery mechanisms.

Platform engagement metrics were also strong, with a 40% year-over-year increase in total conversation page views. Registered users in the United States grew by 29% year-over-year, indicating solid market penetration domestically. Reddit's success in user growth is partly due to its deeper integration into Google search results and faster web processing, which have improved accessibility and visibility.

Reddit Poised to Benefit from TikTok's Troubles: Analysts Predict Revenue Growth Potential

$RDDT (+6,34%) Reddit faces competition from other social media platforms, but its unique community-driven model and diverse content offerings set it apart. The company's lower exposure to video budgets compared to other platforms could be advantageous, especially in light of potential regulatory challenges faced by competitors like TikTok.

Analysts suggest that a potential TikTok ban could encourage advertisers to diversify their spending on platforms like Reddit. Even a small shift in ad budgets from TikTok could result in significant gains for Reddit, with some projections indicating that a 1% shift could lead to a 10% increase in Reddit's revenue forecasts.

Exploring My Investment Journey: From Dividend Stocks to Growth Opportunities

I’ve been following the stock $RDDT (+6,34%) since its IPO at the beginning of this year. I have to say, I was pretty surprised when it exploded just a few weeks ago. I didn’t expect it to jump as it did, and watching the market’s response to Reddit’s unique platform has been fascinating. This kind of volatility is both thrilling and, at times, a bit daunting.

Over the years, my investment strategy has leaned more towards steady, knowledgeable growth. Stocks like $VWRL (+0,41%) (a well-diversified ETF) and stable dividend payers like $PG (-0,4%) have been my go-to choices for consistent returns. Dividend stocks particularly caught my attention earlier this year, and I took the time to dive deep into what makes them tick. What I found is that these stocks, while not the most thrilling or fast-moving investments, offer a dependable source of income. For investors approaching retirement or those who prefer stability, dividend stocks can be an excellent choice since they tend to have lower volatility and can provide a steady income stream. However, steady income doesn’t necessarily mean there will be significant growth in the stock price itself. In fact, a lot of dividend stocks are from established, mature companies, so while you might get that dependable payout, the appreciation might be minimal compared to growth stocks.

After reflecting on my financial goals, I realized that while I appreciate the consistency of dividend stocks, I’m at a stage where I’d like to take advantage of growth opportunities. I still reinvest any dividends I earn into more dividend stocks. This allows me to benefit from the compounding effect without having to put in new capital into that part of my portfolio. However, I’ve decided that any new money I invest will go towards growth stocks, steady growth stocks, or ETFs that provide a blend of both.

The approach of reinvesting dividends is something I feel has long-term potential. By putting those earnings back into dividend-paying stocks, I’m effectively compounding my returns over time, allowing my portfolio to grow passively. This strategy is more aligned with a long-term mindset, as it builds a larger base for future dividends. However, new capital is focused on stocks with more growth potential. For instance, tech stocks, clean energy, or emerging markets. These areas often have higher risk but come with the chance for greater rewards. A high-growth stock may not be the kind of steady income generator that a dividend stock is, but it’s an opportunity to capitalize on market trends or innovation, which can translate to higher returns if timed well.

The question, however, is always about balance. For me, finding a balance between growth and stability has become a guiding principle. It’s tempting to chase high returns, especially in a market where certain stocks can double in weeks. But keeping a portion of my portfolio in steady, dividend-generating assets has given me peace of mind. This mix allows me to benefit from compounding dividends, while also tapping into the potential upside of growth investments.

My strategy has definitely evolved over the past year, and I imagine it will continue to do so. Markets are constantly changing, and I think a flexible approach that allows for adjustments as your own financial goals shift is essential. How do you all find balance between steady dividend stocks and high-growth investments? Do you focus on one over the other, or aim for a combination of both?

Booming right now!! Last week Reddit exploded after releasing their earnings call on the 29th of october. #reddit

$RDDT (+6,34%)

#stockanalysis

When do you think you can buy Reddit shares in Germany? $RDDT (+6,34%)

Titoli di tendenza

I migliori creatori della settimana