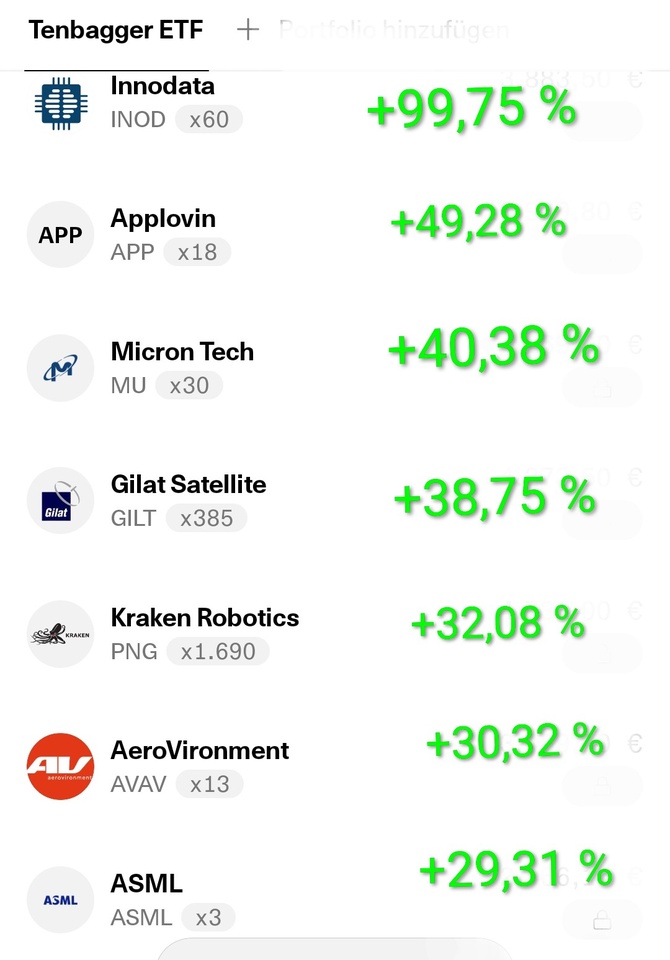

$IREN (+11,25%)

$CIFR (+17,08%)

$BTC (+0,25%)

Maybe some exciting companies for you ✌️

I am currently only in $IREN (+11,25%) and $CIFR (+17,08%) which are the most promising for me in terms of the opportunity/return ratio. In the event of a further setback, I would $CIFR (+17,08%) probably add a little more and perhaps pick up one or two other companies.

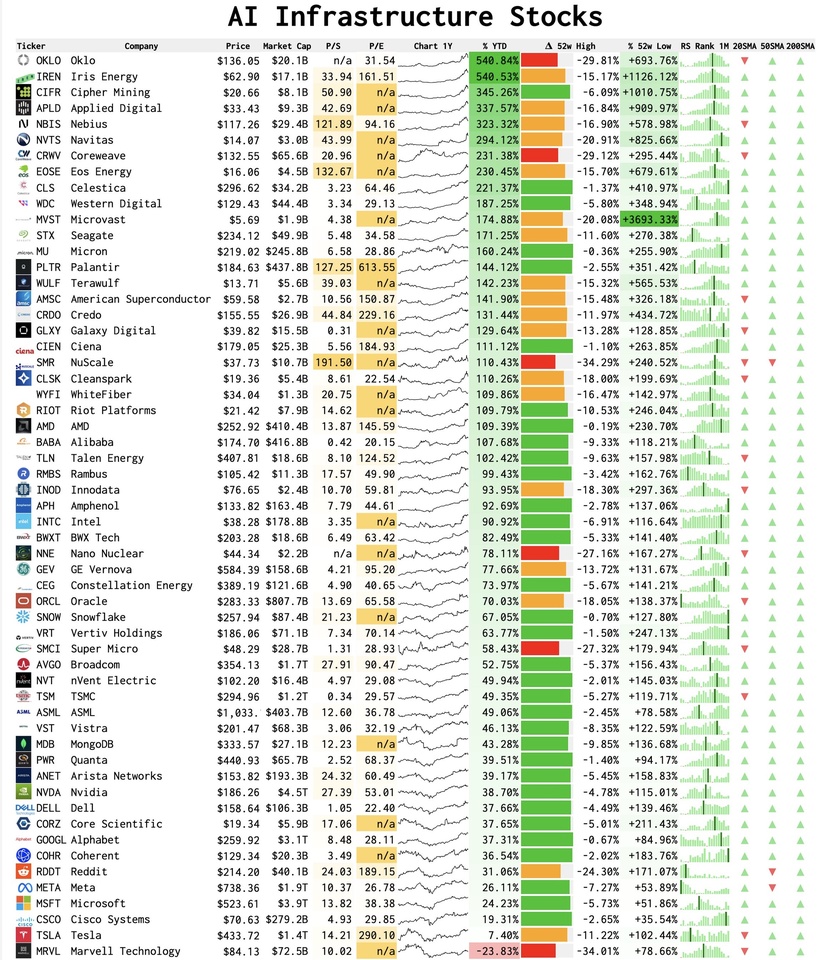

AI stocks, sorted by YTD performance:

Hyperscalers: $GOOGL (+1,8%)

$MSFT (+0,63%)

$AMZN (+1,56%)

$ORCL (+1,12%)

$BABA (+1,49%)

Neocloud: $NBIS (+9,49%)

$IREN (+11,25%)

$CRWV (+6,79%)

$APLD (-1,37%)

$GLXY (+3%)

$WYFI

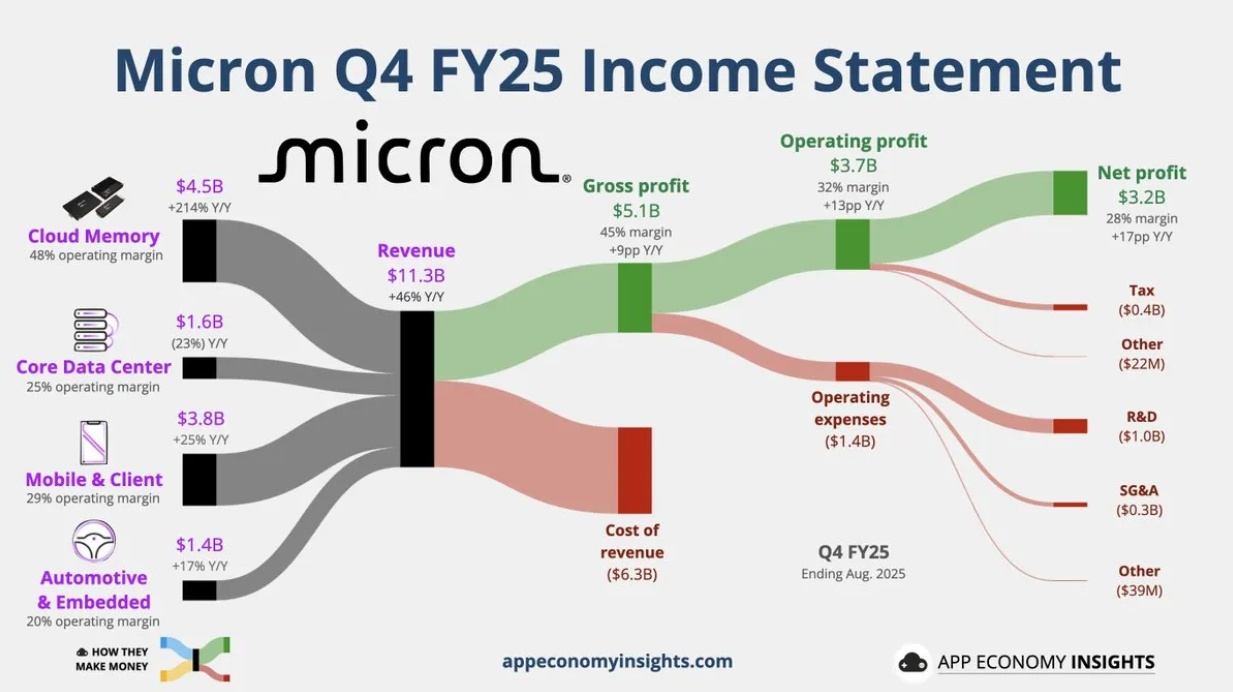

Memory: $SNDK

$STX (+4,07%)

$MU (+5,61%)

$WDC (+3,12%)

$PSTG (+0,71%)

Semiconductor: $NVDA (+2,31%)

$AVGO (+1,78%)

$AMD (+6,32%)

$TSM (+1,4%)

$ASML (-0,02%)

$ARM (+1,87%)

$KLAC (+1,14%)

$INTC (-7,3%)

Networking: $CIEN (+4,21%)

$CLS (+1,59%)

$CRDO

$RMBS (+3,57%)

$ANET (-0,02%)

$APH (-0,89%)

$COHR (+6,21%)

Servers: $VRT (+1,24%)

$DELL (+2,26%)

$HPE (+0,85%)

Data: $INOD (+2,8%)

$PLTR (+2,29%)

$SNOW (+2,02%)

$DDOG (-0,63%)

$MDB (+1,25%)

Energy: $LEU (+11,22%)

$CEG

$OKLO

$TLNE

$GEV (-1,56%)

$NXT (+0%)

Batteries: $EOSE

$QS

$TSLA (-3,07%)

$MVST (+2,85%)

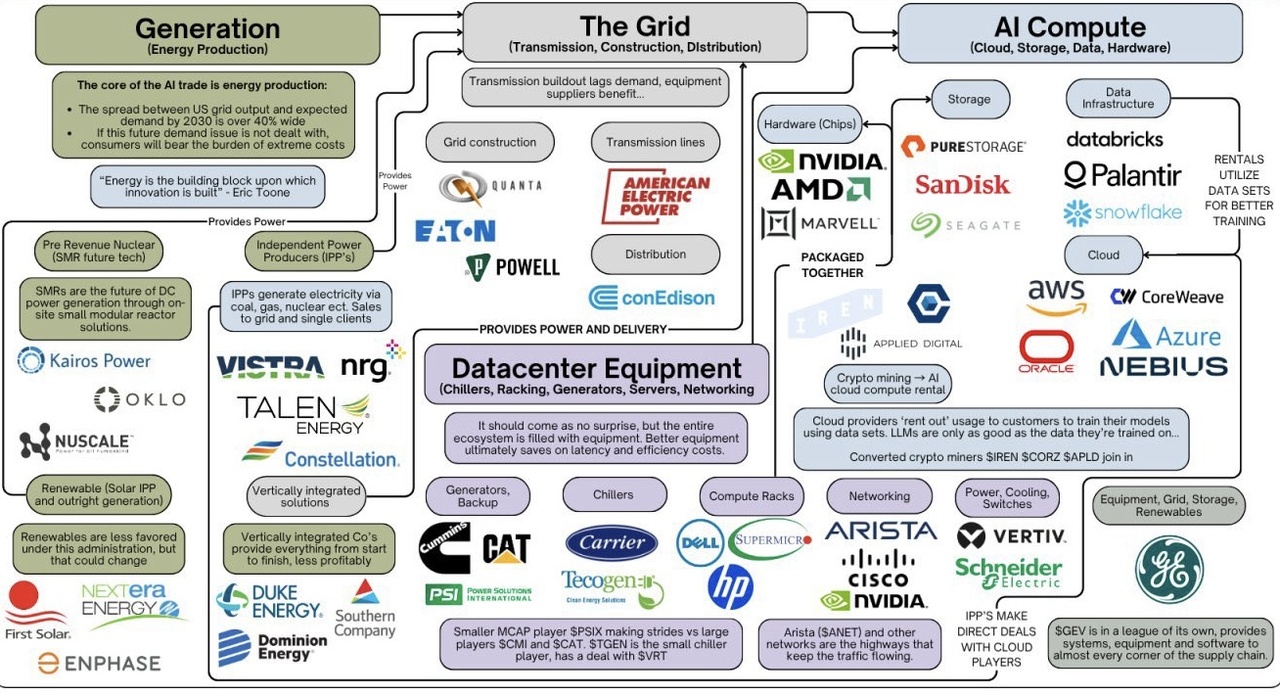

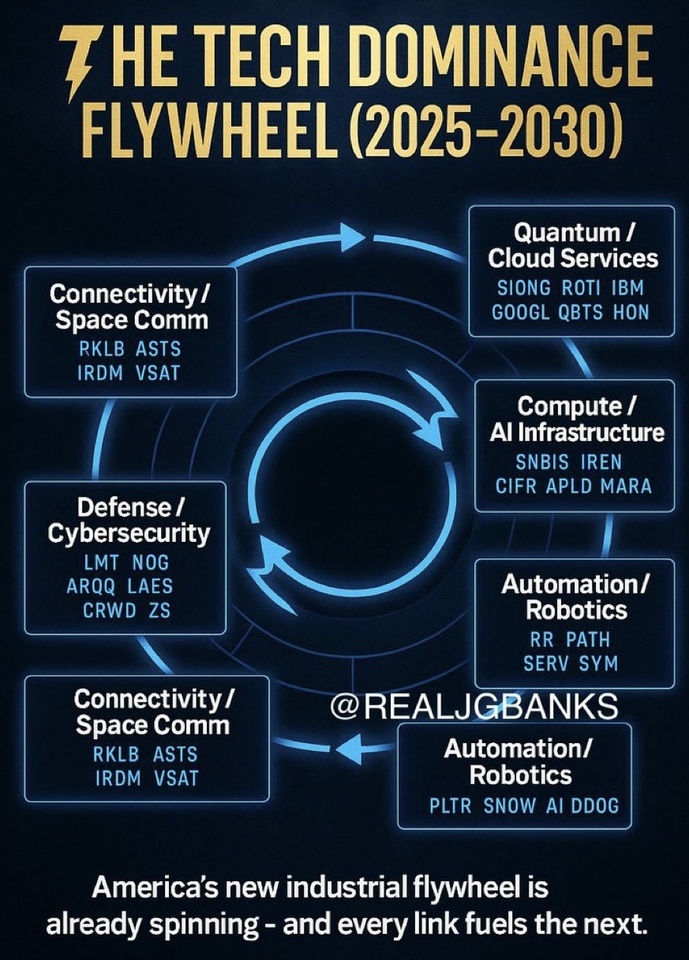

Every AI Value Chain explained: