$NDAQ (+3,99%)

$RTX (+7,79%)

$KO (+3,41%)

$MMM (+5,19%)

$NOC (-0,56%)

$LMTB34

$OR (+0,22%)

$TXN (+0,48%)

$NFLX (+0,17%)

$HEIA (-1,11%)

$SAAB B (-0,84%)

$UCG (-0,64%)

$BARC (+0,96%)

$GEV (-1,17%)

$TMO (+3,24%)

$T (+0,18%)

$MCO (+1,95%)

$IBM (+0,45%)

$SAP (+0,76%)

$TSLA (+0,11%)

$AAL (+1,83%)

$FCX (-2,15%)

$HON (+1,97%)

$DOW (+1,61%)

$NOKIA (-0,32%)

$TMUS (-0,18%)

$INTC (-0,71%)

$NEM (-9,49%)

$F (+5,01%)

$PG (+0,11%)

$GD (+1,03%)

Discussione su PG

Messaggi

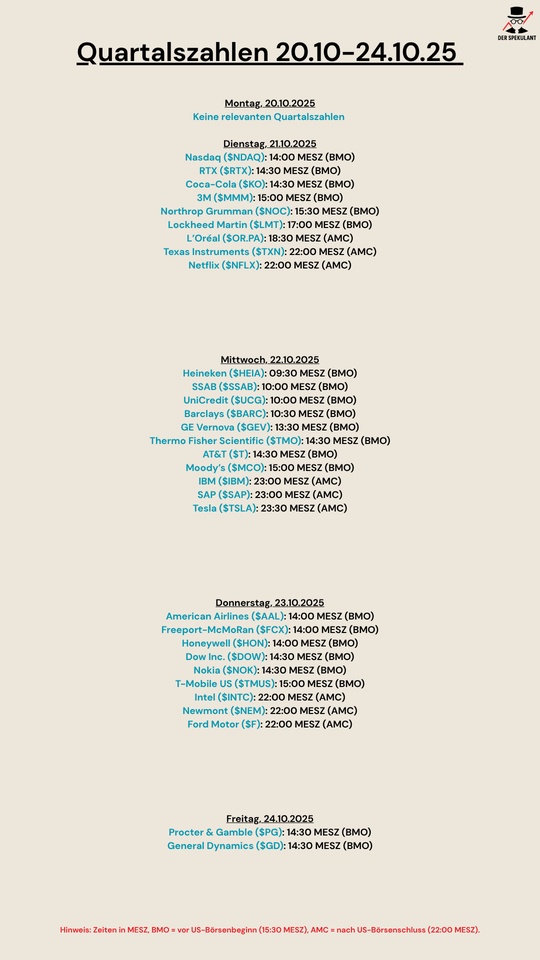

333Quartalsberichte 21.10-24.10.25

New Video Online

Turmoil in the stock market by Usa and China. Shares $PG (+0,11%) purchased. Watch the video and subscribe and follow my Road To 100K

Do you have at home

Today a little $PG (+0,11%) stocked up. Every little helps. Do you also have PG in your portfolio? Or does the share leave you cold? 🥶

THE consumer giant

After about 4 years of waiting and exploring, I made a bold move last week. In my opinion, this stock belongs in every portfolio as a stable pillar. And as a value investor, you know that you should pick up stocks like this at a good price. I therefore enjoy reading articles about sluggish consumer spending. What's more, the depreciation of the USD plays into the hands of us Europeans.

Buy tranche 1 of 3.

Have a nice Sunday

SHOULD YOU OWN P&G IN 2025 AS A DIVIDEND INVESTOR?

YT: https://youtube.com/shorts/HfpV0r_fdpQ?feature=share

If you are into #dividendinvesting , you probably come across $PG (+0,11%) as a dividend stock. I am currently holding some P&G and planning to increase my position at that price for sure. The long dividend history + solid growth and payout ratio and a stable everyday-use product portfolio, in my opinion this is a no brainer when it comes to dividend investing!

I know the perfomance does not look great over the last 12 month, BUT for a long term hold, its a great way to DCA into your holding. And thats what my long term goal is!

Do you own any P&G right now?

#investing

#stocks

#proctergamble

#procterandgamble

#dividends

#passiveincome

Some shares may now also be added to my portfolio

... In my opinion, this is not the ideal time to buy, but some stocks, especially in the more defensive area, are comparatively attractive for me right now, especially as they can also be a defensive anchor if tech should correct again. As far as tech is concerned, I'm waiting for that.

Today I have:

$WM (+0,3%)

$RSG (+1%)

$PG (+0,11%)

$COKE (+0,88%)

$KO (+3,41%)

$LIN (-0,08%)

$CSL (+1,75%)

$NEE (-0,99%)

$DB1 (+0,07%)

$DTE (-0,58%)

$COST (+0,7%) bought

all about the same amount... Linde a little more, Carlisle a little less...

Titoli di tendenza

I migliori creatori della settimana